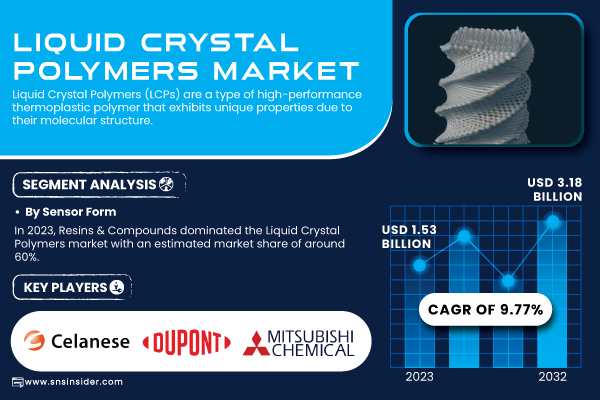

Austin, Dec. 11, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Liquid Crystal Polymers Market Size was valued at USD 1.53 billion in 2023 and is expected to reach USD 3.18 billion by 2032 and grow at a CAGR of 9.77% over the forecast period 2024-2032.”

Liquid Crystal Polymers (LCPs) are high-performance materials widely used in electronics, automotive, medical devices, and packaging due to their exceptional mechanical strength, chemical resistance, and thermal stability. Technological advancements and increasing R&D investments have led to innovative applications, boosting demand across various sectors. In 2023, the use of LCPs grew significantly in electronics and automotive, particularly for connectors, sensors, and high-thermal stability components. Companies like Teijin Limited and Celanese Corporation have enhanced their LCP portfolios, introducing new formulations to improve processing and versatility. The demand for high-performance polymers, including LCPs, is expected to accelerate, driven by the growing adoption of eco-friendly, lightweight materials in the automotive industry, as well as their increasing use in medical devices such as joint replacements and dental products

Download PDF Sample of Liquid Crystal Polymers Market @ https://www.snsinsider.com/sample-request/2022

Key Companies:

- Celanese Corporation (Vectra, Zenite)

- Chang Chun Plastics Co. Ltd (CCLCP-100, CCLCP-200)

- China National Petroleum Corporation (CNPC) (PetroChina LCP, LCP-CN Series)

- DIC Corporation (Dicpurel, LC Series)

- DuPont de Nemours, Inc. (Crastin, Zytel LCP)

- Evonik Industries AG (Vestakeep LCP, Evonik LCP Series)

- JX Nippon Oil and Energy Corporation (JNX-LCP Series, Parmax)

- LG Chem Ltd. (LPL Series, LCP-E)

- Mitsubishi Chemical Corporation (Novaduran, LAPEROS LCP)

- Polyplastics Co., Ltd. (LAPEROS E6000, E4000)

- RTP Company (RTP LCP Series, RTP 6000)

- Shanghai Pret Composites Co., Ltd. (Pret LCP, Pret Advanced Series)

- Shenzhen Wote Advanced Materials Co. Ltd (Wote-LCP, Advanced-LCP)

- Solvay SA (Amodel, Xydar LCP)

- Sumitomo Chemical Company (SUMIKASUPER LCP, E8000 Series)

- Toray International, Inc. (Torelina, Ecomass LCP)

- Toyobo Co., Ltd. (Vectran, Toyobo LCP Series)

- UBE Industries, Ltd. (UBE LCP Series, UPLCP-100)

- Ueno Fine Chemicals Industry Limited (UNL-LCP Series, Ueno-LCP)

- Victrex plc (Victrex LCP Series, VICTREX 6000)

- Wanhua Chemical Group Co., Ltd. (Wanhao LCP, Wanhua Polymer Series)

Liquid Crystal Polymers Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.53 Billion |

| Market Size by 2032 | USD 3.18 Billion |

| CAGR | CAGR of 9.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Thermotropic LCPs, Lyotropic LCPs) • By Form (Resins & Compounds, Films, Fibers) • By End-Use Industry (Automotive & Transportation, Electronics, Medical Devices, Packaging, Consumer Goods, Aerospace & Defense, Others) |

| Key Drivers | • Rising Demand for Advanced Electronics and Miniaturized Devices Drives LCP Market Expansion • Advancements in 3D Printing Technology Accelerate Demand for Liquid Crystal Polymers in Additive Manufacturing |

If You Need Any Customization on Liquid Crystal Polymers Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2022

What are the growth factors for the Liquid Crystal Polymers market?

The main reasons propelling the growth of the worldwide Liquid Crystal Polymers market are the rising use of Liquid Crystal Polymers in the electronics and automotive sectors, increasing adoption in medical devices, and heightened interest in LCP-based biomaterials.

- As the electronics industry continues to evolve, there is a surge in the need for smaller, more efficient components. LCPs offer excellent dimensional stability, which is ideal for electronic connectors and parts that need to withstand high temperatures without distortion.

- With the automotive industry's shift toward lightweight, energy-efficient materials, LCPs are increasingly used in components like sensors and connectors that require both heat resistance and high mechanical strength.

- The use of LCPs in medical devices is expected to rise due to their biocompatibility and long-term durability. Applications in implants, surgical instruments, and diagnostic equipment drive the market growth.

Technological Advancements in Liquid Crystal Polymers Production

| Year | Innovation/Advancement | Impact |

| 2022 | Development of bio-based LCPs | Promoted sustainability in the industry and reduced reliance on petroleum-based polymers. |

| 2023 | Introduction of LCP composites with enhanced thermal stability | Increased use in automotive and electronic industries for high-temperature applications. |

| 2024 | Breakthrough in LCP recycling methods | Reduced environmental impact and improved market acceptance for long-term LCP use. |

Recent advancements in LCP production include the development of bio-based LCPs in 2022, promoting sustainability by reducing reliance on petroleum. In 2023, LCP composites with enhanced thermal stability gained traction in automotive and electronics. By 2024, breakthroughs in LCP recycling methods are expected to reduce environmental impact and boost market acceptance.

Which segment dominated the Liquid Crystal Polymers Market

By End-use Industry - In 2023, the electronics segment dominated the Liquid Crystal Polymers market with a market share of 40%. The growing adoption of LCPs in high-performance connectors, circuit boards, and semiconductors reflects the industry's increasing reliance on these materials. For example, LCPs are essential in microelectronic components like phone connectors and sensors due to their high thermal stability and electrical properties, making them indispensable for modern electronics.

Regional Analysis: Asia Pacific Dominated the Liquid Crystal Polymers Market

In 2023, the Asia Pacific region dominated the Liquid Crystal Polymers (LCP) market, holding around 50% market share. This dominance is driven by rapid industrialization and demand from sectors like electronics, automotive, and telecommunications. Key players include China, Japan, and South Korea, with China being a major consumer and producer, particularly for connectors and flexible circuits. Japan, led by companies like Toray Industries and Mitsubishi Chemical, excels in high-performance LCP production, while South Korea sees significant demand from electronics and automotive. Additionally, the rise of 5G technology is further boosting LCP demand in communication devices across the region.

Buy Full Research Report on Liquid Crystal Polymers Market 2024-2032 @ https://www.snsinsider.com/checkout/2022

Recent Developments

March 2023: Solvay, a leader in specialized materials, announced the expansion of its Xydar liquid crystal polymers (LCP) portfolio with a new high-heat, flame-retardant grade designed to meet the stringent safety requirements for EV battery components.

The Liquid Crystal Polymers market is poised for strong growth, driven by increasing demand across multiple industries, including electronics, automotive, medical devices, and packaging. Technological advancements, sustainable practices, and expanding applications in high-performance sectors are key factors contributing to market expansion.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Liquid Crystal Polymers Market Segmentation, by Type

8. Liquid Crystal Polymers Market Segmentation, by Form

9. Liquid Crystal Polymers Market Segmentation, by End-Use Industry

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2022

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.