Dublin, Oct. 27, 2023 (GLOBE NEWSWIRE) -- The "Veterinary Furniture Market Size, Share & Trends Analysis Report By Product, By Usage (Veterinarian/ Technician Use, Patient Use), By Sales Channel, By Purchasing Channel, By End Use, By Region, And Segment Forecasts, 2023 - 2030" report has been added to ResearchAndMarkets.com's offering.

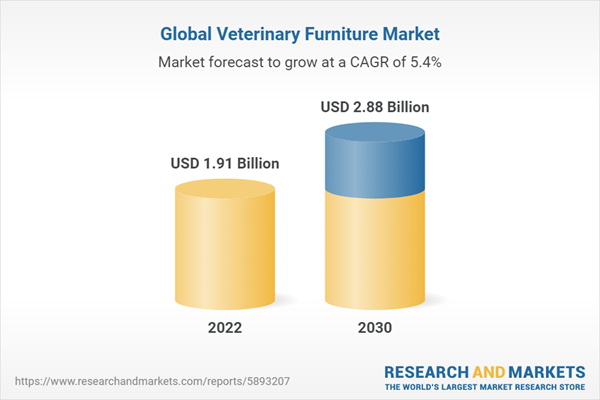

The global veterinary furniture market size is anticipated to reach USD 2.88 billion by 2030, registering a CAGR of 5.41% from 2023 to 2030

The veterinary furniture market is on a growth trajectory, attributed to rapid technological advances in veterinary furniture, enhanced healthcare facilities for animals, increased focus on animal health, and the ergonomic advantages offered by modern surgical equipment. The market is further propelled by the rising demand for electric, adjustable, and portable furniture such as lift tables, spanning various departments within veterinary healthcare.

Key players in the industry are contributing to market growth by developing innovative and cost-effective solutions. An interesting demographic trend adds to the market's growth dynamics: a significant proportion of veterinarians and veterinary technicians are female. These professionals, typically of shorter stature, face challenges in reaching tools and materials stored in cabinets, leading to potential ergonomic issues. In response, leading companies are offering solutions that enhance visibility and accessibility to supplies, addressing these unique needs.

The COVID-19 pandemic had a notable impact on the import and export of veterinary furniture, resulting in reduced sales of various products. Temporary manufacturing facility closures, export restrictions, increased veterinary visits post-COVID-19, and a delay in veterinary hospital renovations contributed to disruptions and shortages in the supply of veterinary furniture.

However, governments have taken measures to ensure the continuity of veterinary services and product supplies during the pandemic. For instance, the Indian government mandated that animal medical care be classified as an essential service during nationwide COVID-19 lockdowns. Consequently, while the pandemic initially disrupted the veterinary furniture market, it has since rebounded to its pre-pandemic state, experiencing a surge in demand for cutting-edge veterinary furniture.

In summary, the veterinary furniture market is witnessing substantial growth due to technological advancements, improved healthcare facilities, and ergonomic benefits. Demographic factors and COVID-19-related challenges have also shaped the market's dynamics, ultimately driving demand for veterinary furniture in the coming years.

Veterinary Furniture Market Report Highlights

- Growing concerns over the patient's comfort and reducing the strain on veterinarians by using innovative veterinary furniture are increasing the opportunities in the veterinary furniture market

- By product, the tables segment dominated the market in 2022 due to the growing usage and availability of several tables used in veterinary hospitals. On the other hand, the workstation segment is projected to witness the fastest growth rate of about 7% in the coming years as more veterinary hospitals use computer workstations to streamline various tasks

- Veterinarian/ technician use accounted for the largest market share by usage in 2022 and is anticipated to grow at the fastest CAGR of over 5.5% over the forecast period due to the growing extent of work pressure and the requirement for appropriate furnishings for staff members working in large animal practices

- In terms of the sales channel, the offline segment dominated the market with a share of over 63% in 2022 due to several advantages, including real-time experience, higher purchasing assurance, full installation support, and simple returns. On the other hand, the online segment is anticipated to witness the fastest growth of about 5.9% during the forecasted period due to the availability of excellent deals & discounts on products

- By purchasing channel, the direct held the largest market share in 2022 and is anticipated to grow at the fastest CAGR of more than 5.4% over the forecast period since direct purchasing from manufacturers reduces the purchasing cost of veterinary furniture

- The veterinary hospital segment dominated the furniture market in 2022 based on end-use. Veterinary clinics are expected to grow at the fastest rate of over 5.5% in the coming years

- In 2022, North America held the highest share of over 39% of the market owing to the easy availability and accessibility of veterinary furniture, high-end veterinary facilities, and a number of specialized veterinary clinics. The Asia Pacific region is expected to grow at the fastest rate of over 7% in the coming years, owing to a huge number of domestic players selling refurbished veterinary furniture at a lower cost

Companies Mentioned

- Midmark Corporation

- TECHNIK Ltd

- OLYMPIC VETERINARY

- Covetrus

- Suburban Surgical Co., Inc.

- GPC Medical Limited

- David Bailey Furniture Systems Ltd

- Everest-Tecnovet, SL

- VETINOX

- DRE Veterinary

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 150 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value (USD) in 2022 | $1.91 Billion |

| Forecasted Market Value (USD) by 2030 | $2.88 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Segment Snapshot (Product, Usage)

2.3 Segment Snapshot (Sales Channel, Purchasing Channel)

2.4 Segment Snapshot (End Use)

2.5 Competitive Landscape Snapshot

Chapter 3 Veterinary Furniture Market Variables, Trends, & Scope

3.1 Market Lineage Outlook

3.1.1 Parent market analysis

3.1.2 Ancillary Market Analysis

3.2 Veterinary Furniture Market Dynamics/ Industry Trends

3.2.1 Market Driver Impact Analysis

3.2.1.1 Increased In Veterinary Visits & Need For Veterinary Furniture

3.2.1.2 Rising Awareness Of Innovative Furniture To Enhance Patient Comfort

3.2.1.3 Technological Advancements In Veterinary Furniture

3.2.2 Market restraint analysis

3.2.2.1 Lack Of Availability Of Veterinary Specific Furniture In Developing Countries

3.2.3 Market Opportunity Analysis

3.2.4 Challenges Faced by Veterinary Furniture Manufacturers

3.3 Veterinary Furniture Market: Porter's 5 Forces Analysis

3.4 Veterinary Furniture Market: PESTEL Analysis

3.5 COVID-19 Impact Analysis

Chapter 4 Product Estimates & Trend Analysis, 2018 - 2030 (USD Million)

4.1 Veterinary Furniture Market by Product: Key Takeaways

4.2 Product Movement Analysis & Market Share, 2022 & 2030

4.3 Veterinary Furniture Market Estimates & Forecast by Product (USD Million)

4.4 Tables

4.4.1 Tables market estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2 Exam Tables

4.4.3 Surgery Tables

4.4.4 Other Categories

4.5 Lift Tables

4.6 Mobile/ Procedure Carts

4.7 Workstation

4.8 Boarding & Containment

4.9 Chairs & Stools

4.10 Others (e.g., Scales, Sinks & Tubs)

Chapter 5 Usage Estimates & Trend Analysis, 2018 - 2030 (USD Million)

5.1 Veterinary Furniture Market by Usage: Key Takeaways

5.2 Usage Movement Analysis & Market Share, 2022 & 2030

5.3 Veterinary Furniture Market Estimates & Forecast, By Usage (USD Million)

5.4 Veterinarian/ Technician Use

5.5 Patient Use

Chapter 6 Sales Channel Estimates & Trend Analysis, 2018 - 2030 (USD Million)

6.1 Veterinary Furniture Market by Sales Channel: Key Takeaways

6.2 Sales Channel Movement Analysis & Market Share, 2022 & 2030

6.3 Veterinary Furniture Market Estimates & Forecast by Sales Channel (USD Million)

6.4 Offline

6.5 Online

Chapter 7 Purchasing Channel Estimates & Trend Analysis, 2018 - 2030 (USD Million)

7.1 Veterinary Furniture Market by Purchasing Channel: Key Takeaways

7.2 Purchasing Channel Movement Analysis & Market Share, 2022 & 2030

7.3 Veterinary Furniture Market Estimates & Forecast, By Purchasing Channel (USD Million)

7.4 Direct

7.5 Distributor

Chapter 8 End-Use Estimates & Trend Analysis, 2018 - 2030 (USD Million)

8.1 Veterinary Furniture Market by End Use: Key Takeaways

8.2 End-Use Movement Analysis & Market Share, 2022 & 2030

8.3 Veterinary Furniture Market Estimates & Forecast, By End Use (USD Million)

8.4 Veterinary Hospitals

8.5 Veterinary Clinics

Chapter 9 Regional Estimates & Trend Analysis, 2018 - 2030 (USD Million)

9.1 Regional Outlook

9.2 Regional Market Share Analysis, 2022 & 2030

9.3 Regional Marketplace, Key Takeaways

For more information about this report visit https://www.researchandmarkets.com/r/ob07w4

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment