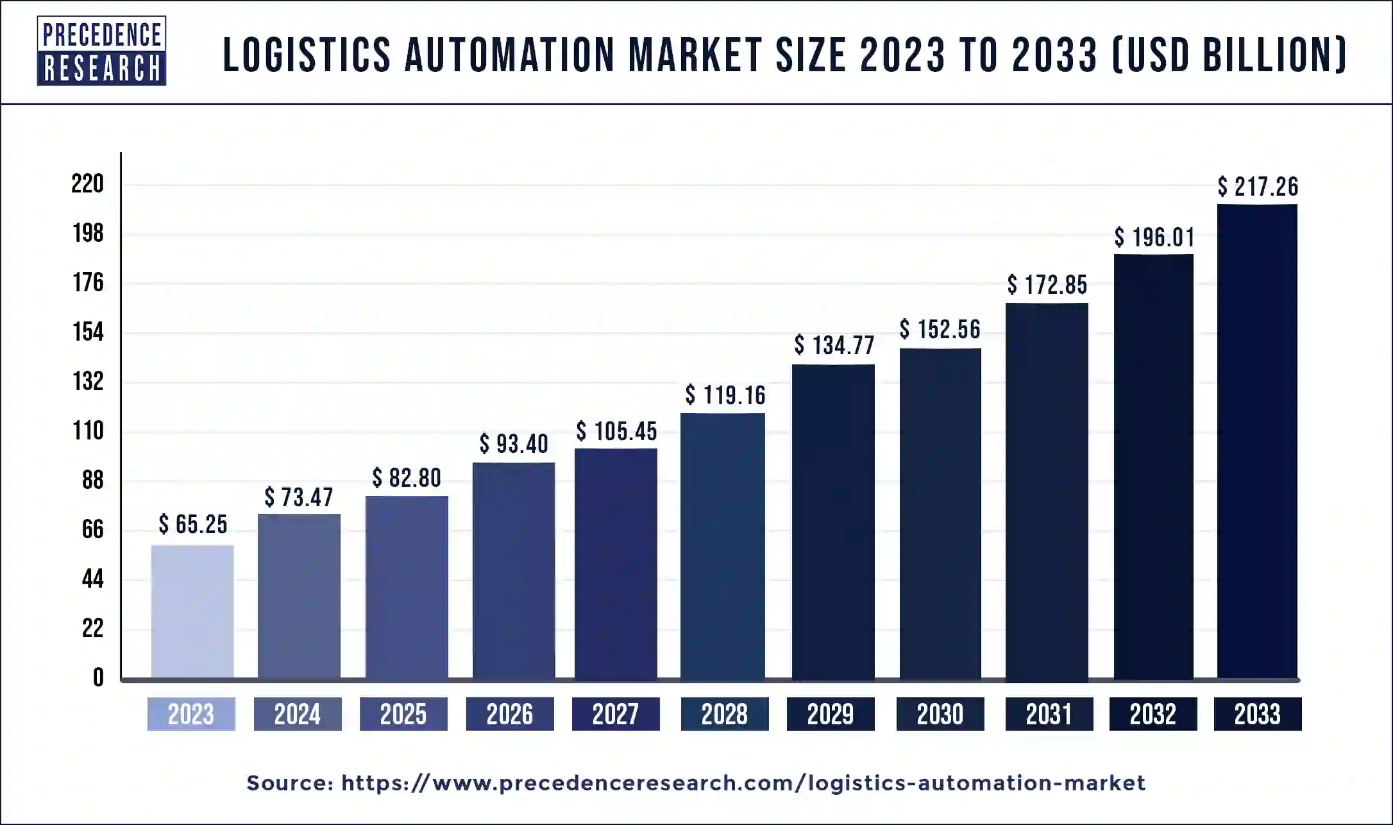

Ottawa, June 21, 2024 (GLOBE NEWSWIRE) -- The global logistics automation market size is predicted to increase from USD 65.25 billion in 2023 to approximately USD 217.26 billion by 2033, according to a study published by Precedence Research. The logistics automation market is driven by increasing demand for new technology, beneficial properties of automation, and government initiatives.

In 2024, the global logistics market size accounted for USD 9.97 trillion in 2024 while the logistics market is projected to grow at 9.35% of annual growth.

The Europe logistics automation market size is estimated to grow from USD 17.01 billion in 2023 to reach around USD 48.62 billion by 2033, expanding at a remarkable CAGR of 11.18% from 2024 to 2033. The Europe logistics automation market is driven by the fast growth in both the retail and e-commerce industries.

The logistics automation market refers to the industry segment focused on the development, implementation, and utilization of automated technologies and systems to optimize various processes within the logistics and supply chain management ecosystem. The application of computer software or automated equipment to improve the productivity of logistics processes, usually at a warehouse or distribution center, is known as logistics automation. It can be customized for specific nodes within a larger logistics network and function in tandem with higher-level computer systems.

Systems include mobile technology, conveyors, sortation systems, automated storage and retrieval systems, and industrial robots. Operational control software handles low-level decision-making, business control software handles higher-level functions, and integration software handles overall control of the automation gear. Automated goods in processes, automated goods retrieval for orders, automated dispatch processing, and automated repackaging are some of the advantages of logistics automation.

Logistics Automation Market Key Insights

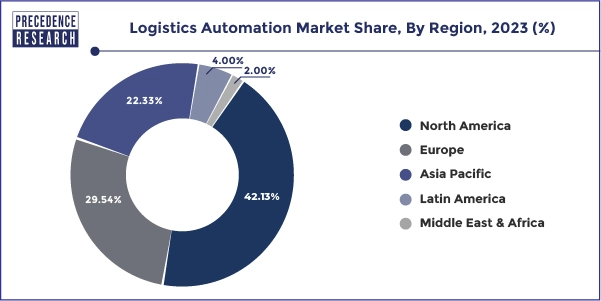

- North America has held a major revenue share of 42.13% in 2023.

- Asia-Pacific is expected to grow at the fastest rate during the forecast period.

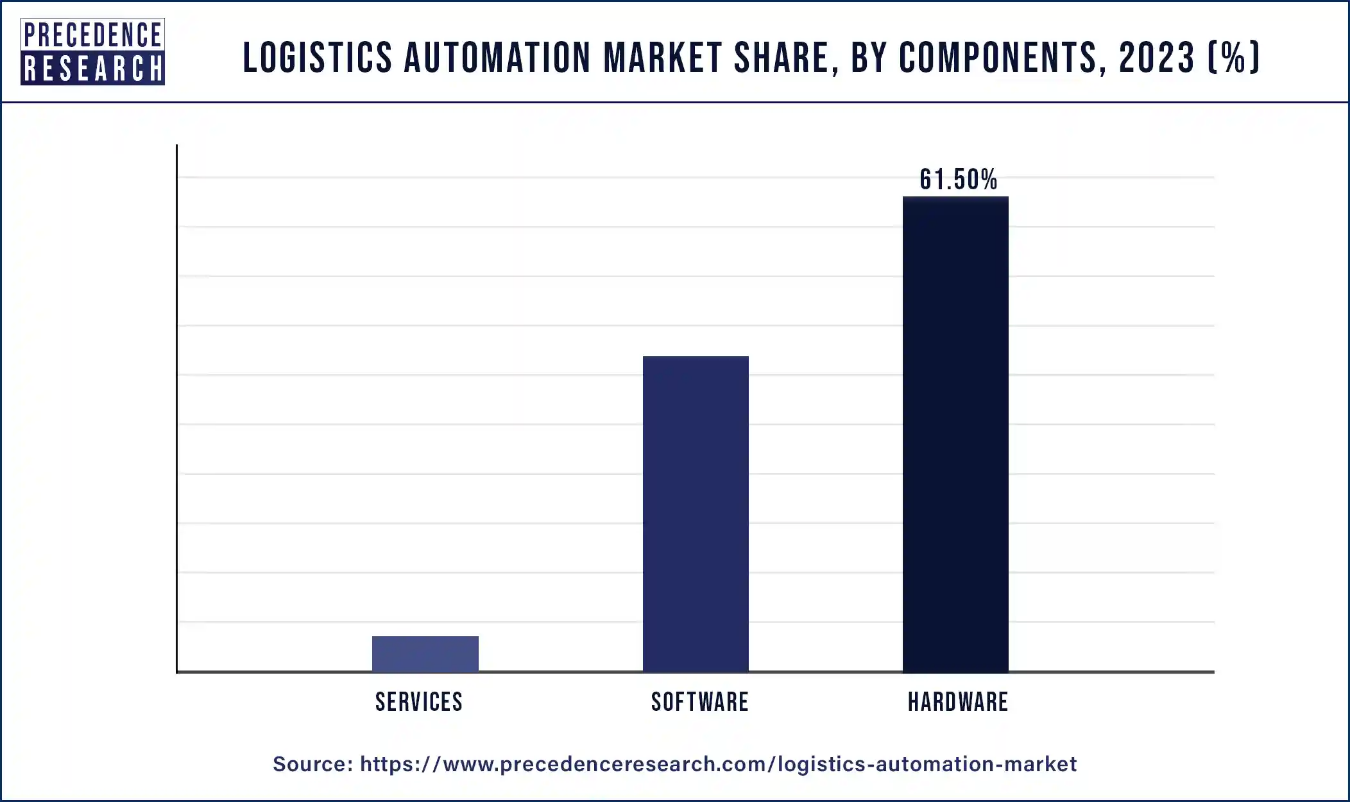

- By component, the hardware segment has contributed more than 61.50% of revenue share in 2023.

- By application, the transportation segment has generated the biggest revenue share in 2023.

- By end-use, the manufacturing segment dominated the market in 2023.

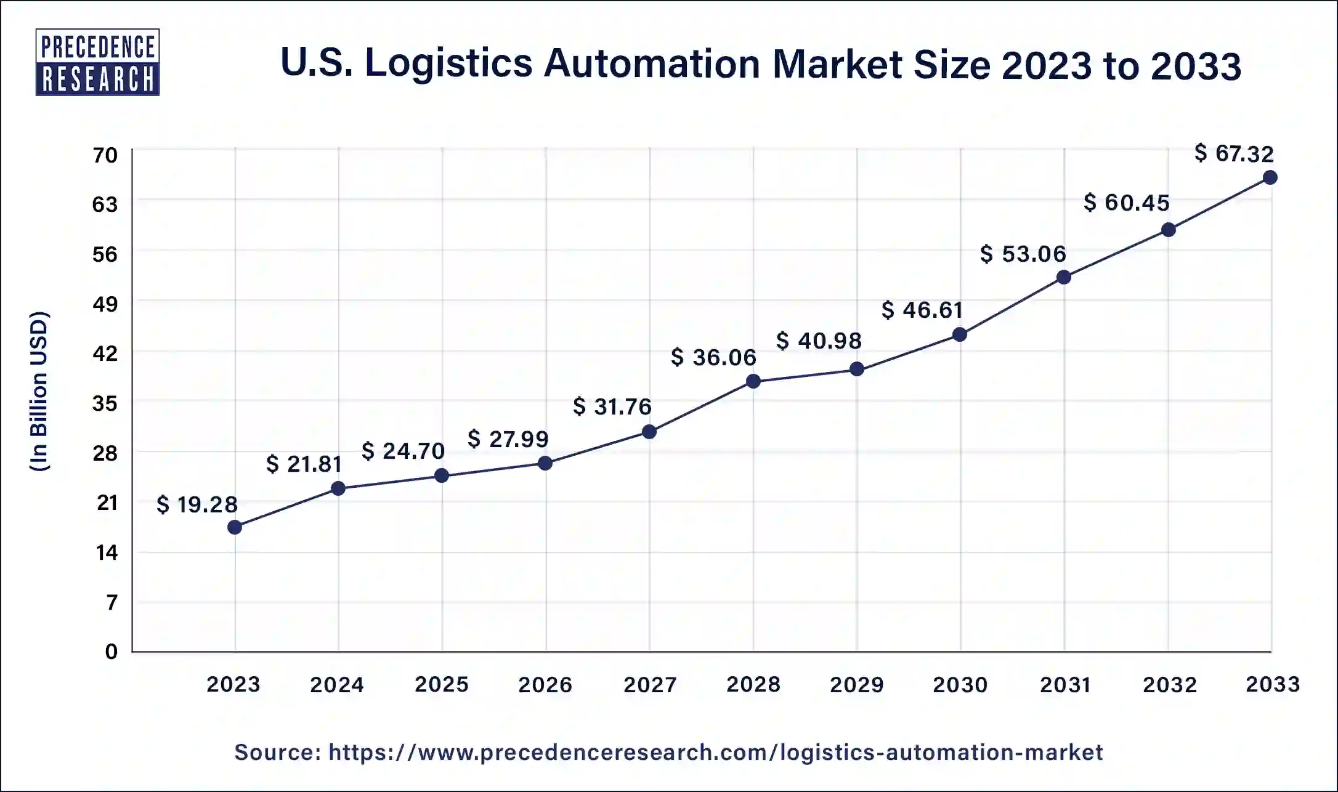

U.S. Logistics Automation Market Size and Forecast

The U.S. logistics automation market size was valued at USD 19.28 billion in 2023 and is predicted to surpass around USD 67.32 billion by 2033, registering a solid CAGR of 13.34% between 2024 and 2033.

North America dominated the logistics automation market in 2023 due to its benefits, including increased customer service, scalability, speed, organizational control, and fewer errors. Robotics is a rapidly developing supply chain technology, with the U.S. ranking as one of the world's major marketplaces for automated solutions. The strong U.S. economic growth, e-commerce activity, and growth in manufacturing are driving demand for solutions for automation in industries such as retail, automotive, food & beverage, and pharmaceuticals. The largest industry is food and beverage manufacturing, which requires equipment such as palletizers and sorting systems. The region is collaborating with cutting-edge technologies to generate higher-quality products at faster rates and lower costs.

Asia-Pacific is expected to grow at the fastest rate during the forecast period. Companies in APAC are increasingly recognizing the value of automation in warehouse processes, with 46% of transport and logistics and 42% of manufacturing organizations planning to use IoT solutions. Automation technologies have become more scalable and versatile, resulting in faster ROI. Smart fulfillment, which combines RFID, real-time location systems, and wearables, improves operational efficiency by providing dynamic picking assignments, increased workflow efficiency, and automated analysis for decision-makers. The need for breakthrough technology and speedy deployment is driving the automation trend.

Scope of Logistics Automation Market

| Report Attribute | Key Statistics |

| Logistics Automation Market Size in 2033 | USD 217.26 Billion |

| Market Size in 2024 | USD 73.47 Billion |

| Growth Rate from 2024 to 2033 | 12.8% of CAGR |

| Largest Market | North America |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Components, Organization Size, End User, Type, Mode of Freight Transport, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Logistics Automation Market Highlights

Components Outlook

The hardware segment dominated the logistics automation market in 2023. Automated Guided Vehicles (AGVs) steer themselves using magnetic tape or rods. Overhead trolleys are self-contained carts used for cargo transport. Automated conveyance robots with AI have emerged, including those that transport goods without magnetic tape, follow workers, and move shelves.

Conveyors and sorters are used to sort and transport huge cargoes. Automatic labeling machines print and attach labels on containers. Racks and shelves are examples of storage equipment, whereas autonomous guided vehicles are included in factory automation designs.

Application Outlook

The transportation segment dominated the logistics automation market in 2023. There are five advantages to logistics automation in transportation management systems (TMS): lower costs, better customer service, organizational control, faster processing, and real-time data. Reducing manual data entry, increasing speedier product transit, and integrating with ERP systems are ways to cut costs.

Auto-pick-up and real-time tracking improve customer service by guaranteeing on-time delivery. The ability of TMS to enforce efficiency policies and adapt to unique business regulations preserves organizational control. Reducing the need for extra staff to oversee the transportation, freight, and logistics divisions is how speed is increased. With real-time data, activities are fully visible, allowing for more informed business decisions based on historical and trend data.

End-Use Outlook

The manufacturing segment dominated the logistics automation market in 2023. Logistics process automation (LPA) expedites order processing, shortens lead times, and boosts manufacturing operational performance by increasing speed and efficiency in the supply chain. Better resource usage, less excess stock, and optimized inventory levels lower costs.

Moreover, LPA reduces errors in order processing, data entry, and other processes, increasing accuracy. It facilitates scalability as manufacturing processes expand, streamlines production scheduling and sequencing, and offers real-time visibility into supply chain operations. The process of collecting and evaluating data from different stages of the manufacturing process leads to data-driven decision-making.

Browse More Insights:

- Logistics Robotics Market Size and Forecast: The global logistics robotics market size was valued at USD 8.78 billion in 2023 and is projected to surpass around USD 39.55 billion by 2033, growing at a CAGR of 16.24% from 2024 to 2033.

- Logistics Outsourcing Market Size and Forecast: The global logistics outsourcing market size was estimated at USD 1,206.44 billion in 2022 and it is expected to hit around USD 1,909.73 billion by 2032, expanding at a CAGR of 4.7% from 2023 to 2032.

- Automotive Logistics Market Size and Forecast: The global automotive logistics market size was valued at USD 315.99 billion in 2022 and is expected to hit USD 636.26 billion by 2032, poised to grow at a CAGR of 7.3% from 2023 to 2032.

- Generative AI in Logistics Market Size and Forecast: The global generative AI in logistics market size was estimated at USD 707.99 million in 2023 and it is expected to hit around USD 23,465.58 million by 2033, expanding at a CAGR of 41.69% during the forecast period from 2024 to 2033.

- Retail Logistics Market Size and Forecast: The global retail logistics market size was valued at USD 250.9 billion in 2023 and is predicted to hit around USD 753.69 billion by 2032, expected to grow at a CAGR of 13% from 2023 to 2032.

- Third-party Logistics Market Size and Forecast: The global third-party logistics market size accounted for USD 1.10 trillion in 2022 and it is projected to hit USD 2.43 trillion by 2032, expected to grow at a CAGR of 8.25% from 2023 to 2032.

- Chemical Logistics Market Size and Forecast: The global chemical logistics market size was estimated at USD 261 billion in 2022 and is expected to hit USD 377.14 billion by 2032, poised to grow at a CAGR of 3.8% from 2023 to 2032.

- Pharmaceutical Logistics Market Size and Forecast: The global pharmaceutical logistics market size was valued at USD 86.64 billion in 2023 and is expected to reach over USD 185.08 billion by 2032 with a registered CAGR of 8.80% from 2023 to 2032.

- Biopharmaceutical Third Party Logistics Size and Forecast: The global biopharmaceutical third party logistics market size was valued at USD 110 billion in 2022 and is expected to hit over USD 192.39 billion by 2032 and growing at a CAGR of 5.80% from 2023 to 2032.

- Cold Chain Logistics Market Size and Forecast: The global cold chain logistics market size was valued at USD 342.8 billion in 2023 and is expected to surpass around USD 1,242 billion by 2033, expected to grow at a CAGR of 13.9% from 2024 to 2033.

Logistics Automation Market Dynamics

Driver: Improved customer service

In the commercial environment, clients frequently seek better shipping conditions and services from competitors. Logistics automation can improve customer service by allowing for improved shipping control and supply chain management. This software enables automatic accounting, complete tracking of goods movement, transaction tracking, automated document preparation, invoice payments, and custom specifications.

Customers can also obtain up-to-date information on the status of their shipment, including its location and expected arrival date, which builds credibility and trust. Businesses that deploy the correct logistics software for process automation can avoid losing critical clients while also providing the finest service and quality possible. Businesses that employ logistics automation can avoid losing key customers and keep a competitive advantage in the market.

Restraint: Infrastructure and investment

Digital transformation can lower expenses by 7% to 34%, but the initial costs of innovative technologies sometimes limit widespread adoption. These expenses include the purchase of technology and possible infrastructural upgrades.

Small and medium-sized businesses (SMEs) may struggle to deploy cash due to budget limits, and they may not see rapid returns on investments. For example, AI expenses for supply chain management have fallen by more than 20%, but server and backup prices may exceed $12,000. These fees may be prohibitively expensive for small businesses with narrow profit margins.

Opportunities

Collaboration and integration

Logistics will become more integrated as businesses interact and integrate their ecosystems. Automation technology will help to facilitate this integration by allowing for seamless information sharing, increased efficiency in supply chains, and real-time data transmission. This will connect logistics systems to suppliers, manufacturers, retailers, and customers, resulting in more accurate demand forecasts, streamlined management of inventory, and synchronized manufacturing and distribution schedules. This integration will cut lead times while improving overall supply chain productivity.

Green and sustainable initiatives

The future of logistics is inextricably related to sustainability and environmental activities. As environmental concerns grow, logistics companies face pressure to reduce their carbon footprint. Automation technologies can help accomplish these objectives by optimizing routes using AI algorithms, developing energy-efficient self-driving cars, and enhancing warehouse inventory management. By embracing automation, logistics organizations may help to create a greener future and fulfill the growing need for sustainable logistics solutions.

Logistics Automation Market Leaders

- Daifuku (Japan)

- Honeywell Intelligrated (US)

- E&K Automation (Germany)

- Seegrid (US)

- Jungheinrich (Germany)

- TGW Logistics Group (Austria)

- Zebra Technologies (US)

- SBS Toshiba Logistics (Japan)

- Falcon Autotech (India)

- Swisslog (Switzerland)

- HighJump (Korber) (US)

- Dematic (US)

- GreyOrange (US)

- Knapp (Austria)

- Locus Robotics (US)

- Manhattan Associates (US)

- Eyesee (Hardis Group) (France) SSI Schaefer (Germany)

- System Logistics (Italy)

- Murata Machinery (Japan)

- Oracle (US)

- SAP (Germany)

Recent Developments:

- In May 2024, C.H. Robinson developed an innovative solution that automates transactions for shippers that continue to utilize email. The technology uses artificial intelligence to categorize incoming emails, analyze them, and reproduce the processes required to complete a customer request. Shippers using this technology can achieve the same speed-to-market and cost reductions as those who are more digitally linked. The company receives more than 11,000 emails per day.

- In March 2024, APM Terminals and Hateco Haiphong International Container Terminal signed an agreement for port automation and green logistics, understanding further collaboration on terminal expansion in Haiphong, North Vietnam. The deal was signed during a Dutch trade mission to Vietnam that concentrated on logistics, waste management, and renewable energy.

- In May 2024, Posti, a Finnish delivery operator, is investing €14 million in its Baltic parcel business, building a new operations center for parcel carrier Itella in Estonia. The three-hectare site in Tallinn is expected to host one of Posti's largest sorting facilities in the Baltics. Construction began in May 2024, with the logistics center projected to be operational by 2025.

Logistics Automation Market Segmentation

By Components

- Hardware

- Software

- Warehouse Management System (WMS) software

- Transportation Management System (TMS) software

- Services

- Consulting

- Implementation

- Support and Maintenance

By Organization Size

- Small and Medium Enterprises

- Large Enterprises

By End User

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast-Moving Consumer Goods

- Retail and E-commerce

- Automotive

- Others

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Mode of Freight Transport

- Air

- Road

- Sea

By Application

- Transportation

- Infotainment system

- Safety and alerting system

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/2002

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: