Ottawa, May 03, 2024 (GLOBE NEWSWIRE) -- The global generic sterile injectable market size is projected to surpass around USD 100.59 billion by 2032, increasing from USD 42.39 billion in 2023, According to Precedence Research. Hospitals provide patients with good healthcare, which contributes significantly to the growth of the market.

Generic Sterile Injectable Market Revenue (USD Million), By Therapeutic Application

| Therapeutic Application | 2020 | 2021 | 2022 | 2023 |

| Cancer | 8,059.7 | 8,885.6 | 9,820.3 | 10,872.4 |

| Diabetes | 5,655.2 | 6,185.9 | 6,774.1 | 7,428.8 |

| Cardiovascular Disease | 4,590.8 | 4,977.7 | 5,408.4 | 5,885.0 |

| Central Nervous System | 2,716.1 | 2,934.7 | 3,177.4 | 3,445.0 |

| Infectious Disorders | 2,927.3 | 3,172.7 | 3,442.3 | 3,739.5 |

| Musculoskeletal System | 2,517.2 | 2,747.1 | 3,001.5 | 3,283.9 |

| Others | 5,962.0 | 6,492.3 | 7,082.5 | 7,737.5 |

Generic Sterile Injectable Market Revenue (USD Million), By Distribution Channel

| Distribution Channel | 2020 | 2021 | 2022 | 2023 |

| Hospital Pharmacies | 16,579.9 | 18,078.0 | 19,754.7 | 21,620.7 |

| Retail Pharmacies | 11,967.4 | 13,103.7 | 14,365.3 | 15,771.4 |

| Online Pharmacies | 3,880.9 | 4,214.4 | 4,586.5 | 5,000.0 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1214

The generic sterile injectable market is expected to grow during the forecast period because sterile injectable products are used in various medical conditions and diseases. Manufacturers focus on the manufacturing of generic sterile injectable drugs without any impact on their injectable quality. The development of generic sterile injectable products contributes to providing patients and healthcare providers with more treatment options and reducing overall healthcare costs, including those associated with drug product administration and patient compliance, which helps in the growth of the market.

In hospitals, generic sterile injectable drugs are commonly used by anesthesiologists. The generic sterile injectable drugs are antiviral, vaccination, anesthetic, antibiotics, and more. These drugs are used in the treatment of chronic and acute conditions.

Key Insights

- North America dominated the market with the largest market share of 39% in 2023.

- Asia-Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033

- By drug type, the monoclonal antibodies segment has recorded the largest market share of 33.95% in 2023.

- By drug type, the vaccine segment is significantly growing during the forecast period.

- By therapeutic application, the cancer segment has generated the biggest market share of 25.64% in 2023.

- By distribution channel, the hospital pharmacies segment has accounted for more than 51% of the market share in 2023.

- By distribution channel type, the retail pharmacies segment is the fastest-growing during the forecast period.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1214

Regional Stance

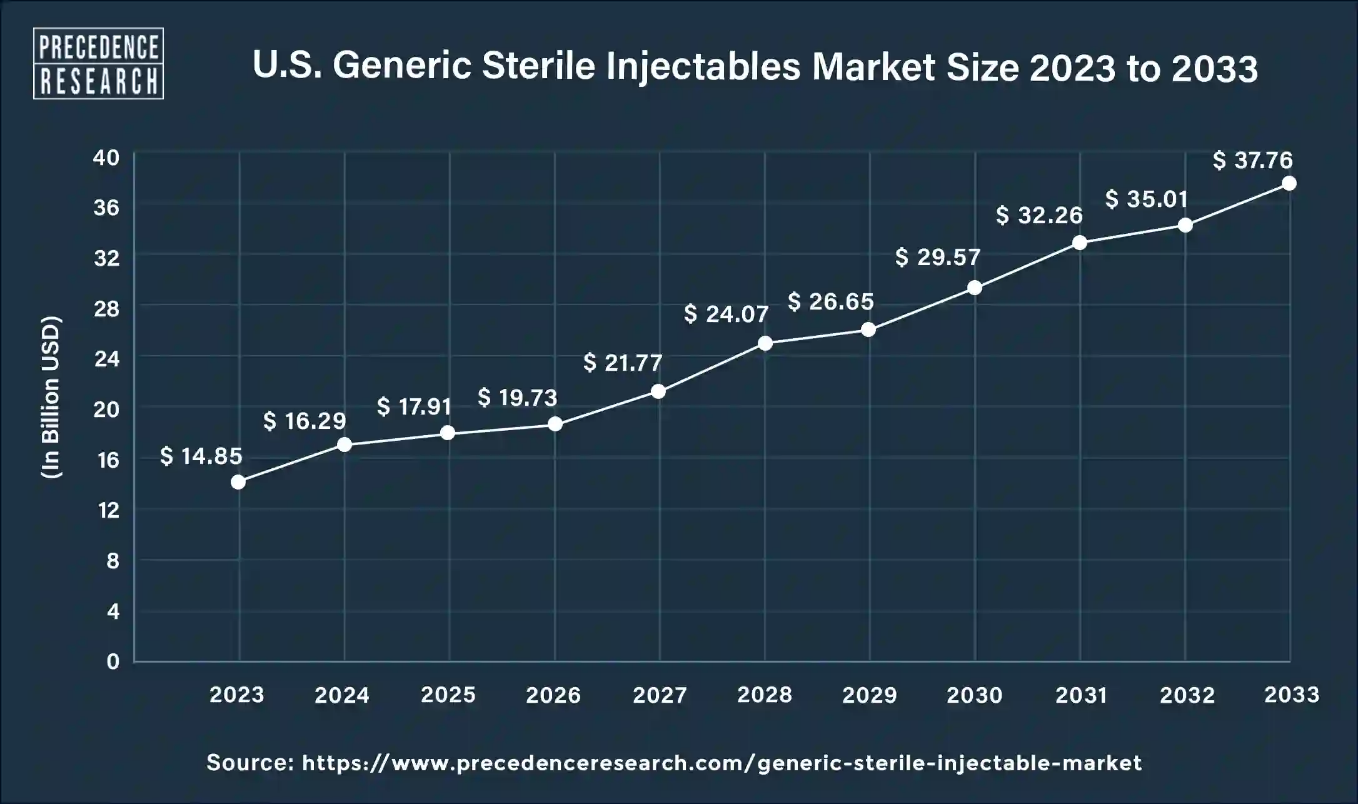

The U.S. generic sterile injectables market size is projected to reach around USD 37.76 billion by 2033 from USD 14.85 billion in 2023, with a CAGR of 9.77% from 2024 to 2033.

Government policies and regulatory bodies like the FDA promote the use of sterile injectable drugs in the North American region. Generic drugs are a mainstay of medical practice in the US and have been a larger economic success for patients. CivicaRx, a not-for-profit generic drug manufacturer, was created by hospitals and foundations to address critical supply chain vulnerabilities for hospital members.

Nowadays, CivicaRx supplies almost 60 sterile injectable products to its members. The US generic sterile injectable market includes major key players Hikma Pharmaceuticals PLC, Gland Pharma Limited, Merck & Co., CIVICA, Ascendia Pharmaceuticals Inc., Pfizer, Mylan, Sandoz, 3M, and Par Pharmaceutical, Inc.

- In June 2023, Endo launched the first generic version of Noxafil® (posaconazole) injection.

- In August 2023, HIKMA appointed Bill Larkins as the new president of injectables business.

- In October 2023, Pharmascience Inc. announced a major expansion of its sterile injectable manufacturing facility in Candiac.

- In February 2024, Pharmascience, a huge Canadian-allowed pharmaceutical company, reported a major $120 million sterile injectable manufacturing facility expansion in its Candiac region.

Asia-Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Increasing chronic diseases, changing lifestyles, and busy schedules contribute to the growth of the market. In the Asia-Pacific region, the increasing population and demand for high-quality healthcare have led to the growth of the market. Pharmaceutical industries and research institutes investing in generic sterile injectable studies contribute to the growth of the generic sterile injectable market. India, Japan, and China are the main regions in the Asia-Pacific region, which helps in the growth of the market.

- In February 2024, an Indian branded formulations company, Eris Lifesciences Ltd., reported the enlargement of its sterile injectables impression between the investment of a 51 percent equity share in Swiss Parenterals Ltd. for a deliberation of Rs.637.50 crore.

- In March 2024, India has planned to introduce HPV vaccines countrywide. TV Padma observes the state situation in a country that nowadays sees one cervical cancer death every seven minutes. To reduce cervical cancer, India found a solution to vaccinating girls.

- In March 2024, Cadila Pharmaceuticals launched a vaccine in India to prevent seasonal flu, a respiratory disease caused by influenza viruses.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Scope of Generic Sterile Injectable Market

| Report Coverage | Details |

| CAGR | 9.85% from 2024 to 2033 |

| Market Size in 2023 | USD 42.39 Billion |

| Market Size in 2024 | USD 46.53 Billion |

| Market Size by 2033 | USD 108.54 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

| Historical Year | 2021-2022 |

| Segments Covered | Product, Therapeutic Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

Product Type

The monoclonal antibodies segment dominated the generic sterile injectable market in 2023. Monoclonal antibodies are research laboratory-manufactured molecules that serve as replaced antibodies that may bring back, increase, and modify the immune system's strike on cells that are not hoped for, such as cancer cells. The monoclonal antibodies are used as therapeutic agents in diseases like diabetes, Crohn's disease, breast cancer, asthma, leukemia, macular degeneration, transplants, and arthritis. Monoclonal antibody treatments can modulate certain signaling pathways of immune cells and stimulate disease-fighting activation of immune responses, helping segment growth.

- In March 2024, Roche, a monoclonal antibody Vabysmo (farcical) launched for two critical diseases, diabetic macular edema (DME) and neovascular age-related macular degeneration (AMD) in India.

- In December 2023, a JSR Life Sciences company, KBI Biopharma, Inc., launched SUREmAb, an offering built on KBI’s SUREtechnology Platform planned for cost-efficient, optimized, safe monoclonal antibody (mAb) manufacturing and development.

The vaccine segment is significantly growing during the forecast period. Vaccines instruct the immune system to produce antibodies, as it does when it is exposed to a disease. Vaccines contain just weakened or killed forms of germs like bacteria and viruses. They reduce the risk of the illness and its complications. Vaccines help to keep you healthy. Vaccination is safe and means the difference between life and death. Vaccines are designed to prevent diseases and not cause diseases. These advantages of vaccines contribute to the growth of the segment.

- In November 2023, Indian Immunologicals Limited launched the measles and rubella vaccine for children.

- In February 2024, Japan's Takeda Pharmaceutical, in regulatory talks about launching a dengue vaccine in India

By Therapeutic Application

The cancer segment held the largest share of the market in 2023. The demand for generic sterile injectables in oncology is due to the increasing number of cancer patients. The applications of injectables have been explored widely, ranging from cancer treatment to long-acting depot injections for central nervous system disorders. The rising demand for generic therapeutics solutions for cancer that usually cost a huge amount for treatment is observed to create a potential for the segment to grow.

- For instance, in August 2023, the National Health Service England launched the world’s first anti-cancer injection capable of reducing cancer treatment time. In some cases, it can reduce the time by up to 75%. It only takes 7 minutes to administer the injection.

The diabetes segment is grow at a substantial rate during the forecast period. Commonly, injectable drugs are used in Type-2 diabetes. Type-2 diabetes injectable drugs include insulin, amylin, and GLP-1 agonists, which contribute to the growth of the segment. The increase in unhealthy lifestyles has led to an increased number of diabetic patients across the world, which is a leading cause of the increased demand for diabetes-related injectables.

- According to the World Health Organization, there are 422 million cases of diabetes globally, among which around 150-200 million people are dependent on insulin therapy.

Personalized your customization here: https://www.precedenceresearch.com/customization/1214

By Distribution Channel Type

The hospital segment dominated the generic sterile injectable market in 2023. Generic sterile injectable drugs are clinically used for hospitalized patients. Operating rooms and intensive care units (ICUs) are the two hospital care areas where high use of generic sterile injectable drugs. Generic sterile injectables are used in hospitals because of their low price and quality compared to normal injectables.

The retail pharmacies segment is the fastest-growing during the forecast period. Retail pharmacies are profitable for the generic sterile injectable market. Retail pharmacies mainly sell GLP-1, which is used to treat diabetes. People who have a doctor’s prescription and don’t need hospital visits can directly purchase the injectables from retail pharmacies. It saves time and hospital visit charges.

Market Dynamics

Driver

Rising investments in research and development

The FDA has reason to invest in research and development to improve existing products or to develop new products. The FDA may substantively improve its approval of new generic suppliers. Laboratories, which certify thousands of products in areas such as fire safety, this arrangement contributes to the speed of market entry by drug suppliers.

Generic manufacturers invest in generic sterile injectable market research to inform them when to expand production in anticipation of an approaching shortage. In emergency rooms, ICUs, cancer clinics, and outpatient elective surgery departments, there is a need for investment in those technologies.

Restraint

Shortage of sterile injectables

Manufacturing and storing injectable medicines are difficult and costly because they can be poisonous or infectious in their natural state. Exposure to light and heat leads to be managed to ensure that they remain sterile.

Many of the physical factors that lead to these shortages include a disruption in the supply of raw materials, an unexpected increase in demand, and natural disasters. Other factors for storage are increasing demand and diseases, which are why manufacturers are unable to fulfill the demand.

Browse More Insights:

- Peptide Therapeutics Market: The global peptide therapeutics market size was valued at USD 45.67 billion in 2023 and is expected to surpass around USD 80.44 billion by 2033 with a noteworthy CAGR of 5.63% from 2024 to 2033.

- Generic Injectable Market: The global generic injectable market size was exhibited at USD 90 billion in 2022 and it is expected to hit around USD 326.39 billion by 2032, expanding at a CAGR of 13.8% from 2023 to 2032.

- Cell Penetrating Peptide Market: The global cell penetrating peptide market size was estimated at USD 1.6 billion in 2022 and is projected to be worth around USD 7.15 billion by 2032, poised to grow at a CAGR of 16.2% from 2023 to 2032.

- Subcutaneous Immunoglobulin Market: The global subcutaneous immunoglobulin market size surpassed USD 15.48 billion in 2023 and is estimated to hit around USD 32.59 billion by 2033 with a CAGR of 7.73% from 2024 to 2033.

- Immunoglobulin Market: The global immunoglobulin market size was estimated at USD 13.36 billion in 2023 and is anticipated to reach around USD 24.98 billion by 2032, poised to grow at a CAGR of 7.20% from 2023 to 2032.

- Intravenous Immunoglobulin Market: The global intravenous immunoglobulin market size was estimated at USD 13.69 billion in 2022 and it is projected to be worth around USD 29.53 billion by 2032, poised to grow at a remarkable CAGR of 7.99% between 2023 and 2032.

Opportunity

Development and use of innovative products

Autoinjectors and prefilled syringes (PFS) are the most widely used devices, although innovative modifications like needle dual-chamber design and safety guards and novel devices like on-body injectors have also become promising presentations. Innovation in long-acting injectable (LAI) formulations may provide many benefits over traditional oral formulations as drug product opportunities. Closed system transfer devices are used to inject the drug into the body without contamination.

Closed system transfer devices (CSTDs) pose a major benefit for drug manufacturers in ensuring and assessing drug acceptability and compatibility of dosing accuracy for a range of clinical administration strategies. In the future, continuous innovation, research, and development can help in developing new products, which will provide better results and boost the generic sterile injectable market’s growth.

Recent Developments

- In May 2023, Juno Pharmaceuticals elevated Montreal-based drugmaker Omega Labs for expanding its generic injectables business in Canada.

- In August 2023, Pfizer implemented emergency ordering processes for sterile injectables.

- In February 2024, after receiving approval from the United States Food and Drug Administration (U.S. FDA), Lupin Limited launched Bromfenac Ophthalmic Solution, 0.075%, which is generic same as BromSite Ophthalmic Solution, 0.075%, of Sun Pharmaceutical Industries Limited.

Market Key Players

- Fresenius Kabi

- Baxter

- Civica

- Pfizer

- Mylan

- Hikma

- Sandoz

- Teva

- Nichi-Iko

- 3M

- Merck & Co., Inc.

- Others

Market Segmentation

By Drug Type

- Monoclonal Antibodies

- Cytokines

- Insulin

- Peptide Hormones

- Vaccines

- Immunoglobulin

- Blood Factors

- Antibiotics

- Others

By Therapeutic Application

- Cancer

- Diabetes

- Cardiovascular Disease

- Central Nervous System

- Infectious Disorders

- Musculoskeletal System

- Others

By Distribution Channel

- Hospitals Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1214

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: