Dublin, Feb. 26, 2024 (GLOBE NEWSWIRE) -- The "Europe Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2020 - 2029" report has been added to ResearchAndMarkets.com's offering.

The Europe Contract Logistics Market size is estimated at USD 78.48 billion in 2024, and is expected to reach USD 89.60 billion by 2029, growing at a CAGR of 2.69% during the forecast period (2024-2029).

Europe Contract Logistics Market Trends

Outsourced Contract Logistics Market to Register Significant Growth

The outsourcing share of contract logistics is low, showing clear growth potential. Globally, the share of contract logistics in the total market is only 10-15%. In Europe, this proportion is estimated at around 20%. The extent of outsourcing varies greatly from country to country. Transportation and storage services are generally outsourced to a large extent.

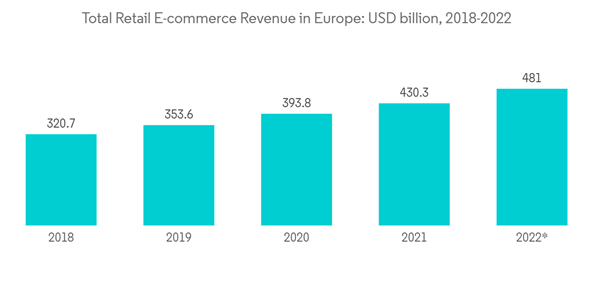

E-commerce is expected to be a major driver of outsourcing growth. As the e-commerce market grows rapidly, so do consumer expectations for faster and more reliable delivery. As a result, outsourcing of warehousing and order processing is expected to increase. Contract logistics offers e-commerce companies of all sizes the following benefits: Business manageability, advanced technology solutions, risk mitigation, and scalability.

Contract logistics companies provide services to online businesses and help enter new markets by making good use of global networks. They also help move closer to customers by offering a choice of delivery options, taking care of customs and value-added tax (VAT) services, and more.

Contract logistics companies offer specialized services for businesses that manufacture consumer electronics, telecommunications devices, computer equipment, or other high-tech products. They help these businesses reduce inventory, lower distribution costs, and launch new products.

Growth in Manufacturing Expected to Drive Demand for Contract Logistics Services

Manufacturing is the backbone of the European economy. Europe occupies a leading position in numerous industrial manufacturing sectors, such as machines and pharmaceuticals. The overall production accounts for 17.3% of EU GDP and 83% of exports, making Europe the world's largest exporter of manufactured goods. Besides, manufacturing inspires 20% of global R&D investments and generates one-third of high-quality scientific publications.

European industry, particularly Europe's engineering and manufacturing companies, undertake a great deal of research and innovation. Pre-competitive collaborative research has a long tradition in Europe: companies operate within regional innovation and industrial ecosystems, often with world-class companies leading and with SMEs and research institutes involved in the process.

The largest European nations, such as Germany, the United Kingdom, France, and Italy, traditionally dominate the manufacturing sector. As these countries became increasingly service-oriented, the manufacturing sector saw large losses, with manufacturing industries relocating and general employment in the sector decreasing. Luckily for Europe, instead of moving abroad, much of the manufacturing has just moved over to Central and Eastern Europe. Countries such as Poland, Slovakia, and the Czech Republic have taken up the mantle of manufacturing in Europe. These countries and their neighbors have seen tremendous growth in the manufacturing sector, and they are helping reaffirm Europe as a global manufacturing center. The developed countries in Europe are of high importance, as they have the required infrastructure and skills readily developed. This is expected to result in a trend of reshoring manufacturing back to Europe, and automation is very often one of the reasons for reshoring in Europe.

Europe Contract Logistics Industry Overview

The prominent players in the market include Deutsche Post DHL Group, Schenker AG (DB Schenker), Ceva Logistics, DSV AS, and SNCF Logistics/Geodis. These players based in Europe have a significant presence across the world. Even though these major players have a strong footprint across the region and account for significant market share, the market is still fragmented to some extent, with many players providing contract logistics services at different levels.

It is necessary for companies to make sure they are constantly evolving to match the industry trends. This is likely to help them gain a stronger foothold by attracting new customers.

Most major companies are based out of the Western European region. The number of local contract logistics providers in the CEE region is comparatively lower. This is an opportunity for the existing local logistics players in the CEE region to enter the contract logistics market and gain significant market share.

For more information about this report visit https://www.researchandmarkets.com/r/8inpjp

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment