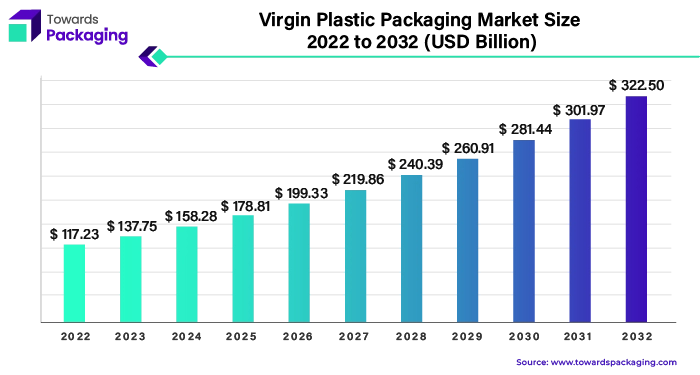

Ottawa, April 23, 2024 (GLOBE NEWSWIRE) -- The global virgin plastic packaging market size surpassed USD 137.75 billion in 2023 and is predicted to hit around USD 301.97 billion by 2031, a study published by Towards Packaging a sister firm of Precedence Research

Virgin plastic is polymer resins which has been manufactured from scratch and does not contain any recycled elements. This form of plastic is created for the very first occasion by employing natural gas or crude oil to generate brand spanking new plastic items. Plastic weakens with each recycling and re-grinding into new recycled materials. As a result, the integrity and endurance of the plastic are reduced. This can make the plastic feel flimsier and much more likely to fracture.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5148

Virgin plastic is a resin produced using natural gas or crude oil and does not contain any recycled materials. Whereas post-consumer recycled plastic, as the name implies, involves the recycling of plastic packaging at its end-of-life as a consumer product. This can include water and cooldrink bottles, plastic bags, milk containers etc.

Whilst virgin plastics can withstand high temperatures and pressure to its sturdier molecular structure, it’s increasing reliance on fossil fuels and subsequent impact on the environment is forcing manufacturers to relook at the design of its products.

Where post-consumer recycled plastics falls a tad short in quality in comparison to virgin plastics, it has a host of cost and environmental benefits, namely: reduction in use of fossil fuels and associated greenhouse gas emissions, decrease in production costs, and reduction of plastic waste at landfill sites.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

The escalation of virgin plastic production and consumption has garnered acknowledgment for its burgeoning, unsustainable trajectory. Nations grapple with an inundation of low-cost virgin plastic, disrupting secondary markets for recycled materials and impeding investments in collection and recycling infrastructure. A significant impetus behind this phenomenon lies in the oil and gas sector's pivot towards plastics as a strategic hedge against potential diminution in demand stemming from concerted climate change mitigation efforts.

The International Energy Agency (IEA) underscores the pivotal role of petrochemicals, constituting eight percent and 14 percent of total primary gas and oil demand, respectively, with projections indicating an imminent elevation of plastics as the principal driver of oil demand, surpassing conventional sectors like transportation. Consequently, a paradigm ensues where cheap virgin plastic prevails, fostering inefficient utilization while rendering recycling economically unviable, exacerbating the chasm between production and recycling rates. Presently, merely ten percent of all plastic waste generated has undergone recycling, with 13 percent subjected to incineration and a staggering 78 percent relegated to landfills or dispersed within the natural environment.

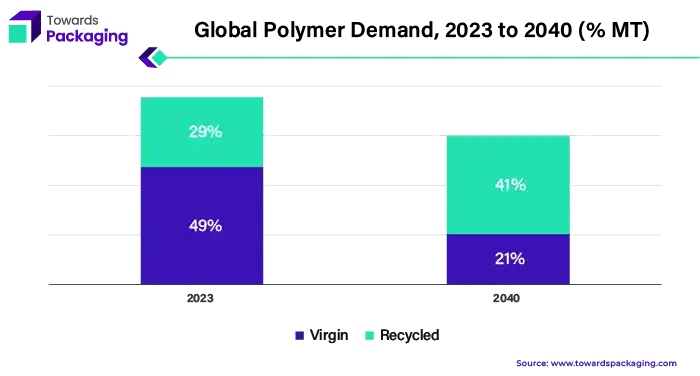

Policymakers increasingly recognize the intertwined nature of eliminating plastic pollution and advancing a circular economy framework for plastics. This nexus is underscored by a comprehensive review conducted by the United Nations Environment Programme (UNEP), which advocates for a cohesive global accord to address the fragmented landscape of plastics governance across the lifecycle, including upstream interventions in plastic production, to realize dual objectives of reduction and circularity. However, prevailing trajectories in virgin plastic production and consumption portend to eclipse waste management endeavors, exacerbating the existing divide. Based on current baselines, annual virgin plastic production is poised to double by 2040, catapulting to a staggering 2,000 million tonnes per annum by 2050.

Virgin Plastic Packaging Market Trends

- The packaging sector continues to use virgin plastic materials because of their advantageous qualities, which include strength, flexibility, clarity, and versatility.

- Advances in virgin plastic packaging solutions are primarily driven by technological improvements in polymer science and processing processes.

- Virgin plastic packaging provides chances for branding and customisation to set products apart and increase brand awareness.

- Virgin plastic packaging offers benefits like lightweight, stackability, and compatibility with automated packing equipment, all of which help to improve supply chain efficiency.

Unveiling Asia-Pacific's Dominance in Virgin Plastic Production

The Asia-Pacific (APAC) region is the driving force behind the worldwide virgin plastics sector, accounting for an astounding 52% of the world's total plastic production, or 390.7 million metric tonnes, per year. The importance of APAC in determining the direction of the virgin plastic industry globally is highlighted by this sizeable share. With a staggering 32% of the world's production of plastic materials, China is the plastic manufacturing behemoth, the greatest producer of plastic globally. China leads the plastic production scene in the region and has a significant impact on the dynamics of the global market because to its strong manufacturing infrastructure and abundant resources. Japan, for example, has a 3% share of the worldwide plastic production market, demonstrating Asia's dominance in the industry. Furthermore, the combined efforts of numerous Asian nations result in a 17% contribution to global plastic output, demonstrating the region's broad and expansive manufacturing capabilities.

For Instance,

- Singha, a Thai beer company, has emerged as a forerunner in this regard, pioneering 100% biodegradable packaging for select products. Singha establishes a precedent for sustainable packaging methods by foregoing typical plastic film in favour of coating-free virgin fibre paper and soy-based inks, demonstrating the potential of environmentally acceptable alternatives in the plastic sector.

Samsara Recycling, an Australian start-up on the cutting edge of plastic recycling technology, complements Singha's environmentally concerned endeavours. Samsara Recycling, in conjunction with the Australian National University, aims to revolutionise plastic recycling by developing PETase enzymes. The falling price of oil, a fundamental factor of virgin plastic production costs, has resulted in a significant price difference between recycled and virgin plastics. As a result, recycled plastic, previously praised as a cost-effective alternative to virgin plastic, now faces a considerable price differential, inhibiting mass adoption and slowing progress towards a circular economy.

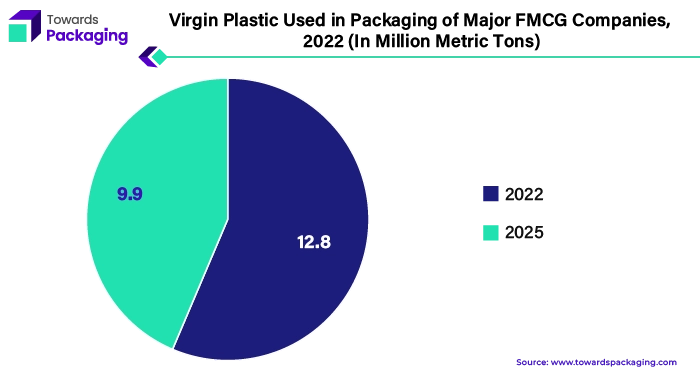

A significant agreement was reached, with major companies promising to boost the proportion of recycled plastic in their goods to 26% while reducing the use of virgin plastic by 18% by 2025. This collaborative initiative demonstrates major stakeholders' commitment to bringing about concrete change in the plastic business environment, ushering in a new era of sustainability and innovation.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5148

Rise of Virgin Plastic Packaging in North America

The global debate against plastic packaging has become more intense, especially in North America. North America is the second-biggest virgin packaging market in the world; thus, it has a big say in laws and industry developments. Governments, consumers, and business owners must all comprehend the intricacies of virgin plastic packaging in this area. According to the International Energy Agency (IEA), North America will only contribute a minor percentage of the world's virgin plastics supply.

The most prominent store, Walmart, has made a move. One of its ambitious targets is to have 20% post-consumer recycled content in all private-brand product packaging in North America by 2025. Walmart is clearly committed to sustainability initiatives as evidenced by its 15% goal to reduce its virgin plastic footprint. The shift in consumer preferences towards recycled and biodegradable materials has had a substantial influence on the virgin plastics business in North America. The shifting North American virgin plastic packaging market has important implications for a wide range of stakeholders. Manufacturers are under pressure to adopt sustainable practices and incorporate recycled materials into their packaging designs.

For Instance,

- In September 2022, HOUSTON revealed that it has agreed to purchase a majority stake in Avangard Innovative's U.S. operations. The new company, Natura PCR, will function independently and scale its recycling capacity to generate an estimated 400 million pounds of post-consumer resin (PCR) annually in five years.

Virgin Plastic Packaging Market, DRO

Demand:

- Products are effectively protected by virgin plastic packaging from environmental elements like humidity, sunlight, oxygen, and physical damage.

Restraint:

- The use of virgin plastic packaging causes environmental issues because it relies on finite fossil fuel resources and contributes to plastic pollution.

Opportunity:

- The development of eco-friendly substitutes for virgin plastic packaging is made possible by advancements in sustainable packaging materials and technology.

Flexible Virgin Plastic Leading the Packaging Sector

Adopting alternative practices in every aspect of life, especially packaging, has become growing in popularity as consumers become increasingly aware of the detrimental impacts that plastic pollution causes on the environment. So, the conventional practice of using virgin plastic packaging is currently being examined with the advent of sustainable alternatives.

The packaging industry has been experiencing a fundamental change towards alternatives that are more sustainable in response to the environmental concerns linked to virgin plastic packaging. Flexible packaging has been a front-runner among these options. Biodegradable polymers, compostable materials, and recycled content are just a few of the ingredients that make up flexible packaging, which provides a flexible and sustainable solution to conventional packaging needs.

Packaging made of virgin plastic, which is made of non-recycled materials, presents serious environmental problems. Its manufacture leads to the loss of natural resources and contributes to the emission of dangerous greenhouse gases into the atmosphere. Also, discarding virgin plastic packaging frequently pollutes landfills and oceans, where it lingers for hundreds of years and destroys ecosystems and marine life.

For Instance,

- In October 2022, PPC Flexible Packaging LLC, a prominent supplier of personalised flexible packaging, has announced the purchase of Plastic Packaging Technologies, LLC, situated in Kansas City, KS.

Significance of Polyethylene Terephthalate (PET) in Virgin Plastic Packaging

PET (polyethylene terephthalate) is an essential polymer used in many industrial applications, most notably in the production of textiles. Because of its adaptable qualities, it is the perfect material for a wide range of items, from polyester fibres to bottles. Recycling virgin PET goods back into their original applications is a key component of a circular economy approach for PET. Through resource reuse, this approach fosters sustainability and environmental conservation by reducing the demand for virgin PET (vPET) significantly.

The Indian government has made significant progress in encouraging PET usage in a sustainable manner. As long as the Food Safety and Standards Authority of India (FSSAI) gives its clearance, recycled materials can now be used in food contact packaging thanks to the Plastic Waste Management (Second Amendment) Rules. Over time, there has been a consistent increase in the manufacture of virgin PET resin in India for use in packaging.

A production estimate of 2,301 kt of virgin PET resin was released for the fiscal year 2022. This growth trend highlights how PET is becoming a more desirable material across a range of industries. The majority of PET used in the Indian market is found in rigid packaging, accounting for about 58% of all PET put. Ninety-five percent of rigid packaging applications are used in the production of bottles, with the remaining five percent going towards the creation of sheets and straps.

For Instance,

- In August 2023, Biffa, a British waste management firm, has purchased Esterpet, a company that recycles polyethylene terephthalate (PET) plastic.

Revolutionizing Packaging with Virgin Plastic Bottles

Virgin plastic bottles have emerged as a prominent alternative in the packaging business amid the growing need for sustainability. Virgin plastic provides a clean slate, in contrast to recycled plastic, which frequently has contaminants and may not be as reliable. Since raw ingredients are used in its manufacturing, a high degree of purity and durability are guaranteed. Virgin plastic bottles have superior quality and purity, which is one of their main benefits. They are exceptional in clarity and uniformity since they are composed of fresh, non-recycled materials. When compared to their recycled equivalents, virgin plastic bottles are more durable and perform better. Because of their flawless composition, they are less likely to have flaws and problems, providing dependable protection for packed items all the way through the supply chain.

The original bottle and pump may be reused up to 20 times, and the innovation helps us reach our 2030 goal of reducing virgin plastic consumption by 50%. A powder refill sachet contains 33% less plastic than a liquid refill pouch, and 90% less than that in another container and pump. At the end of their lives, virgin plastic bottles can be totally recycled even though they might not have come from recycled materials. Thus, the circular economy can be completed by gathering, processing, and reusing them to make new packaging or other goods.

Virgin plastic bottles have an influence on the the environment that goes beyond simple recycling. Plastic has a significantly lower carbon footprint throughout its whole lifecycle—from manufacturing and shipping to end-of-life management—than substitute materials like glass or aluminium. Businesses can reduce emissions and aid in the fight against climate change by selecting alternatives to packaging that are lightweight and effective, such as virgin plastic bottles.

For Instance,

- In January 2024, Coca-Cola UNITED has announced that bottles made entirely of recycled plastic have taken the place of some of its best-selling 20-ounce plastic products across its beverage range. The company wants to reduce the amount of packaging made of virgin plastic, lower its carbon footprint, and move closer to its World Without Waste objectives. This introduction helps them achieve these aims.

Dominance of Pharmaceutical Industries in Virgin Plastic Packaging

The pharmaceutical sector stands out as a key player in the domain of virgin plastic packaging, mainly due to the predominant use of glass and aluminium containers containing significant proportions of recycled materials. Contrastingly, plastic containers predominantly utilize 100% virgin fossil-based plastic. This discrepancy arises from the stringent cleanliness and traceability standards inherent in the pharmaceutical industry, necessitating fresh production and virgin materials for plastic drug containers.

The Consumer Healthcare Products Association (CHPA) is a pivotal trade organization that advocates for the over-the-counter (OTC) pharmaceutical industry and dietary supplements. CHPA actively engages in lobbying and other initiatives, primarily focusing on addressing the disposal of unused medicines and supplements a critical issue impacting safety, expenses, and environmental concerns. Additionally, CHPA is concerned with managing plastic container disposal and recycling. Despite the preference of numerous major retailers for recycled packaging, guidance from the U.S. Food and Drug Administration (FDA) advises using virgin plastics for primary drug packaging.

Key Players and Competitive Dynamics in the Virgin Plastic Packaging Market

The competitive landscape of the virgin plastic market is dominated by established industry giants such as Dow Chemical Company is one of the largest chemical companies globally, Dow produces a wide range of plastics used in packaging applications. They are known for their innovation in creating sustainable packaging solutions.

For Instance, On April 25, 2023, Dow Inc. faced its first-ever shareholder resolution, presented by As You Sow, a shareholder representative. The resolution urged the company to provide a report detailing the impact of decreased global demand for virgin plastic on its business operations. Remarkably, this resolution garnered support from over 30% of shareholders during Dow's recent annual general meeting. Dow holds the position as the world's third-largest producer of single-use bound plastic resins, amounting to 9.2 million tons annually. Consequently, this production contributes to an estimated 5.3 million tons of plastic waste. Single-use plastics represent a significant portion of the 11 million tons of plastic entering global water bodies each year, exacerbating the ongoing global plastic pollution crisis.

ExxonMobil is a major player in the production of virgin plastics, including polyethylene and polypropylene, commonly used in packaging. They focus on developing advanced materials and technologies for packaging applications.

For Instance,

- On March 14, 2024, Toray Plastics (America), Inc. revealed its adoption of ExxonMobil's Exxtend™ technology for enhanced recycling processes. As a result, the company now provides its customers and partners with Torayfan® polypropylene film crafted from certified-circular resins. This strategic move by Toray signifies a significant step forward for the packaging industry towards achieving a circular plastic economy. By investing in ExxonMobil's certified-circular resin, Toray Plastics contributes to the industry's efforts to promote sustainability and reduce environmental impact.

TotalEnergies is Formerly known as Total, TotalEnergies is a major energy company involved in the production of plastics used in packaging. They have initiatives to increase the circularity of plastics by investing in recycling and waste management technologies.

For Instance,

- On January 11, 2022, Plastic Energy and TotalEnergies announced a partnership to advance plastic recycling. Plastic Energy plans to build a second recycling plant in Sevilla, Spain, alongside their existing one, using their patented technology to convert plastic waste into TACOIL. TotalEnergies will process this into high-quality polymers for food-grade packaging. This collaboration aims to promote sustainability by reducing reliance on virgin plastic and advancing the circular economy.

INEOS is one of the largest chemical companies globally, producing a variety of plastics used in packaging, including polyethylene and polypropylene. They focus on innovation and sustainability in their packaging solutions.

For Instance,

- On October 31, 2022, INEOS entered into an agreement with Plastic Energy to establish its largest plant, dedicated to producing 100,000 tonnes of raw materials derived from plastic waste.

Mondelez has established a new objective of reducing virgin plastic use by at least 25% in rigid plastic packaging or 5% in overall plastic packaging by 2025, assuming a steady portfolio mix.

For Instance,

- In the UK, more than 6.4 million plastic windows were removed from Cadbury Easter Inclusion Shell Eggs in 2021, resulting in a 5.4-ton reduction in plastic during the Easter season. Also incorporated was a streamlined and optimised cardboard-only pack construction constructed from 98% environmentally produced cardboard.

Browse More Insights of Towards Packaging:

- The global eco-friendly packaging market size is anticipated to hit around USD 430.38 billion by 2032, increasing from USD 222.61 billion in 2023, growing at a CAGR of 7.6% between 2023 and 2032.

- The global artificial intelligence in packaging market size was at USD 2,021.3 million in 2022 to expected to hit USD 5,375.28 million by 2032, at 10.28% CAGR from 2023 to 2032.

- The global pharmaceutical packaging market size is estimated to grow from USD 117.23 billion to reach an estimated USD 322.50 billion by 2032, growing at a CAGR of 10.7% from 2023-2032.

- The e-commerce packaging market size is estimated to grow from USD 51,248 million in 2022 to reach an estimated USD 2,42,061 million by 2032, at a growing CAGR 16.8% from 2023 to 2032.

- The global pharmaceutical temperature-controlled packaging solutions market size was valued at USD 578.9 million in 2022 and is predicted to reach around USD 945.2 million by 2030, growing at a 6.30% CAGR from 2022 to 2030.

- The global protective packaging market size has reached USD 30,904.05 million in 2023 is expected to reach USD 46,243.03 million by 2032, at CAGR of 4.6% from 2023 to 2032.

- The global pet food packaging market size is estimated to grow from USD 11.38 billion in 2022 to set a foot on USD 22.08 billion by 2032, at 6.9% CAGR from 2023 to 2032.

- The global glass packaging market size is estimated to grow from USD 60.96 billion in 2022 to reach an estimated USD 98.82 billion by 2032, at 5% CAGR from 2023 to 2032.

- The global seafood packaging market size is estimated to grow from USD 13.95 billion in 2022 to reach an estimated USD 24.31 billion by 2032, at 5.7% CAGR from 2023 to 2032.

- The global cold chain packaging market size was at USD 24.86 billion in 2022 to reach around USD 72.83 billion by 2032, registering at a 11.3% CAGR from 2023 to 2032.

Virgin Plastic Packaging Market Player

Virgin plastic packaging leading market players are Dow Chemical Company, ExxonMobil, TotalEnergies, INEOS, Mondelez International, Mura Inc., Pepsi Co Limited, REPLAS, Advanced Environmental Recycling Technologies, Inc., Clear Path Recycling, Wellman Advanced Materials, Reprocessed Plastic, Inc., PLASgran Ltd, Custom Polymers, CarbonLITE Industries, Luxus Ltd, Butler-MacDonald, KW Plastic, Inc., wTe Corporation, Envision Plastic Industries LLC, Kuusakoski, Shanghai PRET, and SCHOENBERG & CO., INC.

Virgin Plastic Market Packaging Market Segments

By Packaging Type

- Bottles

- Containers

- Pouches

- Bags

- Trays

By Material Type

- PET

- PP

- PE

- PVC

- PS

By End User

- Pharmaceuticals

- Food and Beverages

- Personal Care

- Cosmetics

- household Products

- Automotive

By Application

- Flexible

- Rigid

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5148

Explore the statistics and insights concerning the packaging industry and its segmentation: Get a Subscription

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal@ https://www.towardshealthcare.com/

Browse our Brand-New Journal@ https://www.towardsautomotive.com/

Browse our Consulting Website@ https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/