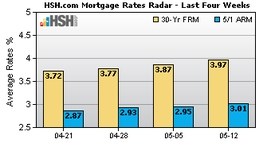

FOSTER CITY, Calif., May 13, 2015 (GLOBE NEWSWIRE) -- Rates on the most popular types of mortgages climbed again this week, according to HSH.com's Weekly Mortgage Rates Radar. The average rate for conforming 30-year fixed-rate mortgages rose by another ten basis points (0.10 percent) to 3.97 percent. Conforming 5/1 Hybrid ARM rates increased by six basis points, closing the Wednesday-to-Tuesday wraparound weekly survey at an average of 3.01 percent.

"Fixed mortgage rates have risen by a quarter of a percentage point over the past three weeks and are now at levels last seen in December," said Keith Gumbinger, vice president of HSH.com. "Financial markets have been very unsettled in recent weeks, with a strong selloff in bonds around the world. Investors seem to be eyeing a diversifying range of opportunities, and it appears that the appeal of safe but low-yielding government bonds has waned a bit."

The global economy is in a state of flux at the moment, with some central banks continuing or initiating QE-style programs, even as the U.S. looks to exit them. These massive purchases of government and other bonds by central banks are intended to fight deflation and promote risk-taking by investors by pushing them in search of greater returns. If the programs work, both economic growth and inflation revive, with somewhat firmer interest rates as a result.

"We're seeing a bit of reversal of the trend that gave us ultra-low interest rates for a long period," adds Gumbinger. "In reality, interest rates have merely firmed up a little from unusually low levels. With prospects for stronger growth here and abroad improving, we may need to become more comfortable with firmer rather than softer mortgage rates as we go along, but there are limits on how high they can go right now, as plenty of issues remain that are troubling many economies."

Average mortgage rates and points for conforming residential mortgages for the week ending May 12, according to HSH.com:

Conforming 30-year fixed-rate mortgage

-Average Rate: 3.97 percent

-Average Points: 0.14

Conforming 5/1-year adjustable-rate mortgage

-Average Rate: 3.01 percent

-Average Points: 0.09

Average mortgage rates and points for conforming residential mortgages for the previous week ending May 5 were, according to HSH.com:

Conforming 30-year fixed-rate mortgage

-Average Rate: 3.87 percent

-Average Points: 0.17

Conforming 5/1-year adjustable-rate mortgage

-Average Rate: 2.95 percent

-Average Points: 0.09

Methodology

The Weekly Mortgage Rates Radar reports the average rates and points offered on conforming 30-year fixed-rate mortgages and conforming 5/1 ARMs. The weekly mortgage rate survey covers a large sample of mortgage lenders and is conducted over a Wednesday-to-Tuesday cycle, with data released every Wednesday. HSH.com's survey helps consumers find the best rates on home loans in changing market conditions. Unlike mortgage rate surveys that report average rates only, the Weekly Mortgage Rates Radar's inclusion of both average rates and average points provides a more accurate view of mortgage terms currently offered by lenders.

Every week, HSH.com conducts a survey of mortgage rate data for a wide range of consumer mortgage products including ARMs, FHA-backed and jumbo mortgages, as well as home equity loans and lines of credit from hundreds of direct lenders in the U.S. For information on additional loan products, visit HSH.com.

About HSH.com

HSH.com is a trusted source of mortgage data, trends, news and analysis. Since 1979, HSH's market research and commentary has helped homeowners, buyers and sellers make smart financial choices and save money on mortgage and home equity products. HSH.com, of Riverdale, N.J., is owned and operated by QuinStreet, Inc. (Nasdaq:QNST), one of the largest Internet marketing and media companies in the world. QuinStreet is committed to providing consumers and businesses with the information they need to research, find and select the products, services and brands that best meet their needs. The company is a leader in ethical marketing practices. For more information, please visit QuinStreet.com.

A photo accompanying this release is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=32907