Dublin, Feb. 15, 2024 (GLOBE NEWSWIRE) -- The "Retail Banking Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028F" report has been added to ResearchAndMarkets.com's offering.

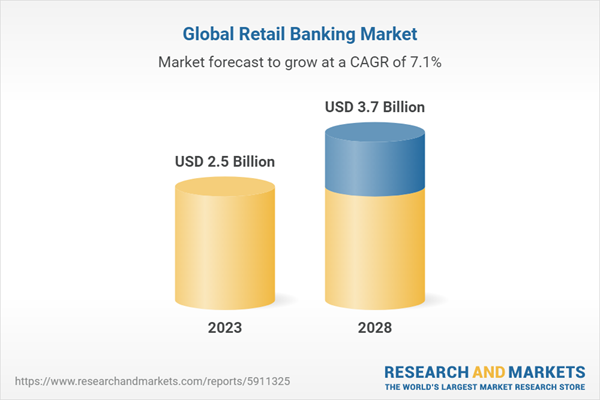

The financial services sector has witnessed an exceptional increase in the adoption of banking solutions tailored for individual consumers and small businesses. The latest report on the Global Retail Banking Market affirms the industry's substantial valuation of USD 2.5 Billion in 2022 and projects a vigorous growth trajectory leading to 2028. The analysis indicates a compounded annual growth rate (CAGR) of 7.11% over the forecast period.

Marked by significant transformations, the market is undergoing a period of considerable change, predominantly driven by the accelerated digital transformation across the banking landscape. Financial institutions across the globe are rapidly enhancing their digital infrastructure to cater to the demands of a tech-savvy consumer base. The increasing prevalence of online and mobile banking applications, underpinned by secure and customer-centric platforms, signifies a pivotal moment for the retail banking sector.

Digital Transformation Shaping the Future of Retail Banking

As the Global Retail Banking Market expands, significant drivers of growth emerge, with digital transformation leading the shift. Embracing the new era of banking, organizations are incorporating artificial intelligence, biometrics, and mobile technologies to ensure seamless customer experiences and secure financial transactions.

Emergence of Fintech and Sustainable Banking Practices

The rapid emergence of fintech startups is revolutionizing the market, providing innovative financial products and compelling traditional banks to adapt their strategies. Likewise, the integration of environmental, social, and governance (ESG) principles in banking practices is reflecting consumer appetite for socially responsible and environmentally sustainable banking.

Financial Inclusion Initiatives Take Center Stage

Ensuring financial inclusion through the provision of banking services to the unbanked or underbanked segments of the population continues to be a primary goal. Innovative solutions, including mobile banking technologies, are instrumental in bridging the financial divide and fostering a more inclusive financial environment.

Regional Spotlight: Europe's Retail Banking Market Positioned for Dynamic Growth

In the European context, the region is showcasing substantial growth within the retail banking domain. The evolution of the market in this region is largely influenced by regulatory initiatives driving open banking frameworks, enhanced digital payment platforms, and a concerted effort toward ESG-driven services.

Segmental Analysis Reveals Credit and Debit Card Dominance

Within the realm of product type insights, credit and debit cards remain dominant, witnessing a continued surge in adoption due to the convenience and rewards they offer. Financial institutions are responding to this trend by innovating and offering specialized credit and debit card products. Private banking also emerges as a robust segment, catering to the wealth management needs of high-net-worth individuals.

The report offers a comprehensive analysis of these trends and more, with detailed insights into various sub-sectors of the market. It serves as an indispensable tool for stakeholders, investors, and participants eager to navigate the complexities of the Global Retail Banking landscape. Key findings suggest that despite challenges such as cybersecurity threats and stringent regulatory compliance demands, the industry's nimble adaptation and forward-thinking approaches signal a resilient and progressive future.

This detailed market report on Global Retail Banking is now available, providing strategic insights into the evolving dynamics of the industry. Entities involved in the retail banking sector will find this analysis particularly valuable for informed decision-making and strategic planning.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 178 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $2.5 Billion |

| Forecasted Market Value (USD) by 2028 | $3.7 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes

- Bank of America

- Wells Fargo

- Citigroup

- Barclays

- ICBC

- HSBC

- NP Paribas

- China Construction Bank Deutsche Bank

- JPMorgan Chase

- Mitsubishi UFJ Financial Group

For more information about this report visit https://www.researchandmarkets.com/r/sc48o7

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment