Dublin, Feb. 29, 2024 (GLOBE NEWSWIRE) -- The "Asia Pacific Social Commerce Market Intelligence and Future Growth Dynamics Databook - 50+ KPIs on Social Commerce Trends by End-Use Sectors, Operational KPIs, Retail Product Dynamics, and Consumer Demographics - Q1 2024 Update" report has been added to ResearchAndMarkets.com's offering.

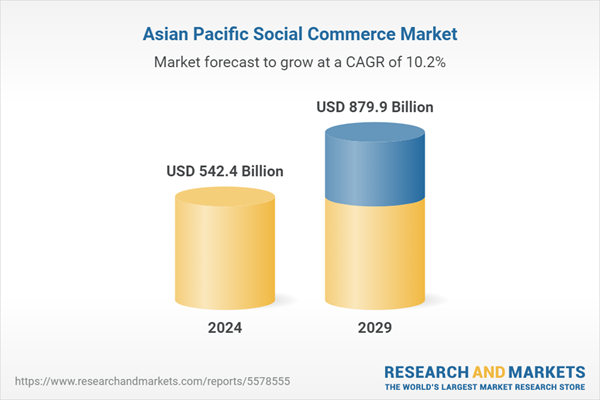

Social commerce industry in Asia Pacific is expected to grow by 12.3% on annual basis to reach US$542.42 billion in 2024.

The social commerce industry is expected to grow steadily over the forecast period, recording a CAGR of 10.2% during 2024-2029. The social commerce GMV in the region will increase from US$482.98 billion in 2023 to reach US$879.87 billion by 2029.

This report provides a detailed data centric analysis of social commerce industry, covering market opportunities and risks. With over 50+ KPIs at country level, this report provides a comprehensive understanding of social commerce market dynamics, market size and forecast, and market share statistics.

The social commerce market is poised to grow at a significant rate over the medium term in the Asia Pacific region. The growth will be driven by increasing consumption and usage of social media platforms for product discovery and inspiration. The integration of payments and product discovery features in social media platforms will also support the market growth in the Asia Pacific region.

Firms are also forging strategic alliances in the sector to evade regulatory bans on social commerce activities in the Southeast Asia region. In India, too, the industry is projected to report strong growth over the medium term. Startups, in India, are raising capital rounds and innovating using artificial intelligence. Overall, the publisher maintains a robust growth outlook for the Asia Pacific social commerce market over the next three to four years.

Chinese social commerce giant is planning to increase its investment in the global market in 2024

With markets like the United States, Canada, and Australia projected to report strong growth over the next three to four years, Chinese social commerce firms are planning to increase their investment in these markets over the medium term.

TikTok, for instance, has been aggressively expanding in the United States over the last few quarters. This trend is projected to continue further in 2024, as the firm seeks to develop its logistic network in the American market to drive the platform's appeal among sellers and buyers. In the United States, TikTok has set an ambitious target of increasing its gross merchandise volume tenfold in 2024. With significant growth in 2023, outpacing Meta Platforms, TikTok is emerging as one of the leading players in the United States market. Further investment in these markets will strengthen the firm's position over the medium term.

The expects other social commerce platforms, in the region, to also increase their investment in the regional and global markets over the next three to four years. This will drive innovation and a competitive landscape in the fast-growing sector from the short to medium-term perspective.

Innovative startups are leveraging artificial intelligence to gain market share in the fast-growing social commerce sector

To drive better shopping experiences for online buyers, an increasing number of platforms are expected to embrace new-age technologies such as artificial intelligence in India. This trend will further support the growth of the social commerce industry over the medium term in the Indian market.

Book My Makeup, an innovative social commerce startup, launched an AI-driven platform offering beauty services. Through new-age tech, the platform has introduced features like augmented reality makeup trials, customized beauty recommendations, and virtual consultations. These features are part of the firm's strategy to make beauty services more engaging, personalized, and convenient for users.

Going forward, the publisher expects more such innovative startups to emerge in the Indian social commerce market. This will aid the competitive landscape in the sector, while also driving the growth of the industry over the next three to four years.

Firms are forging strategic alliances to evade the social commerce ban in the Southeast Asian region

Indonesia, in September 2023, announced a ban on e-commerce transactions on social media networks. The regulatory proceedings were part of the strategy to protect offline merchants and marketplaces from predatory pricing on social media platforms. The ban resulted in a serious hit for TikTok, which was looking at Indonesia as one of its major social commerce markets.

TikTok, however, entered into a strategic partnership with GoTo in December 2023. This collaboration is part of the social commerce platform's strategy to evade the ban in Indonesia. As part of the agreement, Tokopedia and TikTok Shop will be combined into an enlarged Tokopedia entity. Over a period of time, TikTok has committed to invest US$1.5 billion into the entity. The investment means that TikTok has a controlling stake of 75.01% in the entity. The shopping features available inside the TikTok app will now be operated and maintained by the enlarged entity in Indonesia.

While TikTok partnered with GoTo to evade the ban imposed by the authorities in Indonesia, other social media platforms such as Facebook, Instagram, and WhatsApp have applied for social commerce permits in the country.

A Bundled Offering Providing Detailed 13 Reports

- Asia Pacific Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Australia Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- China Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- India Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Japan Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Malaysia Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- South Korea Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Philippines Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Singapore Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Taiwan Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Thailand Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

- Vietnam Social Commerce Market Intelligence and Future Growth Dynamics (Databook)

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 840 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $542.4 Billion |

| Forecasted Market Value (USD) by 2029 | $879.9 Billion |

| Compound Annual Growth Rate | 10.2% |

| Regions Covered | Asia Pacific |

Scope for Each Report

Ecommerce Industry Market Size and Future Growth Dynamics by Key Performance Indicators, 2020-2029

Social Commerce Industry Market Size and Future Growth Dynamics by Key Performance Indicators, 2020-2029

Social Commerce Industry Market Size and Forecast by Retail Product Categories, 2020-2029

- Clothing & Footwear

- Beauty and Personal Care

- Food & Grocery

- Appliances and Electronics

- Home Improvement

- Travel

- Hospitality

Social Commerce Industry Market Size and Forecast by End Use Consumer Segment, 2020-2029

- B2B

- B2C

- C2C

Social Commerce Industry Market Size and Forecast by End Use Device, 2020-2029

- Mobile

- Desktop

Social Commerce Industry Market Size and Forecast by Location, 2020-2029

- Domestic

- Cross Border

Social Commerce Industry Market Size and Forecast by Location, 2020-2029

- Tier-1 Cities

- Tier-2 Cities

- Tier-3 Cities

Social Commerce Industry Market Size and Forecast by Payment Method, 2020-2029

- Credit Card

- Debit Card

- Bank Transfer

- Prepaid Card

- Digital & Mobile Wallet

- Other Digital Payment

- Cash

Social Commerce Industry Market Size and Forecast by Platforms

- Video Commerce

- Social Network-Led Commerce

- Social Reselling

- Group Buying

- Product Review Platforms

Social Commerce Industry Market Size and Forecast by Consumer Demographics & Behaviour,2023

- By Age

- By Income Level

- By Gender

Companies Mentioned

- TikTok

- eBay Australia

- JB Hi-Fi

- BuyersCircle

- Daraz

- ShopUp

- AjkerDeal

- Evaly

- Douyin Live Shopping

- Taobao Live

- Kuaishou

- Pinduoduo

- Taobao Marketplace

- Meesho

- Shopsy

- YouTube

- Chilibeli

- Aplikasi Super

- Line

- Linktree

- Flip Fit

- PG Mall

- TikTok Seller

- Resellee

- cafe24 corp.

- Shopee

- Carousell

- Mdada

- TMON

- Zigbang

- Wemakeprice

- Kkday

- koo.live

- LinkBy

- Zalo

For more information about this report visit https://www.researchandmarkets.com/r/w9kf54

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment