Dublin, Dec. 19, 2024 (GLOBE NEWSWIRE) -- The "Sustainable Data Center Market - Global Outlook & Forecast 2024-2029" report has been added to ResearchAndMarkets.com's offering.

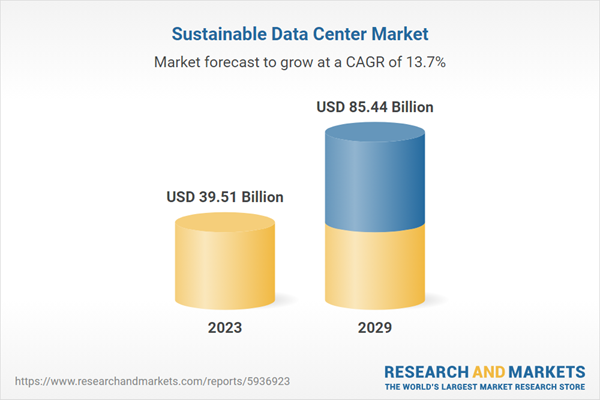

The global sustainable data center market by investment is expected to reach $85.44 billion by 2029 from $39.51 billion in 2023, growing at a CAGR of 13.71% from 2023 to 2029

In the global region, data center leaders such as Vantage Data Centers, Kao Data, Khazna, Africa Data Centres, STT GDC, GDS, and Equinix are adopting HVO fuel for their generators to enhance sustainability. In 2024, GDS China and STT GDC transitioned to hydrotreated vegetable oil (HVO) and hydrogen fuel cells for backup power.

In January 2024, Honda and Mitsubishi revealed plans to pilot a small data center using hydrogen from Tokuyama Corporation's electrolysis plant. This hydrogen, a by-product of sodium hypochlorite and chlorine production, will power Honda's fuel-cell power station and Mitsubishi's data center. The project is set to run until March 31, 2026.

With a growing emphasis on sustainability, fuels such as HVO and fuel cells are entering the market at high costs and limited availability in certain regions. Therefore, data center operators are collaborating to boost sustainable fuel adoption, thereby supporting sustainable data center market growth. For example, Vantage partnered with the Data Center Coalition (DCC) to drive market support for HVO, especially in Northern Virginia, where HVO costs are nearly 95% higher than diesel.

In December 2023, Digital Edge trialed a new robot prototype named 'Nora' at its Narra 1 data center in Manila, Philippines. Nora autonomously navigates and assists visitors using facial recognition and voice commands, functioning for up to eight hours on a single charge.

GEOGRAPHICAL ANALYSIS

The Nordic region offers an ideal environment for green data centers, utilizing renewable energy and minimizing reliance on water-based cooling systems, thereby supporting the sustainable data center market. In Western Europe, Frankfurt, London, Amsterdam, Paris, and Dublin (FLAPD) markets are increasingly implementing sustainable practices, such as using HVO fuel cells and natural gas to replace diesel, aiming to lower their PUE to under 1.5.

In Latin America, countries such as Brazil, Mexico, Chile, Colombia, Argentina, Paraguay, and Uruguay are increasingly turning to renewable energy for their power needs. Despite facing challenges in sustainability compared to North America, APAC, and Europe, Latin American data centers are embracing sustainable initiatives and advanced technologies in 2023 and 2024 and supporting Latin America sustainable data center market growth. For example, Hive Digital Technologies, a Canadian firm, plans to establish a hydroelectric-powered crypto-mining data center in Paraguay, utilizing clean energy from the Itaipu hydroelectric dam for its upcoming 100 MW operation.

The APAC sustainable data center market is witnessing growth during the forecast period, countries such as China, Australia, Japan, India, South Korea, Singapore, Malaysia, and Indonesia are at the forefront of adopting renewable energy to satisfy increasing energy demands. As APAC emerges as a hub for AI, many data centers are prioritizing sustainability, with countries such as Singapore and Taiwan facing challenges such as power supply issues. To enhance energy efficiency, data centers are implementing initiatives such as solar roofs and fuel cell technologies. For example, in 2024, CyrusOne initiated construction on its first data center in Japan, which will include a dedicated substation and rooftop photovoltaic (PV) cells.

In the Middle East and Africa (MEA), sustainability efforts lag due to insufficient infrastructure in Africa and a lack of renewable energy sources in countries such as the UAE and Saudi Arabia. However, in 2023 and 2024, data centers are taking significant steps toward sustainability, such as Africa Data Centers utilizing renewable energy from Distributed Power Africa and Khazna Data Centers partnering with Masdar, which has secured a solar generation license from Abu Dhabi's Department of Energy for a 7 MWp capacity to power the Khazna Abu Dhabi 6 facility.

VENDOR LANDSCAPE

Large Colocation and Hyperscale Data Center Operators Drive Sustainable Data Center Market Growth

Cloud data center tech giants such as Google, Microsoft, Oracle, IBM, Tencent, Meta, and AWS are leading the charge in renewable energy across APAC and various sectors, especially government sectors. For instance, in 2024, AWS constructed a secure sustainable data center for the Australian government, which has pledged USD 850 million over ten years for security and green sustainability.

Major colocation and hyperscale data center operators such as Ark Data Centers, CyrusOne, Khanza, Equinix, Singtel, STT GDC, NTT Data Centers, and Digital Realty are actively reducing their carbon footprints by investing in renewable energy. New players such as Datagrid, Datacom New Zealand, DataVolt, and Bitera Data Center are also contributing significantly to the global sustainable data center market. In 2024, these firms are channeling millions into PPAs for renewable energy, enhancing their commitment to sustainability.

Key renewable energy players in APAC include Engie, ACCIONA Energia, Adani Green Energy, Distributed Power Africa, OX2, European Energy, Elera Renovavies, Emerge, AGL Energy, and ReNew Power Ventures. In 2024, new entrants such as Metlen Energy & Metals (Mytilineos), ScottishPower, Mercury NZ, and Shizen Energy are partnering in the sustainable data center market with leading data centers to enhance sustainability.

Government Push Toward Sustainability

- The European Union (EU) has introduced a new regulation as part of its European Green Deal, aiming for climate neutrality by 2050. This regulation requires data centers with an IT power demand of at least 500 kW to report key performance indicators, including energy use and renewable energy sources, to improve efficiency and reduce fossil fuel dependence, thereby supporting the EU's environmental goals.

- Due to severe droughts, governments are delaying or redesigning projects with sustainable materials such as green concrete and air-based cooling systems. In Latin America, Google paused its Chilean data center project after a court asked them to revise their application, considering climate change and water concerns, specifically the strained Santiago aquifer. Google has since updated its design to incorporate air cooling and is working closely with local authorities.

- Governments worldwide are joining forces to enhance the adoption of renewable energy. Notably, in 2024, India and the United States initiated a USD 1 billion partnership to strengthen India's clean energy supply chain, supported by the International Bank for Reconstruction and Development (IBRD). This initiative aims to boost the production of essential green technologies, such as solar panels and wind turbines and will collaborate with African countries that are interested in clean energy.

- In 2023, China's Ministry of Finance, Ecology and Environment, and Industry and Information Technology introduced a Green Data Center standard, effective July 1, 2023. The standard mandates specific criteria for equipment and services, including a PUE of under 1.4 from June 2023 and under 1.3 from 2025, and requires a water-to-power consumption ratio of less than 2.5 L/kWh.

- In November 2023, Singapore's Minister of State for Trade and Industry unveiled the Sustainable Tropical Data Centre Testbed (STDCT), a cutting-edge facility designed for tropical climates. Hosted by the National University of Singapore, this testbed marks a significant milestone in advancing data center technology and supports Singapore's green technology goals under the RIE 2025 plan.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 664 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $39.51 Billion |

| Forecasted Market Value (USD) by 2029 | $85.44 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |

Sustainable Data Center Market Overview

- Sustainable Data Center Metrics

- Data Centers Shift Toward Sustainability

- Power Usage Effectiveness (Pue)

- Key Metrix of Pue

- Policy Drivers

- Energy Certifications

- E-Waste Disposal

Market Opportunities & Trends

- Innovative Data Center Battery Technologies

- Development of Data Centers with a Pue of < 1.4

- Sustainable Innovations in Data Center Power Technology

- Government Push for Sustainable Data Center Development

- Innovative Data Center Cooling Technologies

- Innovation in Data Center Construction

- Rise in Industrial Electricity Pricing

- AI, Metaverse, Hpc, & Cloud Computing Increase Liquid Cooling Requirements

- Adoption of Advanced IT Infrastructure

Market Growth Enablers

- Renewable Energy Initiatives by Cloud Operators

- Renewable Energy Initiatives by Colocation Operators

- Automation & Intelligent Monitoring

- Deployment of Modular Data Centers

Market Restraints

- Rise in Carbon Emissions from Data Centers

- Increase in Water Consumption by Data Centers

- Lack of Skilled Data Center Professionals

- Location Constraints in Sustainable Data Center Development

Prominent Data Center Investors

- Ada Infrastructure

- Africa Data Centres

- Agility

- AirTrunk

- Aligned Data Centers

- Alibaba Group

- Amazon Web Services (AWS)

- AdaniConneX

- Apple

- AtlasEdge

- Atman

- atNorth (Partners Group)

- Ava Telecom

- AQ Compute

- Aruba

- Bahnhof

- Batelco

- Beyond.pl

- Big Data Exchange (BDx)

- Bitera Data Center

- Bulk Infrastructure

- 5C Data Centers

- CDC Data Centres

- Centersquare

- Chayora

- China Telecom

- China Mobile

- Chindata Group

- China Unicom

- Claro

- Cloudoon

- CloudHQ

- Cologix

- Colt Data Centre Services

- Compass Datacenters

- Conapto

- American Tower (CoreSite)

- CtrlS Datacenters

- CyrusOne

- DartPoints

- DataBank

- Datagrid

- Datavolt

- Data4

- DC BLOX

- Digital Edge DC

- Digital Realty

- EdgeConneX (EQT Infrastructure)

- Edgnex Data Centres by DAMAC

- Emirates Global Aluminium (EGA)

- Equinix

- Flexential

- H5 Data Centers

- Iron Mountain

- IXAFRICA DATA CENTRE

- Kasi Cloud

- Khazna Data Centers

- Meta

- Moro Hub

- GDS Services

- Global Switch

- Global Technical Realty

- Green

- Green Mountain (Azrieli Group)

- Gulf Data Hub

- HostDime

- Iron Mountain

- Kao Data

- Keppel Data Centres

- KIO Networks

- LCL Data Centers

- LG Uplus

- maincubes

- Microsoft

- Nautilus Data Technologies

- NEXTDC

- nLighten

- NorthC

- Novva Data Centers

- NTT Global Data Centers

- Nxera

- Nxtra by Airtel

- Olkaria EcoCloud

- OneAsia Network

- Open DC

- Oracle

- Orange Business

- OVHcloud

- Penta Infra

- Polar Data Centers

- PowerHouse Data Centers

- Prime Data Centers

- Princeton Digital Group (PDG)

- Pure Data Centres

- QTS Realty Trust

- RackBank

- Raxio Data Centres

- Regal Orion

- Sabey Data Centers

- Scala Data Centers

- Serverfarm

- Sify Technologies

- Skybox Datacenters

- Start Campus

- ST Telemedia Global Data Centres

- STACK Infrastructure

- Stream Data Centers

- SUNeVision

- Switch

- T5 Data Centers

- Telehouse

- Telecom Italia Sparkle

- TierPoint

- Vantage Data Centers

- VADS Berhad

- Verne

- Viettel IDC

- VIRTUS Data Centres

- VNET

- Yondr

- Yotta Infrastructure

- YTL Data Center

Renewable Energy Providers

- ACCONIA Energia

- Adani Green Energy (AGEL)

- Adapture Renewables

- AGL Energy

- Algonquin Power & Utilities Corp.

- AMP Energy

- AMPIN Energy Transition

- Apex Clean Energy

- Avaada Energy

- Avangrid Renewables

- Better Energy

- Bryt Energy

- Cenergi Sea

- China Yangtze Power (CYPC)

- Conrad Energy

- Continuum Green Energy

- Datafarm Energy

- Distributed Power Africa (DPA)

- EDF Renewables

- Elawan Energy

- Elera Renovaveis

- Emerge

- Eneco

- Enel Green Power

- Enel Group

- ENEOS Renewable Energy Corporation

- ENGIE

- ERG

- European Energy

- Faro Energy

- Fervo Energy

- Fotowatio Renewable Ventures (FRV)

- FuturEnergy Ireland

- GreenYellow

- GCL-Poly Energy Holdings

- HDF Energy

- ib vogt

- Iberdrola

- Ilmatar Energy

- JinkoSolar

- Mainstream Renewable Power

- Masdar

- Mercury

- Metlen Energy & Metals (Mytilineos)

- Neoen

- Neste

- NextEra Energy Resources

- NTR

- Solar Power New Zealand

- OX2

- PacificLight Energy

- Peak Energy

- Power Capital Renewable Energy

- ReNew Power Ventures

- Repsol

- RZK Energia

- RWE Renewables

- SB Energy

- ScottishPower

- Sembcorp Industries (Sembcorp)

- Shell

- Shizen Energy

- Suzlon Energy

- Solargiga Energy

- Sonnedix

- SSE Renewables

- Star Energy Geothermal

- SunSource Energy

- TagEnergy

- Talen Energy

- Tata Power Solar Systems

- TEPCO

- The AES Corporation

- TotalEnergies

- The AES Corporation

- Trina Solar

- Vena Energy

- Woodside Energy

- Goldwind

For more information about this report visit https://www.researchandmarkets.com/r/9qio7u

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment