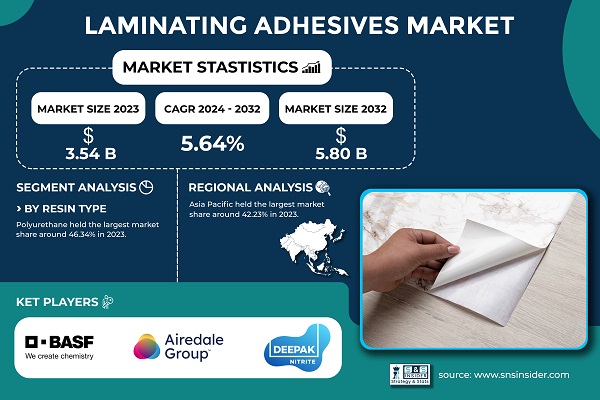

Austin, Jan. 21, 2025 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The laminating adhesives market size was valued at USD 3.54 billion in 2023 and is expected to reach USD 5.80 billion by 2032, growing at a CAGR of 5.64% during the forecast period from 2024 to 2032.”

Growth and Trends in the Laminating Adhesives Market: Driving Innovation Across Industries

The laminating adhesives market has experienced significant growth, driven by the increasing demand for flexible packaging solutions across various industries. These adhesives are essential for bonding multiple layers of substrates, enhancing the durability and functionality of products. The packaging sector, particularly in food and beverages, pharmaceuticals, and consumer goods, has been a major contributor to this growth. The shift towards flexible packaging is attributed to its advantages, including lightweight design, extended shelf life, and improved product protection. This trend has led to a surge in the use of laminating adhesives, as they provide the necessary bonding strength and flexibility required for modern packaging applications.

In addition to packaging, the automotive and electronics industries have also adopted laminating adhesives for various applications. In the automotive sector, these adhesives are utilized in interior components, such as dashboards and door panels, to achieve lightweight and durable designs. Similarly, the electronics industry employs laminating adhesives in the production of flexible displays and wearable devices, where high-performance bonding is crucial. The market is also witnessing a shift towards environmentally friendly and sustainable solutions. Manufacturers are developing waterborne and solvent-free adhesives to meet stringent environmental regulations and cater to the growing consumer preference for eco-friendly products. These innovations not only reduce volatile organic compound (VOC) emissions but also align with global sustainability goals.

Download PDF Sample of Laminating Adhesives Market @ https://www.snsinsider.com/sample-request/2095

Key Companies:

- 3M Company (Fastbond Contact Adhesive, Scotch-Weld Lamination Adhesive)

- Avery Dennison Corporation (Fasson Adhesive Products, Rapid-Roll Lamination Adhesives)

- Arkema Group (Sartomer Laminating Resins, Plexiglas Adhesive Systems)

- Ashland Global Holdings Inc. (Purekote Water-Based Laminating Adhesives, Flexcryl Laminating Adhesives)

- BASF SE (Epotal Water-Based Adhesives, Ultramid-Based Laminating Solutions)

- Bostik SA (an Arkema Company) (Thermogrip Laminating Adhesives, Herberts High-Performance Adhesives)

- Coim Group (Novacote Flexible Laminating Adhesives, Coimflex Laminating Systems)

- Covestro AG (Desmomelt Hot Melt Adhesives, Bayhydrol Water-Based Adhesives)

- DIC Corporation (DICDRY Solvent-Based Adhesives, Superflex Laminating Adhesives)

- Dow Inc. (Adcote Laminating Adhesives, Robond Water-Based Adhesives)

- DuPont de Nemours, Inc. (Surlyn Laminating Films, Bynel Adhesive Resins)

- Evonik Industries AG (VESTOPLAST Hot Melt Adhesives, POLYCAT Catalysts for Laminating Adhesives)

- Franklin International (ReacTITE Laminating Adhesives, Multibond Laminating Systems)

- H.B. Fuller Company (Lunamelt PSA Adhesives, Flextra Fast Laminating Adhesives)

- Henkel AG & Co. KGaA (Technomelt Laminating Adhesives, Loctite Liofol Adhesives)

- Jowat SE (Jowatherm Laminating Adhesives, Jowacoll Dispersion Adhesives)

- Morchem Inc. (MOR-FREE Solvent-Free Adhesives, MOR-THERM Heat Resistant Adhesives)

- Sika AG (SikaForce Laminating Adhesives, Sikaflex Flexible Adhesives)

- Toyochem Co., Ltd. (Toyobo Group) (Tomoflex Laminating Adhesives, Toyo-Melt Adhesive Systems)

- Wacker Chemie AG (VINNAPAS Dispersion Adhesives, SILRES Silicone-Based Laminating Systems)

Laminating Adhesives Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 3.54 Billion |

| Market Size by 2032 | USD 5.80 Billion |

| CAGR | CAGR of 5.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Polyurethane, Acrylic, Others) • By Technology (Solvent-based, Solvent-less, Water-based, Others) • By End-use Industry (Packaging, Industrial, Automotive & Transportation) |

| Key Drivers | • Rising demand for packaging drives the market growth. |

If You Need Any Customization on Laminating Adhesives Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2095

Driving Sustainability: The Shift Towards Eco-Friendly Laminating Adhesives in Packaging

Sustainability initiatives are significantly shaping the laminating adhesives market, as there is a growing demand for eco-friendly packaging solutions. Manufacturers are prioritizing the development of water-based and solvent-free adhesives to align with environmental regulations while maintaining strong bonding capabilities. This shift enables companies to meet the increasing demand for sustainable packaging materials, opening up new market opportunities. By adopting sustainable practices, businesses can reduce their environmental impact and cater to consumer preferences for greener products, ultimately contributing to a more sustainable packaging industry.

Market Trends in Adhesives: Polyurethane Dominance and the Rise of Water-Based Technologies in 2023

By Resin Type: Polyurethane segment dominated with the market share over 46.34% in 2023. These adhesives are widely used in industries such as packaging, automotive, and construction due to their strong adhesion properties and resistance to harsh environmental conditions like moisture, temperature changes, and chemicals. Their ability to perform well in flexible packaging applications, particularly within the food and beverage sector, has contributed to their market dominance. The versatility of polyurethane adhesives in a variety of applications continues to drive their popularity, making them a key player in these industries.

By Technology: Water-based segment dominated due to their eco-friendly properties and adherence to strict environmental regulations. These adhesives, which utilize water as a solvent, are particularly favored in industries like packaging, food and beverage, and healthcare, where sustainability and safety are essential. Known for their strong bonding strength, heat resistance, and versatility with various substrates, water-based adhesives have become the go-to option for manufacturers prioritizing environmental impact.

Asia Pacific Dominates Laminating Adhesives Market with 42.23% Share in 2023

The Asia Pacific region dominated with the market share over 42.23% in 2023. This dominance is driven by a strong manufacturing base, a rapidly growing population, and an increasing need for packaged goods. Key countries like China, India, and Japan are central to industries such as packaging, automotive, and electronics, all of which require laminating adhesives. Additionally, the expanding middle class and growth in sectors like consumer goods, e-commerce, and food and beverage are boosting the demand for innovative packaging solutions. Consequently, the use of laminating adhesives in flexible packaging is rising across the region, fueling market growth.

Buy Full Research Report on Laminating Adhesives Market 2024-2032 @ https://www.snsinsider.com/checkout/2095

Recent Developments

In May 2023: H.B. Fuller, a global leader in adhesive technologies, announced its acquisition of a stake in Beardow Adam, a UK-based company specializing in sustainable adhesive solutions. This acquisition is aimed at strengthening H.B. Fuller's position in the market by expanding its customer base and enhancing its technological capabilities to meet the growing demand for environmentally friendly adhesives.

In April 2023: Bostik, a subsidiary of Arkema Group, introduced a new range of solvent-free adhesive lamination solutions under the HERBERTS series. This product line, designed for food packaging applications, offers an environmentally friendly and sustainable alternative for packaging solutions. It also caters to industrial and pharmaceutical sectors, aligning with the increasing demand for eco-conscious adhesives.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Laminating Adhesives Market Segmentation, by Resin Type

7.1 Chapter Overview

7.2 Polyurethane

7.3 Acrylic

7.4 Others

8. Laminating Adhesives Market Segmentation, by Technology

8.1 Chapter Overview

8.2 Solvent-based

8.3 Solvent-less

8.4 Water-based

8.5 Others

9. Laminating Adhesives Market Segmentation, by End-use Industry

9.1 Chapter Overview

9.2 Packaging

9.3 Industrial

9.4 Automotive & Transportation

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/2095

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.