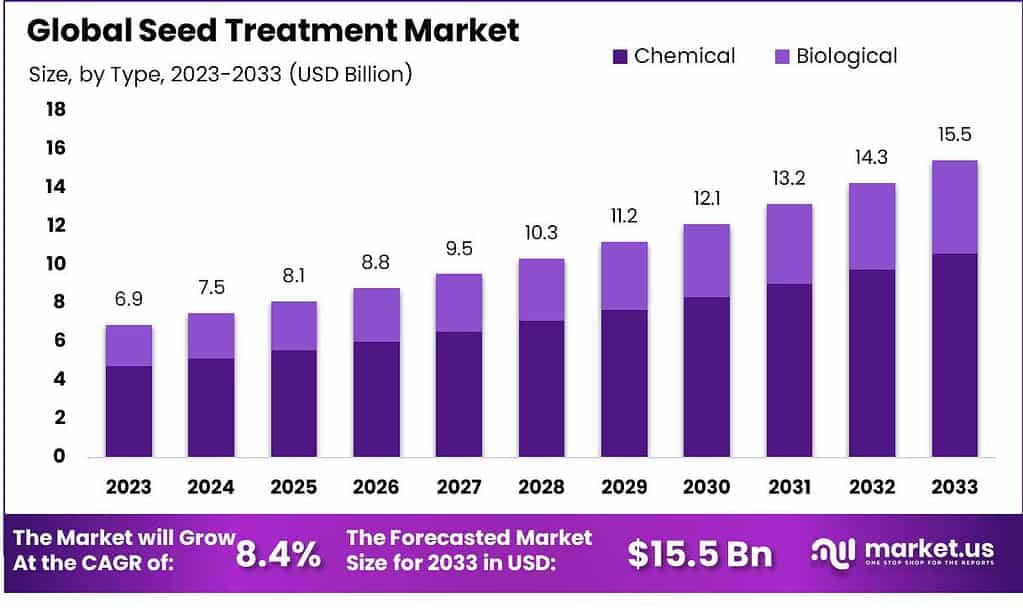

New York, Feb. 20, 2024 (GLOBE NEWSWIRE) -- According to Market.us, the Global Seed Treatment Market size is expected to be worth around USD 15.5 Billion by 2033, from USD 6.9 Billion in 2023, and it is poised to reach a registered CAGR of 8.4% from 2024 to 2033.

The seed treatment market refers to the segment of agriculture focused on the application of biological, chemical, or physical agents to seeds before planting. This treatment is aimed at protecting seeds from pathogens, insects, and other pests, as well as to enhance seed performance under various soil and environmental conditions. Seed treatments can include fungicides, insecticides, nematicides, and other protective coatings that improve seed germination, plant health, and yield outcomes.

The seed treatment market is driven by the increasing demand for high-yield crops due to the growing global population, advancements in agricultural technologies, and the rising awareness of sustainable farming practices. It encompasses various treatment products, equipment for applying treatments, and services related to treatment application and development.

To get additional highlights on major revenue-generating segments, Request a Seed Treatment Market sample report at https://market.us/report/seed-treatment-market/request-sample/

Key Takeaway

- Market Growth: The Seed Treatment Market is poised to reach USD 15.5 billion by 2033, exhibiting a steady 8.4% CAGR, with a 2023 valuation of USD 6.9 billion.

- Type Dominance: In 2023, chemical seed treatments commanded a 68.6% market share, while biological treatments gained momentum for their eco-friendly attributes.

- Crop Segments: Cereals & Grains led with 41.3% market share, followed by Oilseeds and Fruits & Vegetables.

- Function Dynamics: Seed Protection, encompassing insecticides and fungicides, claimed a dominant 38.7% market share, with Seed Enhancement growing due to sustainability trends.

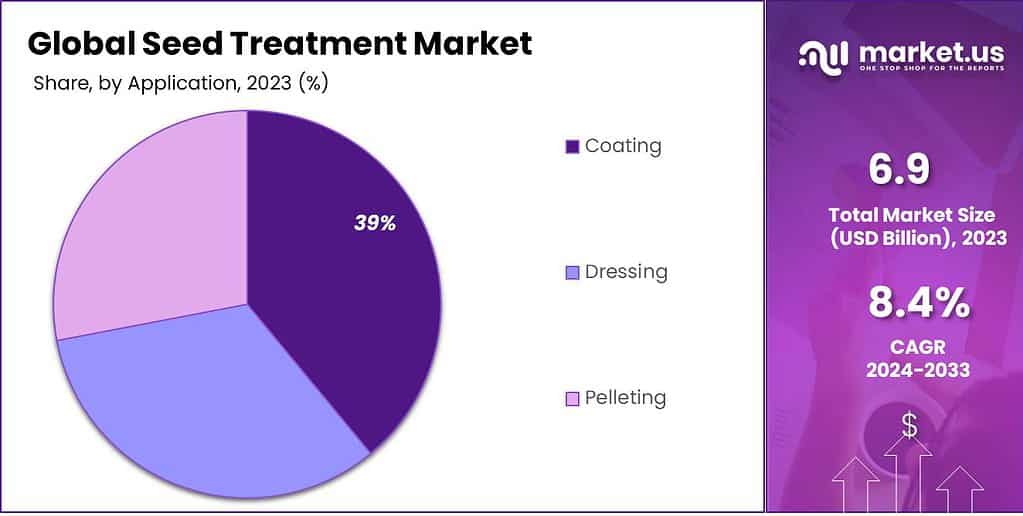

- Application Methods: Coating dominated with a 39% market share, offering benefits like improved handling and protection against diseases and pests.

Factors Affecting the Growth of the Global Seed Treatment Industry

- Technological Advancements: Rapid advancements in seed treatment technologies contribute to increased efficiency, efficacy, and adoption in the global industry.

- Environmental Concerns: Growing awareness of environmental sustainability drives demand for eco-friendly seed treatment methods, boosting the industry's growth.

- Regulatory Landscape: Changes in regulations impact the industry, influencing the development and approval of seed treatment products, and affecting market dynamics.

- Crop Disease Challenges: The prevalence of crop diseases and pests necessitates enhanced seed treatment solutions, driving innovation and demand for effective treatments.

- Market Demand for Higher Yields: The increasing global population and the demand for higher agricultural productivity propel the need for advanced seed treatment methods to optimize crop yields.

Plan your Next Best Move. Purchase the Report for Data-driven Insights: https://market.us/purchase-report/?report_id=36728

Report Segmentation

By Type Analysis

In 2023, the seed treatment market saw clear dominance by the Chemical Segment, securing a substantial 68.6% market share. This was driven by the widespread adoption of chemical treatments in modern agriculture, offering broad protection against pests and diseases. Chemical treatments, known for their convenience and immediate results, are favored by farmers.

Despite its smaller share, the Biological Segment is gaining traction due to its eco-friendly attributes, aligning with the growing emphasis on sustainability in agriculture, indicating potential for continued growth as an alternative to traditional chemical treatments.

By Crop Type Analysis

In 2023, the seed treatment market showcased a diverse landscape, prominently led by the Cereals & Grains segment, commanding a substantial 41.3% market share. This dominance is attributed to the crucial role grains and cereals play in global food production. Seed treatment in this sector provides essential benefits such as disease protection and enhanced germination, addressing food security challenges and sustainable development.

Additionally, the Oilseeds segment, encompassing crops like soybeans and sunflowers, sees increased adoption of seed treatment technologies driven by the demand for healthier cooking oils and sustainable biofuels. The Fruits & Vegetables segment, catering to diverse horticultural crops, relies on seed treatment for improved vigor and disease resistance to meet the demand for high-quality produce. Lastly, the Other Crop Types segment, including specialty crops, witnesses a growing recognition of tailored seed treatment solutions in diversified agriculture and niche markets.

By Function Analysis

In 2023, the seed treatment market showcased distinct functions, primarily divided into Seed Protection and Seed Enhancement. The Seed Protection segment, capturing over 38.7% market share, played a crucial role in safeguarding seeds from pests and diseases, with insecticides and fungicides leading the way. The robust demand for high-quality seeds and the awareness of economic benefits drove its dominance, as farmers prioritized optimizing yields and minimizing risks.

In contrast, the Seed Enhancement segment, although holding a smaller share, focuses on bioinsecticides and bio fungicides for environmentally friendly seed health improvement. Facing competition from conventional methods, its growth potential lies in alignment with the global shift towards sustainable agricultural practices, positioning it for continued expansion and innovation in the seed treatment market.

By Application Analysis

In 2023, the seed treatment market displayed a diverse landscape, with the Coating Segment taking the lead with over 39% market share. This dominance is attributed to the widespread adoption of seed coating techniques, offering benefits such as improved seed handling, protection against diseases and pests, enhanced germination rates, and the inclusion of essential nutrients or biological agents.

Farmers appreciate seed coating for its convenience and cost-effectiveness, making it a preferred choice for delivering multiple benefits in a single application. Advancements in coating technologies and the development of environmentally friendly coatings further contribute to the segment's growth, positioning it as a key player in the seed treatment market.

Key Market Segments

By Type

- Chemical

- Biological

By Crop Type

- Oilseeds

- Soybean

- Cotton

- Canola

- Sunflower

- Others

- Cereals & Grains

- Corn

- Wheat

- Rice

- Sorghum

- Barley

- Others

- Fruits & Vegetables

- Solanaceae

- Cucurbits

- Brassicas

- Leafy vegetables

- Root & bulb vegetables

- Others

- Other Crop Types

By Function

- Seed Protection

- Insecticides

- Fungicides

- Others

- Seed Enhancement

- Bioinsectisides

- Biofungicides

- Others

By Application

- Coating

- Dressing

- Pelleting

Driving Factors

The primary driver of seed treatment market growth is the imperative for efficient crop protection and increased yields. Insecticides and fungicides in seed treatments offer early defense against diseases and pests, resulting in healthier plants and enhanced crop yields. The rising focus on environmental concerns and sustainable agriculture has further boosted the demand for seed treatments, reducing the reliance on chemical treatments and promoting eco-friendly farming practices.

The market is also influenced by the growing acceptance of genetically modified (GM) seeds with specific traits, such as pest resistance. Additionally, addressing the challenges posed by the rising global population, seed treatments contribute to higher agricultural productivity, ensuring crops reach their full potential and supporting global food security amid increasing food demand.

Restraining Factors

Regulatory hurdles pose challenges in the seed treatment market, requiring significant time and resources for compliance and safety evaluations. Resistance development by pests and diseases to certain treatments demands ongoing research for innovative solutions.

Consumer concerns regarding the safety and environmental impact of seed treatment chemicals can influence market perception, even if products are scientifically proven safe. Additionally, the rise of biological solutions, such as biopesticides and beneficial microorganisms, intensifies competition against traditional chemical treatments, necessitating adaptation and innovation from market players.

Growth Opportunities

Significant growth opportunities lie in the seed treatment market's expansion into emerging markets like Asia, Africa, and Latin America, driven by increased agricultural activities and the adoption of modern farming practices. The rise in demand for eco-friendly farming practices opens avenues for biological seed treatments, encouraging investment in research and development to align with sustainability trends.

Customizing seed treatment solutions for specific crops and regional needs presents growth potential, allowing farmers to optimize treatment effectiveness in diverse environmental conditions. Integration of seed treatment data into digital agriculture platforms enhances precision farming, offering companies opportunities to provide comprehensive solutions for improved crop management and decision-making.

Key Market Trends

Current market trends indicate a significant shift towards sustainable and environmentally friendly seed treatment formulations, including reduced-risk chemicals and bio-based treatments aligned with consumer and regulatory preferences. Technological advancements, such as precision application methods and improved coating technologies, are enhancing the efficiency of seed treatments, leading to better outcomes.

Moreover, the market is placing a strong focus on seed enhancement, aiming not only for protection but also for improved germination rates, seedling vigor, and stress tolerance. The rise in global collaborations and partnerships among seed treatment companies, agricultural organizations, and research institutions is fostering innovation, addressing evolving challenges in agriculture, and contributing to the development of novel seed treatment solutions.

Have Queries? Speak to an expert or To Download/Request a Sample, Click here.

Report Scope

| Report Attribute | Details |

| Market Value (2023) | US$ 6.9 Billion |

| Market Size (2033) | US$ 15.5 Billion |

| CAGR (from 2024 to 2033) | 8.4% |

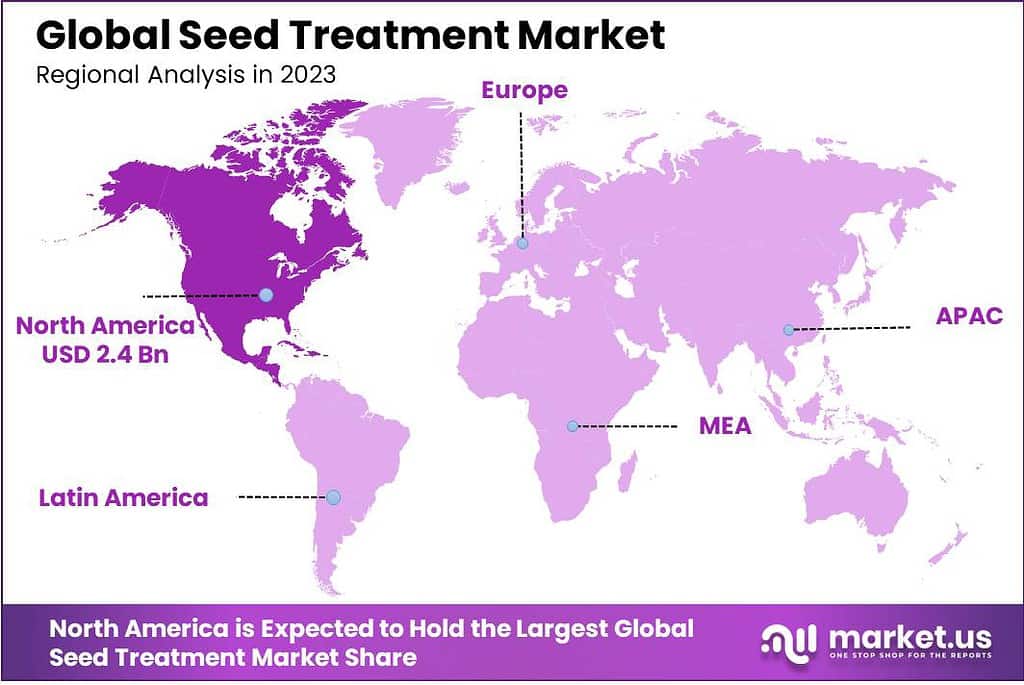

| North America Region Revenue Share | 34.6% |

| Historic Period | 2016 to 2023 |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

Regional Analysis

In 2023, North America led the seed treatment industry, holding a dominant 34.6% market share valued at USD 2.4 billion. The region's strong position is attributed to advanced agricultural practices, a focus on sustainability, and robust research and development. The United States and Canada spearheaded seed treatment adoption to protect crops and ensure optimal yields.

Europe, with stringent regulations on pesticide usage, maintained competitiveness, especially in countries like Germany and France, emphasizing sustainable agriculture. In the Asia-Pacific region, rapid urbanization and government initiatives in countries like China and India fueled significant growth, making it a dynamic hub for seed treatment expansion and addressing food security challenges.

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Competitive Landscape Analysis

Bayer Crop Science AG stands out as a key player in the competitive seed treatment market, contributing significantly to industry growth and innovation. Leveraging extensive research and development capabilities, Bayer provides a diverse range of seed treatment solutions aimed at enhancing yield, crop protection, and overall plant health. The company's commitment to sustainable agriculture and the integration of digital technology in farming has positioned Bayer as a leader in the field.

Top Key Players

- Syngenta International AG

- Bayer Crop Science AG

- BASF SE

- Corteva Agriscience

- Croda International PLC

- KWS

- Evologic Technologies

- Borregaard

- Amulix

- ADAMA Ltd.

- Bioworks Inc.

- Certis Europe

Recent Developments

- In July 2022, Corteva Agriscience introduced two new seed treatment packages featuring several new products designed for corn and canola crops. These packages aim to assist growers in achieving comprehensive control over insects and diseases.

- In May 2022, Syngenta Seedcare launched Victrato, a seed treatment product specifically targeting nematodes and key soil-borne fungal diseases. Victrato is designed to enhance the quality and yield of various crops, including soybeans, corn, cereals, cotton, and rice.

Explore Extensive Ongoing Coverage on Chemical Research Reports Domain:

- catalyst market size was valued at USD 24.4 Bn in 2022, and it is expected to grow to USD 36.4 Bn in the forecast period 2023-2032 with an anticipated CAGR of 4.2%.

- chlorine market was valued at USD 39.5 billion in 2022 and is expected to grow to USD 67.2 Billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 5.6%.

- cyclopentane market accounted for USD 328.7 billion and is expected to grow US$ 665.3 billion in 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 7.5%.

- Heat Transfer Fluids Market Was Valued At USD 4.9 Bn In 2022 and Is Expected To Reach USD 8.3 Bn In 2032, with A CAGR of 5.6% From 2023 To 2032.

- benzene market accounted for USD 39.8 billion and is expected to reach a valuation of USD 71.5 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.2%.

- power transformer market accounted for USD 21.6 billion and will reach USD 38.4 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 6.1%.

- Sulfuric Acid Market was valued at USD 14,491.6 Million in 2023. It is expected to experience an 8.3% CAGR over the forecast period of 2023-2032 and has a value of USD 32,166 Million in 2033.

- Propylene Glycol Market Was Valued At USD 4.3 Bn In 2022 and Is Expected To Reach USD 6.9 Bn In 2032, with A CAGR of 5.0% From 2023 To 2032.

- carotenoids market size was valued at USD 1,875 Mn in 2022 and is anticipated to reach USD 3,402 Mn by 2032 at a CAGR of 6.3% during the forecast period.

- Water and Wastewater Treatment Equipment Market size is expected to be worth around USD 89.7 Billion by 2032 from USD 54.7 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2022 to 2032.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: