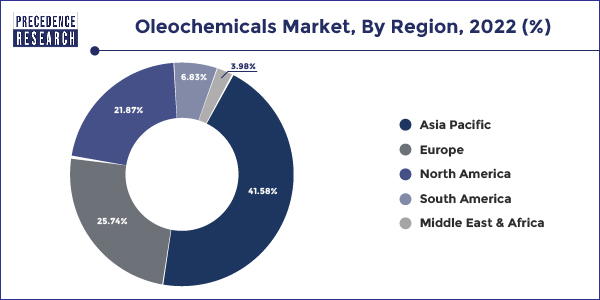

Ottawa, Dec. 19, 2023 (GLOBE NEWSWIRE) -- The global oleochemicals market size was valued at USD 22.66 billion in 2022 and the sector is growing at a CAGR of 7.4% from 2023 to 2032. Asia Pacific led the global market with the largest market share of 41.58% in 2022.

The oleochemicals market is driven by the growing bio-based product demand, increasing government initiatives, rising consumer awareness, increasing applications in diverse sectors and technological advancements. In addition, the growing transition towards green chemistry is also propelling the market expansion during the forecast period.

Oleochemicals are chemical compounds derived from natural fats and oils, typically of plant or animal origin. These raw materials are mainly triglycerides, which consist of glycerol and three fatty acid chains. Oleochemicals are produced by various chemical and enzymatic processes that involve the transformation of these triglycerides into a wide range of chemical products. Oleochemicals are appreciated for being renewable and for being able to replace products made with petrochemicals.

Download the Sample Pages@ https://www.precedenceresearch.com/sample/1693

They are also frequently seen as more sustainable and eco-friendly, which adds to the increased interest in the green and bio-based sectors. The growing collaboration in the industry is also propelling the market growth during the forecast period. For instance, in October 2022, the newly created PET Antifogging compound for direct food contact PET packaging was announced by Emery Oleochemicals and Sukano.

Key Insights:

- The specialty esters segment is expected to hold the largest market share during the forecast period.

- The personal care & cosmetics segment is expected to dominate the market during the forecast period.

- The liquid segment is expected to dominate the market share over the forecast period.

You can place an order or ask any questions, please feel free to contact us at

sales@precedenceresearch.com | +1 650 460 3308

Growth Factors of Oleochemicals Market

It is anticipated that the overall product demand in the US shall rise with the use of all chemicals in the end user industries such as the personal care industries and the pharmaceutical industries. The demand for the olechemicals is also expected to grow as there is an increase in the demand for cleaning products industry which includes self acting soaps, etc. Procter and Gamble, which is a leading manufacturer in the cleaning products line, it is based in Europe and imports many oleochemicals from Malaysia and Indonesia.

The oleochemical segment is expected to grow in the forecast period as there is a demand for the use of natural organic skin care and hair care cosmetic products. As the environmental regulations are becoming stringent constantly and the renewable resources are getting depleted. There is an opportunity for the growth of the oleochemicals and they shall substitute the conventional petroleum based products. The market for green chemicals is rising and there's an increase in the demand for such products in the consumer markets.

Regional Stance:

Asia Pacific is expected to dominate the market during the forecast period because of the growing soap, drug, and personal care sectors in nations like China, India, and Japan, as well as their enhanced capability for manufacturing. According to the Chinese National Bureau of Statistics, retail sales of cosmetics in China reached USD 3.85 billion in April 2023, exceeding USD 3 billion in the same month the previous year. Over the past 10 years, China's cosmetics industry has experienced rapid growth. In 2022, the retail value of cosmetics was valued at USD 55.14 billion.

Additionally, the Asia Pacific oleochemical producers have invested much in increasing production capabilities and implementing cutting-edge technology. This demonstrates the region's dedication to fulfilling the rising demand for products derived from oleochemicals. Furthermore, there are government programs to promote the oleochemicals business in some nations, particularly in Southeast Asia. The industry has grown as a result of policies that support the development of sustainable practices and bio-based companies.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/1693

North America is expected to grow at a steady rate over the projected period. The key driver behind this rise is the region's expanding need for oleochemicals in the personal care, cosmetics, and pharmaceutical industries. The oleochemical sector is expanding due in large part to the region's emphasis on ecologically friendly technologies and sustainability. Consumer desire and knowledge of natural and bio-based goods is growing, which is driving up demand for oleochemicals. Furthermore, market development is expected to be supported by the region's robust infrastructure and distribution networks.

Oleochemicals Market Scope

| Report Coverage | Details | |

| Growth Rate from 2023 to 2032 | CAGR of 7.4% | |

| Global Market Size in 2023 | $ 24.27 Billion | |

| Global Market Size by 2032 | $ 46.26 Billion | |

| Asia Pacific Market Size in 2023 | $ 10.16 Billion | |

| Asia Pacific Size by 2032 | $ 20.62 Billion | |

| Asia Pacific Market Share in 2022 | 41.58% | |

| Glycerol Esters Segment Revenue Share 2022 | 32.83% | |

| Base Year | 2022 | |

| Forecast Period | 2023 to 2032 | |

| Segments Covered | Products, Applications, Form, Feedstock, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa (MEA) | |

We've prepared a service to help you write your own Go-To-Market strategy.

Click to Unlock Your GTM Strategy for the Oleochemicals Market

Report Highlights:

Product Insights

The specialty esters segment is expected to hold the largest market share during the forecast period. Specialty esters find applications in various industries, including cosmetics, personal care, lubricants, plastics, pharmaceuticals, and food. Their unique properties make them well-suited for specific functions in these diverse sectors. It is used in the formulation of cosmetics and personal care products. They can act as emollients, moisturizers, and solubilizers, contributing to the texture and performance of skincare and haircare formulations.

Moreover, it is utilized in the production of bio-based polymers and plasticizers. These esters can enhance the flexibility and performance of polymers, serving as alternatives to conventional petrochemical-based additives. Furthermore, the growing investment by the market participants also propels the market growth. For instance, in May 2023, the production activities for specialty esters and amphoteric surfactants in Hopewell, Virginia were acquired by US chemicals company Kensing from Evonik.

With an emphasis on skin care, hair care, and dental care applications, Kensing's acquisition of amphoteric surfactants and specialty esters products is largely directed towards the personal care sector.

Application Insights

The personal care & cosmetics segment is expected to dominate the market during the forecast period. Consumer intentions for natural and sustainable ingredients have led to a substantial use of oleochemicals in the personal care and cosmetics business. Derived from natural fats and oils, oleochemicals have a variety of qualities that fit them for use in cosmetics and personal care products. In skincare and haircare products, oleochemicals such as fatty acids, fatty alcohols, and esters work well as emollients and moisturizers. They add to the overall texture of formulations, hydrate the skin, and enhance skin sensation. Thereby, driving the market growth.

Form Insights

The liquid segment is expected to dominate the market share over the forecast period. The usage of liquid oleochemicals in a variety of applications as bio-based solvents is growing. Cleaners, paints, and varnishes, for instance, use bio-based solvents made from citrus oils or other oleochemical sources. Liquid oleochemicals are also utilized as lubricants in industrial applications; examples of these include some vegetable oils and their derivatives. In addition to having lubricating qualities, they can be more ecologically friendly than lubricants made of petroleum. Thus, the usage of liquid oleochemicals in diverse sectors drives market growth.

Market Dynamics:

Driver

An increase in the market for bio-based products

The market is expanding as a result of the growing demand for bio-based products among consumers worldwide. As consumers grow more aware of environmental issues, they are starting to choose products made from biofuel. Accordingly, people's growing inclination for natural and bio-based substitutes in their daily lives is fueling the market's expansion. Oleochemicals are biodegradable, plant-based substances that are safe for the body. In addition, the market is seeing a rise in demand for natural ingredients in moisturizers and emollients, among other cosmetics and personal care products. In the same way, customers who value environmentally friendly cleaning products use bio-based surfactants extensively.

Restraint

Volatility in raw material price

The two main raw materials utilized in the production of oleochemicals are vegetable and animal fats. The production of biofuels uses the same basic resources. However, using animal and vegetable lipids as biofuels presents supply chain difficulties. The market for oleochemicals is not expanding as a result of these obstacles. Primarily in the oleochemical markets of North America and Europe, animal fats are utilized as raw materials. The flexible availability of animal fat is one of the main obstacles to its use. According to estimates, 50% of the raw materials used in the European oleochemicals business come from animal fat. Nevertheless, the Bovine Spongiform Encephalopathy (BSE) laws restrict its availability in the area. Players in the oleochemicals industry in these nations may expect challenges due to the indirect reliance of oleochemicals producers on these regulatory policies and an inelastic raw material supply.

Opportunity

The expansion of the packaged food and beverage sector

Breakfast cereals, dairy products, baked goods, baby food, biscuits, cakes, ice cream, fruit snacks, yogurts, gum, candies, frozen food, and energy/cereal bars are examples of packaged foods. The consumption of packaged foods has grown dramatically in emerging nations. Growing economic levels and a preference for urban lives are the main causes of this growth. Products have a longer shelf life because of innovations in the packaged food sector, such as self-cooling and self-heating packaging. The main uses of oleochemicals are as preservatives and emulsifiers in bread, cakes, pastries, and confections, among other food and beverage goods. Furthermore, these compounds are employed in the manufacturing of food additives, which are mostly utilized in sealed food products. Oleochemicals are employed in the dairy sector to produce flavored and plain ice cream. Throughout the projected period, the market is anticipated to develop at a rapid pace due to the growing demand for oleochemicals, notably in the packaged food industry.

Related Reports:

- Specialty Oleochemicals Market: The global specialty oleochemicals market size was estimated at USD 26.06 billion in 2022 and is expected to hit around USD 59.48 billion by 2032, poised to grow at a CAGR of 8.6% during the forecast period 2023 to 2032.

- Emulsifiers Market: The global emulsifiers market size was reached at USD 7.87 billion in 2022 and is projected to hit around USD 15.27 billion by 2032, growing at a CAGR of 6.9% between 2023 and 2032.

- Nutricosmetics Market: The global nutricosmetics market size accounted for USD 6.5 billion in 2022 and it is expected to hit around USD 14.63 billion by 2032, growing at a CAGR of 8.5% during the forecast period 2023 to 2032.

- Wellness Supplements Market: The global wellness supplements market size was valued at USD 240 billion in 2022 and it is expected to hit around USD 474.31 billion by 2032, growing at a significant CAGR of around 7.10% from 2023 to 2032.

- Functional Ingredients Market: The global functional ingredients market size was exhibited at USD 100 billion in 2022 and is expected to hit around USD 199.48 billion by 2032, poised to grow at a CAGR of 7.20% during the forecast period from 2023 to 2032.

Recent Developments:

- In September 2023, having successfully finished the REACH registration procedure, one of the top manufacturers of excellent oleochemicals from renewable sources in Europe is now permitted to create medium chain triglycerides, or MCTs.

- In August 2023, the leading Japanese business Tsukino Oleochemicals achieved great progress in the field of sustainable development. The business just revealed the introduction of a new range of fatty acid ester products made from residual cooking oil. This advancement demonstrates Tsukino's dedication to encouraging the effective use of resources for non-edible vegetable oil, a market that has experienced a recent increase in demand. The new products are an important step toward the realization of a decarbonized society and help to increase the biomass content in diverse products. This program is in line with the Tsukino Group's overarching objectives, which center on maximizing the utilization of rice bran. The organization has ventured into three industries: fine chemicals, oleochemicals, and rice bran oil.

Market Key Players:

- Evonik Industries AG

- Corbion

- Cargill, Incorporated

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Emery Oleochemicals

- Vantage Specialty Chemicals, Inc.

- KLK OLEO

- Godrej Industries

- IOI Corporation Berhad

- Oleon NV

Market Segmentation

By Product

- Specialty Esters

- Glycerol Esters

- lkoxylates

- Fatty Acid Methyl Ester

- Fatty Amines

- Others

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food & Beverages

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Others

By Form

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

By Feedstock

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1693

You can place an order or ask any questions, please feel free to contact us at

sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit:

www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com/

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For the Latest Update Follow Us:

Asia Pacific Market Share in 2022

41.58%

32.83%

- North America