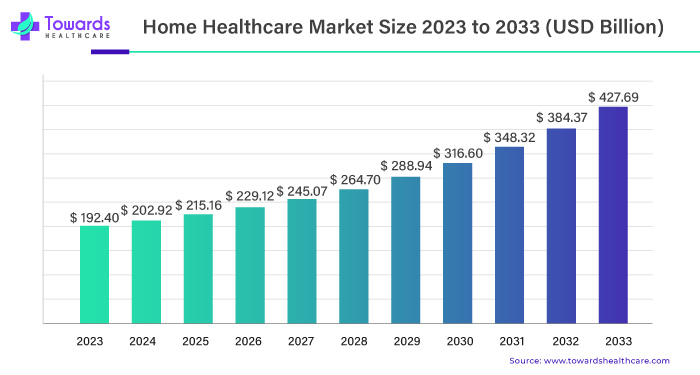

Ottawa, March 14, 2024 (GLOBE NEWSWIRE) -- The global home healthcare market size is expected to be worth USD 384.37 billion by 2032 compared to USD 192.40 billion in 2023, said a 2024 report published by Towards Healthcare a sister firm of Precedence Research.

Report Highlights:

- Diagnostics and monitoring devices took center stage in 2023, commanding a dominant 59% market share.

- Diabetes indication took center stage, accounting for a significant 32% market share in 2023.

- North America emerged as the leader, holding a commanding 44% market share in 2023.

According to the International Diabetes Federation, around 536 million adults had diabetes in 2021, and this number is predicted to reach 783 million by 2045. Home healthcare services help individuals with diabetes manage their health at home, lowering the necessity for hospital visits and reducing overall care expenses.

Download a short version of this report @ https://www.towardshealthcare.com/personalized-scope/5110

Home healthcare is a service where healthcare professionals, like nurses and therapists, bring medical assistance and support directly to your home. This includes various services such as nursing care, physical therapy, and help with everyday activities like bathing or getting dressed. The critical concept is offering medical care for people who need it but would rather stay home than go to a hospital or clinic. This type of care is beneficial for different situations. It could be for people recovering from an illness, managing long-term health conditions, or individuals needing extra help. Home healthcare allows individuals to receive necessary medical attention while staying in a familiar and comfortable environment.

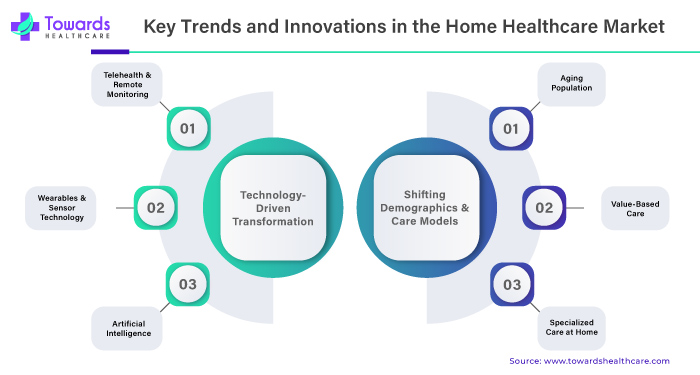

The home healthcare market has been growing for a few reasons. As the population ages, there is an increased demand for healthcare services. Older adults often prefer to age in place, and home healthcare supports that choice. Second, technological advancements and medical practices make it feasible to deliver complex healthcare services in a home setting. This includes using telemedicine for remote consultations and monitoring devices to keep track of health metrics. Additionally, the COVID-19 pandemic has accelerated the adoption of home healthcare. The desire to minimize exposure to crowded places has led more people to opt for home-based care. This has increased the demand for home healthcare services and prompted advancements in technology to make remote healthcare delivery more effective.

According to the CDC, about 12.1% of adults in the U.S. face difficulty walking or climbing stairs due to mobility-related disabilities. These disorders, affecting movement due to physical, psychological, or neurological issues, may be treated with physical therapy, assistive tools, and medications. Home healthcare services offer valuable support to individuals with mobility challenges, aiding with daily tasks to maintain independence. Physiotherapists in home healthcare help people regain mobility, functionality, and strength while reducing pain through exercises, movements, and massages. The increasing prevalence of mobility disorders drives the expected growth of this segment.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Home healthcare is a convenient and personalized way to receive necessary medical care in the comfort of one's home. The growing aging population, technological advancements, and the changing landscape of healthcare delivery have contributed to the increasing popularity and expansion of the home healthcare market.

The Increasing Number of Elderly Individuals

According to the 2023 National Diabetes Statistics Report by the CDC, in 2021, 38.4 million individuals, constituting 11.6% of the U.S. population, were diagnosed with diabetes. Among them, 38.1 million were adults aged 18 years or older, representing 14.7% of all U.S. adults. The age-specific breakdown indicates that 3.0% of those aged 18-44, 10.1% of individuals aged 45-64, and 28.7% of those aged 65 and older had diabetes. As the population continues to grow, the demand for home healthcare services is increasing due to the rising number of people with diabetes, emphasizing the need for suitable home constructions to cater to their healthcare needs.

The increasing demand for home healthcare services is strongly influenced by the aging population, characterized by a growing number of elderly individuals globally. This demographic shift has profound implications, driven by various factors that underscore the preference for receiving care in one's residence. As people age, they naturally tend to prefer healthcare services in the familiar and comfortable setting of their homes. This inclination stems from a desire to maintain independence and control daily life, even facing health challenges. The house serves as a place of emotional significance, offering established routines and a strong familiarity.

Additionally, home healthcare enables aging individuals to preserve their dignity and autonomy. By receiving necessary medical care in their living spaces, they can avoid the perceived loss of independence often associated with institutional settings. This is particularly crucial for those who aspire to age in place, continuing to reside in their homes for an extended duration. One of the key features of home healthcare is its emphasis on tailored and personalized care. Services are designed to meet the specific needs of each individual, addressing the unique health challenges and requirements that typically accompany the aging process. This customization ensures that care plans are adapted to individual preferences and medical conditions.

Notably, home healthcare plays a significant role in reducing the risk of institutionalization. By providing support at home, including medical assistance, rehabilitation, and help with daily activities, the functional abilities and overall well-being of aging individuals are enhanced. This, in turn, decreases the likelihood of them needing to move to long-term care facilities or nursing homes.

For instance,

- The aging population is contributing to a daily increase in cancer cases, presenting a substantial healthcare challenge. Aging is a significant risk factor for cancer, with longer life expectancy heightening the likelihood of its development. This trend emphasizes the need for proactive cancer screening, early detection, and advanced treatment strategies. Furthermore, the rising cancer burden among the elderly underscores the increasing demand for home healthcare services to address the unique healthcare needs of aging individuals facing cancer challenges.

Furthermore, home healthcare promotes family and community integration. Many aging individuals have established social connections within their communities, and receiving care at Home allows for continued engagement with family and neighbors. This social aspect is essential for mental and emotional health, contributing to the overall aging experience.

The preference for home healthcare among the aging population is rooted in the desire for personalized, dignified, and autonomous care in a familiar environment. This aligns with the broader goal of aging in place and maintaining a higher quality of life for as long as possible. As the global population ages, the demand for home healthcare services is expected to persist and grow, influencing the future landscape of healthcare delivery.

The Role of Technology Advancements

Advancements in technology have revolutionized the landscape of home healthcare, ushering in a new era of possibilities for delivering advanced and comprehensive medical care within the familiar confines of one's Home. Notably, telehealth, a pivotal technological innovation, enables healthcare professionals to connect with patients remotely, facilitate virtual consultations, and monitor their health conditions. This not only enhances accessibility to healthcare services but also overcomes geographical barriers, ensuring that individuals in remote or underserved areas can receive timely medical attention.

Predictive Analytics for Early Intervention

- In 2023, Verily Life Sciences will use AI and data analytics in healthcare, including projects related to predictive analytics. However, specific details about their predictive solutions for home healthcare may need more research or contacting the company directly.

- In 2023, CarePredict talks about its platform's capability to predict health risks and take action early. For more specific information, like the algorithms they use or when they launched, it's best to contact the company directly. Such services can involve care planning, monitoring, and education, as well as providing diabetes-related equipment & supplies.

Additionally, integrating remote monitoring devices further amplifies the capabilities of home healthcare. Wearable devices and sensors allow continuous tracking of vital signs, medication adherence, and overall health metrics. This real-time data empowers healthcare providers to monitor patients effectively, identify potential issues early on, and intervene promptly. Using such technology improves the efficiency of healthcare delivery and enhances the overall quality of care by enabling a more proactive and preventive approach. As technology advances, the home healthcare sector is poised to leverage these innovations for more personalized, efficient, and patient-centric care, shaping a future where complex medical care is seamlessly delivered in the comfort of one's home.

Customize this study as per your requirement @ https://www.towardshealthcare.com/customization/5110

Limited Awareness of Home Healthcare

Patient and caregiver education is pivotal in successfully implementing home healthcare services. The effectiveness of home healthcare is not solely dependent on the availability of skilled healthcare professionals or advanced technologies but also on the informed and active participation of patients and their caregivers.

Education is crucial for creating awareness about the benefits of home healthcare. Many patients and their families may need to be fully aware of the scope of services offered at Home or the potential advantages, such as personalized care, comfort, and the ability to maintain independence. By providing clear and comprehensive information, healthcare providers can empower patients to make informed decisions about their healthcare options. Understanding the proper use of home healthcare services is equally important. Patients and caregivers must be educated on navigating and making the most of available resources. This includes guidance on scheduling appointments, using telehealth platforms, and utilizing remote monitoring devices if applicable. Clear instructions on medication management, wound care, and other specific tasks ensure that patients receive the intended benefits of home healthcare without compromising safety or effectiveness.

Additionally, patient and caregiver education fosters active engagement in the care process. When individuals understand their health conditions, treatment plans, and the importance of adhering to prescribed interventions, they become more proactive in managing their health. This empowerment contributes to better treatment adherence, quicker recovery, and improved quality of life. The education process should be advanced to each patient's and their caregivers' specific needs and preferences. This may involve using various educational materials, such as written guides, videos, or interactive online resources.

Furthermore, regular communication between healthcare providers and patients is essential to address questions, provide updates, and ensure ongoing understanding and cooperation. In in-home healthcare, where a significant portion of care is often self-administered or provided by family members, caregiver education is paramount. Caregivers must have the knowledge and skills to offer proper assistance, monitor the patient's condition, and recognize signs that may require professional intervention.

Ultimately, patient and caregiver education contributes to the success of home healthcare and the overall patient experience. It fosters a collaborative and informed approach to healthcare delivery, aligning to promote patient-centered and personalized care in the home setting. As the home healthcare landscape continues to evolve, ongoing education efforts will be crucial to maximizing its potential and ensuring positive health outcomes for patients.

Browse More Insights of Towards Healthcare:

- The global insulin pump market was valued at USD 5.71 billion in 2022 and is projected to hit USD 15.28 billion by 2032, expanding at a CAGR of 9.65% from 2023 to 2032.

- The global behavioral rehabilitation market size accounted for USD 154.67 billion in 2022 to surpass around USD 221.33 billion by 2032, expanding at a CAGR of 3.58% from 2023 to 2032.

- The cell and gene therapy manufacturing market size was valued at USD 3,755.4 million in 2022 to reach around of USD 13,603.4 million by 2032, at a double digit CAGR of 16.25% from 2023 to 2032.

- The global AI in magnetic imaging (MRI) market size estimated at USD 5.77 billion in 2022 and is expected to hit around USD 10.8 billion by 2032, growing at a CAGR of 6.23% from 2023 to 2032.

- The ambulatory surgical center market accounted for USD 94.57 billion in 2022 and is projected to reach to USD 167.1 billion by 2032, growing at a CAGR of 5.66% from 2023 to 2032.

- The global dental services market was valued at for USD 432.1 billion in 2022 and is expected to reach USD 699.7 billion by 2032, growing at a CAGR of 4.93% from 2023 to 2032.

- The global AR and VR in the healthcare industry was at USD 1.57 billion in 2022 and expected to hit USD 13.74 billion by 2032, at a double digit CAGR of 24.81% from 2023 to 2032.

- The global blockchain in healthcare market size reached USD 0.76 billion in 2022 and is projected to hit around USD 14.25 billion in 2032, expanding at a healthy CAGR of 34.02% from 2023 to 2032.

- The global anesthesia drugs market was valued to grow from USD 0.46 billion in 2022 to reach an around USD 1.53 billion by 2032, at a expanding 13.3% CAGR between 2023 and 2032.

- The global AI in life sciences industry size was at USD 1.56 billion in 2022 and it is predicted to reach around USD 9.80 billion by 2032 with a double digit CAGR of 20.21% from 2023 to 2032.

Geographical Landscape

The geographical landscape of home healthcare in North America reflects a diverse and dynamic distribution of services across different regions, shaped by demographic, economic, and healthcare infrastructure factors. The availability and proximity of healthcare facilities, including hospitals and clinics, can influence the prevalence of home healthcare. Regions with fewer healthcare facilities may rely more on home-based services. Cultural attitudes toward aging, healthcare, and family support can influence the acceptance and utilization of home healthcare services. Cultural diversity across North America contributes to varied preferences in care. The geographical landscape of home healthcare in North America involves considering these multifaceted factors. The evolving nature of healthcare delivery, technological advancements, and demographic trends shifts continue to influence the distribution and accessibility of home healthcare services across the continent.

The geographical landscape of home healthcare in the Asia-Pacific region was characterized by a growing demand for home-based healthcare services due to factors such as an aging population, increasing prevalence of chronic diseases, and a focus on improving healthcare accessibility. Many countries in the Asia-Pacific region were experiencing demographic shifts with a rapidly aging population. This demographic trend contributed to an increased demand for healthcare services, including home-based care, to address the unique needs of elderly individuals. Adopting technology in healthcare, including telehealth solutions, remote monitoring devices, and mobile health applications, played a significant role in shaping the home healthcare landscape. These technologies facilitated remote consultations, real-time health monitoring, and improved communication between healthcare providers and patients.

Competitive Landscape

The competitive landscape of home healthcare is evolving with the participation of various players, including traditional healthcare providers, technology companies, and startups. Companies manufacturing medical devices and equipment used in home healthcare, such as home infusion pumps, respiratory devices, and monitoring devices, were key players. These companies often collaborated with healthcare providers to ensure the effective use of their devices in home settings. Pharmaceutical companies were involved in the home healthcare landscape by providing specialty medications, home infusion therapies, and patient support programs. These companies aimed to enhance medication adherence and provide comprehensive care for patients with chronic conditions.

Recent Developments

- In March 2023, Philips launched new solutions and services called Philips Virtual Care Management. It's designed to make telehealth more comprehensive, improving patients' involvement and health outcomes.

- In February 2023, OMRON Healthcare added educational features to its OMRON Connect app. It includes articles about study summaries, identifying AFib, and tips for lifestyle changes to reduce the risk of heart attack and stroke.

- In May 2023, Medtronic shared plans to buy EOFlow Co. Ltd. This company makes the EOPatch, a wearable and disposable device for delivering insulin without tubes.

- In May 2023, Home Instead, Inc. joined forces with Meals on Wheels America. Together, they aim to raise awareness, collect funds, and find volunteers to help elderly community members address health issues.

Market Players

- GE HealthCare

- Amedisys

- LHC Group

- BAYADA Home Health Care

- Koninklijke Philips N.V.

- ResMed

- Becton, Dickinson And Company

- Medline Industries, Inc.

- Arkray, Inc.

- McKesson Medical-Surgical Inc.

Market Segmentations

By Device Type

- Diagnostic & Monitoring Home Devices

- Blood Glucose Monitors

- Blood Pressure Monitors

- Heart Rate Monitors

- Temperature Monitors

- Sleep Apnea Monitors

- Coagulation Monitors

- Pregnancy Test Kits

- Pulse Oximeters

- Pedometers

- Therapeutics Home Healthcare Devices

- Insulin Delivery Devices

- Nebulizers

- Ventilator & CPAP Devices

- IV Equipment

- Dialysis Equipment

- Home Mobility Assist Devices

- Wheelchairs

- Cranes & Crutches

- Other Home Mobility Assist Devices

- Medical Supplies

By Service

- Rehabilitation Services

- Telehealth and Telemedicine Services

- Infusion Therapy Services

- Respiratory Therapy Services

- Unskilled Home Healthcare Services

By Indication

- Cancer

- Respiratory Diseases

- Movement Disorders

- Cardiovascular Diseases & Hypertension

- Pregnancy

- Wound Care

- Diabetes

- Hearing Disorders

- Other

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5110

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Explore the comprehensive statistics and insights on healthcare industry data and its associated segmentation: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Web: https://www.towardshealthcare.com

Browse our Brand-New Journal@ https://www.towardspackaging.com

Browse our Consulting Website@ https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare