Pune, Dec. 14, 2024 (GLOBE NEWSWIRE) -- Field Service Management (FSM) Market Size Analysis:

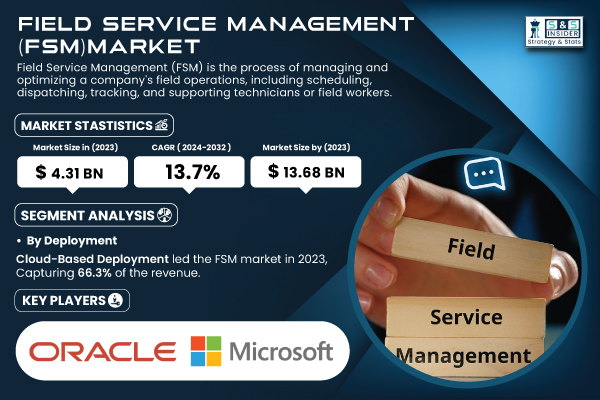

“The Field Service Management (FSM) market was valued at USD 4.31 billion in 2023 and is projected to grow with a significant CAGR of 13.7% over the forecast period of 2024–2032.”

Technological Innovations and Operational Efficiency Drive Growth Across Industries

The FSM market has undergone rapid evolution, primarily driven by the growing adoption of digital tools and increasing demand for efficient service management. Key drivers include the integration of technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and big data analytics. These advancements enable organizations to streamline processes, optimize workforce productivity, and enhance service delivery. Rising customer expectations have pushed industries like telecom, utilities, and healthcare to adopt FSM systems. These solutions not only ensure efficient service management but also provide transparency and real-time insights, reducing downtime and improving decision-making. Moreover, regulatory mandates and the need to comply with environmental and safety standards are encouraging organizations to implement FSM solutions to mitigate risks and maintain accountability.

Get a Sample Report of Field Service Management (FSM) Market@ https://www.snsinsider.com/sample-request/2888

Major Players Analysis Listed in this Report are:

- Oracle Corporation (Oracle Field Service Cloud, Oracle Service Cloud)

- Microsoft Corporation (Dynamics 365 Field Service, Dynamics 365 Remote Assist)

- Salesforce (Salesforce Field Service, Service Cloud)

- SAP SE (SAP Field Service Management, SAP Service Cloud)

- ServiceMax (ServiceMax Core, ServiceMax Asset 360)

- IFS AB (IFS Field Service Management, IFS Mobile Workforce Management)

- ClickSoftware (acquired by Salesforce) (Click Field Service Edge, ClickMobile)

- Astea International (acquired by IFS) (Alliance Enterprise, FieldCentrix)

- Zinier (Zinier Field Service Automation, Zinier Intelligent Automation)

- Trimble Inc. (Trimble PULSE, Trimble Fleet Management)

- FieldAware (FieldAware Mobile, FieldAware Scheduling)

- Praxedo (Praxedo FSM, Praxedo Mobile)

- Accruent (Kykloud, Maintenance Connection)

- Comarch (Comarch FSM, Comarch IoT FSM)

- GEOCONCEPT (Opti-Time, GeOptimization)

- OverIT (Geocall, SPACE1)

- Jobber (Jobber Business Management, Jobber Client Hub)

- Mize (Mize Field Service Management, Mize Service Parts Management)

- Coresystems (acquired by SAP) (Coresystems Field Service, Coresystems Now)

- Inseego Corp. (Inseego Field Service Automation, Ctrack Field Service Management)

Field Service Management (FSM) Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 4.31 Billion |

| Market Size by 2032 | US$ 13.68 Billion |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • The integration of AI and machine learning, enabling predictive maintenance, optimized scheduling, and real-time decision-making. |

Do you have any specific queries or need any customization research on Field Service Management (FSM) Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/2888

Market Segmentation

By Deployment

Cloud-based deployment segment held the largest revenue share of 66.3% in 2023. The cloud model offers unmatched scalability, flexibility, and cost-efficiency, making it a preferred choice for businesses. Organizations benefit from real-time access to data, seamless integration with enterprise systems, and reduced IT infrastructure costs.

Government initiatives promoting digital transformation and secure cloud adoption are further propelling this segment. For instance, the U.S. Cloud Smart Strategy emphasizes cloud-first solutions, while the European Union’s policies encourage businesses to adopt digital tools for enhanced operational efficiency. Cloud-based FSM solutions also offer superior scalability, enabling organizations to adapt quickly to market demands and operational changes.

By Enterprise Size

The Large enterprises segment dominated the market and accounted for a 65.3% share in 2023. These organizations leverage FSM systems to manage extensive operations, monitor large workforces, and address complex logistical challenges. With increasing focus on automation and efficiency, large enterprises are deploying FSM tools to reduce operational costs and improve service delivery.

Small and medium-sized enterprises (SMEs) are also gaining traction through the adoption of FSM solutions. Affordable subscription-based cloud models and user-friendly interfaces have made FSM technologies accessible to smaller businesses, allowing them to compete effectively in their respective markets. SMEs are realizing the benefits of FSM tools in enhancing productivity and reducing operational bottlenecks.

By End-Use Vertical

The telecom sector held the largest revenue share in 2023, accounting for 31.1% of the FSM market. Telecom companies face immense pressure to maintain seamless network performance and enhance customer experiences. FSM solutions play a crucial role in managing field operations, reducing downtime, and addressing network maintenance challenges. With the proliferation of 5G networks and increasing demand for high-speed internet, telecom operators are adopting FSM tools to ensure precise scheduling and efficient resource allocation. These solutions also aid in minimizing service disruptions and ensuring timely response to customer complaints. Beyond telecom, industries such as healthcare and utilities are emerging as significant contributors to the FSM market, utilizing these solutions for equipment maintenance, service delivery, and resource optimization.

Field Service Management (FSM) Market Segmentation:

By Component

- Solution

-

- Mobile field execution

- Service contract management

- Warranty management

- Workforce management

- Customer management

- Inventory management

- Others

- Services

-

- Implementation

- Training & support

- Consulting & advisory

By Deployment

- On-Premise

- Cloud

By Enterprise

- Large enterprises

- SMEs

By End-use

- Energy & utilities

- Telecom

- Manufacturing

- Healthcare

- BFSI

- Construction & real estate

- Transportation & logistics

- Retail & wholesale

- Others

Regional Analysis

The North American region dominated the FSM market with a 33% share in 2023. The region's leadership in technology innovation, coupled with a robust digital infrastructure, has facilitated the widespread adoption of FSM solutions. The integration of IoT devices and AI-driven analytics has further enhanced field service operations, enabling businesses to achieve greater efficiency. Government support, such as the U.S. Cloud Smart Strategy and Canada’s focus on billing accuracy in utilities, has played a significant role in driving adoption. With the increasing implementation of 5G networks and IoT technologies, North America is expected to retain its market leadership in the coming years.

APAC Region is growing with the fastest growth rate over the forecast period 2024-2032, growing with the rapid industrialization and digital transformation initiatives. Countries like India and China are investing heavily in smart city projects and digital infrastructure, creating significant opportunities for FSM solution providers. India’s "Digital India" campaign and the Chinese government’s emphasis on innovation under the 14th Five-Year Plan are promoting the adoption of digital tools for operational efficiency. The telecom sector in these countries is particularly benefiting from FSM solutions, as service providers focus on reducing operational costs and improving customer satisfaction.

Buy an Enterprise-User PDF of Field Service Management (FSM) Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/2888

Recent Developments

- In August 2024, Salesforce introduced advanced AI-powered FSM tools, enabling real-time tracking, predictive analytics, and dynamic scheduling to enhance operational efficiency.

- In June 2024, Oracle unveiled its next-generation FSM platform with IoT integration, providing predictive maintenance solutions for improved service delivery.

- In April 2024, ServiceNow collaborated with a leading telecom provider to deploy a cloud-native FSM solution, focusing on reducing downtime and improving technician efficiency.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Field Service Management (FSM) Market Segmentation, By Component

8. Field Service Management (FSM) Market Segmentation, By Deployment

9. Field Service Management (FSM) Market Segmentation, By Enterprise

10. Field Service Management (FSM) Market Segmentation, By End-use

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Details of Field Service Management (FSM) Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/field-service-management-market-2888

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.