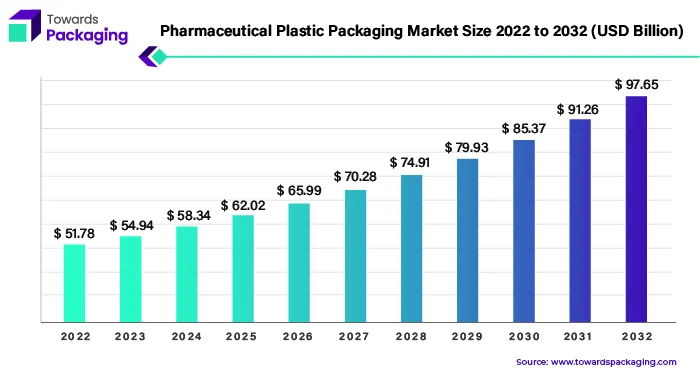

Ottawa, March 13, 2024 (GLOBE NEWSWIRE) -- The global pharmaceutical plastic packaging market size was valued at USD 54.94 billion in 2023 and is projected to surpass around USD 85.37 billion by 2030, a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

- Unravelling North America's prowess in tailored pharmaceutical plastic packaging solutions.

- Mapping the swift growth of plastic packaging in pharmaceutical expansion across Asia Pacific economies.

- Plastic packaging solutions and their impact on the growth of the pharmaceutical industry.

- Exploring the dominance and flexibility of Polyethylene (PE) in the realm of pharmaceutical plastic packaging.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5106

Pharmaceutical plastic packaging plays an essential function in protecting pharmaceutical items from different hazards such as contamination, damage, deterioration and counterfeiting. Its relevance goes beyond conventional protection to include the prolonging of a product's shelf life. In the complex world of pharmaceuticals, producers must follow tight international laws, making packaging an essential component of the entire medication supply chain. The pharmaceutical plastic packaging market has grown significantly, incorporating plastic bottles, parenteral containers and blister packaging. This rise is driven by several causes, including increased research and development efforts, the proliferation of generic pharmaceuticals, and the discovery of novel packaging materials. Notably, the change in packaging extends to specialty bags, closures, labels, and associated things. Furthermore, a distinct trend of growing outsourcing to contract packagers contributes to the industry's rapid expansion.

Drugs have traditionally been taken orally as tablets or capsules, accounting for 51% of the total. This delivery is frequently aided by blister packs, a common technique in Europe and Asia or plastic pharmaceutical bottles, particularly in the United States. Oral drug intake also includes powders, pastels, and liquids. However, alternate administration approaches are gaining popularity. Notably, parenteral or intravenous procedures account for 29%, inhalation for 17%, and transdermal methods for 3% of medication consumption.

Despite the thriving industry, obstacles remain, particularly in increased packaging prices. Strict regulatory rules and persistent anti-counterfeiting efforts have increased compliance costs, limiting the market's potential expansion. These limitations highlight the delicate balance pharmaceutical firms must strike between guaranteeing product safety and complying with changing regulatory environments.

Pharmaceutical plastic packaging is a multidimensional industry in which compliance with international standards is critical, innovation drives diversity, and cost constraints dictate strategic solutions. The market's trajectory is intimately intertwined into the fabric of pharmaceutical breakthroughs, and its continued expansion is dependent on negotiating the complexity of regulatory landscapes while embracing innovations that improve both efficacy and safety in drug delivery.

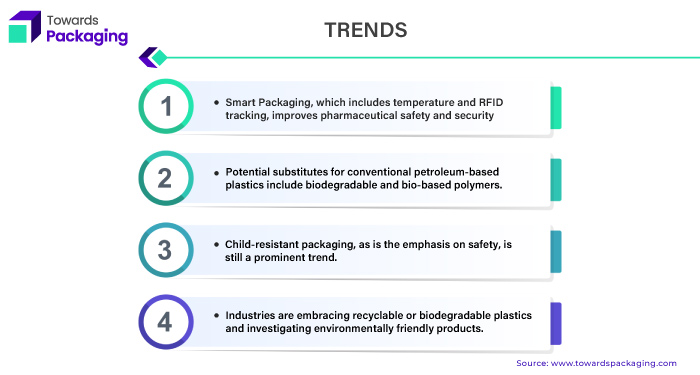

Pharmaceutical Plastic Packaging Market Trends

Decoding North America's Leadership in Specialized Pharmaceutical Plastic Packaging Solutions

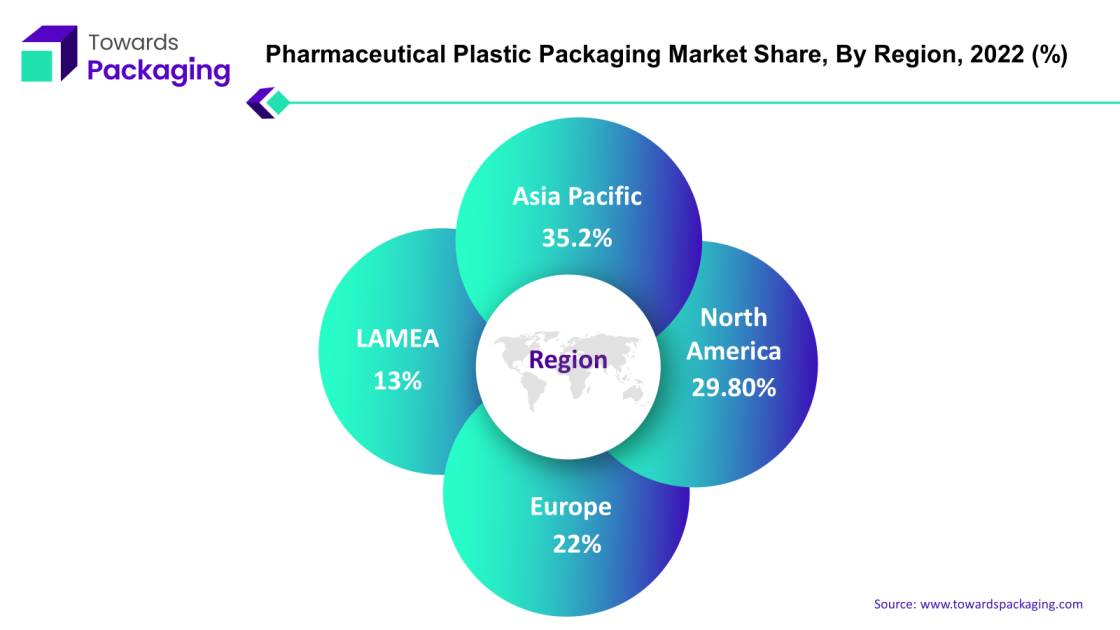

North America dominates the pharmaceutical plastic packaging industry, owing to an increase in new product releases that necessitate specialized packaging solutions. This region's dominance is bolstered by the growing tendency to outsource pharmaceutical manufacturing activities to emerging economies, creating new market growth opportunities. The United States has consistently maintained its position as the global leader in drug delivery innovation in North America. With an excellent 8.26, the United States continues to set the standard for pioneering advances in medication delivery systems. This unwavering leadership position demonstrates the country's dedication to innovation and its critical role in influencing the global trajectory of the pharmaceutical industry.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

One of the critical elements determining North America's continued market share is the frequency of specialized packaging requirements for recently launched items. This pattern reflects how the pharmaceutical industry is changing and how special packaging is needed to meet the various needs of new drug formulations. Because of this, the area has drawn the attention of pharmaceutical companies looking for innovative packaging options that improve medication delivery's overall efficacy and safety while meeting regulatory requirements. the North American pharmaceutical plastic packaging market is promising, given the strategic shift towards outsourcing pharmaceutical manufacturing to emerging nations. As businesses take advantage of manufacturing facilities' capabilities and cost advantages in these developing areas, this movement creates new growth opportunities.

For Instance,

- In August 2022, The Tufpak® high-temperature polypropylene films and bags, which offer global sterilizability qualities and are primarily intended for medical and biopharmaceutical applications, were made available by Spartech, a prominent developer of engineered thermoplastics and customized packaging solutions, in October 2023.

The pharmaceutical plastic packaging industry in North America is resilient and growing overall because of the cooperative dynamics between established pharmaceutical markets and developing manufacturing centres. Several factors, including a rise in specialized packaging requirements brought on by introducing new products and the deliberate outsourcing of manufacturing processes, contribute to North America's continued dominance in the pharmaceutical plastic packaging business. The United States' ongoing capacity for innovation reinforces the country's position as a leader in developing new drug delivery methods on the global stage.

Charting the Rapid Expansion of Pharmaceutical Plastic Packaging in Asia Pacific Economies

The Asia Pacific pharmaceutical plastic packaging industry is expanding rapidly, with a particular emphasis on developing nations such as China and India. The strong growth in these economies has played a significant role in raising revenue forecasts in the pharmaceutical plastic packaging industry. According to projections, the packaging business in India is expected to experience substantial expansion in the following years. An increase in demand, especially from sectors like pharmaceutical plastic packaging, is driving this expansion. The predicted worldwide market recovery will likely further strengthen the region's economic prospects, raising demand for packing machinery. Rising growth rates are expected in emerging economies, particularly in China and India, mainly because of these nations' increasing trends in generics production and contract manufacturing activities.

For Instance,

- In September 2023, The Sanner Group, a leader in developing and manufacturing active healthcare packaging and components for medical devices worldwide, established a new manufacturing facility in Kunshan, China, as part of its expansion of production capacity in the Asia-Pacific region.

Prefillable syringes and parenteral vials are the segments of the pharmaceutical plastic packaging industry that are expected to experience the most significant growth. This increase is anticipated to continue as novel medicines requiring injection administration are introduced due to biotechnology developments. In particular, India's pharmaceutical industry has experienced a phenomenal upswing, with a 25% gain that has propelled the nation ahead of China and into the third rank among the most innovative countries.

The expansion of China and India has made the Asia Pacific region a significant player in the pharmaceutical plastic packaging market. The demand boom, technological developments and the recovery of the worldwide market pave the way for a vibrant and growing industry landscape in the years to come.

For Instance,

- In July 2021, Sanner introduced Sanner BioBase®, the industry's first bio-based effervescent tablet packaging of renewable raw materials.

Plastic Packaging Solutions Redefining Possibilities in Pharmaceutical Industry Growth

The plastic bottle market is expanding rapidly thanks to its affordability, broad use in the pharmaceutical industry, and resistance to numerous environmental variables. Plastic bottles have become indispensable and widely regarded as the most cost-effective and lightweight pharmaceutical plastic packaging material. However, it is vital to remember that plastic, as a material prone to interacting with and permeating gases and liquids, has limitations in the types of medications it can store. The primary pharmaceutical plastic packaging market is seeing tremendous growth, fuelled by the introduction of novel and complicated biologics, showing ample room for expansion. Plastic Packaging emerges as an expert in a wide range of pharmaceutical plastic packaging solutions, including liquid, solid, and ophthalmic applications and plastic vials and bottles used for personal hygiene.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5106

For Instance,

- In October 2023, a Leading producer of medical equipment and pharmaceutical plastic packaging, Bormioli Pharma, introduced the Plastic Academy as a training initiative to introduce young people to the field of plastics processing technicians.

There has been a significant transition in pharmaceutical plastic packaging materials, with composite and plastic materials accounting for 24% and 43% of the industry's overall value, respectively. Plastic, particularly Cyclic Olefin Polymer (COP), has emerged as a viable replacement, driven by durability and cost-effectiveness. Concurrently, composite materials, which account for 24% of the market, provide a unique combination of plastic strength and desirable properties such as transparency and barrier protection. This transition in packaging materials expands pharmaceutical businesses' options, encouraging innovation in response to changing client preferences for sustainability and product integrity. The variety of packaging materials encourages the business to respond to shifting demands. The pharmaceutical plastic packaging market in China is significant, totalling 106.8 billion yuan, demonstrating the enormous scale and potential of the country's pharmaceutical plastic packaging landscape.

For Instance,

- In May 2022, The debut of EcoPositive, a brand for all of its sustainable packaging products, is Bormioli Pharma, a producer of plastic and glass primary packaging for pharmaceutical applications.

Browse More Insights of Towards Packaging:

- The sustainable packaging market size predicted to climb from USD 260.21 billion in 2022 to obtain a projected USD 490.73 billion by 2032, growing at a 6.6% CAGR between 2023 and 2032.

- The luxury packaging market size expected to increase from USD 15.30 billion in 2022 to attain a calculated USD 25.27 billion by 2032, growing at a 5.2% CAGR between 2023 and 2032.

- The meat packaging market size anticipated to rise from USD13.48 billion in 2022 to achieve an approximation USD22.28 billion by 2032, growing at a 5.2% CAGR between 2023 and 2032.

- The packaging machinery market size forecasted to expand from $46.10 billion in 2022 is estimated to reach $75.45 billion by 2032, growing at a 5.1% CAGR between 2023 and 2032.

- The global beer packaging market size is predicted to climb from USD 23.84 billion in 2022 to attain a calculated USD 36.14 billion by 2032, growing at a 4.3% CAGR between 2023 and 2032.

- The fragrance packaging market size is presumed to grow from USD 2.14 billion in 2022 to reach a conjectured USD 3.33 billion by 2032, growing at a 4.6% CAGR between 2023 and 2032.

- The global compostable flexible packaging market size is predicted to climb from USD 1.2 billion in 2022 to attain a calculated USD 2.11 billion by 2032, growing at a 5.9% CAGR between 2023 and 2032.

- The global non-alcoholic beverage packaging market size speculated to escalate from USD 172.2 billion in 2022 to acquire a anticipated USD 304.03 billion by 2032, growing at a 5.9% CAGR between 2023 and 2032.

- The global PCR plastic packaging market size anticipated to rise from USD 39.78 billion in 2022 to secure a forecasted USD 72.93 billion by 2032 at a growing CAGR of 6.3% between 2023 and 2032.

- The baby food packaging market size envisaged to surge from USD 62.21 billion in 2022 to hit a presumed USD 128.80 billion by 2032, at a growing CAGR of 7.6% CAGR between 2023 and 2032.

Unveiling the Dominance and Versatility of PE in Pharmaceutical Plastic Packaging

Polyethylene (PE) is the most popular material, accounting for 34% of the plastics market. Polyethylene polymer strands in this category pack densely to create high-density polyethylene (HDPE). HDPE is the most common plastic used for solid pharmaceutical products and is known for its moisture resistance and structural strength. Its inherent properties make it an appropriate material for creating containers that protect medications from environmental hazards.

Polyethylene (PE) is an essential material in the pharmaceutical plastic packaging industry. PE provides increased stability due to increased interactions between its polymers related to its peculiar form. Increased polymer interactions lead to a more muscular and stable material. One notable advantage of PE plastics is their ability to withstand autoclaving, a sterilization process. This sterilization capacity makes PE a good alternative for producing sterile drug containers that meet the pharmaceutical industry's demanding hygiene and safety criteria.

Polyethylene makes up a significant amount of the plastics market and is most common in the form of HDPE. Because of its qualities, including structural stiffness and moisture resistance, it is the best option for solid medicinal goods. Conversely, Polyethylene (PE) is a crucial material for making sterile medicinal product containers that adhere to the strict hygienic requirements of the pharmaceutical sector because of its improved stability and autoclaving capacity.

For Instance,

- In October 2023, Stoelzle Pharma, one of the world's leading manufacturers of high-quality primary packaging glass, announced their new PharmaCos line. This packaging line is developed explicitly for wellness and healthcare items.

Competitive Landscape

The competitive landscape of the pharmaceutical plastic packaging market is characterized by established industry leaders such as SCHOTT AG, Gerresheimer AG, Amcor PLC, West Pharmaceutical Services, In, Aptar Group Inc., Comar LLC, Klöckner Pentaplast Group, Pretium Packaging, Parekhplast India Ltd and Mondi Plc. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

Pharmaceutical Plastic Packaging Market Players

Pharmaceutical Plastic Packaging Market players are SCHOTT AG, Gerresheimer AG, Amcor PLC, West Pharmaceutical Services, In, Aptar Group Inc., Comar LLC, Klöckner Pentaplast Group, Pretium Packaging, Parekhplast India Ltd and Mondi Plc.

Recent Developments

- In January 2023, TricorBraun acquired Plas-Pak WA, a distributor and maker of plastic packaging situated in Perth, Australia. Plas-Pak WA staff will remain with TricorBraun.

- In March 2023, The ALPLA Group strengthened its position in the global pharmaceutical plastic packaging business by forming a joint venture with Indian Pharma. ALPLA, an international plastic and recycling specialist, and Spanish pharmaceutical plastic packaging manufacturer Inden Pharma are forming a long-term relationship to produce bottles, containers, and closures in clean rooms beginning in March.

- In August 2023, DuPont declared the completion of its acquisition of Spectrum Plastics Group (Spectrum), a reputable world leader in specialist medical devices and componentry.

- In October 2023, Asahi Kasei Pax's film division was split into a new company. Sumitomo Bakelite, a Japanese chemical manufacturing company, has agreed to buy 90% of the shares. To ensure a consistent supply and service of pharmaceutical plastic packaging films, Sumitomo will integrate Asahi's processing technology.

- In December 2022, Shriji Polymers (India) Limited, a manufacturer of rigid plastic packaging solutions for the pharmaceutical industry, acquired a controlling stake in Parekhplast India Limited.

Market Segmentation

By Product Type

- Plastic Bottles

- Blister Packs

- Pouches

- Ampoules & Vials

- Others

By Material

- Polyethylene (HDPE/LDPE)

- Polypropylene (PP)

- Polystyrene (PS)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

By Region

- North America

- Europe

- Asia Pacific

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5106

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/