NEW YORK, Sept. 01, 2022 (GLOBE NEWSWIRE) -- Arrow Investment Advisors announced today plans to transfer the listing of two ETFs from The Nasdaq Stock Market LLC to CBOE Global Markets, Inc. The transfer is expected to occur on or about Sept. 16, 2022. No shareholder action is required due to this change, nor is the transfer expected to affect fund shares trading.

Transferring ETFs: (Ticker)

Arrow DWA Tactical: Macro ETF DWAT

Arrow DWA Tactical: International ETF DWCR

Arrow Investment Advisors serves as the investment adviser for Arrow Funds. Arrow Funds offers tactically managed ETFs, including a global country and stock momentum strategy with its country rotation ETF (DWCR) and the highly rated global macro-ETF (DWAT).

Arrow applies the disciplined capabilities of Dorsey Wright's (DWA's) research by employing a rules-based buy and sell discipline. Arrow Funds has been offering unique solutions with DWA since 2006.

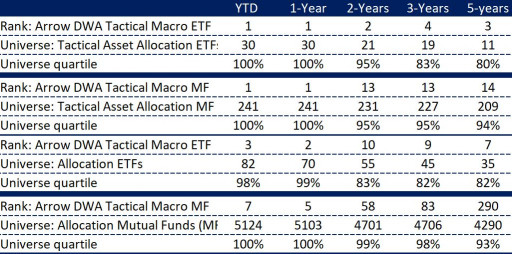

The Global Macro strategy is offered in a mutual fund (DWTNX) and exchange-traded wrapper. The Global Macro Fund's ability to adapt and source returns has helped the fund generate positive returns in 2022. The funds have maintained their #1 ranking in the Morningstar tactical asset allocation category based on total return in their perspective wrappers for both YTD and the one-year period through 8/31/22.

Arrow's global macro investment approach systematically identifies and provides exposure to leading global market strategies and can hedge risk for prolonged market drawdowns. This approach has allowed Arrow Global Macro Funds to stand out among its peers. As of 8/31/22, it is the top quartile performer among all asset allocation funds in the YTD, one-year, three-year, and five-year periods.

The principles behind the Morningstar classification system is categories have enough constituents to form the basis for reasonable peer group comparisons and portfolios within a category invest in similar types of securities. These distinctions are meaningful to investors and assist in their pursuit of investing goals. The breakdown table (Image Source: Morningstar as of 8/31/22) image shows the rankings used among all the ETFs and Mutual Funds for both the Morningstar tactical asset allocation category and allocation category groups.

Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted above. Investment return and principal value will fluctuate, so that shares, when sold or redeemed, may be worth more or less than their original cost. Rankings are only one form of performance measurement, to obtain the most recent DWTNX performance data, click here, and for the most recent DWAT performance data, click here, or call 1-877-277-6933. source: Morningstar proprietary ratings performance through Aug. 31, 2022. The rankings are subject.

About Arrow: Arrow Funds, including the exchange traded product line ArrowShares, is a company that offers targeted portfolio solutions for ever-changing markets. The company's vision is to be recognized as the leading provider of alternative and tactical investment solutions with a focus on education, research and client service as the cornerstones. To learn more, visit www.ArrowFunds.com.

Before investing, please read the prospectus and shareholder reports to learn about the investment strategy and potential risks. Investing involves risks, including the potential for loss of principal. An investor should consider the fund's investment objective, charges, expenses and risks carefully before investing. The funds may not be suitable for all investors. This and other information about the fund is contained in the fund's prospectus, which can be obtained by calling 1-877-277-6933.

Press Follow-up: Click Here

Content reviewed by an affiliate, Archer Distributors, LLC. 0072-AD-09012022

Related Images

Image 1: Global Macro's Rank among Peers

Rankings among ETFs and MFs

This content was issued through the press release distribution service at Newswire.com.

Attachment