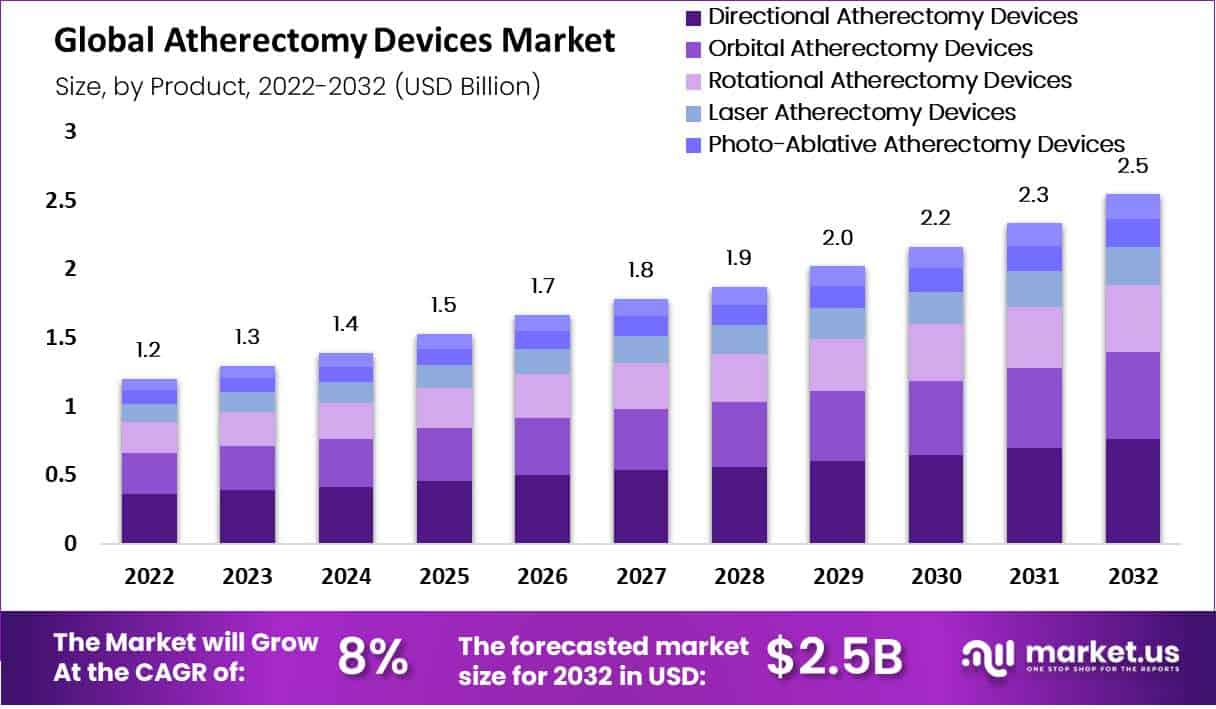

New York, May 09, 2023 (GLOBE NEWSWIRE) -- In 2022, Atherectomy Devices Market was valued at USD 1.2 Billion and is expected to reach USD 2.5 billion in 2032. This market is estimated to register the highest CAGR of 8% between 2023 and 2032.

A surgical treatment called an atherectomy uses a catheter with a sharp blade to remove plaque and atherosclerosis from the blood arteries in the body. Essentially, it is a local anesthetic-assisted endovascular minimally invasive surgical treatment. Atherectomy works by removing plaque and hardened lesions from the artery to create a substantial lumen, which aids in reviving blood flow in the arteries. They are frequently employed in peripheral, neurovascular, and cardiovascular applications.

Get additional highlights on major revenue-generating segments, Request an Atherectomy Devices Market sample report at https://market.us/report/atherectomy-devices-market/request-sample/

Key Takeaway:

- By product, in 2022, the market for atherectomy devices is expected to be dominated by the directional atherectomy segment in terms of revenue.

- By application, the market for atherectomy devices is expected to be dominated by peripheral vascular applications with a share of 45%.

- By end-user, the hospitals and surgical centres segment is anticipated to contribute a significant revenue contribution to the global atherectomy devices market

- In 2022, North America dominated the market with the highest revenue share of 36%.

- APAC is anticipated to have the highest CAGR among all the regions.

- APAC is expected to grow at a greater pace owing to affordable prices, increasing medical tourism, as well as hospitals and clinics, among other factors.

Factors Affecting the Growth of the Global Atherectomy Devices Market

The global atherectomy devices market is expected to grow in the coming years due to several factors including:

- Increasing prevalence of peripheral artery disease (PAD): The growing incidence of PAD is driving demand for atherectomy devices, which are used to treat blockages in the arteries. The incidence of PAD is increasing due to the aging population, the growing prevalence of diabetes, and increasing sedentary lifestyles.

- Technological advancements in atherectomy devices: Technological advancements in atherectomy devices are driving the growth of the market. For example, the development of atherectomy devices that use laser technology, such as the Diamondback 360 Coronary Orbital Atherectomy System, has improved the efficacy and safety of atherectomy procedures.

- Increasing adoption of minimally invasive procedures: Atherectomy devices are used in minimally invasive procedures, which are becoming increasingly popular due to their reduced recovery times and reduced risk of complications compared to traditional surgical procedures.

- Increasing healthcare expenditure: Healthcare expenditure is increasing globally, as governments and private healthcare providers invest in new treatments and technologies. This is driving the demand for atherectomy devices, which are increasingly being used in a range of medical procedures.

- Favourable reimbursement policies: Favourable reimbursement policies can have a significant impact on the growth of the market. Companies that can secure reimbursement for their products are more likely to be successful in the market.

- Regulatory approvals: Regulatory approvals are important for atherectomy device manufacturers, as they must meet strict safety and efficacy standards to be approved for use. Companies that can secure regulatory approvals for their products are more likely to be successful in the market.

- Increasing awareness about the benefits of atherectomy procedures: Increasing awareness about the benefits of atherectomy procedures, such as their ability to remove plaque without damaging the arterial walls, is driving demand for atherectomy devices. This increased awareness is due to growing patient and physician education efforts.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/atherectomy-devices-market/#inquiry

Top Trends in the Global Atherectomy Devices Market

- Growing demand for minimally invasive procedures: Atherectomy devices are minimally invasive, which means they offer several advantages over traditional surgical techniques. Patients generally experience less pain, shorter hospital stays, and quicker recovery times. This has led to an increasing adoption of these procedures, particularly in developed countries.

- Advancements in device technologies: The market is witnessing a constant influx of new technologies aimed at improving the safety, efficacy, and outcomes of atherectomy procedures. These include new materials, delivery systems, and imaging techniques, as well as the development of new devices and applications.

- Emergence of new market players: The market is experiencing an increasing number of new entrants, particularly in emerging markets. These players are expected to offer low-cost, locally-manufactured devices, which could expand access to these procedures in areas where they are currently limited.

- Increasing adoption of image-guided procedures: The use of imaging technologies, such as fluoroscopy and ultrasound, is increasing in atherectomy procedures. This presents an opportunity for manufacturers to develop devices that are optimized for use with these imaging technologies.

- Integration of artificial intelligence and machine learning: The integration of artificial intelligence and machine learning is expected to play a growing role in the development of atherectomy devices. These technologies can help improve the accuracy and precision of procedures, as well as patient outcomes.

- Increasing focus on patient safety and outcomes: Patient safety and outcomes are becoming increasingly important in healthcare, and there is a growing focus on improving the safety and effectiveness of medical procedures. Device manufacturers can capitalize on this trend by developing devices that are optimized for safety and outcomes.

Market Growth

The primary drivers of the market's growth include the world's aging population, peripheral artery disease (PAD), atherosclerosis, diabetes, and obesity. The market's optimistic prognosis is further influenced by the increased demand for MI atherectomy surgical treatments among patients and healthcare professionals. These tools lessen the risk of infection, lessen the patient's suffering during surgery, and speed their recovery. Other commercial advances, such as the creation of balloons coated with pharmaceuticals, are additional elements that drive expansion (DCB). DCBs are used instead of permanent implants in directional atherectomy and anti-restenosis therapy (DAART), which is used to treat lesions with severe calcifications and supply anti-proliferative medications.

Regional Analysis

With a market share of 36%, North America is predicted to be the most lucrative region for atherectomy devices. There is a sizable patient population with peripheral and coronary artery diseases, more clinical trials are being undertaken, and atherectomy systems are becoming more well-liked among medical professionals. The American Heart Association estimates that CVD caused 18.6 million deaths globally in 2019. As a result of the strain it puts on the country's healthcare system, the demand for atherectomy devices is anticipated to increase over the course of the projected period. The market's growth is additionally supported by a favorable reimbursement environment and a wide range of FDA-approved devices.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 1.2 billion |

| Market Size (2032) | USD 2.5 billion |

| CAGR (from 2023 to 2032) | 8% |

| North America Revenue Share | 36.0% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

With the growing demand for less intrusive surgery, rising disease incidence, growing older population, and higher success rates vascular problems are becoming more common among people everywhere (peripheral artery disease, coronary artery disease). More than 200 million people worldwide are thought to be affected by peripheral artery disease (PAD), according to the NCBI. The number of old people has likewise significantly increased. 18.5% of Canadians will be 65 or older in 2021, increasing their risk of developing coronary heart disease. The need for atherectomy devices has increased as a result.

Atherectomy is one minimally invasive technique that has become more popular recently among patients and doctors alike. Atherectomy devices are becoming more necessary as a result, which considerably fuels the market's expansion. According to a study by the American Heart Association (AHA), atherectomy devices were successful in 94.7% of patients. It is projected that as a result, market growth will quicken and have a higher success rate.

Market Restraints

Due to the high cost of atherectomy, patients must select alternative means of treatment. According to an NCBI study, the average cost of an angioplasty is about USD 7300. On the other hand, an atherectomy normally costs USD 9300. The high costs affect atherectomy demand and restrict market growth. Despite the high success rate of atherectomy, the high rate of restenosis leads patients to select alternative therapies, which restrains the market's growth. The rate of restenosis after atherectomy was 37.7%.

Market Opportunities

By using more advanced atherectomy devices, the industry's growth can be sped up and more growth opportunities created. Percutaneous revascularization techniques, which use optical coherence tomography and interventional radiology as therapeutic concepts, can help atherectomy devices. Atherectomy techniques like thrombectomy and vitrectomy are also an option. Healthline reports that the success rate for vitrectomies is 90%, even for patients over the age of 60.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=101181

Report Segmentation of the Global Atherectomy Devices Market

Product Insight

The directional atherectomy accounted for the largest market share in 2021 at over 21%. It is expected that this will continue to rise through the forecast period. This is mostly due to technological developments in the field of guided atherectomy that are best suited to the therapeutic advantages offered. Orbital atherectomy systems are a promising new method for treating various artery problems like CAD and PAD. As the world's population ages and the danger of coronary and peripheral artery calcification rises, surgical procedures to address arterial plaque are becoming more and more common. As a result, more people are buying orbital technology, which will support market growth in the future. Because of the low procedural challenges and low rates of restenosis, orbital implants are also in higher demand.

Application Insight

According to the application channel, Peripheral Vascular Applications are anticipated to hold a 45% share of the market for atherectomy devices. Clinically referred to as "peripheral artery disease," occlusive or stenotic lesions caused by thromboembolic or atherosclerotic disease. Patients with peripheral artery disease typically require invasive procedures to remove blockages and prevent the illness from worsening. Balloon angioplasty and percutaneous transluminal angioplasty are common treatments for localized lesions. However, the likelihood of rebound and the inadequate patency rates for longer lesions limit the market for these treatments. Furthermore, the presence of hard calcifications may lead to incomplete or partially completed stent expansion and persistent stenosis.

End User Insight

The end-user sector of hospitals and surgical centers is predicted to have the largest share of over 27% in terms of revenue over the forecast period among all end-user segments, contributing a sizeable amount of revenue to the worldwide atherectomy devices market. This may be a result of atherectomy becoming more and more common during the expected time period as a treatment for peripheral and cardiac vascular disease. Ambulatory surgery centers (ASCs) offer high-quality care at a low indirect cost of care. They are affordable. ASCs provide specialized surgeons, cutting-edge surgical technology, and well-appointed operating rooms without the need for time-consuming administrative procedures, which is likely to boost the segment's growth.

Recent Development of the Atherectomy Devices Market

- In August 2022- Angio Dynamics revealed that the FDA has given the green light for the sale of its more complex Auryon-Atherectomy System. The 2.35 mm and 2.0 mm catheters from Auryon System will also be made available by AngioDynamics for the treatment of arterial thrombosis. Both catheters are excellent atherectomy conducting devices and can be used to treat ISR/In-Stent Restenosis.

- In February 2022- develop a wide range of cutting-edge thrombectomy tools. Innova believes that by collaborating with CSI, it will be able to benefit from that business's competitive positioning in the thrombectomy device market and speed up the sale of its products after they have obtained regulatory approval. Some of the biggest names in the bio-based surface disinfection market are listed below.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/atherectomy-devices-market/request-sample/

Market Segmentation

Based on Product

- Directional Atherectomy Devices

- Rotational Atherectomy Devices

- Orbital Atherectomy Devices

- Laser Atherectomy Devices

- Photo-Ablative Atherectomy Devices

- Support Devices

- Others

Based on the Application

- Peripheral Vascular Applications

- Cardiovascular Applications

- Neurovascular Applications

Based on End User

- Hospitals & Surgical centres

- Ambulatory Care Centres

- Research Laboratories

- Academic Institutes

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The existence of a select few major players distinguishes the consolidated nature of the global atherectomy devices market. The industry's vendors are employing a variety of techniques to widen their regional reach and boost their market shares. Also, they are heavily investing in research to create effective products and obtain regulatory clearances for their market introduction. Other sellers are also implementing the idea of premium pricing to sell their goods in order to thrive in this market.

Some of the major players include:

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Becton, Dickinson, and Company (BD Interventional)

- Koninklijke Philips N.V.

- Avinger Inc.

- Rex Medical

- AngioDynamics

- Cardiovascular Systems Inc.

- Bard Peripheral Vascular Inc.

- Spectranetics St.

- Jude Medical Inc.

- Straub Medical AG

- Terumo IS

- Volcano Corporation

- Others Key Players

Browse More Related Reports:

- Cardiovascular Biomaterial Market is projected to reach a valuation of USD 667.04 Bn by 2032 at a CAGR of 15.6%, from USD 135.4 Bn in 2021.

- Neurovascular Catheters Market size is expected to be worth around USD 5,988.60 million by 2032 from USD 3,072.9 million in 2022, growing at a CAGR of 6.9% during the forecast period from 2022 to 2032.

- Cardiovascular and Soft Tissue Repair Patches Market was valued at USD 4,000 million in 2021 and estimated CAGR of 8% between 2023 and 2032.

- Surgical Equipment Market size is expected to be worth around USD 36 Billion by 2032 from USD 16.7 Billion in 2022, growing at a CAGR of 8.20% during the forecast period from 2023 to 2032.

- Aneurysm Clips Market size is expected to be worth around USD 2.0 Billion by 2032 from USD 1.1 Billion in 2022, growing at a CAGR of 6.2% during the forecast period from 2022 to 2032.

- Intravascular Ultrasound Market size is expected to be worth around USD 1296 Million by 2032 from USD 707.55 Million in 2022, growing at a CAGR of 6.40% during the forecast period from 2023 to 2032.

- Breast pump market was valued at USD 1.49 Billion in 2022 and is expected to reach USD 2.86 Billion in 2032. This market is estimated to register a CAGR of 6.9% between 2023 and 2032.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: