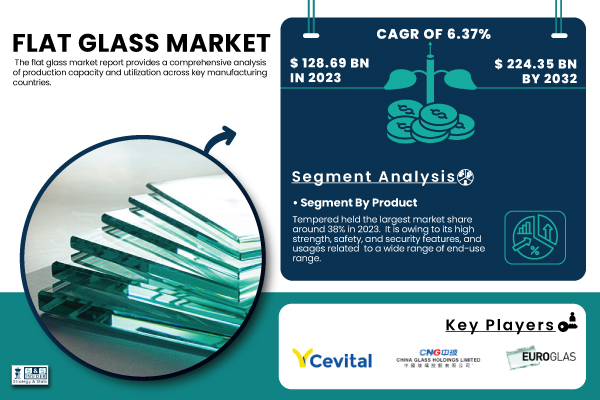

Austin, Feb. 24, 2025 (GLOBE NEWSWIRE) -- The Flat Glass Market Size was valued at 128.69 Billion in 2023 and is expected to reach USD 224.35 Billion by 2032, growing at a CAGR of 6.37% over the forecast period of 2024-2032.

The flat glass market is experiencing strong growth as demand from the construction and automotive sectors continues to rise. In addition, growing adoption of energy-efficient glass solutions such as low-emissivity glass, owing to strict energy conservation standards, has propelled the market growth. Buildings, the U.S. Department of Energy says, use almost 40% of total energy consumption and as such, insulated glass units (IGUs) have been increasingly used to improve energy efficiency. Moreover, as per the International Energy Agency (IEA), in 2023 more than 75% of newly established buildings in developed areas were fitted with energy efficient glass solutions. The demand for flat glass in the automotive industry is driven by the trend toward lightweight, high-performance glazing materials. Saint-Gobain launches new vehicle aerodynamics technology in 2024 to improve fuel consumption in the laminated glass category In addition, the Ministry of Industry and Information Technology (MIIT) in China released a proposal to raise the local output of high-grade flat glass to help the infrastructure development of the country by 15% by the year 2025. Various dynamic factors enable the market to consistently integrate into thriving flat glass market sectors.

Download PDF Sample of Flat Glass Market @ https://www.snsinsider.com/sample-request/5645

Key Companies:

- AGC Inc. (Planibel, Solarshield)

- Central Glass Limited (MiruGlas, Coolverre)

- CEVITAL Group (Evergrow, Clearlite)

- China Glass Holding Ltd. (Jinjing Ultra Clear, EnergyPlus)

- Euroglas (Silverstar, Luxguard)

- Fuyao Glass Industry Group Co., Ltd. (Fuyao Float, Fuyao Solar)

- Guardian Industries (SunGuard, ClimaGuard)

- Nippon Sheet Glass Co., Ltd. (Pilkington Optiwhite, Pilkington Suncool)

- Saint-Gobain (Planitherm, SGG Bioclean)

- Şişecam Group (Şişecam Tentesol, Şişecam Low-E)

- Vitro (Solarban, Starphire)

- Xinyi Glass Holdings (Xinyi Energy-Saver, Xinyi UltraClear)

- Taiwan Glass Industry Corporation (TGI SunEnergy, TGI SuperClear)

- CSG Holding Co., Ltd. (CSG Ultra Low-E, CSG SmartGlass)

- Interpane Glas Industrie AG (iplus, ipasol)

- AGP Group (AGP Defendor, AGP eGlass)

- Henan Ancai Hi-Tech Co., Ltd. (Ancai Low-E, Ancai Smart)

- Schott AG (Schott Conturan, Schott Pyran)

- Jinjing Group (Jinjing Solar, Jinjing Float)

- Fuyao Group (Fuyao Acoustic, Fuyao Laminated)

Flat Glass Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 128.69 Billion |

| Market Size by 2032 | USD 224.35 Billion |

| CAGR | CAGR of 6.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Basic, Tempered, Laminated, Insulated, Others) • By End Use (Architectural, Automotive, Others) |

| Key Drivers | • Increasing demand for lightweight and high-performance materials which drives the market growth. |

If You Need Any Customization on Flat Glass Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/5645

By Product

Tempered glass dominated the flat glass market, accounting for around 38% of the total market share in 2023. The dominance of tempered glass in the market can largely be attributed to the rising demand for tempered glass in applications such as automotive, safety glazing, and modern architecture. Tempered glass is used extensively in the automobile industry for side and rear windows because of its increased strength and shatter resistance. Moreover, as high-rise constructions are on the rise, the building codes also dictate the use of tempered glass for safety reasons. Market expansion has also been propelled by companies including AGC Inc. and Guardian Glass that have invested in advanced tempering technologies to increase the durability and aesthetic appeal of their products.

By End-Use

The architectural segment dominated and accounted for the largest share of 52% in the flat glass market in 2023. Urbanization and commercial and residential infrastructure development are primary driving factors of this segment’s dominance. In modern construction, glass facades, curtain walls, and skylights are critical components that contribute to energy efficiency and aesthetics. The demand for sustainable green buildings has also driven the commercial segment to embrace low-emissivity (Low-E) glass and insulated glass. In addition to this, with smart city projects growing in number in developed economies including U.S. and China, the demand for architectural flat glass is also expected to uptick.

Asia-Pacific dominated the global Flat Glass market in 2023, holding a 55% market share.

The rise of urbanization, infrastructure development, and industrial growth in these countries resulted in a better demand for flat glass. China, both the leading producer of and consumer of flat glass, continues to invest in the manufacture of high-performance glass to underpin its building boom. India’s Smart Cities Mission has also played a role with a major uplift in adopting energy-efficient glass with infrastructure developments. Vitreous flat glass for automotive and electronics unique pieces are also seeing increased demand from Japan and South Korea driving the regional growth.

North America emerged as the fastest-growing region with a significant CAGR in the forecast period of 2024 to 2032

Increasing emphasis on energy-efficient buildings and strict regulatory standards, like Leadership in Energy and Environmental Design (LEED) certification requirements, are significant growth drivers. There has been a 20% increase in green-certified buildings from the U.S. Green Building Council (USGBC) in 2023, meaning demand for low-emissivity and insulated glass will be greater. Moreover, the growth of the electric vehicle (EV) market has propelled the need for lightweight and advanced glazing solutions. Such factors further increase the scope of North America as a prominent high-growth smart glass market in terms of revenue for transportation sector and commercial buildings.

Recent Highlights

- February 2025: AGC Glass opened its new Volta flat glass production line — a production line setting a new standard for sustainable glass manufacturing. The plant, which is expected to help reduce carbon emissions and improve energy efficiency in production.

- February 2025: Saint-Gobain and Maltha worked together to transform solar panel glass to flat glass, a big step in the circular economy in glass. Panel recycling promotes sustainability by turning the end-of-life panels into new products made of glass.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Flat Glass Market Segmentation, by Product

8. Flat Glass Market Segmentation, by End-Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practice

12. Conclusion

Buy Full Research Report on Flat Glass Market 2024-2032 @ https://www.snsinsider.com/checkout/5645

Buying Options

- 5 Reports Pack (USD 7500)

- 10 Report Pack (USD 12000)

- Vertical Subscription (150 Reports Pack Valid for 1 Year)

- Use this link to Purchase above packs @ https://www.snsinsider.com/subscription

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.