Dublin, Jan. 30, 2024 (GLOBE NEWSWIRE) -- The "Italy Alternative Lending Market Business and Investment Opportunities Databook - 75+ KPIs on Alternative Lending Market Size, By End User, By Finance Model, By Payment Instrument, By Loan Type and Demographics - Q2 2023 Update" report has been added to ResearchAndMarkets.com's offering.

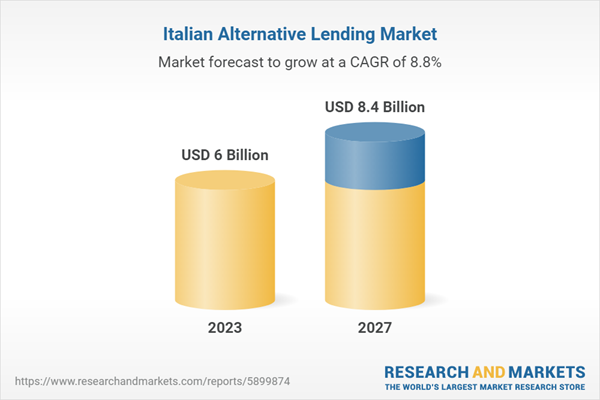

Italy's burgeoning alternative lending market is poised for significant growth, presenting dynamic opportunities for investors and financial service providers. A robust compound annual growth rate (CAGR) of 8.8% is projected from 2023-2027, signaling a vibrant ecosystem ripe for strategic investment and innovation.

Recent research has unveiled that the Italian alternative lending landscape will grow exponentially from an evaluated US$ 5.18 billion in 2022 to an estimated US$ 8.41 billion by the year 2027. This expansion is attributed primarily to the increasing adoption of diverse financial models that cater to the evolving needs of both businesses and consumers.

The comprehensive databook provides an in-depth, data-centric analysis of the rival alternative lending sector in Italy across multiple dimensions. Transaction value, transaction volume, and average transaction value are among the over 75+ key performance indicators (KPIs) explored to furnish stakeholders with a profound understanding of market dynamics.

Unprecedented Growth in Italy's Alternative Financing Sector

Amidst a global financial revolution, Italy presents a promising scenario for alternative lending. The nation’s marked increase in the adoption of innovative finance models and payment techniques is particularly noteworthy. With statistics indicating a steadfast growth trajectory, Italy aligns well with global trends placing alternative financial services at the forefront of the industry conversation.

For savvy investors and financial intermediaries, the report serves as an invaluable resource, offering actionable insights that span across Italy's diverse economic landscape. The potential for harnessing these alternative lending mechanisms is vast, opening up new avenues for consumer credit, business financing, and property lending through next-generation financial services.

The detailed analysis provides critical information for anyone looking to engage with or better understand the Italian alternative lending space. As the market steadily carves a niche in Italy's broader financial sector, stakeholders stand to gain strategic advantages by aligning with the detailed forecasts and emerging trends outlined within this data-rich report.

Among the critical insights, the report highlights:

- The size and forecast of the Italy alternative lending market across various financial models, including P2P lending, balance sheet lending, and debt-based securities.

- Analyzed market segmentation by payment instruments such as cash, credit cards, e-money, mapping their usage to different lending models.

- A deep dive into the diverse types of loans offered within the market such as personal loans, lines of credit, and invoice factoring.

- Detailed consumer attitudes and behavior analysis segmented by demographics like age, income, and gender, offering lenders nuanced insights into their target audiences.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 164 |

| Forecast Period | 2023 - 2027 |

| Estimated Market Value (USD) in 2023 | $6 Billion |

| Forecasted Market Value (USD) by 2027 | $8.4 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Italy |

For more information about this report visit https://www.researchandmarkets.com/r/xlv7xr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment