Ottawa, April 04, 2024 (GLOBE NEWSWIRE) -- The global flexible plastic packaging market size surpassed USD 186.63 billion in 2023 and is projected to be worth around USD 274.69 billion by 2031, a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

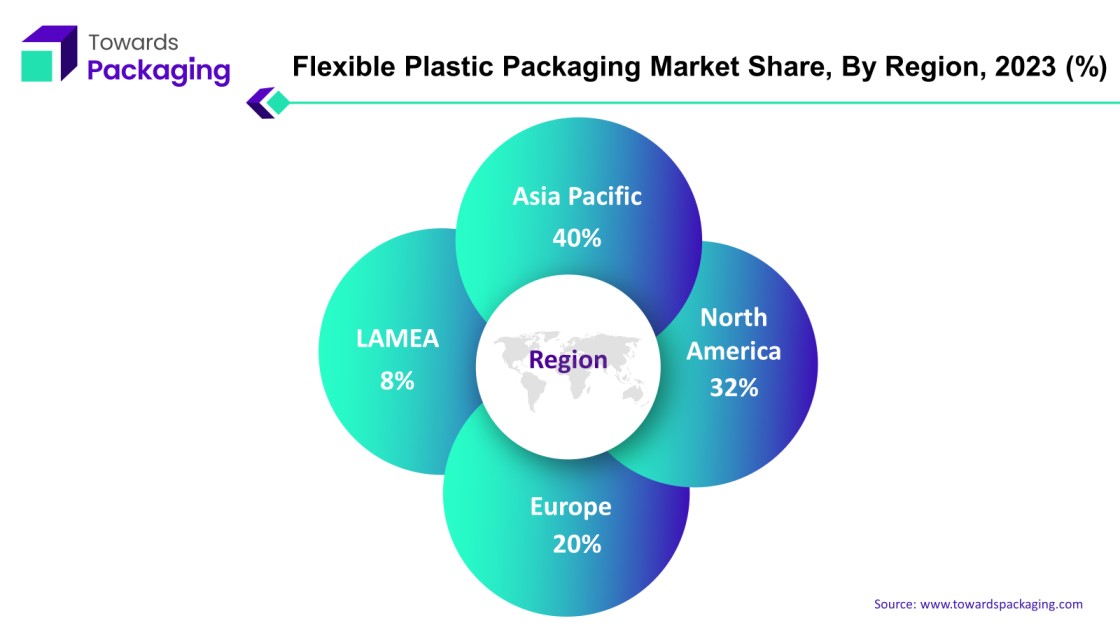

- Asia Pacific's leading role in the flexible plastic packaging market.

- Anticipated growth of flexible plastics in North America.

- Creative uses of polyethylene in flexible plastic packaging.

- Rising popularity of flexible pouches in the flexible plastic packaging sector.

- Food and beverage industry as key consumers of flexible plastic packaging.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5142

Packaging materials composed of various flexible plastic materials that may conform to the shape of the item being packaged are referred to as flexible plastic packaging. It consists of a variety of plastic packaging shapes, mostly meant for home use, that are flexible or semi-flexible, like bags, films, pouches, and tubes. Because of their cost-effectiveness and versatility in the supply chain, plastic polymers generated from fossil hydrocarbons are commonly used to create these packaging solutions.

There are significant economic and ecological benefits to switching from rigid to flexible packaging formats. Because of its decreased weight and lower material consumption, flexible packaging improves supply chain efficiency and reduces costs. The transition to flexible packaging can result in significant environmental benefits, with potential material and energy savings reaching 50% when compared to rigid packaging options.

Two of the most common polymers used in flexible packaging are linear low-density polyethylene (LLDPE) and low-density polyethylene (LDPE). In Australia, almost 223,000 tonnes of LDPE packaging were used; 32 percent of this amount was recycled, according to data from the Plastics and Chemicals Industries Association (PACIA). The market for flexible plastic packaging is witnessing a surge in the significance of sustainability measures, as recycling programmes seek to reduce ecological footprints and foster circular economies.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Flexible plastic packaging Market Trends

- Consumers perceive convenience features includes pour spouts, easy-open tear strips, and resealable closures appealing in flexible plastic packaging.

- Unique flexible plastic packaging solutions have been developed as a result of advancements in material research and technology for manufacturing.

- Within the market for flexible plastic packaging, sustainability is becoming more and more important.

- Customization and branding options are made possible by flexible plastic packaging, resulting in product distinction and brand identification.

Asia-Pacific Dominance in Flexible Plastic Packaging Market

Asia has a dominant position in the flexible plastic packaging market. The Asia-Pacific region offers distinct prospects for brand owners to leverage flexible packaging for their brands, as markets are developing at different rates. US, Australia and New Zealand are developed economies with established customer bases. Similarly, Japan, while mature, faces unusual market dynamics affected by an ageing population, with more than a quarter of the population aged 65 and up. This group prefers lightweight, easy-to-open, and reseal packaging with clear, legible labels, which corresponds to their choice for health-focused items.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5142

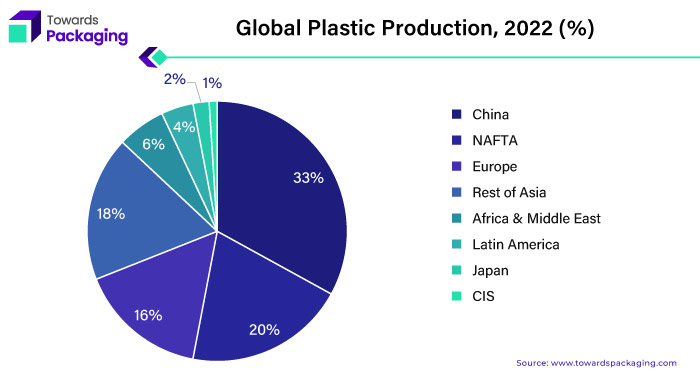

Consumers respond to user-friendly packaging that improves their overall experience throughout the region, including China. China's market for flexible packaging is driven mainly by the country's large plastic manufacturing and the growing popularity of packaged food. The flexible packaging industry is expanding due to the combination of China's dominance in plastic manufacture and the desire for easy-to-use packaging solutions. The proliferation of global legislation involving eco-friendly packaging underscores the urgency of resolving environmental problems, particularly those regarding to plastics.

Asia-Pacific's flexible packaging industry is dynamic, with a variety of market situations and shifting client demands. Brand owners must alter their packaging strategies to comply with these the flexible packaging market in the Asia-Pacific area is dynamic, with a range of market conditions and shifting consumer expectations. Owners of brands modify their packaging tactics to meet these with a variety of market circumstances and shifting consumer demands, the flexible packaging industry in the Asia-Pacific area is dynamic. Brand owners need to adjust their packaging strategy to accommodate these distinctions in order to achieve criteria for sustainability while preserving consumer satisfaction. Making use of flexible packaging's benefits is one way to achieve this. nuances, making the most of flexible packaging's advantages to satisfy customer.

In October 2022, PPC Flexible Packaging LLC, a prominent supplier of customisable flexible packaging, has announced the purchase of Plastic Packaging Technologies, LLC (PPT), situated in Kansas City, KS.

Growth Projection for Flexible Plastics in North America

North America region is the second largest in flexible packaging market. Flexible plastics share in north America expected to grow at approx. 2.3% in 2022. Plastics are still a major substrate in the market. New developments in technology and the trend towards lighter clothing are driving this expansion. Because of their lightweight appearance and great consumer appeal, stand-up pouches, for example, are recommended for new product introductions.

Board substrates are expanding in the region, supported in part by the increase of internet retail. But it's important to remember that Americans consume far more plastic on average than people in many other nations. Given the recent increase in consumption, it is evident that the North American market is heavily dependent on plastic packaging.

Flexible plastics continue to remain in high demand primarily because of consumer preferences and their practical advantages, even in the face of growing sustainability concerns. The plastic packaging solutions sector is always innovating and utilising technical developments to improve the functioning and appeal of their products. To lessen the negative effects of plastic usage on the environment in North America, there has been increasing pressure on companies to adopt more ecologically friendly processes and materials, despite the increased focus on sustainability.

For Instance,

- In January 2024, the acquisition of 100% of the shares of Germany-based Wentus has been agreed to by Sweden-based Trioworld, a producer of plastic packaging products in North America and Europe.

Flexible plastic packaging Market, DRO

Demand:

- Flexible plastic packaging extends the shelf life and freshness of packaged items by providing effective protection against the moisture, light, air, and contaminants.

Restraint:

- Flexible plastic packaging is being condemned for promoting plastic waste and environmental degradation, despite its convenience and use.

Opportunity:

- Potential prospects for closed-loop recycling systems and package recovery programmes as the economy shifts to a circular one.

Innovative Applications of Polyethylene in Flexible Plastic Packaging

Polyethylene material leading in the flexible packaging market and hold largest share in the packaging market. An innovative material that is widely used in the flexible plastic packaging market is polyethylene, particularly low-density polyethylene (LDPE). LDPE's flexible, lightweight and softness appreciated. For applications where rigidity, high temperature obstructions, and structural strength are not the main concerns, this material's low temperature flexibility, toughness, and corrosion resistance make it perfect. Because of its advantageous qualities, including strong chemical and impact resistance, ease of fabrication and shaping, and cost-effectiveness, LDPE is used in orthotics and prosthetics.

The versatile and reasonably priced flexible PVC is a material that is frequently utilised in plastic extrusions. Flexible PVC comes in several grades and colours, including clear alternatives, and can be found in a wide variety of softness and hardness degrees, including semi-rigid forms. Its versatility and affordability make it a preferred option for a wide range of applications in various industries.

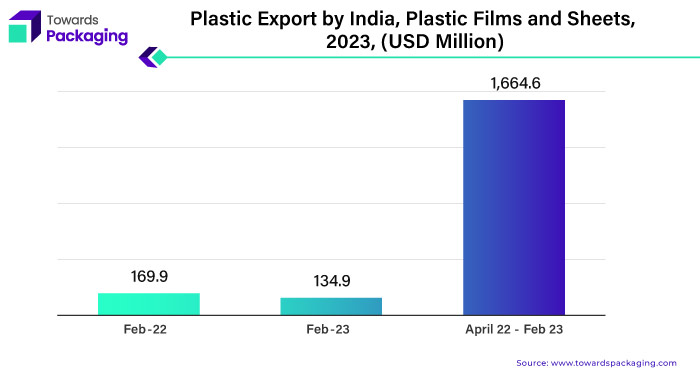

In February 2023, exports showed an apparent downturn, even though plastic films and sheets are widely used across a range of industries. The decline was ascribed to a decline in sales of films and sheets with self-adhesive, rigid and flexible propylene polymer sheets, flexible polyethylene terephthalate sheets and films, metallized sheets and films, and laminated sheets and films. Because of the slowdown in global demand and huge levels of inventory, Indian manufacturers also saw a decline in production in tandem with the export decline.

For Instance,

- In June 2023, LyondellBasell and AFA Nord, two agricultural film recyclers, have launched a 50:50 joint venture to improve the recycling of waste from post-commercial flexible secondary packaging. The joint company aims to produce high-grade recycled plastic from discarded linearly low-density polyethylene (LLDPE) and low-density polyethylene (LDPE) components.

Growing Trend of Flexible Pouches in Flexible Plastic Packaging

Flexible spouted pouches are becoming a growing trend in the flexible plastic packaging sector due to their low environmental effect and support for refilling choices. These pouches utilise 90% less plastic than typical HDPE bottles, which means that their carbon footprint is reduced by 65% and their packaging weight is reduced by 90%. This corresponds with the increasing inclination towards reusable packaging options, especially for consumables like detergents, soap, and cleaners. Brands encourage a circular economy and lessen waste by providing refill pouches, which allow customers to reuse their current bottles and containers.

Refill pouches and other flexible plastic packaging are appealing because they fit neatly in customers' recycling containers. Refill models' enhanced sustainability appeals to buyers who care about the environment, many of whom value conservation above all else and are prepared to pay extra for eco-friendly packaging.

The growing cost-of-living problem throughout Europe is driving up demand for refill pouches as consumers look for less expensive options. Because of this, companies are switching from bulky HDPE bottles to flexible packaging alternatives like spouted pouches or adding refill pouches to complement their current bottles.

Brand owners are emphasising distinctive materials and pouch shapes in order to stand out in the market. They are also implementing cutting-edge resealing technologies that provide easy access to the contents while prolonging shelf life. In order to draw in customers looking for economical, environmentally friendly packaging options, firms use this strategic differentiator.

For Instance,

- In June 2023, the globally recognised CCL Industries Inc. declared that it has finalised an agreement to purchase Pouch Partners AG, Switzerland, a business that is under the ownership of the Capri-Sun Group, a Swiss corporation.

Food and Beverage Leading Consumers of Flexible Plastic Packaging

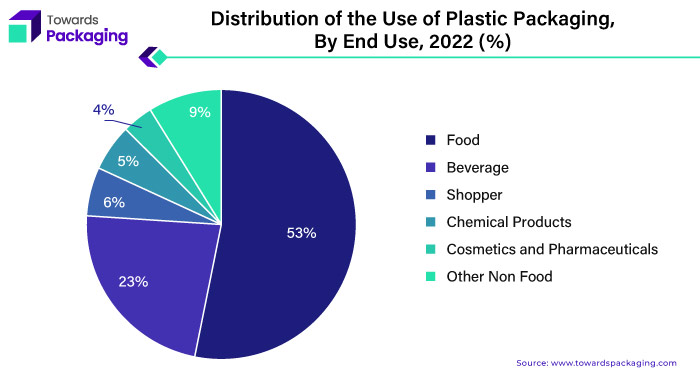

Food and beverage largest end users of flexible plastic packaging. Flexible packaging such as pouches, bags, films and wrappers, which is required for the safe and hygienic transportation of agricultural good and food products. It prolongs product life, reduces food waste, and protects goods from harm. Recycling plastic packaging that is flexible poses an immense challenge. It increases the shelf life of products, helps to reduce food waste and protects products from insects and others.

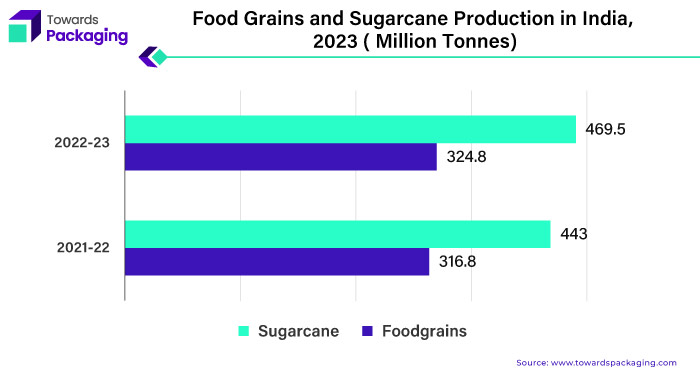

India ranks as one of the largest generators of agricultural products and food in the globe. India has the largest farming economy, with 3.5% growth predicted in 2022–2023. India is a major producer of pulses, dairy products, wheat, rice, and other food grains.

Food and drink products make up around two thirds of all packaging, and they use about 90% of all flexible packaging. Flexpack's growth into new product categories is being driven by its advantages. Setting this in perspective, flexible packaging presently accounts for roughly 19% of the US market and 39% of the worldwide packaging business. The benefits and versatility of flexible plastic packaging continue to promote its significance as the worldwide packaging market approaches $1 trillion yearly, especially in the food and beverage sector.

For Instance,

- In June 2021, Redi-Bag, an established manufacturer of polyethylene flexible plastic packaging, was purchased by Soteria Flexibles. Soteria Flexible was able to penetrate the seafood and product packing markets because to the acquisition.

Key Players and Competitive Dynamics in the Flexible Plastic Packaging Market

The competitive landscape of the flexible plastic packaging market is dominated by established industry giants such as Sealed Air Corporation, FlexCollect, Mondi Group, Berry Global Group, Amcor Ltd., Constantia Flexibles Group GmbH, DS Smith Plc, Bemis Company, Oyj Huhtamäki, Sonoco Products Company, Inc, AR Packaging Group AB. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Amcors offers creative, eye-catching, and environmentally friendly flexible packaging options to make companies stand out and better while also protecting the environment. Apart from its reduced ecological footprint, lightweight packaging presents noteworthy advantages in terms of logistics. However, not every pouch is equally prepared to satisfy the needs of e-commerce supply chains (particularly with regard to liquid-containing pouches). By making your flexible packaging more e-commerce-friendly, you can prevent product damage and protect your brand's reputation.

Browse More Insights of Towards Packaging:

- The sustainable packaging market size predicted to climb from USD 260.21 billion in 2022 to obtain a projected USD 490.73 billion by 2032, growing at a 6.6% CAGR between 2023 and 2032.

- The luxury packaging market size expected to increase from USD 15.30 billion in 2022 to attain a calculated USD 25.27 billion by 2032, growing at a 5.2% CAGR between 2023 and 2032.

- The meat packaging market size anticipated to rise from USD13.48 billion in 2022 to achieve an approximation USD22.28 billion by 2032, growing at a 5.2% CAGR between 2023 and 2032.

- The packaging machinery market size forecasted to expand from $46.10 billion in 2022 is estimated to reach $75.45 billion by 2032, growing at a 5.1% CAGR between 2023 and 2032.

- The global beer packaging market size is predicted to climb from USD 23.84 billion in 2022 to attain a calculated USD 36.14 billion by 2032, growing at a 4.3% CAGR between 2023 and 2032.

- The fragrance packaging market size is presumed to grow from USD 2.14 billion in 2022 to reach a conjectured USD 3.33 billion by 2032, growing at a 4.6% CAGR between 2023 and 2032.

- The global compostable flexible packaging market size is predicted to climb from USD 1.2 billion in 2022 to attain a calculated USD 2.11 billion by 2032, growing at a 5.9% CAGR between 2023 and 2032.

- The global non-alcoholic beverage packaging market size speculated to escalate from USD 172.2 billion in 2022 to acquire a anticipated USD 304.03 billion by 2032, growing at a 5.9% CAGR between 2023 and 2032.

- The global PCR plastic packaging market size anticipated to rise from USD 39.78 billion in 2022 to secure a forecasted USD 72.93 billion by 2032 at a growing CAGR of 6.3% between 2023 and 2032.

- The baby food packaging market size envisaged to surge from USD 62.21 billion in 2022 to hit a presumed USD 128.80 billion by 2032, at a growing CAGR of 7.6% CAGR between 2023 and 2032.

For Instance,

- Recycling-ready mono-PE and mono-PP versions of Amcor's AmPrima® flexible packaging solution is offered.

FlexCollect will contribute to the development of a thorough understanding of the most effective ways to maximise recovery and recycling by integrating flexible plastic packaging into currently available household collection services, spanning various regions and demographics.

For Instance,

- In May 2022, with funding from UK Research and Innovation (UKRI), FlexCollect—the largest collaborative project in the UK—launched today to facilitate the collection and recycling of flexible plastic packaging.

Flexible Plastic Packaging Market Player

Flexible plastic packaging leading market players are Sealed Air Corporation, Mondi Group, Berry Global Group, Amcor Ltd., Constantia Flexibles Group GmbH, DS Smith Plc, Bemis Company, Oyj Huhtamäki, Products Company Sonoco, Inc. CCL Industries, AR Packaging Group AB.

Market Segments

By Material

- Polyethylene

- PVC

- Polypropylene

- Polystyrene

- Others

By Packaging Type

- Pouches

- Bags

- Sachets

- Films

- Wraps

- Containers

By End Use

- Food and Beverage

- Pharmaceutical

- Personal care & Cosmetics

- Industrial

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5142

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/