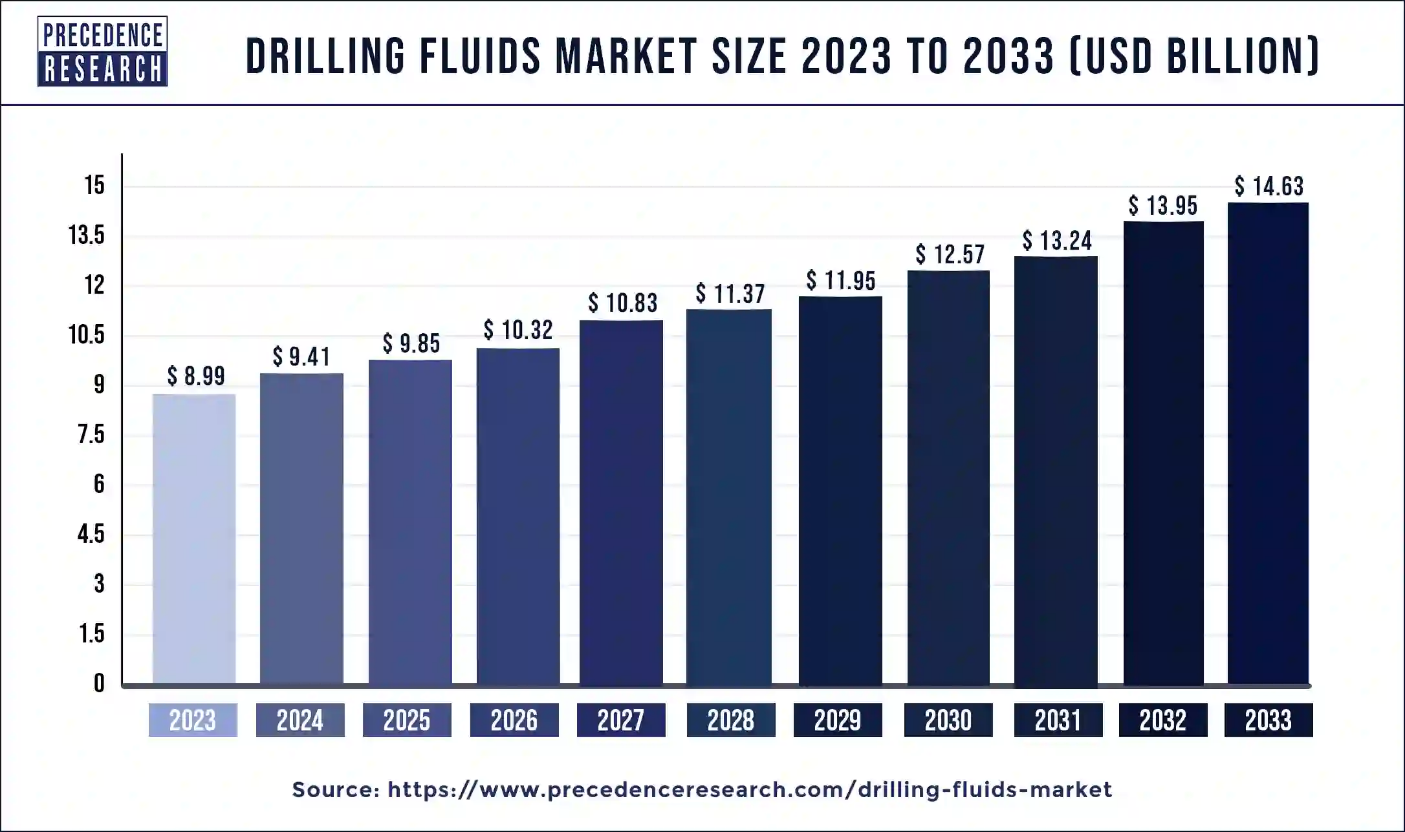

Ottawa, June 03, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global drilling fluids market size surpassed USD 8.99 billion in 2023 and is anticipated to reach around USD 13.95 billion in 2032. The drilling fluids market is driven by rising environmental concerns, innovative technologies, and government initiatives.

The drilling fluids market encompasses the production, distribution, and application of fluids used in the drilling process for oil and gas exploration and extraction. Drilling fluid, commonly known as drilling mud, is used to drill boreholes for oil, gas, and water wells. There are two types of mud: water-based (WB) and non-aqueous (OB).

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1055

WBs are made of bentonite clay and additives such as barium sulfate and calcium carbonate, whereas OBs use petroleum-based fluids for improved lubricity, shale restriction, and cleaning capabilities. Different drilling fluids are utilized in different portions of the hole, including air, air/polymer, air/water, and water. Synthetic-based fluids, often known as low-toxicity oil-based mud, are utilized on offshore rigs because they are less harmful.

Drilling Fluids Market Key Insights

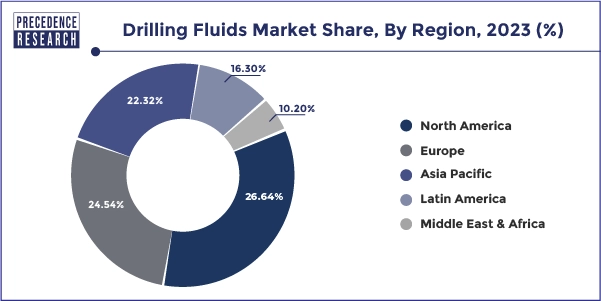

- North America has held a major revenue share of 26.64% in 2023.

- Asia Pacific is estimated to expand at the fastest CAGR during the forecast period.

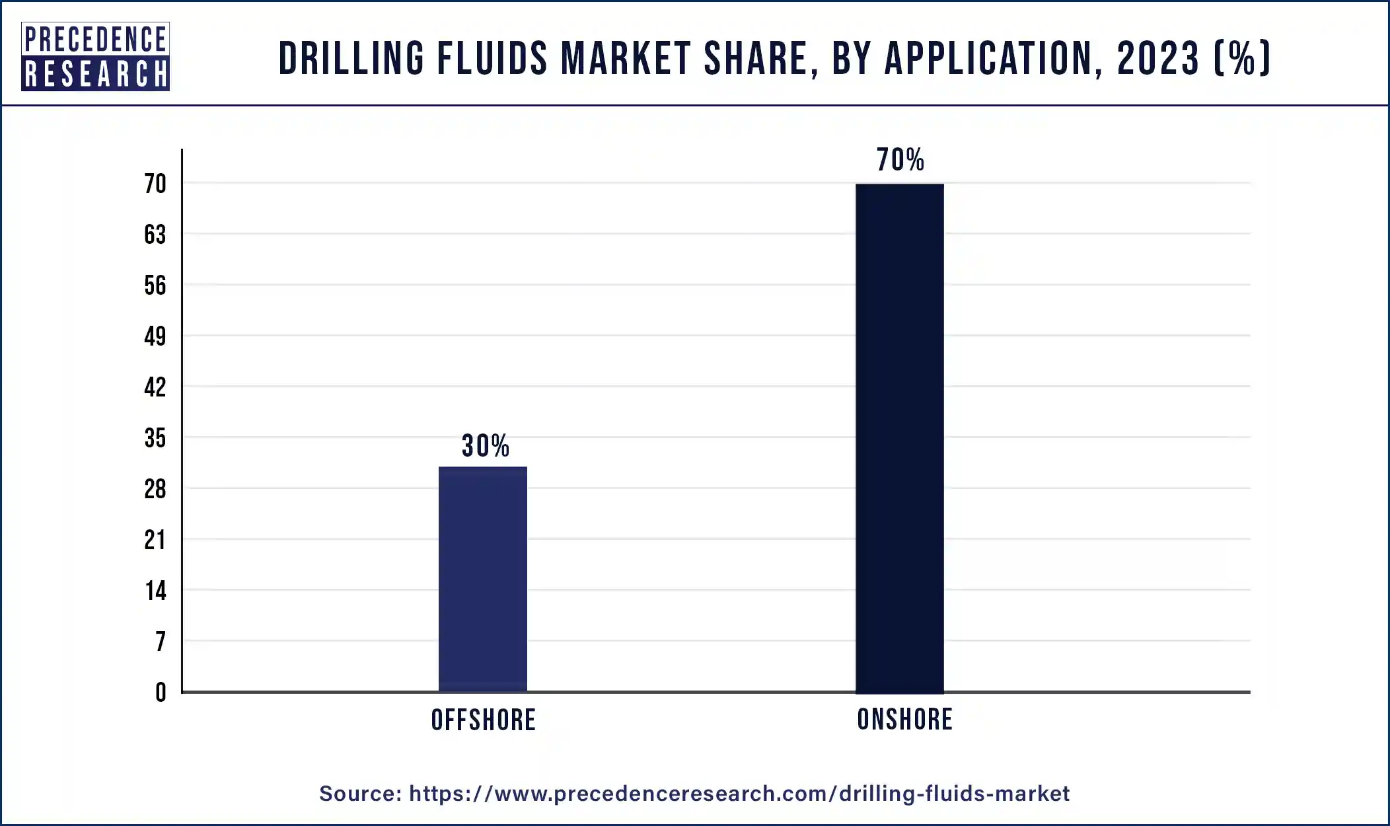

- By Application, the onshore segment has contributed more than 70% of revenue share in 2023.

- By Product, the water-based fluids segment has recorded the largest revenue share of 52.3% in 2023.

- By Product, the synthetic-based fluids segment is anticipated to grow at the fastest rate during the forecast period.

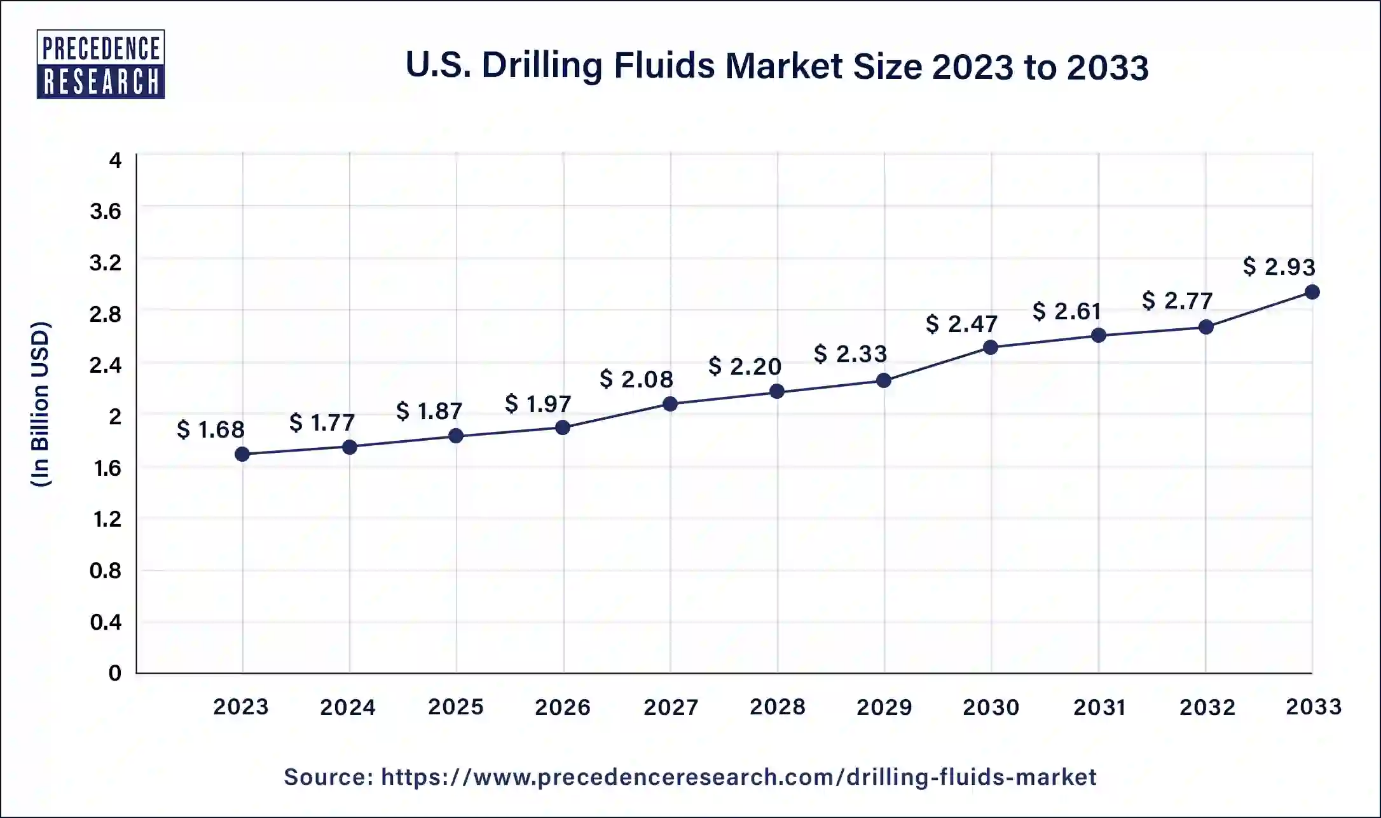

U.S. Drilling Fluids Market Size and Growth 2024 to 2033

The U.S. drilling fluids market size accounted for USD 1.77 billion in 2024 and is estimated to hit around USD 2.93 billion by 2033, growing at a CAGR of 5.76% from 2024 to 2033.

North America dominated the drilling fluids market in 2023. The U.S. is a significant contributor to the global market for drilling and completion fluids. Upstream oil and gas activity has transitioned to shell deposits, with tight oil and dry gas from shale sources accounting for a major share of total crude oil and natural gas output, respectively. This output increase necessitates more wells per hectare than conventional oil fields, increasing demand for drilling fluid across the country. The growing number of horizontal wells is likely to drive up demand for these fluids.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Asia Pacific is predicted to grow at the fastest CAGR during the forecast period as demand for oil rises and new oil and gas sources are discovered. As one of the world's top oil importers, the area is seeing a surge in deep-water and ultra-deep-water drilling. Notable finds include MBS171HAA-1 "Amrit" in Mumbai, Arabian Sea, and MB-SHDA-1.

According to the ONGC Director (Exploration), the company has made successive fresh discoveries in the OALP blocks, reiterating its commitment to unlocking India's hydrocarbon resources and accumulating reserves, hence boosting the country's energy security. These repeated finds are aiding regional drilling fluids market expansion.

Scope of Drilling Fluids Market

| Report Attribute | Key Statistics |

| Drilling Fluids Market Size in 2023 | USD 8.99 Billion |

| Drilling Fluids Market Size in 2024 | USD 9.41 Billion |

| Drilling Fluids Market Size by 2033 | USD 14.63 Billion |

| Drilling Fluids Market CAGR | 5.03% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drilling Fluids Market Highlights

Application Outlook

The onshore segment dominated the drilling fluids market in 2023.

Onshore drilling is the process of drilling oil or gas wells on land instead of offshore or undersea areas. Drilling rigs, as well as equipment, are set up to drill vertically into subsurface reservoirs, allowing rich energy resources to be extracted under the Earth's surface. When compared to offshore drilling, onshore drilling has several advantages, including quicker access to equipment, fewer operational costs, and lower environmental dangers. It also enables easier logistics, shorter transit distances, and fewer onerous regulatory requirements.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/1055

Product Insights

The water-based fluids segment dominated the drilling fluids market in 2023. Water-based drilling fluids (WBM) are becoming more popular in high-temperature, high-pressure (HTHP) wells due to ecological and economic considerations. Dispersed water-based fluids are popular and cost-effective, making them ideal for HTHP situations. Water-based fluids also aid in counteracting shale swelling and fracturing during drilling, as they have a consistent point of yield and gel strength throughout a wide temperature range. They feature shear thinning capabilities, high-temperature resistance, greater fluid loss control, better hole cleaning, and well-tube stability.

The synthetic-based fluids segment is expected to grow at the fastest rate during the forecast period. Synthetic-based drilling mud (SBM), also known as low-toxicity oil-based mud (LTOBM), is an inversion emulsion mud that contains synthetic oil as its exterior phase. SBM's environmental appeal and outstanding performance make it an economically viable option for offshore drilling. SBM's rapid penetration rate and reduced mud-related inactivity make it an inexpensive alternative. SBM, like oil-based muds, can improve penetration rate, promote lubricity in wells, and minimize wellbore instability. It performs similarly to mineral oil and diesel-based fluids.

Browse More Insights:

- Drilling Waste Management Market: The global drilling waste management market size reached USD 6.19 billion in 2023 and is projected to hit around USD 11.57 billion by 2032, growing at a CAGR of 7.20% from 2023 to 2032.

- Oilfield Chemicals Market: The global oilfield chemicals market size accounted for USD 30.81 billion in 2023 and it is expected to attain around USD 45.79 billion by 2032, growing at a CAGR of 4.5% from 2024 to 2032.

- Energy ESO Market: The global energy ESO market size was estimated at US$ 230 billion in 2022 and is expected to hit US$ 1261.05 billion by 2032, poised to grow at a CAGR of 18.60% from 2023 to 2032.

- Enhanced Oil Recovery Market: The global enhanced oil recovery market size is estimated to reach US$ 98.74 billion by 2032 from valued at US$ 49.50 billion in 2022 and poised to grow at a CAGR of 7.20% from 2023 to 2032.

- Digital Oilfield Market: The global digital oilfield market size was valued at USD 29.29 billion in 2022 and it is projected to hit USD 57.89 billion by 2032 with a compound annual growth rate (CAGR) of 7.1% from 2023 to 2032.

Drilling Fluids Market Dynamics

Driver

Environmentally friendly formulation

In recent years, there has been an increased emphasis on developing drilling fluids that are both ecologically friendly and sustainable. Traditional drilling fluids typically contain additives and chemicals that, if not managed properly, can pollute the environment. However, developments in formulation methods have resulted in the creation of sustainable substitutes that are non-toxic, biodegradable, and emit minimal levels of pollutants. These new fluids not only decrease the environmental effect of drilling operations, but they also follow tight regulations, lowering both legal and reputational concerns for operators.

The use of bio-based additives derived from renewable resources, such as microbial enzymes, plant extracts, and biopolymers, is also considered a superior alternative. These additives have various advantages over their synthetic equivalents, including greater biodegradability, less toxicity, and enhanced performance. These additives also contribute to the industry's efforts to reduce reliance on fossil fuels and mitigate carbon emissions.

Restraint

Loss of circulation due to heavy drilling fluids

Lost circulation is the loss of mud into a formation caused by a variety of events, such as drilling with heavy mud loads or surging the formation. This can result in fracture pressure concerns, clogged pipes, well control challenges, and even damage to the manufacturing zone. To avoid mud losses, drilling procedures should be designed around assessing data from offset wells to determine the necessary mud weight. Lost circulation material (LCM) can be employed frequently in the working system while drilling across probably lost circulation strata, and it can be pumped with drilling fluids without changing their rheology or other predetermined qualities.

Opportunity

Nanotechnology

Nanoparticles are transforming drilling fluid technology by providing several advantages such as decreased formation damage, cost savings, fluid loss management, hazard elimination, enhanced lubrication, heat transfer, and rheological qualities. Polymeric nanoparticles, such as TiO2/PAM, have been successfully studied for application in WB drilling fluid systems, whereas ceramic nanoparticles, which have great temperature resistance and chemical inertness, are employed in imaging, drug administration, photodegradation, and photocatalysis.

Incorporating aluminum, magnesium, and silica nanoparticles into WB drilling fluids has enhanced filtration and rheological and thermal properties. Silica nanoparticles have also been investigated for their mechanical properties in drilling fluids. Overall, nanoparticles have the potential to transform the drilling fluids market.

Recent Developments:

- In October 2023, the oil and gas business emphasized sustainable and ecologically friendly drilling fluids and technology, including cellulose nanomaterials (CNMs). CNMs have plentiful, cost-effective, and renewable qualities and may be generated using various methods. Their categorization, manufacture, and qualities may be studied to optimize their application in a variety of industries.

- In October 2022, the Indian Institute of Technology Kharagpur (IIT Kharagpur) and the Oil and Natural Gas Corporation (ONGC) signed a memorandum of understanding (MoU) to collaborate on many research and development initiatives. The MoU was previously inked by the Institute of Drilling Technology in Dehradun. However, more formalization steps are required before the collaborative move is disclosed.

Drilling Fluids Market Top Companies

- Anchor Drilling Fluids USA, LLC

- National Oilwell Varco

- Baker Hughes Incorporated

- Schlumberger Limited

- Gumpro Drilling Fluids Pvt. Ltd.

Segments Covered in the Report

By Product

- Water-based fluids (WBF)

- Oil-based fluids (OBF)

- Synthetic-based fluids (SBF)

- Others

By Application

- Offshore

- Onshore

By Regional Outlook

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1055

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: