Dublin, Jan. 24, 2024 (GLOBE NEWSWIRE) -- The "Canada Nuclear Medicine Market Size, Share & Trends Analysis Report by Product (Diagnostic, Therapeutic), Application (Oncology, Bone Metastasis, Neurology, Cardiology), End-use (Hospitals & Clinics, Diagnostic Centers), Province, and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

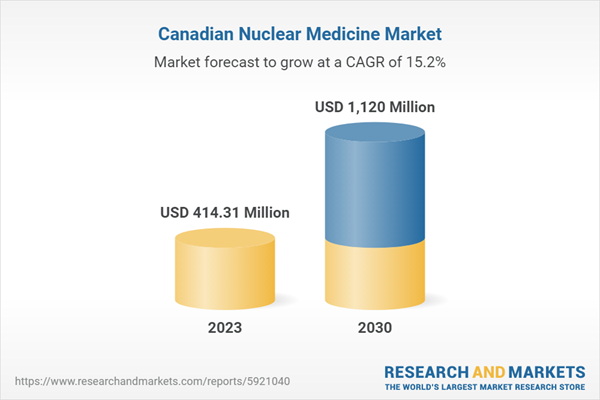

The Canada nuclear medicine market size is expected to reach USD 1.12 billion by 2030, according to the study. The market is anticipated to advance at a CAGR of 15.16% from 2024 to 2030. This growth is driven by a rising need for early and precise disease diagnosis and increasing demand for improved treatment options. For instance, as per the Canadian Cancer Society, cancer is the leading cause of death in the country, leading to over 28% of deaths annually. Also, around 233,900 new cancer cases and 85,100 cancer deaths were estimated in Canada in 2022.

Due to an increasing demand for radioisotopes in therapeutic and diagnostic applications in the healthcare industry, a number of players developing and producing these radioisotopes have entered the country's market. Some key facilities producing radioactive substances for different medical uses in Canada are Chalk River Laboratories, McMaster Nuclear Reactor, Ecole Polytechnique, Royal Military College of Canada, University of Alberta, and Saskatchewan Research Council.

Moreover, in June 2023, the Minister of Innovation, Science, and Industry launched the Canadian Medical Isotope Ecosystem (CMIE) to support nuclear medicine & radiopharmaceutical projects run by notable market players such as BWXT Medical, Canadian Nuclear Laboratories (CNL), Bruce Power, and McMaster University. CMIE will be receiving around USD 35 million during a 5-year period to support initiatives to increase production and research activities of medical isotopes and radiopharmaceuticals in Canada.

An increasing number of organizations are undertaking initiatives to help address the growing need for nuclear medicine, which is anticipated to accelerate market growth. For instance, the Canadian government continues to undertake initiatives to strengthen the country's healthcare sector. Since March 2020, the government has invested more than USD 2 billion in 36 major projects to boost Canada's life science sector's capacity. Moreover, the government is investing in the medical isotope segment to position the country as a global leader in the production and supply of radioisotopes for diagnosis and treatment.

However, stringent regulations pertaining to production, storage, and usage of nuclear medicine & radiopharmaceuticals is expected to restrain the growth of Canada's nuclear medicine market. Radioactive substances are capable of mutating genes and may cause severe adverse effects, including fatalities. Thus, handling radioactive substances is strictly regulated by governments to ensure compliance with radiation safety policies. Approval procedures for products containing radioactive substances are stringent, which delays their market launch.

Canada Nuclear Medicine Market Report Highlights

- In terms of product, the diagnostics segment accounted for a larger revenue share in 2023, owing to benefits such as affordability, ease of handling, compatible half-life of radioisotopes, and applications such as diagnosis of cancer and cardiovascular diseases

- Based on application, the oncology segment dominated Canada's nuclear medicine market in 2023, owing to rising R&D investments in nuclear medicine for cancer diagnosis and treatment

- In terms of end-use, hospitals & clinics dominated the nuclear medicine market in Canada in 2023, based on revenue, owing to increasing collaborations of health institutions with research organizations and industry leaders to expand access to state-of-the-art radiopharmaceuticals, thus improving patient care and outcomes

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 120 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $414.31 Million |

| Forecasted Market Value (USD) by 2030 | $1120 Million |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Canada |

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

2.1 Market Snapshot

2.2 Product and End-Use Segment Snapshot

2.3 Application Segment Snapshot

2.4 Competitive Landscape Snapshot

Chapter 3 Canada Nuclear Medicine Market Variables, Trends, and Scope

3.1 Canada Nuclear Medicine Market Lineage Outlook

3.1.1 Parent Market Outlook

3.1.2 Ancillary Market

3.2 Market Dynamics

3.2.1 Market Driver Analysis

3.2.1.1 Rising Incidence Of Cancer And Cardiovascular Diseases

3.2.1.2 Increasing Applications Of Radiopharmaceuticals/Nuclear Medicine

3.2.1.3 Growing Demand For Accurate Diagnostic Methods

3.2.2 Market Restraint Analysis

3.2.2.1 Stringent Regulations Pertaining To Production, Storage, & Usage Of Nuclear Medicine & Radiopharmaceuticals

3.2.2.2 High Costs Associated With Diagnostics & Therapeutic Procedures

3.3 Canada Nuclear Medicine Market Analysis Tools

3.4 Market Trends

3.4.1 SPECT Radioisotopes Trends

3.4.2 PET Radioisotopes Trends

3.4.3 Therapeutic Radioisotope Trends

3.5 COVID-19 Impact

3.6 Pipeline Analysis

Chapter 4 Canada Nuclear Medicine Market - Segment Analysis, by Product, 2018-2030 (USD Million)

4.1 Canada Nuclear Medicine Market: Product Movement Analysis

4.2 Canada Nuclear Medicine Market Estimates & Forecast, By Product (USD Million)

4.2.1 Diagnostic Products

4.2.1.1 SPECT

4.2.1.1.1 TC-99m

4.2.1.1.2 TL-201

4.2.1.1.3 GA-67

4.2.1.1.4 I-123

4.2.1.1.5 Other SPECT products

4.2.1.2 PET

4.2.1.2.1 F-18

4.2.1.2.2 SR-82/RB-82

4.2.1.2.3 Other PET products

4.2.2 Therapeutic Products

4.2.2.1 Alpha Emitters

4.2.2.1.1 RA-223

4.2.2.1.2 Others

4.2.2.2 Beta Emitters

4.2.2.2.1 I-131

4.2.2.2.2 Y-90

4.2.2.2.3 SM-153

4.2.2.2.4 Re-186

4.2.2.2.5 Lu-117

4.2.2.2.6 Other beta emitters

4.2.2.3 Brachytherapy

4.2.2.3.1 Cesium-131

4.2.2.3.2 Iodine-125

4.2.2.3.3 Palladium-103

4.2.2.3.4 Iridium-192

4.2.2.3.5 Other Brachytherapy Products

Chapter 5 Canada Nuclear Medicine Market - Segment Analysis, by Application, 2018-2030 (USD Million)

5.1 Canada Nuclear Medicine Market: Application Movement Analysis

5.2 Canada Nuclear Medicine Market Estimates & Forecast, by Application (USD Million)

5.2.1 Cardiovascular Disorders

5.2.2 Neurology

5.2.3 Oncology

5.2.4 Thyroid

5.2.5 Lymphoma

5.2.6 Bone Metastasis

5.2.7 Endocrine Tumor

5.2.8 Others

Chapter 6 Canada Nuclear Medicine Market - Segment Analysis, by End Use, 2018-2030 (USD Million)

6.1 Canada Nuclear Medicine Market: End-Use Movement Analysis

6.2 Canada Nuclear Medicine Market Estimates & Forecast, By End Use (USD Million)

6.2.1 Hospitals & Clinics

6.2.2 Diagnostic Centers

6.2.3 Others

Chapter 7 Canada Nuclear Medicine Market - Province Analysis, by Product, Application, End Use, 2018-2030 (USD Million)

7.1 Canada

7.1.1 Alberta

7.1.2 Saskatchewan

7.1.3 Manitoba

7.1.4 Rest of Canada

Chapter 8 Competitive Landscape

- GE Healthcare

- Nordion (Canada)

- Lantheus Medical Imaging

- Cardinal Health

- Jubilant Life Sciences

- Isologic Innovative Radiopharmaceuticals

- Curium Pharma

- adMare BioInnovations

For more information about this report visit https://www.researchandmarkets.com/r/yygtvt

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment