Dublin, Aug. 27, 2024 (GLOBE NEWSWIRE) -- The "United States Aviation Gasoline Market, By Region, Competition, Forecast & Opportunities, 2019-2029F" report has been added to ResearchAndMarkets.com's offering.

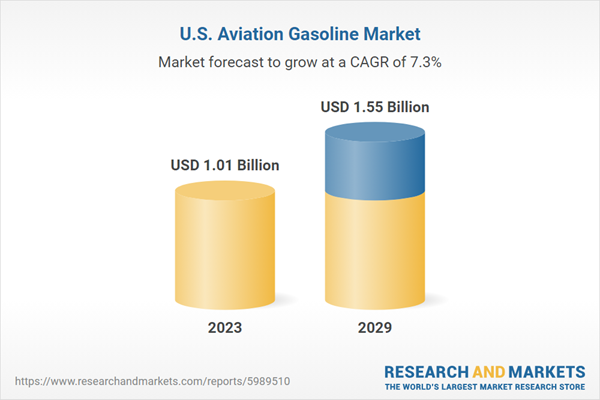

The United States Aviation Gasoline Market was valued at USD 1.01 Billion in 2023 and is predicted to experience robust growth in the forecast period with a CAGR of 7.27% through 2029.

The United States aviation gasoline (avgas) market is a critical segment of the broader aviation fuel industry, serving a niche yet essential role in powering a wide range of aircraft, particularly piston-engine planes used in general aviation, training, and recreational flying. In recent years, the market has experienced a dynamic interplay of factors influencing its trajectory, including regulatory changes, technological advancements, and evolving demand patterns.

One of the primary drivers of the avgas market in the U.S. is the sustained demand from the general aviation sector. General aviation, encompassing private flying, flight training, and aerial work such as surveying and agricultural applications, relies heavily on avgas due to the prevalence of piston-engine aircraft. This sector continues to thrive, driven by economic growth, increasing personal wealth, and the popularity of recreational flying. Additionally, the robust infrastructure supporting general aviation, including numerous small and regional airports across the country, bolsters the demand for avgas.

However, the avgas market faces significant challenges, notably the environmental and health concerns associated with leaded aviation fuel. Traditional avgas, such as 100LL (Low Lead), contains tetraethyllead, which has been under scrutiny for its environmental and health impacts. This has led to regulatory pressure from agencies such as the Environmental Protection Agency (EPA) and the Federal Aviation Administration (FAA) to develop and adopt unleaded alternatives. The industry's response has included significant investment in research and development to produce viable unleaded avgas formulations that meet performance and safety standards without compromising engine reliability.

The transition to unleaded avgas represents both a challenge and an opportunity. While it necessitates substantial changes in production, distribution, and certification processes, it also opens avenues for innovation and leadership in cleaner aviation technologies. Companies that successfully navigate this transition can position themselves favorably in a market increasingly focused on sustainability.

Technological advancements are also playing a crucial role in shaping the Aviation Gasoline market. Innovations in piston-engine design and fuel formulations are aimed at improving efficiency, performance, and environmental compliance. Additionally, the potential for biofuels and synthetic fuels as supplements or alternatives to traditional avgas is being explored, driven by a broader industry shift towards reducing carbon footprints and enhancing sustainability.

The Aviation Gasoline market is also influenced by broader economic and geopolitical factors. Fluctuations in crude oil prices, supply chain disruptions, and international trade policies can impact production costs and availability. Moreover, the global nature of aviation means that developments in international markets and regulations can have ripple effects on the U.S. Aviation Gasoline market.

Increasing Demand for General Aviation

The United States aviation gasoline (avgas) market is witnessing a surge in demand driven by the growing general aviation sector. General aviation, which includes private and recreational flying, charter services, and flight training, is experiencing a revival post-pandemic. This resurgence is fueled by increased leisure travel, the popularity of private flying as a safer travel alternative, and a rise in flight training activities as the aviation industry prepares for a future pilot shortage.

The Aircraft Owners and Pilots Association (AOPA) has reported a steady increase in pilot certifications and flying hours, further boosting avgas demand. Additionally, the expansion of air taxi services and regional connectivity initiatives are contributing to the increased use of piston-engine aircraft, which predominantly use avgas. As a result, the avgas market is expected to see sustained growth, driven by these expanding general aviation activities.

Shift Towards Unleaded Avgas

Environmental concerns and regulatory pressures are driving a significant trend towards unleaded avgas in the United States. Traditional leaded avgas, primarily 100LL (low lead), has been scrutinized for its environmental and health impacts due to lead emissions. In response, the Federal Aviation Administration (FAA) and industry stakeholders have been actively pursuing the development and certification of unleaded alternatives.

Companies like Swift Fuels and GAMI (General Aviation Modifications, Inc.) have made significant progress, with GAMI's G100UL gaining FAA approval for use in all piston-engine aircraft. The transition to unleaded avgas not only addresses environmental concerns but also aligns with global trends towards cleaner aviation fuels. This shift is expected to accelerate as more unleaded options become available, supported by policy incentives and the aviation community's growing commitment to sustainability.

Technological Advancements in Fuel Formulations

Technological advancements in fuel formulations are playing a crucial role in shaping the United States avgas market. Innovations aimed at enhancing fuel efficiency, performance, and environmental compatibility are gaining momentum. Research and development efforts are focused on creating high-performance avgas blends that meet the stringent requirements of modern piston engines while reducing harmful emissions. For instance, the development of high-octane, unleaded avgas variants is a notable trend. These advanced formulations offer improved detonation characteristics, enabling better engine performance and longevity.

Moreover, collaborations between fuel manufacturers, engine makers, and regulatory bodies are fostering the development of standardized avgas formulations that can be universally adopted. These advancements are expected to drive the market by providing superior fuel options that cater to evolving industry demands and regulatory standards.

Increased Focus on Fuel Infrastructure Development

The avgas market in the United States is experiencing a trend towards enhanced fuel infrastructure development. With the anticipated growth in general aviation and the transition to unleaded avgas, there is a pressing need to upgrade and expand fueling infrastructure at airports and fixed-base operators (FBOs). Investments are being directed towards modernizing fuel storage and dispensing systems to accommodate new avgas formulations and ensure safety and efficiency.

Additionally, efforts are being made to improve the distribution network to ensure consistent and widespread availability of avgas, especially in remote and underserved areas. The FAA's continuous support for infrastructure projects through grants and funding is playing a pivotal role in this trend. Enhanced infrastructure not only facilitates the adoption of new avgas variants but also ensures that the growing demand from the aviation sector is met reliably.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 88 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value (USD) in 2023 | $1.01 Billion |

| Forecasted Market Value (USD) by 2029 | $1.55 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | United States |

Report Scope:

Key Market Players

- Exxon Mobil Corporation

- Shell plc

- BP p.l.c.

- Chevron Corporation

- TotalEnergies Aviation

- Phillips 66 Savings Plan

- Repsol, S.A.

- Gazpromneft-SM LLC

- Neste Corporation

- QatarEnergy

- Petroleo Brasileiro S.A.

- ConocoPhillips Company

United States Aviation Gasoline Market, By End-User:

- General Aviation

- Commercial Aviation

- Military Aviation

United States Aviation Gasoline Market, By Avgas Grade:

- Avgas 100LL

- Avgas 80

- Others

United States Aviation Gasoline Market, By Region:

- Northeast

- Southwest

- West

- Southeast

- Midwest

For more information about this report visit https://www.researchandmarkets.com/r/4oqpf2

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment