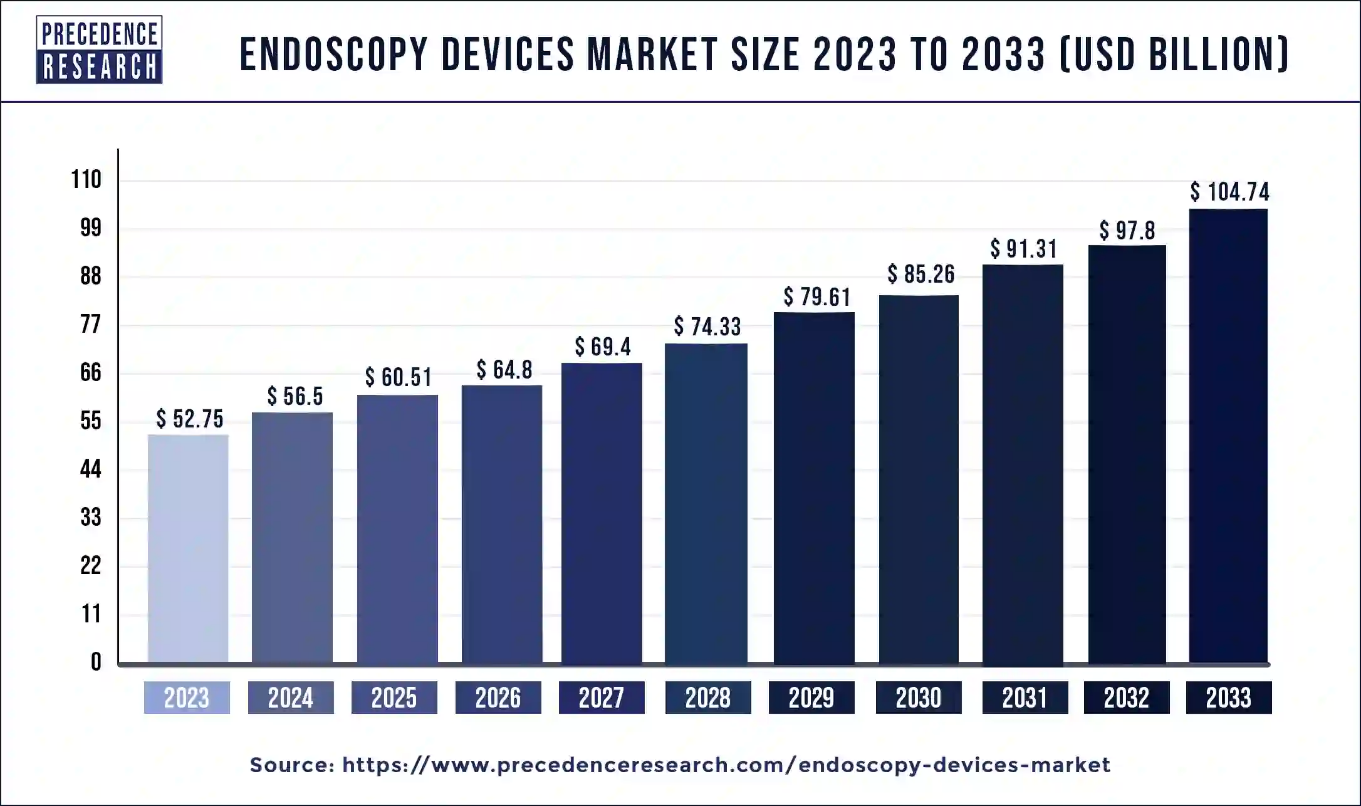

Ottawa, June 13, 2024 (GLOBE NEWSWIRE) -- The global endoscopy devices market size is projected to increase from USD 56.5 billion in 2024 to approximately USD 104.74 billion by 2033. The market is expected to grow at a solid CAGR of 7.1% during the forecast period from 2024 to 2033. Diagnosis and monitoring without any surgical procedure of the body increases the demand for endoscopic devices.

Endoscopy devices are minimally invasive medical procedures that diagnose, prevent, and treat complications associated with visceral organs. The endoscopy devices market deals with sectors like hospitals, ambulatory surgical devices, and other applications, which include mediastinoscopy, otoscopy, arthroscopy, laparoscopy, bronchoscopy, laryngoscopy, obstetrics endoscopy, gastrointestinal (GI) endoscopy, and urology endoscopy which contribute to the growth of the market. It helps healthcare professionals see the difficult areas that are not seen by the naked eye. These endoscopy devices are used to take biopsies or remove polyps for treatment.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1095

Endoscopy Devices Market Key Statistics

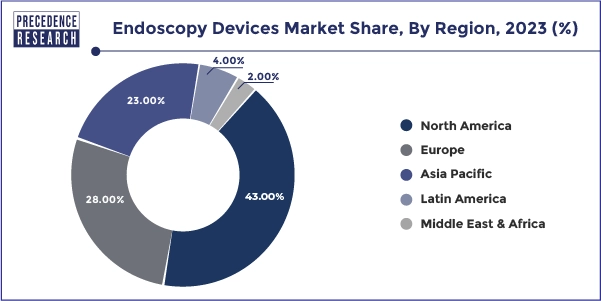

- North America dominated the market with the largest revenue share of 43% in 2023.

- Asia Pacific region is poised to grow at a notable CAGR of 6.9% between 2024 and 2033.

- By product, the endoscopy visualization systems segment has held a major revenue share of 37% in 2023.

- By end user, the hospitals segment has contributed more than 48% of revenue share in 2023.

- By application, the gastrointestinal (GI) endoscopy segment has recorded a revenue share of around 55.2% in 2023.

- The urology endoscopy application segment is growing at a strong rate.

Regional Outlook

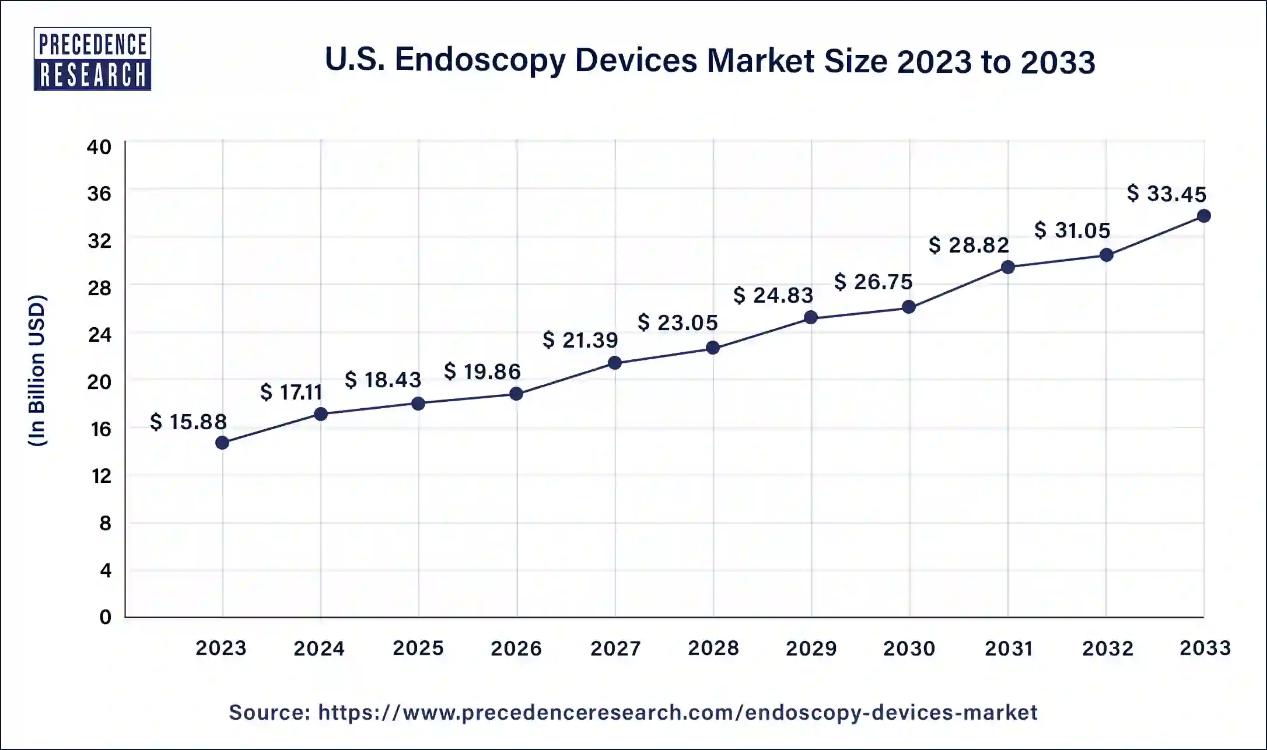

The U.S. endoscopy devices market size accounted for USD 17.11 billion in 2024 and is anticipated to reach around USD 33.45 billion by 2033, expanding at a CAGR of 7.73% from 2024 to 2033.

North America dominated the endoscopy devices market in 2023. North American industries have the main role in the use of endoscopy devices. Dedicated industry professional training and education are offered by the ASGE through the American Society of Gastrointestinal Endoscopy (ASGE) recognized industry associate program. This is helpful for equipment manufacturers, pharmaceuticals, clinical trials, and medical therapies for GI diseases and helps the growth of the market. The U.S. is promoting reusable endoscopy devices for environmental sustainability, which will help in the transition to green endoscopy and sustainable care. In the United States, a large section of the money benefits in spine surgeries from the medical devices industries by selling endoscopic devices and other devices, which helps the growth of the market.

Asia-Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. Increased progress and development of modern devices and diagnostic apparatus help to grow the market. The factors include demographic, economic, socioeconomic, scientific, and technological progress that contributes to the growth of the market in the Asia Pacific region. Preventive medical treatments are conducted by endoscopic devices, laboratory instruments, and other devices, and there is high demand for these devices. In recent years, China has developed the quality and utilization of digestive endoscopy.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Endoscopy Devices Market Coverage

| Report Attribute | Key Statistics | |

| Market Size in 2033 | USD 104.74 Billion | |

| Market Size in 2024 | USD 56.5 Billion | |

| CAGR 2024 to 2033 | 7.1 | % |

| Largest Market | North America | |

| Fastest Growing Market | Asia Pacific | |

| Base Year | 2023 | |

| Historical Year | 2021-2022 | |

| Forecast Period | 2024 to 2033 | |

| Segments Covered | Product, Application, Hygiene, End User, and Regions | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

Endoscopy Devices Market Segment Outlook

Product Type Outlook

The endoscopy visualization system segment dominated the endoscopy devices market in 2023. Using the endoscopy visualization system helps describe the human body’s inner cavity procedure of inspection. In various surgical treatments, an endoscopy visualization system is used. It is easy to examine the areas and anatomy of the eye. Without its use, it is difficult to view. For surgeons, it is helpful to visualize pathology, anatomy, and tissues by using an endoscopy visualization system that may be invisible by traditional surgical views. These factors help the segment's growth and contribute to the market's growth.

The endoscopes segment is the fastest growing during the forecast period. The endoscopes are named related to their applications procedures or organs, including gastrointestinal endoscopy, thoracoscopy, laparoscopy, neuro-endoscopy or throat, nose, and ear endoscopy, gynecological endoscopy, urological endoscopy, bronchoscopy, small bowel endoscopy, colonoscopy, duodenoscopy, gastroscopy, and esophagoscopy. In some applications, stereo cameras are used to allow 3D visualization. This is used mostly in robotic and laparoscopic surgeries. These factors help the growth of the segment and contribute to the growth of the endoscopy devices market.

Personalized your customization here: https://www.precedenceresearch.com/customization/1095

End-use Outlook

The hospital segment dominated the endoscopy devices market in 2023. In hospitals, there is a higher demand for endoscopy devices than in other end-use types like ambulatory surgical centers. It helps the doctors to determine the cause of any unusual symptoms. To remove the small tissue samples that may be sent to the lab for further testing, known as endoscopy biopsy. It helps doctors to see surgical procedures inside the body, including removing tumors and gallstones and repairing stomach ulcers. These factors help the segment's growth and contribute to the market's growth.

Applications Outlook

The gastrointestinal (GI) endoscopy segment dominated the market in 2023. Gastrointestinal endoscopy is used to assess routine colon cancer screening, growths or polyps in the colon, changes in bowel habits like diarrhea or chronic constipation, digestive tract bleeding, difficulty swallowing, gastritis, ulcers, and stomach pain. To overcome these diseases, gastrointestinal endoscopy is used in the treatment. This contributes to the growth of the segment.

The urology endoscopy segment is the fastest growing during the forecast period. To examine or treat the urinary tract, including kidneys, ureters, bladders, and urethra, doctors perform a urology endoscopy. There are two types of urology endoscopy: cystoscopy and ureteroscopy. The cystoscopy is used by doctors, with a long tube linked to a camera to look at the bladder and urethra in the cystoscopy process. The ureter is used to observe ureters and kidneys, and an even longer tube is linked to a camera. These help to the growth of the segment and contribute to the growth of the endoscopy devices market.

Browse More Insights:

- Endoscopy Equipment Market: The global endoscopy equipment market size was valued at USD 29.29 billion in 2023 and is expected to reach over USD 54.98 billion by 2033 with a registered CAGR of 6.5% from 2024 to 2033.

- U.S. Endoscopes Market: The U.S. endoscopes market size was estimated at USD 4.40 billion in 2023 and is projected to hit around USD 10.38 billion by 2033, growing at a CAGR of 9% from 2024 to 2033.

- Dermatology Endoscopy Devices Market: The global dermatology endoscopy devices market size was evaluated at USD 1.69 billion in 2022 and is expected to attain around USD 3.31 billion by 2032, growing at a CAGR of 7% from 2023 to 2032.

- Neuroendoscopy Market: The global neuroendoscopy market size was valued at USD 152.93 million in 2023 and is anticipated to reach around USD 260.49 million by 2033, growing at a CAGR of 5.47% from 2024 to 2033.

- Disposable Endoscopes Market: The global disposable endoscopes market size was estimated at USD 2 billion in 2023 and is expected to hit around USD 9.58 billion by 2033, with a registered CAGR of 16.95% during the forecast period 2024 to 2033.

- Bronchoscopy Market: The global bronchoscopy market size accounted for USD 2.8 billion in 2022 and is projected to hit around USD 5.74 billion by 2032, growing at a CAGR of 7.5% during the forecast period from 2023 to 2032.

- Rigid Endoscopes Market: The global rigid endoscopes market size was estimated at USD 7.66 billion in 2023 and is projected to reach around USD 15.35 billion by 2033, expanding at a CAGR of 7.2% during the forecast period from 2024 to 2033.

- Flexible Endoscopes Market: The global flexible endoscopes market size was estimated at USD 10.17 billion in 2023 and it is expected to hit around USD 18.85 billion by 2033, growing at a CAGR of 6.4% during the forecast period 2024 to 2033.

- Urology Devices Market: The global urology devices market size was exhibited at USD 39.13 billion in 2023 and is projected to surpass around USD 59.66 billion by 2032, poised to grow at a projected CAGR of 4.8% during the forecast period 2023 to 2032.

- Sinus Dilation Devices Market: The global sinus dilation devices market size was valued at USD 3.02 billion in 2023 and is anticipated to reach around USD 7.60 billion by 2033, growing at a CAGR of 9.67% from 2024 to 2033.

Endoscopy Devices Market Dynamics

Driver: High demand for endoscopy devices

Endoscopy devices are in high demand because they are normally not painful and are quick to perform. To make a diagnosis, it allows doctors to use endoscopy devices for diagnosing conditions. Endoscopy devices are used to treat conditions like digestive tract conditions. It is also helpful to perform surgeries, place stents, including the small tubes that open damaged or blocked organs, fix blockages, widen too-narrow organs, remove tumors or damaged tissue, internal bleeding stoping, drain fluid, inject medicine, and seal wounds. These factors help to grow the endoscopy devices market.

Restraint: Complications in endoscopy devices

Endoscopy devices have some complications, which include pancreatitis as a result of ERCP, bleeding, infection, reaction to sedation, and tear in the gut wall (perforation). Other risks include swelling and redness at the incision site in the area of endoscopy, persistent pain, fever, damage to organs such as possible perforation, and chest pain. These risks may restrict the growth of the endoscopy devices market.

Opportunity: Towards greener endoscopy and environmental sustainability

Endoscopy devices can made to improve sustainability and to reduce environmental impact. Reduction of carbon emission which is produced by the gastrointestinal endoscopy. Fewer instruments can be used per procedures, alternative products that can reduce carbon emission, and use of recycling packaging materials that help to the environmental sustainability. These factors help to the growth of the endoscopy devices market.

Endoscopy Devices Market Top Companies

- Ambu Inc.

- Boston Scientific Corporation

- CONMED Corporation

- Ethicon Endo-Surgery, LLC

- Fujifilm Holdings Corporation

- HOYA Corporation

- Intuitive Surgical Inc.

- Johnson & Johnson

- Karl Storz GmbH & Co. KG

- Machida Endoscope Co., Ltd.

- Medtronic Plc

- NEC Corporation

- 3NT Medical Ltd

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- Smith & Nephew Inc.

- Stryker Corporation

Recent Developments

- In October 2023, a next-generation endoscopy system, EVIS X1 for gastrointestinal (GI) practitioners, was launched by Olympus, a medical technology company. The EVIS X1 endoscopy device properties include color and texture improvement imaging technology to improve texture and color in the endoscopic screening to improve the visibility of polyps and lesions.

- In July 2023, a new medical device for endoscopic surgery gives successful clinical study results announced by EndoTheia. This device is helpful for clinical investigators and patients as an alternative to duodenoscopes and also reduces disposable and inexpensive components.

- In February 2024, ALOKA ARIETTA 850, an advanced endoscopic ultrasound machine, was launched by a pioneer in diagnostic information and imaging systems, Fujifilm, in India. Its first installation was in the Fortis Hospital in Bengaluru.

- In April 2024, an Endoscopic Submucosal Dissection (ESD) device was launched by a leading innovator in endoscopy solutions, Fujifilm, in India. This device helps for removing cancerous lesions and precancerous lesions in the gastrointestinal (GI) tract.

Endoscopy Devices Market Segmentation

By Product

- Endoscopes

- Flexible Endoscopes

- Colonoscopes

- Upper Gastrointestinal Endoscopes

- Sigmoidoscopes

- Bronchoscopes

- Pharyngoscopes

- Laryngoscopes

- Nasopharyngoscopes

- Duodenoscopes

- Rhinoscopes

- Other Flexible Endoscopes

- Rigid Endoscopes

- Arthroscopes

- Laparoscopes

- Cystoscopes

- Urology Endoscopes

- Neuroendoscopes

- Gynecology Endoscopes

- Other Rigid Endoscopes

- Disposable Endoscopes

- Capsule Endoscopes

- Robot Assisted Endoscope

- Flexible Endoscopes

- Endoscopy Visualization Systems

- High Definition (HD) Visualization Systems

- 3D Systems

- 2D Systems

- Standard Definition (SD) Visualization Systems

- 3D Systems

- 2D Systems

- Ultrasound Devices

- High Definition (HD) Visualization Systems

- Endoscopy Visualization Components

- Insufflators

- Camera Heads

- High-definition Monitors

- Light Sources

- Video Processors

- Suction Pumps

- Operative Devices

- Access Devices

- Energy Systems

- Hand Instruments

- Suction & Irrigation Systems

- Snares

- Wound Retractors

By Application

- Urology Endoscopy

- Gastrointestinal (GI) Endoscopy

- Obstetrics Endoscopy

- Laryngoscopy

- Laparoscopy

- Bronchoscopy

- Arthroscopy

- Otoscopy

- Mediastinoscopy

- Other Applications

By Hygiene

- Single-Use

- Reprocessing

- Sterilization

By End-Use

- Ambulatory Surgical Centers

- Hospitals

- Other End-uses

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1095

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: