Dublin, Feb. 15, 2024 (GLOBE NEWSWIRE) -- The "Train Battery Market by Type & Technology (Lead-acid Tubular, VRLA, Conventional; Ni-Cd Sinter, Fiber, Pocket, & Li-ion; LFP, LTO), Advanced Train (Fully Battery-Operated and Hybrid), Rolling Stock Type, Application and Region - Global Forecast to 2030" report has been added to ResearchAndMarkets.com's offering.

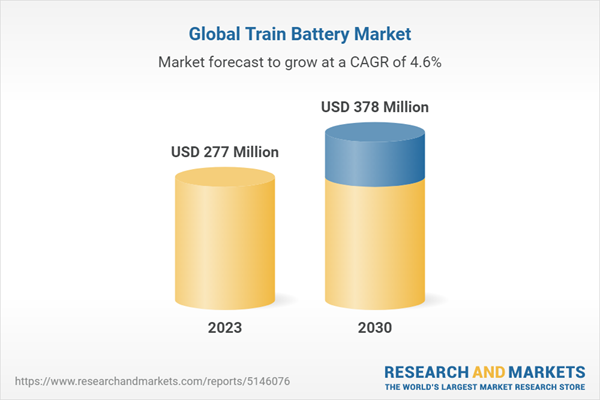

The train battery market is projected to grow from USD 277 Million in 2023 to USD 378 Million by 2030, at a CAGR of 4.6% from 2023 to 2030

The train battery market is primarily driven by factors such as rapid urbanization and the growing expansion of railway networks. Along with these factors, the swiftness of rail travel and low operational cost compared to other modes of transport are driving governments all over the globe to invest in urban rail infrastructure. The growing expansion of rail networks is expected to create a demand for energy storage systems.

As of 2021, Urban Transport Trends and Prospects (UTTP) indicates that there is a total operational network of light rails and trams spanning 15,824 kilometers. Most of these networks are situated in Europe, accounting for 58% of the total, while Eurasia constitutes 22%. Notably, several European countries, including Finland, the UK, and Switzerland, are actively focusing on expanding their light rail networks. For instance, in 2021, the UK government approved the extension of the Blackpool Tram.

Additionally, the increasing development of metro projects is contributing to the rising demand for batteries in metro systems. As an example, in December 2022, the Russian government initiated the construction of the 70-km Moscow Big Circle Line metro project, with a total cost of USD 6.8 billion. Consequently, the growth of light rail and tram networks, coupled with the growing adoption of metro systems for urban transit, is expected to fuel the utilization of batteries in these modes of transportation in the upcoming years.

The train battery market comprises major manufacturers such as EnerSys (US), Exide Industries (India), Saft (France), Amara Raja Batteries (India), GS Yuasa Corporation (Japan), and HOPPECKE Batterien GmbH & Co.KG.

The Auxiliary Batteries are expected to account for the largest market share in 2023.

The auxiliary battery systems provide backup to all essential train systems, such as emergency lighting and ventilation. Auxiliary batteries also offer safety to the train without output failure and train separation incidents. Additionally, the increase in the demand for high-speed trains is leading to the high demand for advanced features such as emergency braking, tilting systems, etc.

VRLA technology holds the largest share in the train battery market due to its technical benefits such as maintenance-free operation, no periodic water filling requirement, fast charging capability, and heat & shock resistance, and is mainly preferred for auxiliary functions in railways. However, the high energy density, good low-temperature performance, and good cycle life means they can be recharged more times than VRLA batteries. Hence, considering these benefits of Ni-cd batteries, the demand for VRLA batteries in railways will be impacted gradually.

Moreover, the latest rolling stocks have been implementing advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), deep learning, and driver advisory systems (DAS) to improve efficiency and enhance the passenger experience. Improvements in resource planning, passenger experience, and decision-making, along with the optimization of field equipment such as ACs, heaters, braking systems, and other onboard appliances, are expected to increase the adoption rate of train batteries for these auxiliary systems.

Passenger Coaches will dominate the train battery market during the forecast period.

Passenger coaches are railroad cars designed to carry passengers. Modern passenger coaches require auxiliary batteries for functions such as reading lights, bathroom lights, vestibule lights, door lights, emergency lights, HVACs, fans, screens, Wi-Fi, and ceiling lights. These functions depend upon the types of coaches, such as AC and non-AC coaches. In developed countries, coaches have automated doors, infotainment systems, and passenger information systems.

These added features are powered through battery power packs. The battery capacity for AC coaches is higher compared to non-AC passenger coaches. Typically, the voltage capacity requirement for passenger capacity is 108V to 120V. Batteries installed in passenger coaches are used for auxiliary power backup. Based on the capacity and power output of the passenger coach, the manufacturer decides the battery chemistry. With increased travel demand, environmental concerns, government investments, improved passenger amenities, safety and reliability, high-speed rail development, intermodal connectivity, and reduced congestion, the need for passenger coaches and train batteries would grow parallelly in the coming years.

Asia Pacific is expected to account for the largest aftermarket share in 2022.

The Asia Pacific region has the world's most extensive railway network and holds the top spot in the global count of rolling stock. Furthermore, it stands as the world's largest producer of rolling stock. This geographical concentration of major rolling stock manufacturers has notably driven the demand for train batteries.

Moreover, with the widespread urban rail network expansion and the presence of international train battery manufacturers in the region, an anticipated rise in demand is foreseen. This is further compounded by the escalating number of passengers, which will necessitate increased utilization of train batteries to enhance the overall travel experience. Rail network electrification, emission regulations, and advancements in battery technologies are expected to drive train battery aftermarket in Asia Pacific.

The growing diesel engine retrofitting and refurbishment at a year-on-year rate of 5%. Further, trains operating in the Asia Pacific region are at high temperatures compared to Europe and North America due to which battery lifespan in the Asia Pacific region is less, thus the demand for battery replacement is high.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 315 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $277 Million |

| Forecasted Market Value (USD) by 2030 | $378 Million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

Premium Insights

- Development of High-Speed Trains and Expansion of Urban Rail Networks to Drive Market

- Nickel-Cadmium Batteries Segment to Hold Largest Market Share During Forecast Period

- Auxiliary Batteries Segment to Register Highest CAGR During Forecast Period

- Sinter/Pne Ni-Cd Segment to Lead Market During Forecast Period

- Electric Locomotives Segment to Register Highest CAGR During Forecast Period

- Passenger Coaches Segment to Hold Largest Market Share During Forecast Period

- Fully Battery-Operated Trains Segment to Witness Higher CAGR Than Hybrid Trains Segment During Forecast Period

- Coaches Segment to Lead Aftermarket During Forecast Period

- Lead-Acid Batteries Segment to Hold Larger Market Share Than Nickel-Cadmium Batteries Segment During Forecast Period

- Auxiliary Batteries Segment to Register Higher CAGR Than Starter Batteries Segment During Forecast Period

- Asia-Pacific to Lead Aftermarket During Forecast Period

- Asia-Pacific Estimated to Account for Largest Market Share in 2023

Case Study Analysis

- Project of Septa and Viridity Energy to Increase Operational Efficiency with Less Energy Consumption

- Reliable Autonomous Battery Solutions for Harsh Weather from Saft to Vr Group

- Emergency Battery System from Saft to Chengdu Metro

- Lithium-Ion Battery Solutions from Saft to Alstrom Transport for Different Weather Conditions and High-Vibrating Environments

- Development of Hybrid Train for Non-Electrified Subsections of Line

- Electrification of Rail Milling Trains for Emission-Free Track Maintenance

- Partnership Between Hitachi and Turntide Technologies to Provide More Sustainable Rail Journeys in the UK

Market Dynamics

Drivers

- Increasing Adoption of Autonomous and High-Speed Railways

- Stringent Emission Regulations

- Expansion of Railway Networks

Restraints

- High Capital Investment and Operating Cost of High-Speed Rail Networks

Opportunities

- Expansion of IoT, AI, and Das Technologies

- Improvements in Battery Technology

- Retrofitting of Diesel-Electric Trains

Challenges

- Technical Challenges Related to Lead-Acid and Lithium-Ion Batteries

- High Cost of Charging Infrastructure and Replacement

- Trends and Disruptions Impacting Customer Business

Market Ecosystem

- Train Battery Manufacturers

- Component/Raw Material Suppliers

- Train Oems

- Government and Regulatory Authorities

- Dealers and Distributors

- Service & Repair Providers

Technological Analysis

- Mitrac Pulse Traction Batteries

- Mrx Nickel Batteries

- Solid-State Batteries

- Lithium-Sulfur Batteries

Company Profiles

Key Players

- Enersys

- Saft

- Gs Yuasa International Ltd.

- Exide Industries Ltd.

- Amara Raja Batteries Limited

- Hoppecke Batterien GmbH & Co. Kg

- Sec Battery

- First National Battery

- Power & Industrial Battery Systems GmbH

- Exide Technologies

- Toshiba Corporation

Other Players

- East Penn Manufacturing Company

- Microtex Energy Private Limited

- Aeg Power Solutions

- Furukawa Electric Co., Ltd.

- Hunan Fengri Power & Electric Co., Ltd.

- Shuangdeng Group Co., Ltd.

- Coslight India

- Shield Batteries Limited

- Akasol Ag

- Dms Technologies

- National Railway Supply

- Leclanche Sa

- Ecobat

- Hbl Batteries

- Star Battery Ltd.

- Hitachi, Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/lscx4z

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment