HONG KONG, Jan. 06, 2026 (GLOBE NEWSWIRE) -- CoinEx Research’s December 2025 Report: In the world of cryptocurrency, December 2025 felt less like the anticipated Santa rally and more like a market paused at the edge of the North Pole, awaiting clearer signals. According to CoinEx Research's latest monthly report, Bitcoin embodied the steadfast reindeer, maintaining its position and displaying early indicators of bottoming out amid macroeconomic haze and policy ambiguity.

Ethereum, on the other hand, trailed behind, even as it discreetly rolled out the Fusaka upgrade under the holiday lights. The Federal Reserve delivered its projected rate cut, but without robust forward guidance and with liquidity still tight, the environment fostered caution and range-bound trading rather than a decisive upturn. Precious metals like gold and silver stole the show in the broader macro arena, underscoring a defensive stance fueled by currency debasement and geopolitical tensions. Positively, stablecoin inflows held steady, indicating no widespread alarm beneath the festive glow. While this wasn't the explosive rally many envisioned, the market seems poised for a more vigorous launch into the new year once genuine liquidity flows back in.

Rate Cuts Are In, But Direction Remains Elusive

Following a dip to around $80,500 in late November, Bitcoin mounted a comeback, stabilizing between $86,000 and $88,000 by the close of 2025. Despite shedding 30% from its October zenith, it continues to serve as the go-to asset for institutional investors. Ethereum endured a harsher period, confined to a descending channel and unable to surpass the $3,080 resistance level.

On December 10, the Fed implemented a 25-basis-point rate reduction—the third of the year—bringing rates to about 3.6%. Internal rifts within the Fed were evident, with the revised "dot plot" revealing a scattered array of opinions and no unified vision for 2026 interest rates. The median forecast hints at just one cut next year, but the actual course will hinge on inflation and labor market dynamics.

Regarding the balance sheet, quantitative tightening wrapped up earlier in the month, sparking speculation about quantitative easing. Yet, the Fed's new short-term Treasury buys, dubbed Reserve Management Purchases (RMP), aren't QE in disguise. These are aimed at stabilizing money market liquidity and bolstering interbank operations, not injecting widespread stimulus. Any true QE rollout is likely deferred to the incoming Fed leadership in late 2026.

Key Charts to Watch

Bitcoin exhibited weakness in December but sidestepped steeper falls, posting a modest -1.88% monthly decline. It's now fluctuating in the lower $84,000–$92,000 band. The daily chart has pierced the bearish trend line (in blue), signaling a gradual bottoming process. Prices could consolidate before rebounding to challenge upper resistance. However, this appears more like a bounce than a reversal—true shifts demand extended consolidation and multiple resistance tests.

Zcash ($ZEC) surged 78% this month, but its fundamentals haven't matched the price action. As a privacy-focused coin, its shielded transaction volume—a core metric—has flatlined, showing no upward momentum. This mismatch suggests $ZEC may struggle to eclipse prior highs, with near-term retracement risks looming. Long-term, though, the outlook stays positive.

Precious Metals: The Winners of the Debasement Trade

2025 was unequivocally the year of metals. Gold and silver fulfilled their classic roles as safeguards against macroeconomic turbulence, thriving amid geopolitical strife, trade disputes, and end-of-cycle policy vagueness. With real yields stuck in a range, demand for non-fiat value stores persisted, especially as doubts grew over fiscal restraint and monetary impartiality.

- Gold (XAU) wrapped its strongest year since 1979, skyrocketing about 70%. December saw it hit record highs near $4,550 per ounce before retreating to $4,340. The surge stemmed from escalating U.S.-China trade frictions and a softening dollar.

- Silver (XAG) emerged as the standout performer, boasting over 140% annual gains and briefly topping $80 per ounce in late December. Its boom was propelled by industrial supply shortages in AI data centers, solar power, and electric vehicles, amplified by China's export curbs.

The XAU/BTC ratio's breakout highlights a protective macro setup where gold leads as the hedge, capping Bitcoin until liquidity loosens. Historically, when gold's surge plateaus, Bitcoin often steps up as the follow-on play, attracting liquidity spillover to the next high-potential scarce asset.

Ethereum Ships Fusaka Upgrade

December 3 marked a milestone for Ethereum with the Fusaka upgrade's activation, advancing "The Surge" roadmap. This enhancement bolsters Layer 2 (L2) scaling via tech upgrades and economic tweaks. At its heart is PeerDAS (EIP-7594), which eases data availability constraints by letting nodes validate data subsets, enabling exponential L2 growth. Blob capacity increases are phased in for stability.

Fusaka also refines Ethereum's economics, introducing a blob minimum base fee (EIP-7918). This sets a price floor for blob storage, curbing fee drops during low demand and stabilizing L2 costs while securing consistent protocol revenue from data services.

Stablecoin Flows Stabilize; No Signs of Panic Selling

Unlike November's sharp outflows, December saw stablecoin liquidity rebound with $2.4 billion in net inflows. The absence of major exits implies that beneath the tepid prices and gloomy online chatter, liquidity isn't crumbling.

This aligns with CoinEx Research's November "Bull Case": inflows have halted their slide and are edging up. Consequently, the ongoing correction might wrap up swiftly—perhaps within the quarter—mirroring the May 2024 rebound.

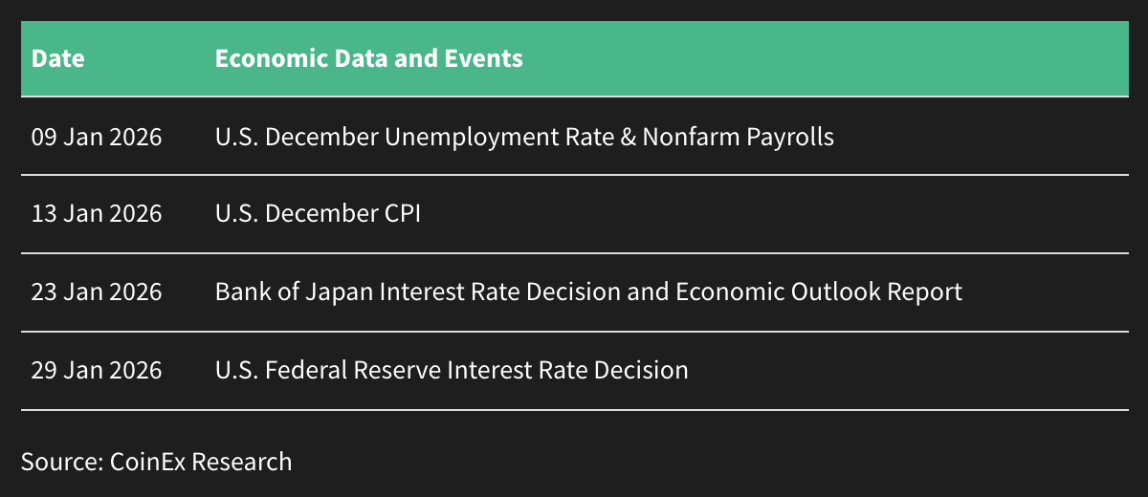

Economic Data & Events to Watch in January 2026

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

pr@coinex.com

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector—including cryptocurrency, NFTs, and mining—complete accuracy cannot always be guaranteed.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/dfe91325-b547-4fa1-935e-a90918cd010b

https://www.globenewswire.com/NewsRoom/AttachmentNg/70d062ce-7eb9-46b8-b668-8a2663be090c

https://www.globenewswire.com/NewsRoom/AttachmentNg/08af2fbf-c598-4d20-919d-0389d49df02d

https://www.globenewswire.com/NewsRoom/AttachmentNg/8b358344-8ce5-4b7c-bb10-42b0d50b09ad

https://www.globenewswire.com/NewsRoom/AttachmentNg/c5eb3726-e608-4376-86aa-c25764a37404

https://www.globenewswire.com/NewsRoom/AttachmentNg/f3ea6cd2-5f77-4dfb-a88b-14167a9fc2a1