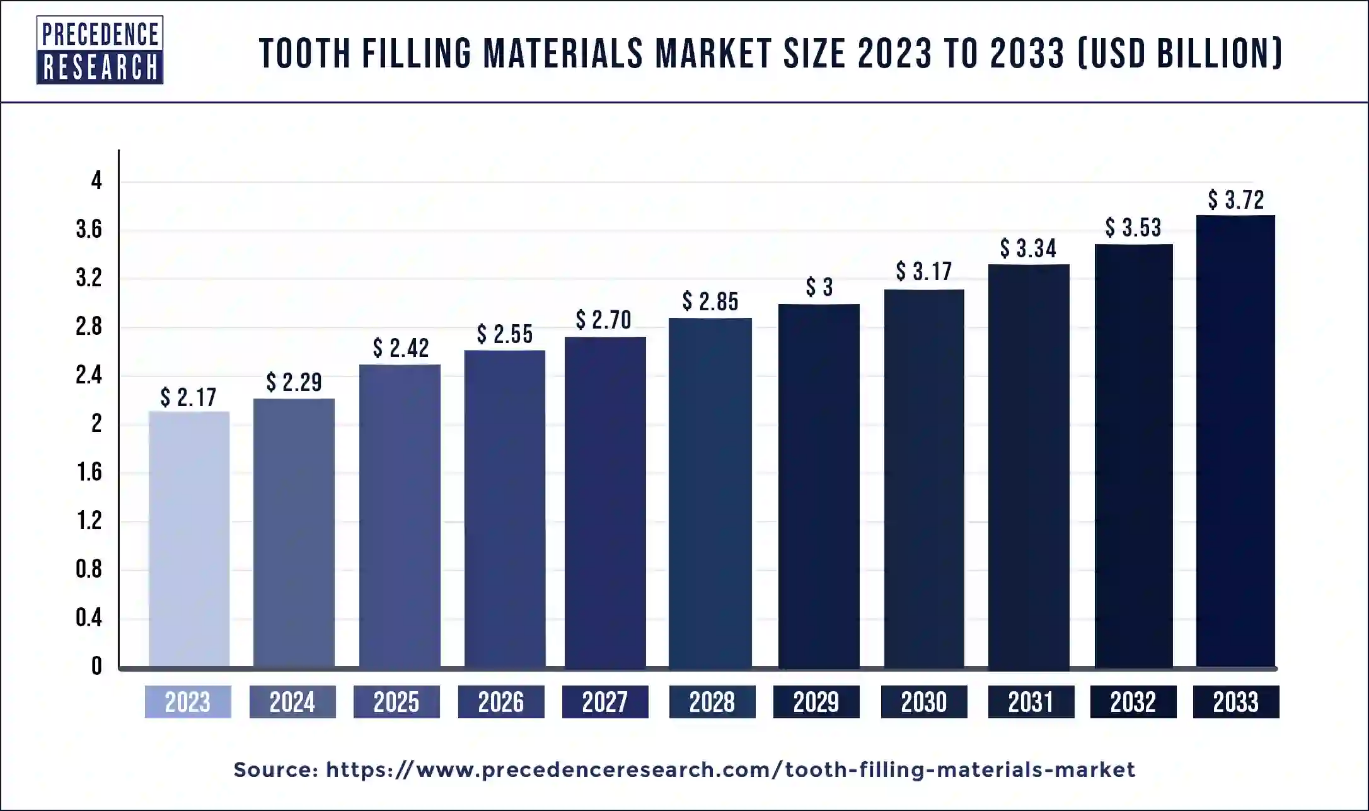

Ottawa, June 10, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global tooth filling materials market size was estimated at USD 2.17 billion in 2023 and is predicted to surpass around USD 3.53 billion by 2032. The tooth filling materials market is driven by increasing consumer awareness, a rise in demand for good social appearance, and technological advances.

The tooth filling materials market refers to the global trade and consumption of materials used to fill cavities in teeth. Gold, porcelain, silver amalgam, composite resin, and glass ionomer are among the materials used to fill dental cavities. Gold fillings are durable, long-lasting, and non-corrosive, but they are costly and require several dental visits. Silver amalgam fillings are popular because of their low cost and minimal mercury content.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4034

Composite resin fillings are cosmetically pleasing and commonly used on front teeth, although they are more expensive and have longevity issues. Ceramic fillings are stain-resistant and long-lasting, but they cost more than silver amalgam fillings. Ceramic fillings can be color-matched to existing teeth and endure for 15 years or more. Despite these risks, ceramic fillings are a great option for front teeth if they are within your budget. Overall, the choice of dental filling material is determined by criteria such as location, decay severity, insurance coverage, and overall health.

Tooth Filling Materials Market Key Insights

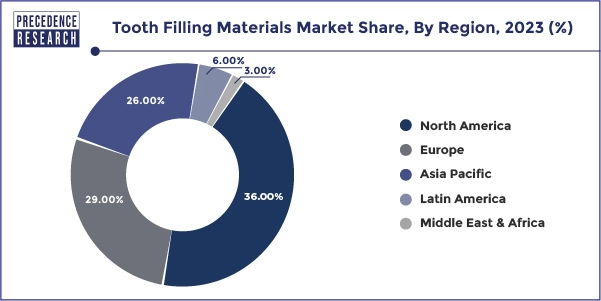

- North America has held a largest revenue share of 36% in 2023.

- Asia Pacific is expected to expand at the notable CAGR during the forecast period.

- By product, the composite resin segment has contributed more than 36% of revenue share in 2023.

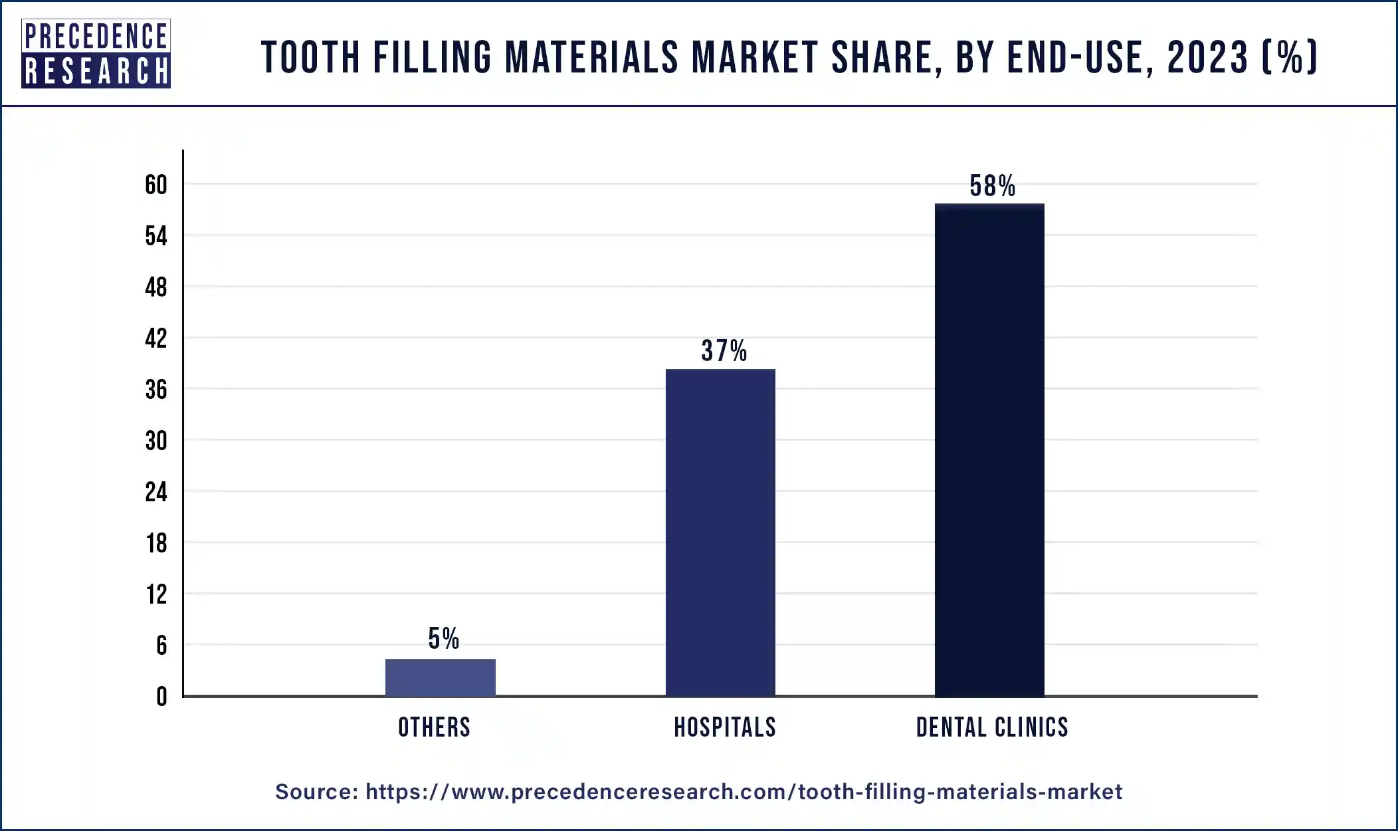

- By end-use, the dental clinics segment has accounted for the major revenue share of 58% in 2023.

- By end-use, the hospitals segment is projected to grow at a significant CAGR throughout the forecast period.

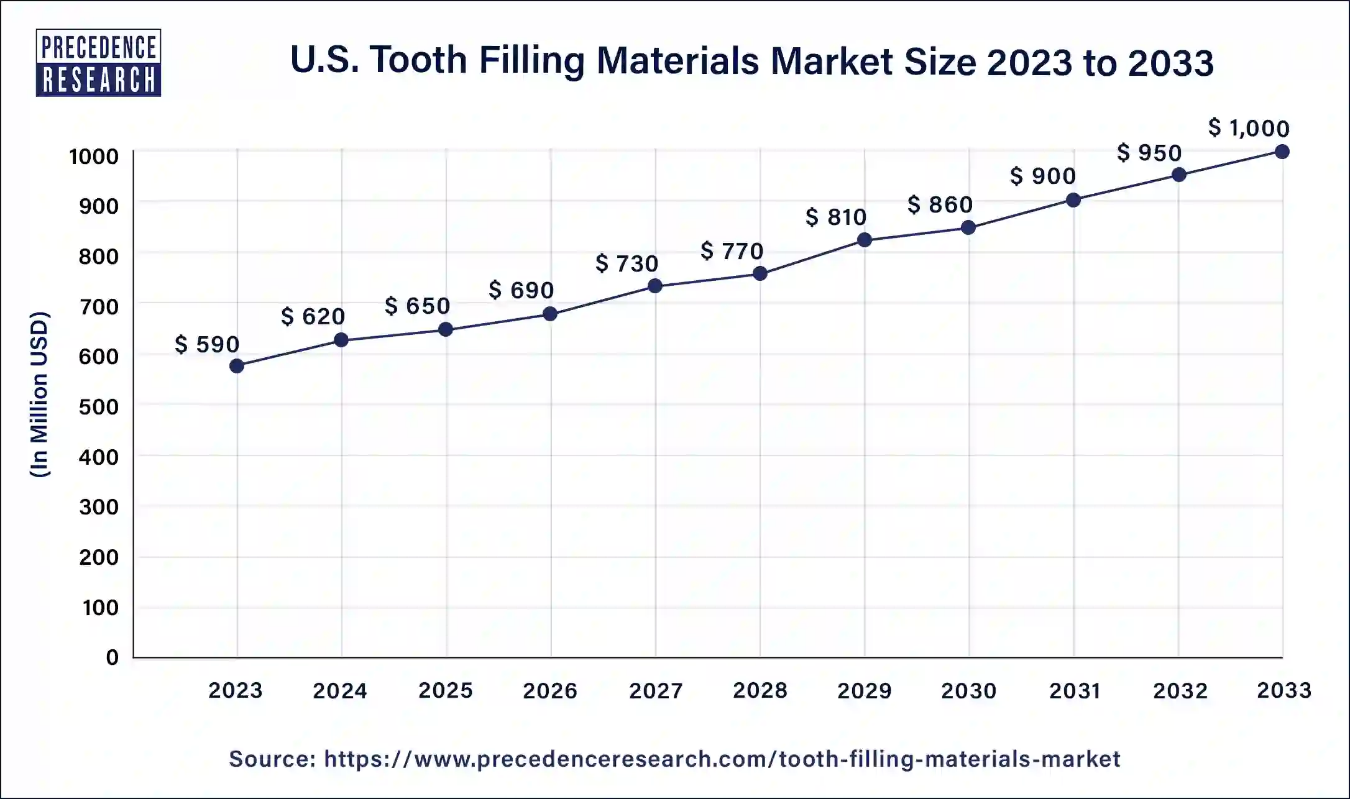

U.S. Tooth Filling Materials Market Size

The U.S. tooth filling materials market size was USD 590 million in 2023, accounted for USD 620 million in 2024, and is projected to hit around USD 1,000 million by 2033. The industry is expanding at a remarkable CAGR of 5.60% over the forecast period 2024 to 2033.

North America and Asia Pacific Regional Outlook

North America dominated the tooth filling materials market in 2023, owing to advancements in dental healthcare infrastructure, medical tourism, cosmetic dentistry, senior citizens, government policy on reimbursement, rising medical care infrastructure, public awareness, and an increase in dental disorders. Companies have expanded dental treatments and revenue through strategic collaborations, acquisitions, and product introductions. Digital technologies and electronic health records in the United States have the potential timprove dental care and collaboration across dental, medical, and behavioral health practitioners. Nearly one in every five adults in the United States experiences dental fear and anxiety, emphasizing the importance of addressing these issues and supporting specific groups.

- According to the CDC report 2023, More than 40 percent of adults report having felt pain in their mouth in 2022, and more than 80 percent of people will have had at least one cavity by age 34. The United States spends more than USD 124 billion on costs related to dental care each year.

- According to the ADAH (American Dental Hygienists' Association), nearly 80% of Americans will have at least one cavity before they reach age 17, and almost 80% of Americans have some level of gum disease.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Asia Pacific is expected to experience the fastest growth, owing to an increase in dental clinics, healthcare infrastructure investment, a growing oral disease burden, an aging population, and awareness of better dental care. Furthermore, new product development and cosmetic dentistry preferences are anticipated. Oral diseases are common in South-East Asia, causing a considerable burden on impoverished and disadvantaged people. About 900 million cases of untreated dental caries, severe periodontal disorders, and edentulism were estimated.

The region has the highest incidence and fatality rates from oral cancer among all WHO regions. Other diseases and ailments, including dental trauma, orofacial clefts, oral mucosa diseases, and systemic diseases, add to the overall burden. The South-East Asia Oral Health Action Plan 2022-2030 seeks to achieve universal oral health coverage by 2030, allowing people to enjoy happy and fulfilled lives. The strategy also includes two regional targets for tracking oral health progress by 2030.

- In March 2024, Sensodyne, a leading oral care company, is marking World Oral Health Day by partnering with 136 dental colleges across India. The initiative, part of the brand's “BeSensitiveToOralHealth” initiative, aims to highlight the importance of proactive oral care to dental students via educational sessions with celebrated Deans of leading dental colleges and dentists.

Scope of Tooth Filling Materials Market

| Report Attribute | Key Statistics |

| Tooth Filling Materials Market Size in 2023 | USD 2.17 Billion |

| Tooth Filling Materials Market Size in 2033 | USD 3.72 Billion |

| U.S. Tooth Filling Materials Market Size in 2023 | USD 590 Million |

| U.S. Tooth Filling Materials Market Size in 2033 | USD 1,000 Million |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Tooth Filling Materials Market Highlights

Type Insight

The composite resin segment dominated the tooth filling materials market in 2023. Composite resin is a multipurpose dental material that requires less drilling than other materials and has an attractive appearance. It is sufficiently soft for dentists to blend in, and it may be tailored to fit the color and shape of teeth.

Fillings, veneers, inlays, and on lays, as well as aesthetic bonding procedures, can all be restored using it. Because composite restorations harden quickly and don't require a dental lab, they can be installed in a single appointment. By shielding the tooth from high temperatures and acting as an insulator, they also lessen tooth sensitivity. When composite fillings deteriorate from frequent use or grinding, they can be fixed.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/4034

The glass ionomers segment is expected to grow at the fastest rate during the forecast period. Dentists choose glass ionomer sealants because of their capacity to release fluoride, which helps reverse the early stages of tooth decay. They fit in well with the color of the tooth, are simple to install, and involve little disruption of healthy tooth structure. They release fluoride over time and adhere nicely to tooth surfaces without the need for a bonding agent.

End Use Insight

The dental clinics segment dominated the tooth filling materials market in 2023. To maintain oral health, a dental clinic provides a variety of treatments, such as teeth cleaning, sophisticated procedures, and preventive care. These services are performed by licensed experts who recognize the value of maintaining proper dental hygiene. Cleaning your teeth is essential for maintaining good dental health. Fillings can be used to fix cavities, and extraction is an option if necessary. Gum disease and tooth decay can be avoided with routine cleanings and examinations. Treatment can begin as soon as oral health problems are identified. Plans for individualized care can be created specifically for each patient. Maintaining good dental health enhances self-esteem and lowers the risk of systemic health problems like heart disease. In general, dental clinics are necessary to keep your mouth healthy.

The hospital segment is expected to grow at the fastest rate during the forecast period. A person with severe anxiety, autism, cerebral palsy, special needs, Down syndrome, behavioral difficulties, complex medical issues, and physical mobility disabilities may benefit from hospital dentistry. Dentists can offer sedation for painless, stress-free, and time-saving procedures in calm, comfortable consultations. For lengthy treatments, full sedation is advised to enable a single session to be completed. For less intensive care, alternative sedation and relaxation techniques are offered.

Tooth Filling Materials Market Dynamics

Driver: Social appearance

The rise of social media has resulted in a huge increase in demand for cosmetic dentistry treatments, and hence, there is a rise in the growth of the tooth filling materials market, particularly those related to self-image issues. People's exposure to celebrity and influencer profiles with "the perfect smile" has increased in patients seeking these treatments. This could be attributed to online trends and a growing emphasis on aesthetics and appearance.

Snapchat and Instagram have offered 'filters' that foster concerns about self-image issues by allowing users to change their appearance or achieve a specific look. However, excessive use of these filters can create anxiety and sadness, which is one of the factors driving rising interest in cosmetic treatments such as dental whitening and veneers. While cosmetic dentistry is an exciting field that boosts patients' self-esteem and improves the appearance of their smiles, there have been worries about unrealistic expectations.

Restraint: Deteriorating fillings

Dental fillings might deteriorate, chip, or crack as a result of frequent chewing, grinding, or clenching. Regular checkups can reveal flaws in repairs. If the barrier between dental enamel and filling fails, decay-causing bacteria can enter the tooth, causing more decay and perhaps an abscess. If the filling is substantial or extensive, a crown can be required.

New fillings may fall out due to poor dental treatment, contamination of the preparation, or fracture from the bite or chew damage. Older restorations are usually lost owing to deterioration or fracture of the remaining tooth.

Browse More Insights:

- Digital Dentistry Market: The global digital dentistry market size reached USD 5,331.59 million in 2023 and is projected to hit around USD 15,512.86 million by 2032, growing at a CAGR of 12.60% from 2023 to 2032.

- Robotic Dentistry Market: The global robotic dentistry market size was estimated at USD 461.38 million in 2023 and is projected to hit around USD 1,714.14 million by 2032, registering a CAGR of 15.70% from 2023 to 2032.

- Dental Services Market: The global dental services market size accounted for USD 453.44 billion in 2023 and it is expected to hit around USD 731.59 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

- U.S. Dental Services Market: The U.S. dental services market size was estimated at USD 154.96 billion in 2023 and is expected to reach over USD 259.93 billion by 2033, growing at a CAGR of 5.30% between 2024 and 2033.

- Dental X-ray Market: The global dental X-ray market size was valued at USD 2.95 billion in 2023 and is anticipated to reach around USD 6.95 billion by 2033, growing at a CAGR of 8.94% from 2024 to 2033.

- Dental Lasers Market: The global dental lasers market size was valued at USD 358.16 million in 2023 and is anticipated to reach around USD 747.85 million by 2033, growing at a CAGR of 7.64% from 2024 to 2033.

Opportunity: Nano-filling technology

Nano-fillings are a rapidly rising trend in 2023, with nanotechnology used to manufacture long-lasting fillings composed of carbon nanotubes and nanocomposites. These materials are more durable than standard fillings and can withstand long-term deterioration. They require less drilling, resulting in fewer dental visits.

Nano-fillings also have a more natural appearance and feel, with a wide range of hues available to match natural tooth colors. They are less prone to sensitivity or discomfort, making them the best option for keeping a healthy and appealing smile. To summarize, nano-fillings provide a promising future for the tooth filling materials market.

Recent Developments:

- In April 2024, Kettenbach Dental expanded its Visalys composites business to include five restorative options for cementing, core build-ups, temporary restorations, and nano-hybrid composites for direct filling therapy. The most often utilized materials, Visalys Temp and Visalys Core are now accessible for reliable temporary and core build-ups, confirming their value in the dentistry sector.

- In February 2024, Caries is a common human disease triggered by bacteria-produced acids, which induce pulp inflammation. Current therapies, such as dental resin composites (DRCs), have low fracture strength and limited anti-caries bioactivity. Using a dynamic self-assembly approach, researchers created and manufactured fluorinated urchin-like hydroxyapatite (FUHA) inspired by plant roots to improve soil stability.

- In June 2023, The American Dental Association (ADA) issued a clinical practice guideline for addressing tooth decay in both primary and permanent teeth. A group of experts established the guideline, which suggests conservative treatments utilizing conventional restorative materials for better results. It provides 16 recommendations for mild to advanced tooth decay that does not require endodontic treatment.

Tooth Filling Materials Market Top Companies

- SDI Limited

- 3M

- Coltene Whaledent

- DETAX Ettlingen

- DenMat Holdings

- SDI Limited

- VOCO GmbH

- GC America

- Kerr Corporation

- Coltene Whaledent

- Kettenbach

- DMG Chemisch-Pharmazeutische Fabrik

- Pentron Clinical Technologies

- Kuraray Noritake Dental

- Dentsply Sirona

- Ivoclar Vivadent

- Shofu dental

- Bisco, Inc

Market Segmentation

By Type

- Silver Amalgam

- Composite Fillings

- Glass Ionomers

- Gold Fillings

- Temporary Cement

- Others

By End-use

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4034

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: