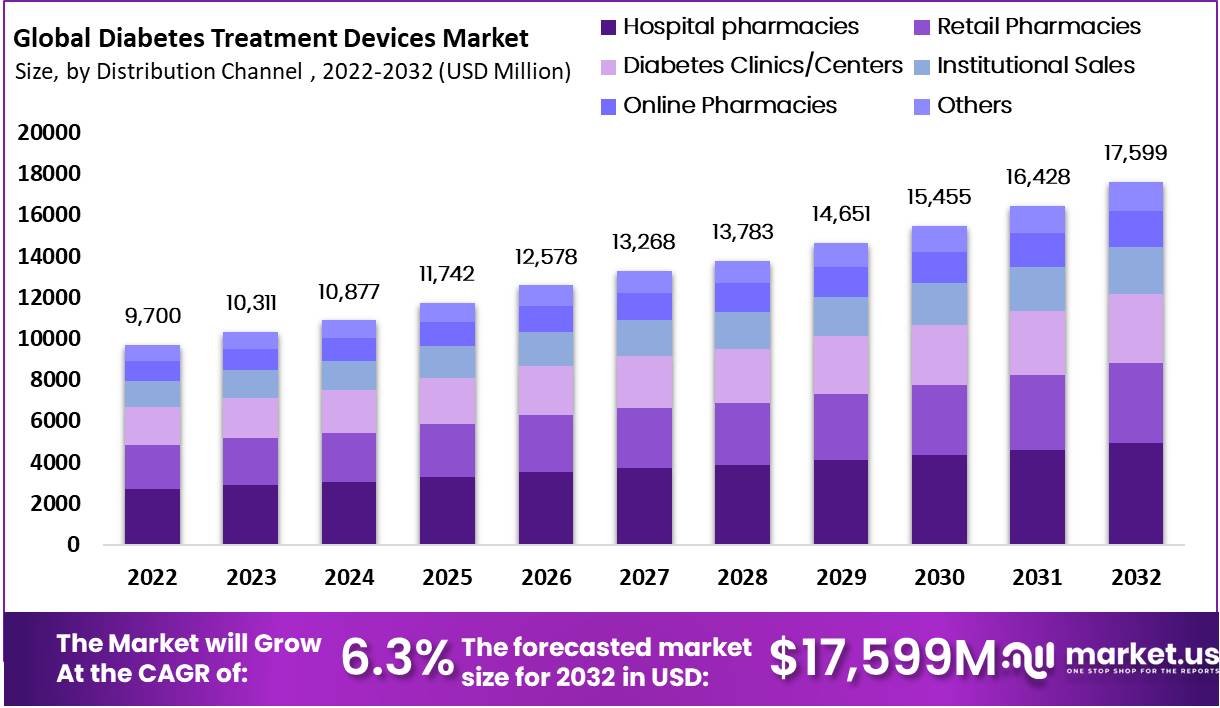

New York, March 13, 2023 (GLOBE NEWSWIRE) -- The global diabetes treatment device market size was valued at around USD USD 9,700 Million in 2022 and size is projected to surpass USD 17,599 million by 2032, it is growing at a compound annual growth rate (CAGR) of 6.3% from 2023 and 2032. Diabetes is a chronic condition in which blood sugar levels are higher than normal due to a defect in insulin(a pancreatic hormone) production. However, Blood sugar is the core source of energy and can be obtained from the foods we eat and controlled by insulin.

Normal blood sugar levels are between 70 and 100 mg/dL, but diabetics patients may experience elevations of 80 to 130 mg/dL which causes severe problems to the health of the patient. To monitor the glucose levels in the blood, diabetes care devices are used. This technology is especially useful for people with diabetes. Many diabetic treatment devices can monitor diabetes status, including continuous blood glucose monitors, injection pens, insulin pumps, and others, which allow them to control their blood sugar and improves the patient's overall health.

To get additional highlights on major revenue-generating segments, Request a Diabetes Treatment Devices Market sample report at https://market.us/report/diabetes-treatment-devices-market/request-sample/

Key Takeaway:

- By Device, the Insulin Pens Segment is anticipated to grow with the increasing revenue during the forecast period (2023-2032).

- By Distribution channels, online pharmacies can purchase diabetes devices directly from manufacturers. This allows them to offer customers lucrative deals. This segment is driven by a growing awareness of online pharmacies among patients and an increase in public-private funding over the forecast period 2023 to 2032.

- By End users, This market was dominated by the hospital segment, which held 48.9% of the total market in 2022.

- In 2022, North America dominated the market with the highest revenue share of 43%.

- Europe is expected to be the second-largest market due to the presence of a large patient population and increased healthcare expenditure.

- Asia-Pacific will grow at the fastest CAGR during the forecast period 2023 to 2032.

According to the report, The COVID-19 pandemic's impact on the market for diabetes care devices remains positive due to patients with diabetes and high blood pressure at greater risk of any infection. Diabetic patients need continuous insulin access and care, such as administration done with syringes, pens, or via a drip. Therefore, insulin pens and continuous glucose monitor devices were developed to increase the demand for optimal diabetes management.

Factors Affecting the Growth of the Diabetes Treatment Devices Market?

There are several factors that can affect the growth of the diabetes treatment devices market. Some of these factors include:

- Increasing prevalence of diabetes: The number of people diagnosed with diabetes is increasing worldwide, which is driving the growth of the diabetes treatment device industry.

- Growing awareness among patients: Growing awareness of the availability and effectiveness of diabetes treatment devices is encouraging more people to seek out these treatments.

- Technological advancements: Advancement in technology have led to the development of more efficient and effective diabetes treatment devices in coming years.

- Increasing adoption of home monitoring devices: Home monitoring devices allow for easier and more accurate monitoring of blood glucose levels, which is driving the growth of the diabetes treatment device market.

- Government initiatives: Governments across the globe are taking initiatives to promote diabetes awareness and treatment to encourage more people to get the required treatment for avoiding life harm; this factor improves the growth of the diabetes treatment device market.

- Rising healthcare expenditure: Increasing healthcare expenditure is leading to more people having access to diabetes treatment devices, which fuel the market growth.

To understand how the diabetes treatment devices Market report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/diabetes-treatment-devices-market/#inquiry

Market Growth

As a result of changing lives and an increase in the diabetic population globally, there is ultimately growing demand for diabetes treatment devices. When comparing the population without and with diabetes, there is a 300% greater chance of them being hospitalized. This means that they are more likely to need healthcare, and because of their earlier age and longer duration of diabetes, youth are at greater risk for developing diabetes. This can hurt the quality of life, reduce life expectancy, increase healthcare costs, and decrease their ability to pay for healthcare. The current lifestyle and technological advancements that have led to increased use of diabetes care devices, as well as the possibility of diabetes occurring more frequently in young adults and youth, raise concerns.

Regional Analysis

North America accounted for the largest revenue and it is expected to grow with a moderate CAGR in the forecast period. Asia Pacific is projected to grow at an even higher CAGR. This is due to increasing diabetes prevalence, increased use of insulin delivery devices that are more technologically advanced, and increased demand. An increase in diabetes diagnosis rates, and increased awareness among patients regarding early diagnosis, are two factors that will drive greater demand for insulin. This will drive the growth in the global diabetes treatment devices market during the forecast period from 2023-2032. Europe, on the other hand, is expected to experience significant growth in the market because of the rising prevalence of diabetes and government initiatives toward awareness about diagnosis and treatment. A rising healthcare cost increased diabetes awareness, and greater awareness of diabetes treatment will lead to a significant increase in Latin America, Africa, and the Middle East.

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include Medtronic plc, Abbott Laboratories, Hoffmann-La-Ltd., Bayer AG, Lifescan, Inc., B Braun Melsungen AG, Lifescan, Inc., Dexcom Inc., Insulet Corporation, Ypsomed Holdings, Other key players.

Have Queries? Speak to an expert, or To Download/Request a Sample, Click here.

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 9,700 Million |

| Market Size (2032) | USD 17,599 Million |

| CAGR (from 2023 to 2032) | 6.3% |

| North America Revenue Share | 43% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The main driving factor for the diabetes care devices market will be created by increasing awareness of diabetes monitoring devices and untapped markets in developing countries. The demand for home care is also increasing due to the aging population. According to the World Health Organization, 80% of all the world's elderly live in low- or middle-income countries. The total population of 60-year-olds and over is expected to grow to 2 billion by 2050. Due to this step, the demand for insulin pumps in home care settings is increasing rapidly. This will lead to an exponential growth rate. Obesity is a leading cause of diabetes in the general populace. The WHO records show that around half of the world's population is overweight or obese. In that population, men are more likely to be obese than women. Diabetes is directly linked to increasing rates of obesity, so the disease rate is high in the male gender. The above factors lead to the growth of the diabetic treatment device market.

Market Restraints

On the other hand, Painful sensor insertions and difficulty fitting multiple devices into small bodies additionally disruptive alerts, leading to data gaps, lost signals, adhesive issues, skin irritation, and improved information generated by difficult-to-carry diabetes care devices are factors inhibiting market expansion.

Market Opportunities

The market is also being driven by awareness campaigns and government initiatives. The UK DESMOND education program is an organized, patient education and management program for newly diagnosed type 2 diabetics. Their goal is to help people recognize early health risks. The government has increased funding for healthcare. According to the International Diabetes Federation, diabetes-related healthcare spending is on the rise. Bigfoot partnered with Abbott to develop the Bigfoot Unity Diabetes Management System, and U.S. FDA approved the collaboration. This system 2 is the first of its kind and includes smartpen caps that can be used to insert insulin via disposable insulin pens. They integrate with Abbott's Freestyle Liber 2 technology. Many supportive initiatives and increased awareness are expected to increase diabetes device demand in foreseeable future.

Grow your profit margin with Market.us - Purchase Premium Diabetes Treatment Device Market Report at https://market.us/purchase-report/?report_id=95307

Report Segmentation of the diabetes treatment device Market

Device Type Insight

Based on Device Type, the market is segmented into insulin pens, pumps, jet injectors, and syringes. The market for insulin pens will grow at an impressive CAGR over the forecast period. At the initial stage, insulin syringes could be used easily and were self-administrable, but the advent of reusable, minimally invasive, and prefilled insulin delivery devices has reduced the need for insulin syringes. The growth rate of insulin pumps is expected to be significant during the forecast period.

Distribution Channel Insight

Hospital pharmacies have been responsible for high market penetration in recent years. This is due to their high footfall and the availability of products. Inpatient and outpatient pharmacies are the two types of pharmacies found within a hospital campus. Online pharmacies can purchase diabetes devices directly from manufacturers, and this allows them to offer customers lucrative deals. A growing awareness of online pharmacies drives this segment among patients and an increase in public-private funding. Outpatient pharmacies are usually located in the hospital's lobbies or entrances. The outpatient pharmacy has insulin delivery devices and handheld glucose meters. The COVID-19 pandemic had a positive impact on the e-pharmacies industry. Diabetes device sales volumes have increased via this platform.

End User Insight

The hospital segment dominated the market in 2022, accounting for 48.9% of the market overall. This is due to the high prevalence of diabetes patients in hospitals, who are three times more likely to be diagnosed with the condition than those without it. In recent years, the technology for diabetes has advanced rapidly, driving increased usage of insulin pumps in clinics and hospitals. Meanwhile, the homecare sector is projected to expand with a 7.4% CAGR over the forecast period, as more people become aware of diabetes prevention and the user-friendly capabilities of insulin pumps.

For more insights on the historical and Forecast Diabetes Treatment Devices Market data from 2016 to 2032 – download a sample report at https://market.us/report/diabetes-treatment-devices-market/request-sample/

Market Segmentation

By Device Type

- BGM Devices

- Self-Monitoring Devices

- Blood Glucose Meters

- Testing Strips

- Lancets

- Continuous Glucose Monitoring Devices

- Sensors

- Transmitters

- Receiver

- Insulin Delivery Devices

- Pumps

- Disposable pens

- Cartridges in Reusable Pens

- Syringes

- Needles

- Diagnostic

- Others

By Distribution Channel

- Hospital pharmacies

- Retail Pharmacies

- Diabetes Clinics/Centers

- Institutional Sales

- Online Pharmacies

- Other Distribution Channel

By End-User

- Hospitals

- Homecare

- Diagnostic Centers

- Ambulatory Surgery Centers

- Other End-Users

By Application

- Knees

- Shoulders

- Ankle & Foot

- Back & Spine

- Elbow & Wrist

- Hips

- Other Application

By Geography

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- Medtronic plc

- Abbott Laboratories

- Hoffmann-La-Ltd.

- Bayer AG Company Profile

- Lifescan, Inc.

- B Braun Melsungen AG

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Other key players.

Recent Development of the diabetes treatment device Market

- March 2021 - F. Hoffmann-La Roche Ltd. announced the launch of a new Accu-Check Intl system. This new system monitors blood glucose and supports Roche's personalized, integrated diabetes management approach.

- April 2021 – BIOCORP and Roche Diabetes Care France announced Mallya, a smart insulin pen for France. BIOCORP will be able to leverage Roche's extensive distribution network in pharmacies.

- August 2020 - Medtronic plc announced their intention to purchase Companion Medical. Companion Medical is a privately owned company that manufactures InPen, an FDA-approved smart insulin pen system that integrates diabetes management software.

- June 2020 - Tandem Diabetes Care and Abbott agreed to jointly develop and commercialize integrated solutions for diabetes. This agreement will combine Tandem's innovative insulin delivery system with Abbott's continuous glucose monitoring.

Browse More Related Reports:

- Blood Glucose Meters Market size is expected to be worth around USD 22.6 Bn by 2032 from USD 10 Bn in 2022, growing at a CAGR of 8.7%

- CIS Insulin Market will be valued at USD 466 million in 2022 and is projected to grow at a CAGR of 2.45% from 2023 to 2032.

- Diabetes Wearables Market is projected to reach a valuation of USD 36.25 Bn by 2032 at a CAGR of 6.3%, from USD 20.92 Bn in 2021.

- Blood Transfusion Diagnostics Market size is expected to be worth around USD 9095 mn by 2032 growing at a CAGR of 7%.

- Automated Insulin Delivery Devices Market was valued USD 12.51 billion in 2021 and estimated CAGR of 7.9%, over forecast period.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn | Facebook | Twitter

Our Blog: