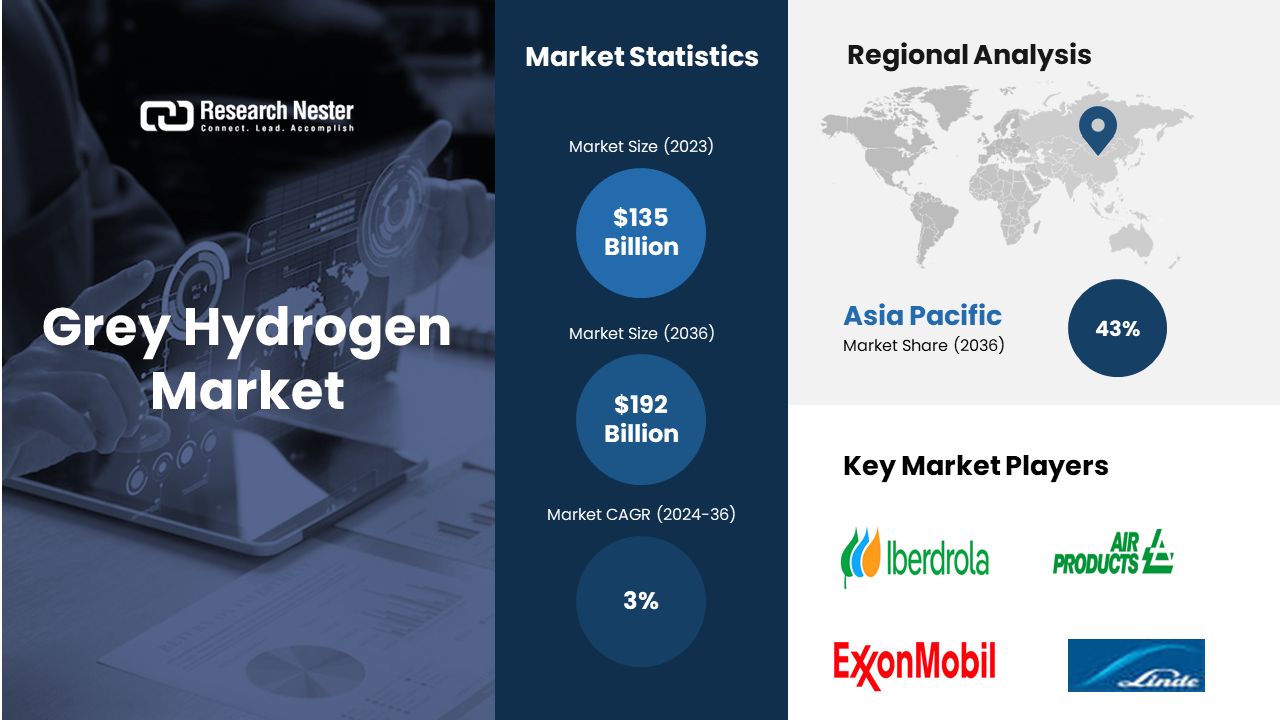

New York, Feb. 13, 2024 (GLOBE NEWSWIRE) -- The global grey hydrogen market size is predicted to expand at ~3% CAGR between 2024 and 2036. The market is projected to garner a revenue of USD 192 billion by the end of 2036, up from a revenue of ~USD 135 billion in the year 2023.Grey Hydrogen’s role as a transitional solution in the broader hydrogen economy is one of the primary drivers for the market’s growth. Grey hydrogen, derived from fossil fuels like natural gas or coal, serves as a bridge between conventional fuels and cleaner alternatives. In the Net Zero Emissions by 2050 scenario, novel uses in heavy industries and long-distance transport account for one-third of worldwide hydrogen demand by 2030, compared to less than 0.1% in the former case. Its widespread use stems from established infrastructure and cost-effectiveness, meeting immediate industrial demands for hydrogen.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5477

As nations and industries aim for carbon neutrality and sustainable energy solutions, grey hydrogen acts as a stepping stone, allowing for a smoother transition. Additionally, advancements in technologies like carbon capture and utilization (CCU) enhance its environmental credentials, making it more attractive as a solution. The transitional role positions grey hydrogen as a crucial growth driver by supporting the initial stages of hydrogen adoption until cleaner technologies mature and become more widespread.

Increasing Demand for fertilizers across the Globe to Boost Market Growth

Increasing Demand for fertilizers across the Globe to Boost Market Growth

To produce ammonia, which is used to make fertilizers, grey hydrogen is used. Due to the desire to reduce production costs and boost crop yields and nutritional content, there is a substantial global demand for fertilizers. Global population increase and rising purchasing power and disposable income, particularly in developing nations, are to blame for the rise in food product consumption. This is anticipated to increase the global need for fertilizer by driving the food business. This is expected to accelerate grey hydrogen market expansion. In the petrochemical industry, it is primarily employed in hydrocracking to create petroleum products. Furthermore, it is used to remove impurities, such as sulfur, to create methanol (CH3OH). The hydrogen economy is gaining momentum, as it is utilized in various sectors. Clean hydrogen can contribute to reducing the petroleum industry’s carbon footprint, as carbon neutral hydrogen could provide low carbon fuel to heat steam furnaces and, in the long- term, offer feedstock to manufacture petrochemicals. Thus, chemical and petrochemical industries are anticipated to provide significant business opportunities. Industries such as refining, ammonia production, and methanol production heavily rely on hydrogen, especially grey hydrogen derived from natural gas or coal. As these sectors grow and evolve, the demand for grey hydrogen increases, driving market growth.

Grey Hydrogen Market: Regional Overview

The market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Industrial Expansion and Hydrogen Demand to Drive the Market Growth in Asia Pacific Region

The grey hydrogen market in Asia Pacific region is estimated to garner the largest revenue by the end of 2036. The region presents a dynamic landscape for the market. Countries like China, India, South Korea, and Australia drive substantial demand owing to their burgeoning industrial sectors. With its rapidly increasing renewable capacity, China is already the biggest producer and consumer of hydrogen in the world. This country's current annual hydrogen output is approximately 33 million tons, with an annual capacity of 40 million tons. Rapid industrialization fuels the reliance on grey hydrogen, derived predominantly from coal and natural gas, to meet energy needs. Further, several nations in the region are actively investing in research and development to enhance hydrogen production efficiency and reduce emissions through carbon capture technologies. Governments in the Asia Pacific region are setting ambitious emission reduction targets, driving the exploration of technologies, including carbon capture and storage (CCS) in grey hydrogen production.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5477

Growing environmental concerns to Propel the Growth in the North America Region

The North America grey hydrogen market is estimated to garner the highest CAGR by the end of 2036. The United States and Canada are key players, leveraging abundant natural gas reserves to produce grey hydrogen. Historically, industries such as refining, chemicals, and ammonia production have relied on grey hydrogen due to its cost-effectiveness. Further, in recent years, environmental concerns and a growing focus on reducing carbon emissions have prompted a shift in the hydrogen landscape. Moreover, government incentives and policies supporting clean energy initiatives are driving a gradual transition towards low carbon and green hydrogen. Partnerships between public and private sectors, along with advancements in cleaner production methods, are shaping the North American grey hydrogen market toward greater sustainability while maintaining energy security and economic stability. As per our analysis, in the U.S., around 10 million tons of hydrogen are manufactured annually which amounts to about 1 quadrillion BTUs at a yearly consumption rate of just under 1 % of America's energy demand. In the US there are now more than 95 percent grays in hydrogen production.

Grey Hydrogen, Segmentation by Source

- Natural Gas

- Coal

Amongst these segments, the natural gas segment in grey hydrogen market is anticipated to hold the largest share over the forecast period. In the context of the energy transition, natural gas is often considered a transition fuel due to its lower carbon intensity compared to coal and oil. As countries strive to reduce carbon emissions, the use of natural gas can serve as a bridge between high-emission fossil fuels and renewable energy sources. Policymakers and industries may prioritize natural gas to achieve emissions reduction targets in the short to medium term. According to the International Energy Agency (IEA), natural gas accounted for 23% of global energy-related CO2 emissions in 2020, significantly lower than coal and oil. Natural gas is a crucial feedstock for various industrial processes, including chemical manufacturing, steel production, and petrochemicals. Industries rely on natural gas for both heat and power, making it indispensable for processes such as steam methane reforming in hydrogen production, ammonia synthesis, and other high-temperature applications. Accessible and well-developed infrastructure is crucial for the widespread use of natural gas. Ongoing investments in pipeline networks and LNG facilities enhance the reach and flexibility of natural gas supply, supporting its growth.

Grey Hydrogen, Segmentation by Application

- Ammonia Production

- Methanol Production

- Refineries

- Chemical Production

Amongst these segments, the ammonia production segment in grey hydrogen market is anticipated to hold a significant share over the forecast period. The development of green ammonia, produced using renewable energy sources, is gaining momentum as a sustainable and low-carbon alternative. According to the Ammonia Energy Association, global green ammonia capacity reached 120,000 metric tons in 2020, with ongoing projects aiming to scale up production. Green ammonia is produced through a process that utilizes renewable energy, such as electrolysis of water to produce hydrogen for the Haber-Bosch process. The growth of green ammonia aligns with efforts to reduce the carbon footprint of ammonia production. Ammonia production is closely linked to hydrogen production, with green and blue ammonia playing a significant role in the emerging hydrogen economy. Hydrogen is a key input in ammonia production, and as interest in cleaner hydrogen sources grows, the ammonia segment stands to benefit from advancements in green and blue hydrogen technologies. Industries utilize ammonia as a raw material for the production of various chemicals and materials, driving demand beyond its use in agriculture. Growth in industrial applications contributes to the overall expansion of the ammonia production segment.

Few of the well-known industry leaders in grey hydrogen market that are profiled by Research Nester are Air Products and Chemicals, Inc., Exxon Mobil Corporation., Iberdrola, S.A., Air Liquide, Reliance Industries Limited., Indian Oil Corporation Ltd, Messer SE & Co. KGaA, Ørsted, China National Petroleum Corporation, JERA Co., Inc., and other key market players.

Recent Development in the Grey Hydrogen Market

- The first hydrogen refuelling system for passenger trains was introduced by Linde. It is anticipated to refill 14 passenger trains fueled by hydrogen, enabling each train to travel 1000 kilometers without emitting any emissions on a single refuelling. With a daily total capacity of 1600 kg of hydrogen, the plant is among the biggest hydrogen refueling systems ever constructed. The facility is outfitted with cutting-edge technology to incorporate green hydrogen production on-site in the future.

- To generate hydrogen from natural gas, Air Products and Chemicals Inc. intends to construct a USD 1.3 billion plant in Edmonton, which it hopes to open in 2024. The company has signed a construction-related memorandum of understanding. The deal is still contingent on additional talks for incentives from the federal and Albertan governments, including a USD 15 million contribution from the province's emissions reduction fund.

Read our insightful Blogs and Data-driven Case Studies:

- Waste-to-Energy: The Modern Age Technology to Recover Energy

This blog provides an overview of the concept of waste-to-energy: types, advantages, and disadvantages. Further, our blog uncovers the market outlook in Asia Pacific and Europe along with current and future scope.

- Energy & Natural Resource Company to overcome Intermittent Energy Resource Challenges through Sustainable Solutions

The case study uncovers how an energy & natural resource company overcame its challenges with our customized Smart Solar Market Analysis. Our analysts offered them current & future potential in smart solar solutions.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.