Dublin, Feb. 28, 2024 (GLOBE NEWSWIRE) -- The "Global Pet Food Ingredients Market by Ingredient (Meat & Meat Products Cereals, Vegetables & Fruits Fats, and Additives), Source (Animal-based, Plant Derivatives, and Synthetic), Pet (Dogs, Cats, and Fish), Form and Region - Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

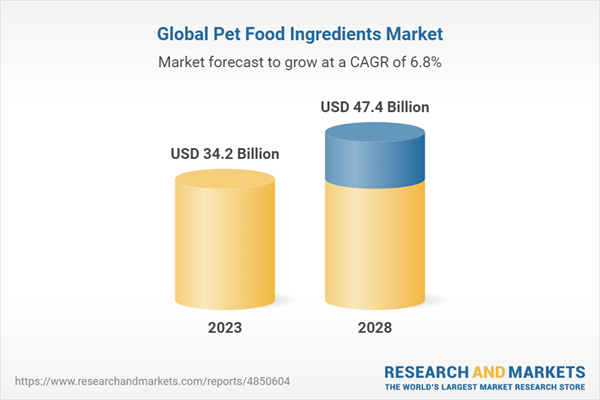

The global market for pet food ingredients is estimated at USD 34.2 billion in 2023 and is projected to reach USD 47.4 billion by 2028, at a CAGR of 6.8% during the forecast period. Mirroring trends in human food, there is an increasing emphasis on health and wellness in pet nutrition. Pet owners are actively looking for ingredients that promote overall well-being and longevity, and address specific health requirements of their pets. The global surge in pet ownership, especially in urban settings, plays a pivotal role as more individuals adopt pets, leading to a heightened demand for both pet food and its constituent ingredients.

Pet ownership boom fuels demand for high-quality ingredients

The surge in pet ownership, particularly in urban areas, has led to a paradigm shift in pet nutrition trends. Pet owners are now regarding their animals as integral family members, sparking a growing demand for higher-quality and diverse pet food ingredients. This shift towards a more family-centric approach is evident in the willingness of pet owners to invest in premium and specialty pet foods that boast innovative and superior ingredients. Consequently, this increased demand for premiumization is driving manufacturers to revamp their ingredient formulations, ushering in a new era of pet nutrition. The industry is witnessing a transformation as consumers seek out pet foods that contribute not only to the overall well-being and longevity of their pets but also address specific health needs.

In 2022, plant derivatives stood as the second-largest segment within the by source of pet food ingredients

Pet caregivers are becoming more attuned to potential allergies and sensitivities in their pets, driving a preference for plant-based ingredients that offer alternatives to common allergens present in animal-based products. The ethical considerations of pet owners regarding the sourcing of ingredients for pet food are on the rise. Plant-derived sources are frequently seen as more ethical, resulting in a notable shift in consumer preferences. In response to pet owners seeking diverse options to meet their pets' tastes and preferences, manufacturers are incorporating plant-derived ingredients to introduce a broad spectrum of flavors and textures in pet food.

Within the ingredients segment, Meat and Meat Products segment holds the most substantial share

The dominance of meat and meat products in the pet food ingredient segment is primarily propelled by their rich composition of essential nutrients, including proteins, vitamins, and minerals crucial for the comprehensive health and well-being of pets. The inherent palatability of meat enhances the overall appeal of pet food, as its taste and aroma contribute to increased acceptance by pets, promoting better consumption and fulfilling their dietary requirements. With a high biological value, the protein in meat provides a well-balanced and complete profile of essential amino acids, making it a remarkably efficient source of protein that supports pets' growth and muscle development. Considering the carnivorous nature of many pets, especially dogs and cats, a meat-based diet aligns seamlessly with their dietary preferences and nutritional necessities, rendering it a popular and effective choice in formulating pet food.

The pet food ingredients market in Europe is anticipated to maintain consistent growth throughout the forecast period

In Europe, the pet food ingredients market is expected to sustain steady growth over the forecast period. According to FEDIAF, an organization that annually reviews member association data on market and population trends, their latest report affirms robust growth in pet ownership. Approximately 46% of European households, totaling 91 million, own one or more of the region's 340 million pets. This rise in pet ownership is reflected in the market, which has now reached a value of USD 30.60 billion euros. The correlation between the increasing number of pet-owning households and the expanding market underscores a positive trend in the European pet food industry, indicating a consistent and healthy growth trajectory.

The report provides insights on the following:

- Analysis of key drivers (Increase in pet expenditure with a substantial rise in pet food expenditure, switch from mass products to organic pet food ingredients, and acceptance of insect-based protein and oil by pet owners), restraints (non-uniformity of regulations hindering international trade and limited availability of ingredients and price sensitivity) opportunities (use of cannabis in pet food, technological advancements to enhance product development, and shift in focus toward natural and grain-free products), and challenges (capital investments for equipment, threat from counterfeit products, and oxidation in pet food palatability).

- Product Development/Innovation: Detailed insights on, research & development activities, and new product launches in the pet food ingredients market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pet food ingredients market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the pet food ingredients market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Darling Ingredients Inc (US), Cargill, Incorporated (US), Ingredion (US), DSM (Netherlands), Omega Protein Corporation (US), ADM (US), Kemin Industries, Inc (US), Chr. Hansen Holding A/S (Denmark), Roquette Freres (France), The Scoular Company (US), Symrise (Germany), Mowi (Norway), Lallemand Inc. (Canada), Phileo by Lesaffre (France), 3D Corporate Solutions (US), Hydrite Chemical (US), AFB International (US), Gillco Ingredients (US), SARIA International GmbH (Germany), Green Source Organics (US), Biorigin (Brazil), Zinpro (US), APS Phoenix LLC (US), and LaBudde Group Inc (US) among others in the pet food ingredients market.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 322 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value (USD) in 2023 | $34.2 Billion |

| Forecasted Market Value (USD) by 2028 | $47.4 Billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

- Pet Food Ingredients Market Snapshot, 2023 vs. 2028

- Pet Food Ingredients Market, by Ingredient, 2023 vs. 2028 (USD Million)

- Pet Food Ingredients Market, by Pet, 2023 vs. 2028 (USD Million)

- Pet Food Ingredients Market, by Form, 2023 vs. 2028

- Pet Food Ingredients Market, by Source, 2023 vs. 2028 (USD Million)

- Pet Food Ingredients Market: Regional Snapshot

4 Premium Insights

4.1 Attractive Opportunities for Key Players in Pet Food Ingredients Market - Increasing Adoption of Pets and Rising Pet Humanization Trend to Propel Growth

4.2 North America: Pet Food Ingredients Market, by Key Country and Source - US and Animal-based Source Accounted for Largest Shares in North American Market in 2022

4.3 Pet Food Ingredients Market, by Pet - Dogs Pet Segment to Lead During Forecast Period

4.4 Pet Food Ingredients Market, by Ingredient - Meat & Meat Products Ingredients to Lead During Forecast Period

4.5 Pet Food Ingredients Market, by Form - Dry Form Segment to Lead During Forecast Period

4.6 Pet Food Ingredients Market, by Source - Animal-based Source Segment to Lead During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Macroeconomic Factors

5.2.1 Increase in Pet Adoption Among Urban Population

5.2.2 Increasing Trend of Humanization of Pets to Drive Demand for Premium Pet Products

5.3 Market Dynamics

5.3.1 Drivers

- Increase in Pet Expenditure Along with a Substantial Rise in Pet Food Expenditure

- Preference for Organic Pet Food Ingredients

- Acceptance of Insect-based Protein and Oil by Pet Owners

5.3.2 Restraints

- Non-Uniformity of Regulations Hindering International Trade

- Limited Availability of Ingredients and Price Sensitivity

5.3.3 Opportunities

- Increase in Pet Humanization Trend

- Technological Advancements to Enhance Product Development

- Shift in Focus Toward Natural and Grain-Free Products

5.3.4 Challenges

- Capital Investments for Equipment

- Threat from Counterfeit Products

- Oxidation in Pet Food Palatability

6 Industry Trends

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Technology Analysis

6.5 Price Analysis: Pet Food Ingredients Market

6.6 Market Mapping and Ecosystem of Pet Food Ingredients Market

6.7 Trends/Disruptions Impacting Customer Business

6.8 Pet Food Ingredients Market: Patent Analysis

6.9 Trade Data: Pet Food Ingredients Market

6.10 Porter's Five Forces Analysis

6.11 Case Studies

6.11.1 ADM: Pet Food Ingredients for Dogs and Cats

6.11.2 Gillco Ingredients: Enhancing Emulsification and Water-Holding in Dog Food Kibble Topper with Citri-Fi Citrus Fiber

6.12 Key Conferences and Events

6.13 Tariff and Regulatory Landscape

6.14 Key Stakeholders and Buying Criteria

7 Pet Food Ingredients Market, by Ingredient

8 Pet Food Ingredients Market, by Pet

9 Pet Food Ingredients Market, by Source

10 Pet Food Ingredients Market, by Form

11 Pet Food Ingredients Market, by Nature

12 Pet Food Ingredients Market, by Region

13 Competitive Landscape

13.1 Key Player Strategies/Right to Win

13.2 Market Share Analysis

13.3 Revenue Analysis

13.4 Company Evaluation Matrix (Key Players), 2022

13.5 Startup/Small and Medium-Sized Enterprise (SME) Evaluation Matrix, 2022

13.6 Competitive Scenario

14 Company Profiles

- BASF

- Darling Ingredients Inc

- Cargill, Incorporated

- Ingredion

- DSM

- Omega Protein Corporation

- Adm

- Kemin Industries

- Chr. Hansen Holding

- Roquette Freres

- The Scoular Company

- Symrise

- Mowi

- Lallemand

- Phileo by Lesaffre

- 3D Corporate Solutions

- Hydrite Chemical

- Afb International

- Gillco Ingredients

- Saria International

- Green Source Organics

- Biorigin

- Zinpro

- Aps Phoenix

- Labudde Group, Inc

For more information about this report visit https://www.researchandmarkets.com/r/p6nrqk

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment