Austin, Jan. 17, 2025 (GLOBE NEWSWIRE) -- Market Size & Growth Analysis:

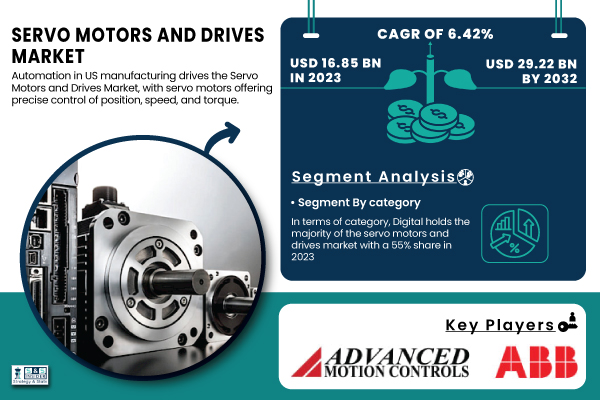

The SNS Insider report indicates that,“The Servo Motors and Drives Market Size was valued at USD 16.85 billion in 2023, and is expected to reach USD 29.22 billion by 2032, and grow at a CAGR of 6.42% over the forecast period 2024-2032.”

Surge in Automation and Industry 4.0 Drives Growth in US Servo Motors and Drives Market

The rapid rise of automation in US manufacturing, bolstered by initiatives like the Infrastructure Investment and Jobs Act (IIJA), the CHIPS and Science Act, and the Inflation Reduction Act (IRA), is significantly propelling the growth of the Servo Motors and Drives Market. These acts, which focus on clean energy and electric vehicles, have created a surge in private-sector investments, particularly in automation-heavy industries like semiconductor and clean technology manufacturing. With semiconductor and clean technology investments nearly doubling since 2021, and nearly 200 new manufacturing facilities being announced, the demand for precise automation solutions like servo motors is on the rise. Servo motors, known for their unparalleled precision, play a crucial role in the automation of Industry 4.0 technologies, such as robotics and smart factories. As US manufacturers increasingly invest in connectivity and real-time optimization, the servo motors and drives market is positioned for sustained growth, driven by the expanding need for high-precision, automated systems.

Get a Sample Report of Servo Motors and Drives Market Forecast @ https://www.snsinsider.com/sample-request/4413

Dominant Market Players with their Products Listed in this Report are:

- ABB (Industrial Robots, Servo Motors, Drives)

- Advanced Motion Controls (Servo Drives, Motion Control Solutions)

- Allied Motion, Inc. (Servo Motors, Controllers, Motion Control Solutions)

- Baumüller (Servo Motors, Inverters, Drive Systems)

- Bosch Rexroth AG (Electric Drives and Controls, Linear Motion, Servo Motors)

- Danfoss (Variable Frequency Drives, Servo Drives, Motion Controllers)

- Delta Electronics, Inc. (Servo Motors, Variable Frequency Drives, Industrial Automation Products)

- ESTUN Automation Co., Ltd (Servo Motors, Servo Drives, Industrial Robots)

- Fuji Electric Co., Ltd. (Inverters, Servo Motors, Drives)

- Hitachi (AC Servo Motors, Industrial Motors, Drives)

- Ingenia Cat S.L.U. (High-Performance Servo Motors, Motion Control Solutions)

- KEB Automation KG (Servo Motors, Industrial Automation, Drive Technology)

- Kollmorgen (Servo Motors, Motion Controllers, Integrated Motion Systems)

- Mitsubishi Electric Corporation (Servo Motors, Motion Controllers, Programmable Logic Controllers)

- NIDEC Corporation (AC Servo Motors, DC Motors, Drives)

- Panasonic Corporation (Servo Motors, AC Drives, Motion Controllers)

- Rockwell Automation, Inc. (Servo Drives, Programmable Logic Controllers, Motion Control Products)

- Schneider Electric (Servo Motors, Variable Speed Drives, Motion Control Products)

- Siemens (Servo Motors, Industrial Automation, Motion Control Systems)

- YASKAWA Electric Corporation (Servo Motors, Inverters, Motion Control Solutions).

Digital Systems and AC Drives Lead the Servo Motors and Drives Market in 2023 with Advanced Capabilities and Technological Innovation

By Category

In 2023, digital systems captured the largest share of the servo motors and drives market at 55%, reflecting a growing demand for advanced, efficient solutions. This shift is driven by customers seeking enhanced system performance. Industry leaders like Siemens and Mitsubishi Electric are at the forefront, developing innovative devices that offer superior control and durability. This trend aligns with broader industry movements toward automation and energy efficiency. As manufacturing continues to expand and investments in automation increase, digital servo systems are poised to capitalize on new opportunities with their enhanced capabilities and cutting-edge technologies.

By Devices

In 2023, AC drives dominated the servo motors and drives market, holding a 56% share due to their enhanced ability to manage high current spikes, increased torque, high speeds, and noise reduction. Technological advancements and supportive policies aimed at optimizing operations further drive the market's growth. A notable example is Kollmorgen’s launch of the EKM series of brushless AC servo motors in September 2022. These motors are designed for harsh environments, offering benefits such as fast speed ratings up to 8000 RPM, effective environmental sealing, high power and torque density, and insulation for voltages up to 480 VAC.

Do you Have any Specific Queries or Need any Customize Research on Servo Motors and Drives Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4413

Key Market Segments:

By Category

- Digital

- Analog

By Drive

- AC drive

- DC drive

By Application

- Oil & gas

- Meta cutting & forming

- Material handling equipment

- Packaging and labeling machinery

- Robotics

- Medical robotics

- Rubber & plastics machinery

- Warehousing

- Automation

- Extreme environment applications

- Semiconductor machinery

- AGV

- Electronics

- Others

Asia Pacific and North America Lead the Global Servo Motors and Drives Market with Technological Advancements and Strategic Investments

In 2023, the Asia Pacific region led the servo motors and drives market with a 38% share, driven by increased investments in manufacturing and process industries, along with rising R&D activities. Developing economies in the region are accelerating digital transformation, focusing on technology upgrades for real-time performance monitoring. A notable example is Panasonic Corporation's launch of the AI-equipped MINAS A7 servo system in Japan, designed to reduce human work time by 90%.

North America experienced the fastest market growth, capturing 25% of the share in 2023. This growth is fueled by government-backed initiatives in infrastructure, clean energy, and reshoring manufacturing. The US focus on expanding its semiconductor sector and automakers like Ford and GM investing in robotic assembly lines are driving the demand for precise servo systems. Leading companies like Rockwell Automation and Emerson are developing small, eco-friendly servo systems, positioning North America for continued growth in the market.

Purchase an Enterprise User License of Servo Motors and Drives Market Report at 40% Discount @ https://www.snsinsider.com/checkout/4413

Recent Development

- February 2024: ABB Launches ACH580 4X Drive for Harsh HVACR Environments ABB's ACH580 4X variable frequency drive is built for extreme HVACR conditions, offering UL Type 4X certification for protection against harsh elements. It features HVACR-specific software, Bluetooth connectivity, and enhanced safety for outdoor installations.

- June 2024: Rockwell Automation Introduces ArmorKinetix Distributed Servo Drives Rockwell Automation's ArmorKinetix Distributed Servo Drives allow for direct mounting on machines, reducing machine size, component requirements, and energy consumption. The drives feature IP66 certification, vibration and thermal sensors, and offer up to 90% reduction in cabling and 30% cost savings.

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates by Region

5.2 Investment and Funding Data by Region

5.3 Production and Manufacturing Capacities

5.4 Customer Purchase Behavior and Preferences by Region

6. Competitive Landscape

7. Servo Motors and Drives Market Segmentation, by category

8. Servo Motors and Drives Market Segmentation, by Drive

9. Servo Motors and Drives Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of Servo Motors and Drives Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/servo-motors-and-drives-market-4413

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.