Pune, Aug. 20, 2024 (GLOBE NEWSWIRE) -- Logistics Robots Market Size & Growth Analysis:

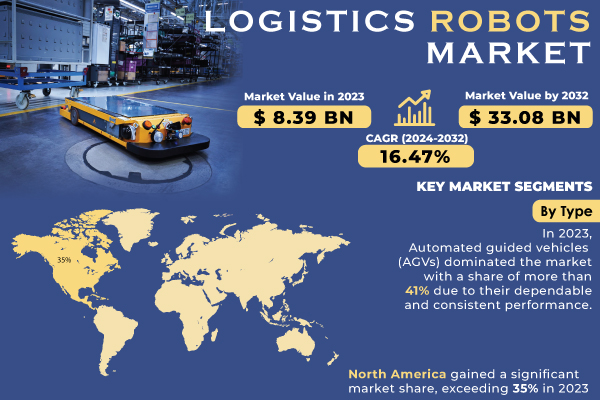

“According to SNS Insider Research, The Logistics Robots Market size was valued at US$ 8.39 billion in 2023 and is expected to reach US$ 33.08 billion by 2032 and grow at a CAGR of 16.47% over the forecast period 2024-2032.”

Increase in online shopping drives need for more logistics robots.

The growth of the logistics robot market is being fueled by the increase in online shopping. In 2023, with e-commerce sales accounting for 22% of U.S. retail and average order values hitting USD 90, retailers are under growing pressure to provide fast delivery. In order to keep up with the need for quicker shipping, companies are making big investments in automation technologies such as logistics robots to improve warehouse functions and boost the effectiveness of order processing.

Investment from the government fuels the demand for logistics robots.

Government assistance is driving the need for logistics robots in the manufacturing industry in the U.S. Programs such as the Manufacturing USA institutes, which receive more than USD 1 billion in federal funding, and the CHIPS and Science Act's USD 52 billion investment in semiconductor manufacturing are breathing new life into the industry. Just-in-time inventory systems greatly benefit from logistics robots, which rely on precise timing and coordination to streamline material transport. These machines improve efficiency and safety by handling hazardous or bulky items, thus fueling growth in the logistics robot market.

Get a Sample Report of Logistics Robots Market@ https://www.snsinsider.com/sample-request/3816

Major Players Analysis Listed in this Report are:

- ABB Ltd

- KUKA AG

- Toyota Industries Corporation

- Fanuc Corporation

- Yaskawa Electric Corporation

- Kion Group Ag

- Toshiba Corporation

- Krones AG

- Kawasaki Heavy Industries Ltd.

- Omron Corporation

- Other Players

Logistics Robots Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 8.39 Billion |

| Market Size by 2032 | USD 33.08 Billion |

| CAGR | CAGR of 16.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Growth Drivers | • Technological advancements in robotics technology, such as enhanced sensors, artificial intelligence, and machine learning. • Logistics robots boost operational efficiency and cost savings by automating processes. |

Do you have any specific queries or need any customization research on Logistics Robots Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/3816

“AGVs Lead, But AMRs and Palletizing Applications Are Rapidly Rising"

AGVs are the leading players in the logistics robot industry, holding more than 41% of the market in 2023 thanks to their dependable performance. Nevertheless, the scenery is changing quickly due to the rise of autonomous mobile robots (AMRs). AMRs are experiencing quick market growth due to their increased flexibility and adaptability. Their capacity to maneuver through changing surroundings and manage a range of logistical duties sets them up for significant market dominance down the line.

In 2023, palletizing and de-palletizing applications dominated the logistics robot market, securing more than 40% of the market share. E-commerce's boom is pushing the growth of this sector, highlighting the need for effective warehouse management. Logistics robots greatly decrease labor expenses, improve accuracy, and enhance overall goods management by automating the process of stacking and unstacking products.

Logistics Robots Market Key Segmentation:

By Type

- Automated Guided Vehicles

- Autonomous Mobile Robots

- Robot Arms

- Others (UAVs)

By Application

- Palletizing & De-palletizing

- Pick & Place

- Transportation

- Others (Shipment & Delivery)

By Industry

- E-commerce

- Healthcare

- Retail

- Food & Beverages

- Automotive

- Others (Consumer Electronics)

"North America's Market Leadership in Robotics and APAC's Rapid Growth in Logistics Automation “

North America gained a significant market share, exceeding 35% in 2023, due to its embrace of advanced technology, significant investment in automation, and highly developed infrastructure. The United States and Canada both have many advanced warehouses and distribution centers that use robotics to improve how they operate. Leading companies such as Amazon and Walmart are making significant investments in robotic technology for logistics to improve the efficiency of their supply chains. The technological skills, thriving economy, and expensive labor in the region also drive the need for automation.

The Asia-Pacific (APAC) region is accounted to grow at a faster CAGR during the forecast period 2024-2032, driven by fast-paced industrialization, urbanization, and the expansion of e-commerce. Nations such as China, Japan, and South Korea are making significant investments in robotics to update their logistics and supply chain activities. The area enjoys cost savings on labor, an expanding tech-savvy labor force, and government efforts backing automation. The implementation of logistics robots is being driven by China's Belt and Road Initiative and Japan's emphasis on Industry 4.0.

Recent Development for Logistic Robots Market

- In March 2024, Anyware Robotics introduced an add-on for its Pixmo robot, designed to aid in truck and container unloading. The accessory features a vertical lift and conveyor belt for enhanced efficiency.

- In March 2024, Mobile Industrial Robots unveiled the MiR1200, an autonomous pallet jack using 3D vision and AI for precise pallet handling. It was showcased at LogiMAT 2024.

Buy an Enterprise-User PDF of Logistic Robots Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/3816

Key Takeaways for Logistic Robots Market

- Comprehend new trends and technologies in order to take advantage of fresh market opportunities.

- Evaluate the possible ROI for incorporating logistics robots by analyzing market information.

- Find locations where robots in logistics can boost effectiveness, cut expenses, and increase efficiency.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Logistics Robots Market Segmentation, by Type

8. Logistics Robots Market Segmentation, by Application

9. Logistics Robots Market Segmentation, by Industry

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Logistics Robots Market Analysis 2024-2032@ https://www.snsinsider.com/reports/logistics-robots-market-3816

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.