Selbyville, Delaware,, March 06, 2024 (GLOBE NEWSWIRE) --

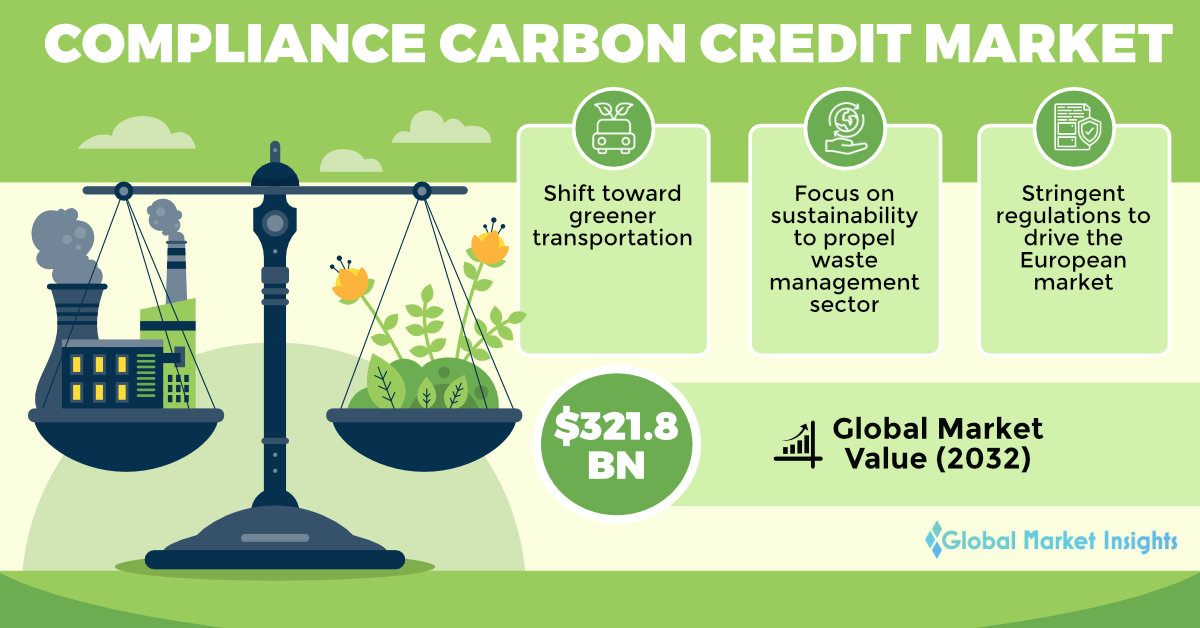

The compliance carbon credit market is expected to reach USD 321.8 billion by 2032, as reported in a research study by Global Market Insights Inc.

The industry growth is attributed to the commitment to combat climate change that increases focus on carbon mitigation strategies. Governments and organizations worldwide are under regulatory pressure to reduce their carbon emissions and achieve net-zero targets. Compliance carbon credits provide a crucial avenue for entities to meet these obligations by investing in emission reduction projects, fostering the market expansion.

Request for a sample of this research report @ https://www.gminsights.com/request-sample/detail/6971

Additionally, companies are incorporating carbon credits into their environmental, social, and governance (ESG) strategies to enhance their environmental performance and meet stakeholder expectations. In May 2023, Thailand’s national upstream company PTTEP and Krungthai Bank jointly promoted sustainable finance through the introduction of a one-year carbon credit-linked investment program for the operator’s liquidity management.

Transportation segment is poised to generate sustained demand through 2032. With growing inclination for sustainable practices, the transportation sector faces growing pressure to reduce its carbon footprint. Companies within this sector are shifting to compliance carbon credits to offset emissions, meet regulatory requirements, and demonstrate a commitment to environmental responsibility. Notably, the shift towards EVs, biofuels, and other cleaner technologies create avenues for carbon credit utilization.

The compliance carbon credit market from the waste management segment share is poised to grow at substantial rate during 2023-2032, driven by its potential to turn environmental challenges into sustainable opportunities. Waste management practices, including landfill gas capture, waste-to-energy projects, and methane reduction initiatives, offer significant carbon mitigation potential. Companies engaged in waste management are increasingly leveraging compliance carbon credits to not only offset their carbon emissions but also transform waste into an asset. The symbiotic relationship between waste management practices and carbon credit utilization reflects a strategic approach towards addressing climate change while fostering sustainable waste handling practices.

Europe compliance carbon credit market size is touted to expand at a rapid pace through 2032. The stringent environmental regulations and the European Union's commitment to achieving carbon neutrality have catalyzed an increase in demand for compliance carbon credits. With ambitious climate targets, European businesses are actively seeking avenues to offset their emissions and align with regulatory standards. Companies across various sectors are recognizing compliance carbon credits as essential instruments to bolster their environmental credentials and meet the evolving expectations of environmentally conscious stakeholders.

Some of the leading players in the global compliance carbon credit market are The Carbon Trust, Green Mountain Energy Company, Climate Impact Partners, WGL Holdings, Inc., South Pole, Sterling Planet Inc., 3Degrees, The Carbon Collective Company, VERRA, Atmosfair, TerraPass, ALLCOT, CarbonClear, Ecosecurities, PwC, ClimeCo LLC., and EcoAct.

Make an inquiry for purchasing this report @ https://www.gminsights.com/inquiry-before-buying/6971

Partial chapters of report table of contents (TOC):

Chapter 2 Executive Summary

2.1 Compliance carbon credit industry 3600 synopsis, 2019 - 2032

Chapter 3 Compliance Carbon Credit Market Insights

3.1 Industry ecosystem analysis

3.2 Regulatory landscape

3.3 Industry impact forces

3.3.1 Growth drivers

3.3.2 Industry pitfalls & challenges

3.4 Growth potential analysis

3.5 Porter's Analysis

3.5.1 Bargaining power of suppliers

3.5.2 Bargaining power of buyers

3.5.3 Threat of new entrants

3.5.4 Threat of substitutes

3.6 PESTEL Analysis

Browse our Reports Store - GMIPulse @ https://www.gminsights.com/gmipulse

Related Reports:

Forestry and Landuse Carbon Credit Market Size - By Type (Voluntary, Compliance) Regional Outlook, Competitive Market Share & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/forestry-and-landuse-carbon-credit-market

North America Carbon Credit Market Size - By Type (Voluntary, Compliance), By End Use (Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Industrial, Forestry & Land use, Renewable Energy, Waste Management) & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/north-america-carbon-credit-market

Carbon Credit Market Size - By Type (Voluntary, Compliance), By End Use (Agriculture, Carbon Capture & Storage, Chemical Process, Energy Efficiency, Industrial, Forestry & Landuse, Renewable Energy, Transportation, Waste Management) & Forecast, 2024 – 2032

https://www.gminsights.com/industry-analysis/carbon-credit-market

About Global Market Insights Inc.

Global Market Insights Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider, offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy, and biotechnology.