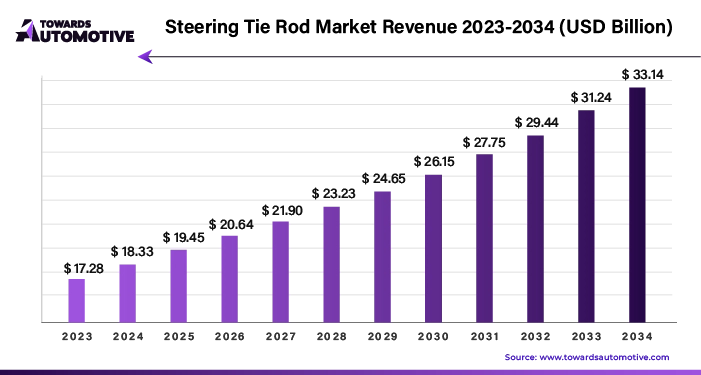

Ottawa, Aug. 27, 2024 (GLOBE NEWSWIRE) -- The global steering tie rod market size is predicted to increase from USD 17.28 billion in 2023 to approximately USD 33.14 billion by 2034, a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1321

Key Takeaways:

- East Asia is expected to command approximately 38.1% of the steering tie rod market share by 2034.

- The South Asia and Pacific regions are poised for significant growth due to increasing vehicle demand and infrastructure development.

- In Latin America, economic growth and urbanization are driving notable growth in the steering tie rod market.

- China remains a major player in the global automotive industry, bolstered by extensive production capabilities and favorable government policies.

- The OEMs segment is projected to experience a high compound annual growth rate (CAGR) over the forecast period from 2024 to 2034.

- The outer tie rods segment is anticipated to grow at a CAGR of 6.2% from 2024 to 2034.

- The number of registered vehicles in the US increased by 3.5% between 2018 and 2022.

- There were about 278,870,463 personal and commercial vehicles registered in the US in 2022.

The steering tie rod market is expected to grow significantly in the next few years, especially in regions like South Asia, the Pacific, East Asia, and Latin America. This growth is largely due to the rising demand for vehicles and new advancements in automotive technology. In 2023, the automotive market was valued at about USD 4,070.19 billion and is expected to reach over USD 6,678.28 billion by 2032, with a strong annual growth rate of more than 5.66%.

Top Companies in the Steering Tie Rod Market

- Tenneco

- ZF Friedrichshafen AG

- Delphi Automotive PLC

- Mando Corporation

- Nexteer Automotive Group Limited

- NSK Ltd

- CTR Corporation

- Sankei Industry Co., Ltd.

- ACDelco

- Mevotech LP

- Febi Bilstein

- Dorman Products, Inc

- Dana Inc

- Motorcraft

- HARDRACE

- MEYLE AG

- THK

- Rane Group

- Skyjacker

- Whiteline Performance

Recent Industry Updates

- ZF Friedrichshafen AG Expansion Initiatives: December 2023 ZF Friedrichshafen AG, a prominent German automotive supplier, announced plans to increase its local production of axles and transmissions in Coimbatore, India. This expansion aims to support anticipated growth in the global construction equipment sector. The new facility, along with an existing hub in Germany, is expected to enhance manufacturing capacity and bolster regional production capabilities. In May 2023, ZF Group further demonstrated its commitment to advancing manufacturing technology by investing USD 43.2 million in its Toluca, Central Mexico facility. This investment is set to expand the plant's area by approximately 8,000 square meters and create 150 new jobs over the next two years. The expansion reflects ZF Group’s strategy to boost its advanced manufacturing capabilities.

- Nexteer Automotive Group Limited's New Facility: April 2024 Nexteer Automotive Group Limited, headquartered in the United States, announced the launch of a new facility in Mexico. This 8,350 square meter technical center will focus on electric power steering and steering column innovations. It will also house pre-production prototype and product validation capabilities, reinforcing Nexteer's technical and operational support for OEM clients in the region.

- HL Mando and Tianrun Industrial Technology Joint Venture: February 2024 South Korea's HL Mando and China's Tianrun Industrial Technology have embarked on a new joint venture to manufacture parts for commercial vehicles. Tianrun has invested CNY 60 million (approximately USD 8.3 million) for a 60% stake, while HL Mando has invested CNY 40 million for a 40% share. This collaboration will leverage HL Mando's product and production technologies, enhancing the joint venture's manufacturing capabilities and market reach.

Get the latest insights on automotive industry segmentation with our Annual Membership @ https://www.towardsautomotive.com/get-an-annual-membership

Regional Growth Insights for the Steering Tie Rod Market

East Asia

East Asia is expected to lead the steering tie rod market, holding about 38.1% of the market share by 2034. Here’s why:

- Urbanization and Population Growth: With rapid urban growth and increasing population density, there's a higher demand for personal transportation. More people moving to cities means a greater need for reliable and efficient transport solutions like steering tie rods.

- Government Support: Countries in East Asia, especially China, are supporting the automotive industry with various policies. For example, China is offering a subsidy of about US$1,380 to buyers of electric vehicles to replace their petrol cars. These incentives help drive innovation and investment in the sector.

- Manufacturing Hub: East Asia, led by China and Japan, is a major center for automotive manufacturing. The region’s advanced infrastructure and skilled workforce attract global companies, boosting the production of vehicles and components, including steering tie rods.

South Asia and the Pacific

South Asia and the Pacific are also expected to see strong growth in the steering tie rod market, driven by:

- Increased Vehicle Demand: As populations grow and economies improve, more people are buying personal vehicles. For example, a 2018 survey in India found that 38% of people with a monthly income between INR 30,000 to 50,000 preferred personal vehicles for commuting. This growing demand for vehicles raises the need for steering tie rods.

- Infrastructure Development: Ongoing improvements in infrastructure, like transportation networks and urban planning, are helping boost the automotive sector and increasing the need for automotive components.

Latin America

Latin America is set for significant growth in the steering tie rod market due to:

- Economic Growth and Urbanization: As Latin American countries develop and urbanize, vehicle demand is rising, which in turn increases the need for steering tie rods.

- Manufacturing and Export Opportunities: The region is becoming more attractive to automotive manufacturers because of its growing market and strategic location for exports.

Boosting Steering Tie Rod Market Growth with AI

Artificial Intelligence (AI) is set to transform the Steering Tie Rod market by driving innovation and efficiency. AI technologies, such as machine learning and data analytics, can enhance the design and manufacturing processes for steering tie rods. AI helps predict wear and potential failures, resulting in more durable and reliable parts.

AI-driven automation improves precision and reduces human errors in production, ensuring high-quality and consistent products. Additionally, AI enables real-time monitoring and diagnostics, allowing for proactive maintenance and minimizing vehicle downtime.

AI also plays a key role in market analysis by identifying trends, consumer preferences, and competitive dynamics. This helps companies make better decisions and adapt their products to meet market demands. Overall, AI integration promises to streamline operations, cut costs, and drive significant growth in the steering tie rod market as the automotive industry evolves.

Understanding the Steering Tie Rod Supply Chain

The supply chain for steering tie rods is complex and involves several stages and players. It starts with raw material suppliers who provide steel or aluminum. These materials are then sent to manufacturers who produce the tie rods using advanced machinery and quality control processes.

Once made, steering tie rods are distributed through wholesalers and distributors. These middlemen manage inventory and ensure that the parts reach automotive manufacturers and repair shops. Distribution methods vary, including direct sales to Original Equipment Manufacturers (OEMs) or through aftermarket suppliers.

Effective supply chain management relies on strong logistics and inventory systems to track products from production to delivery. Market trends, like the rise in electric vehicle demand, can affect supply chain strategies, leading to adjustments in production and distribution.

Key Players and Their Roles in the Steering Tie Rod Market

Steering tie rods are essential for steering systems, helping the vehicle’s wheels turn correctly. They consist of two main parts: the inner tie rod, which connects to the steering rack or gearbox, and the outer tie rod, which links to the steering knuckle.

Several companies are crucial to the steering tie rod market. Manufacturers like Delphi Technologies and TRW Automotive focus on producing high-quality tie rods with improved durability and performance. They invest in research and development to keep up with industry standards.

Suppliers such as SKF and NTN provide important components and materials to ensure the tie rods’ reliability. Aftermarket companies like MOOG and Mevotech offer replacement parts and upgrades, helping to maintain vehicle performance and safety with quality alternatives to original equipment parts.

Together, these companies drive innovation, enhance vehicle handling, and support the overall efficiency of the steering tie rod market.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Industry Insights: Advancements and Trends in Steering Tie Rods

Focus on Vehicle Safety

The automotive industry is ramping up research and development to make steering tie rods safer and more durable. Manufacturers are working hard to improve the strength and resistance of these components to better handle the stresses of driving. With a growing global demand for safer trucks and vehicles, there's a push to create tie rods that can endure extreme conditions.

Move to Lighter Materials

A major trend is the use of lighter materials in steering tie rods. This shift is part of the industry's effort to boost fuel efficiency and vehicle performance. Stricter regulations on carbon emissions are also driving this change. Manufacturers are now exploring materials like aluminum alloys, carbon fiber composites, and high-strength steel to reduce vehicle weight while maintaining strength and durability. These materials help make vehicles more environmentally friendly and improve their overall performance.

Growth in Emerging Markets

Emerging economies are becoming important markets for steering tie rods. As car sales rise in these regions, companies are setting up local manufacturing and distribution networks to meet the demand. Investing in these markets helps companies lower production costs and avoid international trade issues. The growing number of vehicles in these areas presents significant opportunities for manufacturers.

Increased Vehicle Ownership

With more people owning cars globally, there's a higher demand for reliable steering components. The increase in vehicle numbers drives both the need for new steering tie rods and for replacement parts. For example, in the US, the number of registered vehicles grew by 3.5% from 2018 to 2022. To keep up with this growing demand, manufacturers are boosting production, improving supply chains, and introducing new technologies. This expanding automotive market offers promising opportunities for manufacturers to meet evolving customer needs.

Global Steering Tie Rod Market: Supplier Tiers

Tier 1 Suppliers: The Big Players

- Who They Are: Major companies with revenues over USD 25 million.

- Market Share: They hold about 36% of the market.

- What They Do: These suppliers are key to the industry. They work directly with big car manufacturers and are known for their innovation, wide range of products, and advanced manufacturing capabilities.

Tier 2 Suppliers: Specialized Contributors

- Who They Are: Companies with revenues between USD 6 million and USD 27 million.

- Market Share: They make up around 41% of the market.

- What They Do: These suppliers provide specialized parts and components. They often supply to Tier 1 companies and car manufacturers, focusing on specific types of components to keep the supply chain running smoothly.

Tier 3 Suppliers: Niche Providers

- Who They Are: Smaller companies with revenues up to USD 4 million.

- Market Share: They account for about 24% of the market.

- What They Do: These suppliers offer unique or specialized parts that bigger suppliers might not. They play a crucial role by adding variety and flexibility to the supply chain, meeting specific needs in the automotive industry.

Overall, each tier of suppliers plays an essential role in the steering tie rod market, contributing to its overall efficiency and diversity.

Global Growth Trends in the Automotive Industry: Insights into Key Markets

China: Driving Growth with Proactive Policies

China is a major force in the global automotive industry, known for its massive production and export capabilities. This success is largely due to supportive government policies aimed at boosting both the domestic and international markets for vehicles.

The Chinese government has introduced various measures to encourage automotive production. These policies not only boost local consumption but also attract significant foreign investment. China’s extensive and efficient supply chain, which includes affordable raw materials and labor, gives its automotive manufacturers a big edge. This leads to lower production costs and more flexible operations.

India: Emerging as a Key Player in Automotive Components

India is quickly becoming a major player in the automotive sector, with rising vehicle production and sales. This growth is also expanding the market for automotive parts, like steering tie rods.

The Indian government has rolled out several initiatives to strengthen domestic manufacturing and infrastructure. For example, in May 2024, a new auto policy was announced to make India a global hub for electric vehicles. This policy offers incentives for global companies to set up manufacturing plants in India.

The “Make in India” initiative and other incentives for electric vehicle manufacturing are creating a supportive environment for auto part manufacturers. These policies are attracting investments and fostering growth in the automotive sector.

India’s large pool of skilled workers, cost-effective manufacturing, and improved logistics are helping it become a major exporter of automotive components, including tie rods, through 2034.

Overall, the automotive industry in India is set for steady growth, thanks to supportive government policies, a skilled workforce, and a growing domestic market.

Browse More Insights of Towards Automotive:

- The global EV charging panelboard market size is calculated at USD 6.13 billion in 2024 and is expected to be worth USD 29.53 billion by 2034, expanding at a CAGR of 17.13% from 2023 to 2034.

- The global automotive microcontroller market size is calculated at USD 14.37 billion in 2024 and is expected to be worth USD 31.93 billion by 2034, expanding at a CAGR of 8.31% from 2023 to 2034.

- The global automotive valve stem seal market size is calculated at USD 563.11 million in 2024 and is expected to be worth USD 863.90 million by 2034, expanding at a CAGR of 4.43% from 2023 to 2034.

- The global compact loader market size is calculated at USD 5.27 billion in 2024 and is expected to be worth USD 7.49 billion by 2034, expanding at a CAGR of 3.13% from 2023 to 2034.

- The global high-speed engines market size is calculated at USD 25.76 billion in 2024 and is expected to be worth USD 39.95 billion by 2034, expanding at a CAGR of 4.83% from 2023 to 2034.

- The global integrated traffic system market size is calculated at USD 36.93 billion in 2024 and is expected to be worth USD 90.03 billion by 2034, expanding at a CAGR of 9.83% from 2023 to 2034.

- The global marine life raft market size is calculated at USD 1,311.12 million in 2024 and is expected to be worth USD 2,032.30 million by 2034, expanding at a CAGR of 4.54% from 2023 to 2034.

- The global heat shield market size is calculated at USD 5.04 billion in 2024 and is expected to be worth USD 8.73 billion by 2034, expanding at a CAGR of 5.93% from 2023 to 2034.

- The global ship repair and maintenance service market size is calculated at USD 28.35 billion in 2024 and is expected to be worth USD 53.29 billion by 2034, expanding at a CAGR of 6.63% from 2023 to 2034.

- The global EV charger converter module market size is calculated at USD 5.23 billion in 2024 and is expected to be worth USD 46.43 billion by 2034, expanding at a CAGR of 25.47% from 2023 to 2034.

Automotive Steering Rod Market: Growth Driven by Outer Tie Rods and OEMs

The automotive steering rod market is expected to grow significantly in the coming years, mainly due to the increasing need for outer tie rods and Original Equipment Manufacturers (OEMs). Here’s a look at what’s driving this growth and what to expect through 2034.

Outer Tie Rods: A Vital Part of Steering Systems

Segment: Outer Tie Rods (Position) Projected Growth Rate (2024 to 2034): 6.2%

Outer tie rods are crucial for a vehicle’s steering system. They handle a lot of stress from driving and road conditions, which makes them prone to wear and tear. Since they often need to be replaced more frequently than inner tie rods, which last longer, there will be a steady demand for new outer tie rods. This need for replacements is expected to drive the market growth at a solid rate of 6.2% per year from 2024 to 2034.

OEMs: Driving Force Behind Steering Rod Demand

Segment: OEM (Sales Channel) Projected Growth Rate (2024 to 2034): 6.0%

OEMs are a major factor in the steering rod market's growth. They use high-quality steering rods in new vehicles, which means fewer replacements are needed. Advances in materials, like stronger alloys and composites, are making these parts more durable and longer-lasting. As roads improve worldwide, the demand for strong and reliable steering rods continues to rise, sustaining steady demand from OEMs.

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Growth Drivers and Challenges

- Forecast and Market Outlook

Introduction

- Definition of Steering Tie Rod

- Importance in Vehicle Dynamics

- Overview of Market Segmentation

Market Dynamics

- Drivers

- Increasing Vehicle Production and Sales

- Technological Advancements in Steering Systems

- Growing Demand for Vehicle Safety and Performance

- Restraints

- Fluctuating Raw Material Prices

- Competition from Alternative Technologies

- Opportunities

- Expansion in Emerging Markets

- Innovations in Tie Rod Materials and Designs

- Challenges

- Regulatory and Compliance Issues

- Supply Chain Disruptions

Market Segmentations

Market Analysis by Vehicle Type

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Market Analysis by Position

- Inner Tie Rods

- Market Size and Growth

- Key Trends and Developments

- Outer Tie Rods

- Market Size and Growth

- Key Trends and Developments

Market Analysis by Material

- Carbon Steel

- Market Share and Growth

- Key Applications and Trends

- Stainless Steel

- Market Share and Growth

- Key Applications and Trends

Market Analysis by Sales Channel

- OEM

- Market Share and Growth

- Trends and Key Players

- Aftermarket

- Market Share and Growth

- Trends and Key Players

- OEM Service Centers

- Independent Service Centers

Regional Market Analysis

- North America

- Market Size and Forecast

- Key Trends and Developments

- Latin America

- Market Size and Forecast

- Key Trends and Developments

- Europe

- Market Size and Forecast

- Key Trends and Developments

- Asia Pacific

- Market Size and Forecast

- Key Trends and Developments

- Middle East and Africa

- Market Size and Forecast

- Key Trends and Developments

Cross Segmentations

By Vehicle Type and Position

- Passenger Cars

- Inner Tie Rods

- Outer Tie Rods

- Compact

- Inner Tie Rods

- Outer Tie Rods

- Mid-size

- Inner Tie Rods

- Outer Tie Rods

- Luxury

- Inner Tie Rods

- Outer Tie Rods

- SUVs

- Inner Tie Rods

- Outer Tie Rods

- Light Commercial Vehicles

- Inner Tie Rods

- Outer Tie Rods

- Heavy Commercial Vehicles

- Inner Tie Rods

- Outer Tie Rods

By Vehicle Type and Material

- Passenger Cars

- Carbon Steel

- Stainless Steel

- Compact

- Carbon Steel

- Stainless Steel

- Mid-size

- Carbon Steel

- Stainless Steel

- Luxury

- Carbon Steel

- Stainless Steel

- SUVs

- Carbon Steel

- Stainless Steel

- Light Commercial Vehicles

- Carbon Steel

- Stainless Steel

- Heavy Commercial Vehicles

- Carbon Steel

- Stainless Steel

By Position and Material

- Inner Tie Rods

- Carbon Steel

- Stainless Steel

- Outer Tie Rods

- Carbon Steel

- Stainless Steel

By Sales Channel and Vehicle Type

- OEM

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Aftermarket

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- OEM Service Centers

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Independent Service Centers

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel and Material

- OEM

- Carbon Steel

- Stainless Steel

- Aftermarket

- Carbon Steel

- Stainless Steel

- OEM Service Centers

- Carbon Steel

- Stainless Steel

- Independent Service Centers

- Carbon Steel

- Stainless Steel

By Region and Vehicle Type

- North America

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Latin America

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Europe

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Asia Pacific

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Middle East and Africa

- Passenger Cars

- Compact

- Mid-size

- Luxury

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Region and Sales Channel

- North America

- OEM

- Aftermarket

- OEM Service Centers

- Independent Service Centers

- Latin America

- OEM

- Aftermarket

- OEM Service Centers

- Independent Service Centers

- Europe

- OEM

- Aftermarket

- OEM Service Centers

- Independent Service Centers

- Asia Pacific

- OEM

- Aftermarket

- OEM Service Centers

- Independent Service Centers

- Middle East and Africa

- OEM

- Aftermarket

- OEM Service Centers

- Independent Service Centers

Go-to-Market Strategies (Region Selection)

Introduction to Go-to-Market Strategies

- Definition and Importance

- Objectives of Go-to-Market Strategies

- Overview of Key Elements

Market Penetration Strategies

- Geographic Expansion

- Entry into New Regional Markets

- Localization Strategies

- Target Market Segmentation

- Identifying High-Growth Segments

- Tailoring Solutions to Customer Needs

- Competitive Positioning

- Differentiation from Competitors

- Building Brand Equity

Product and Service Strategy

- Product Development

- Innovation and Design Improvements

- Addressing Customer Feedback

- Service Offering

- Value-Added Services

- Enhancing Customer Experience

- Pricing Strategy

- Pricing Models and Structures

- Competitive Pricing Analysis

Sales and Distribution Strategy

- Sales Channels

- Direct Sales vs. Indirect Sales

- Leveraging OEM and Aftermarket Channels

- Distribution Network

- Building and Managing Distribution Partnerships

- Efficient Logistics and Supply Chain Management

- Sales Force and Training

- Developing an Effective Sales Team

- Training Programs and Incentives

Marketing and Promotion Strategy

- Brand Positioning and Messaging

- Crafting a Compelling Value Proposition

- Brand Identity and Communication

- Advertising and Public Relations

- Traditional vs. Digital Advertising

- PR Campaigns and Media Outreach

- Digital Marketing

- Online Presence and Social Media

- Content Marketing and SEO

- Trade Shows and Events

- Participation in Industry Events

- Networking and Lead Generation

Customer Engagement and Retention Strategy

- Customer Relationship Management (CRM

- Implementing CRM Systems

- Personalizing Customer Interactions

- Loyalty Programs and Incentives

- Developing Customer Loyalty Programs

- Incentives for Repeat Business

- Feedback and Continuous Improvement

- Collecting and Analyzing Customer Feedback

- Implementing Improvements Based on Feedback

Partnerships and Alliances

- Strategic Partnerships

- Collaborations with Industry Leaders

- Joint Ventures and Strategic Alliances

- Supplier and Vendor Relationships

- Building Strong Supplier Relationships

- Managing Vendor Partnerships

Regulatory and Compliance Strategy

- Regulatory Requirements

- Understanding Local and International Regulations

- Compliance with Industry Standards

- Risk Management

- Identifying and Mitigating Risks

- Implementing Risk Management Practices

Financial Planning and Budgeting

- Budget Allocation

- Allocating Resources for Marketing and Sales

- Cost Management and Optimization

- ROI and Performance Metrics

- Measuring Success and ROI

- Key Performance Indicators (KPIs)

Implementation Plan

- Action Plan and Timeline

- Key Milestones and Deliverables

- Timeline for Execution

- Monitoring and Evaluation

- Tracking Progress and Adjusting Strategies

- Evaluating Strategy Effectiveness

Integration of AI in the Steering Tie Rod Market

Introduction to AI Integration

- Definition and Scope of AI in Manufacturing

- Importance of AI in the Steering Tie Rod Market

- Overview of AI Technologies

AI Technologies and Applications

- Machine Learning (ML)

- Predictive Maintenance

- Quality Control and Defect Detection

- Artificial Neural Networks (ANN)

- Design Optimization

- Performance Analysis

- Computer Vision

- Automated Inspection Systems

- Real-time Monitoring

- Robotic Process Automation (RPA)

- Automation in Production Processes

- Enhanced Efficiency and Precision

- Internet of Things (IoT)

- Data Collection and Analysis

- Smart Manufacturing

AI in Product Design and Development

- Design Optimization

- AI-Driven Simulation and Testing

- Enhancing Product Performance and Durability

- Material Selection

- AI for Analyzing Material Properties

- Improving Material Efficiency

- Customization and Personalization

- AI-Driven Custom Design Solutions

- Meeting Specific Customer Requirements

AI in Manufacturing Processes

- Process Automation

- AI-Driven Robotics and Automation

- Reducing Human Error and Increasing Efficiency

- Predictive Maintenance

- AI for Monitoring Equipment Health

- Reducing Downtime and Maintenance Costs

- Quality Assurance

- AI-Based Defect Detection Systems

- Ensuring Consistent Product Quality

AI in Supply Chain Management

- Demand Forecasting

- AI for Accurate Demand Predictions

- Inventory Management Optimization

- Supplier and Vendor Management

- AI for Evaluating Supplier Performance

- Enhancing Supplier Relationships

- Logistics and Distribution

- AI-Optimized Route Planning

- Efficient Distribution Strategies

AI in Sales and Marketing

- Customer Insights and Analytics

- AI for Analyzing Market Trends

- Enhancing Customer Targeting and Segmentation

- Pricing Strategies

- AI-Driven Dynamic Pricing Models

- Maximizing Revenue and Market Share

- Digital Marketing

- AI for Personalizing Marketing Campaigns

- Optimizing Ad Spend and ROI

Challenges and Considerations

- Implementation Challenges

- Integration with Existing Systems

- Cost and Resource Requirements

- Data Privacy and Security

- Ensuring Compliance with Regulations

- Protecting Sensitive Data

- Skills and Training

- Workforce Skills Development

- Training Programs for AI Adoption

Case Studies and Examples

- Successful AI Integration Examples

- Case Studies of Companies Utilizing AI

- Key Outcomes and Benefits

- Lessons Learned

- Best Practices and Insights

- Common Pitfalls and Solutions

Future Trends and Developments

- Emerging AI Technologies

- Advances in AI for Manufacturing

- Future Applications in the Steering Tie Rod Market

- Market Impact

- Predictions for AI’s Role in Market Growth

- Long-term Strategic Implications

Production and Consumption Data

Introduction

- Overview of Production and Consumption in the Steering Tie Rod Market

- Importance of Data Analysis

- Objectives of Production and Consumption Data Analysis

Global Production Data

- Production Volume

- Historical Production Trends

- Current Production Levels

- Future Production Forecast

- Production Capacity

- Installed Capacity by Region

- Utilization Rates

- Production Facilities

- Major Production Plants

- Key Manufacturers and Their Facilities

- Technological Advances

- Innovations in Production Technology

- Impact of Automation and AI on Production

Regional Production Analysis

- North America

- Production Volume and Capacity

- Key Players and Facilities

- Latin America

- Production Trends and Forecast

- Major Production Sites

- Europe

- Regional Production Overview

- Notable Manufacturers and Facilities

- Asia Pacific

- Production Data and Growth Trends

- Major Production Centers

- Middle East and Africa

- Production Overview and Key Facilities

- Regional Growth and Development

Global Consumption Data

- Consumption Volume

- Historical Consumption Trends

- Current Consumption Levels

- Future Consumption Projections

- Demand Analysis

- Key End-User Industries

- Regional Demand Variations

- Market Share by Vehicle Type

- Passenger Cars

- SUVs

- Commercial Vehicles

- Consumer Preferences

- Preferences by Vehicle Type and Region

- Factors Influencing Consumption

Regional Consumption Analysis

- North America

- Consumption Trends and Forecast

- Key Markets and Demand Drivers

- Latin America

- Consumption Data and Growth Factors

- Major Consumption Centers

- Europe

- Regional Consumption Patterns

- Influencing Factors and Market Dynamics

- Asia Pacific

- Consumption Trends and Market Drivers

- Key Regional Markets

- Middle East and Africa

- Consumption Overview and Trends

- Key Demand Drivers and Challenges

Supply Chain and Distribution

- Supply Chain Overview

- Key Components and Processes

- Supply Chain Challenges and Solutions

- Distribution Channels

- Major Distribution Networks

- Role of OEMs and Aftermarket Channels

- Logistics and Transportation

- Impact on Production and Consumption

- Efficient Logistics Practices

Market Dynamics and Factors Affecting Production and Consumption

- Economic Factors

- Impact of Economic Conditions on Production and Consumption

- Regulatory and Policy Factors

- Influence of Regulations on Production and Consumption

- Technological Developments

- How Technological Advances Affect Production and Consumption

- Consumer Trends

- Changing Preferences and Their Impact on Demand

Case Studies and Examples

- Successful Production Strategies

- Case Studies of Leading Manufacturers

- Key Outcomes and Lessons Learned

- Consumption Trends Analysis

- Examples of Emerging Trends and Their Impact

- Examples of Emerging Trends and Their Impact

Future Outlook and Projections

- Production and Consumption Forecast

- Long-Term Projections and Growth Trends

- Market Opportunities and Challenges

- Potential Growth Areas

- Challenges and Mitigation Strategies

Comprehensive Market Analysis Report

Executive Summary

- Key Findings and Insights

- Market Overview

- Strategic Recommendations

Opportunity Assessment

- Market Opportunities

- Identification of High-Growth Areas

- Emerging Trends and Innovations

- Competitive Analysis

- Opportunities for Differentiation

- Competitor Strengths and Weaknesses

- Customer Needs and Preferences

- Analysis of Customer Pain Points

- Opportunities for Meeting Unmet Needs

- Regulatory and Policy Opportunities

- Impact of Regulations on Market Opportunities

- Potential for Policy-Driven Growth

New Product Development

- Idea Generation

- Sources of Innovation and Inspiration

- Methods for Generating New Product Ideas

- Product Design and Development

- Process from Concept to Prototype

- Design Considerations and Innovations

- Market Testing and Validation

- Strategies for Testing New Products

- Gathering and Analyzing Feedback

- Launch Strategy

- Planning and Executing Product Launches

- Marketing and Distribution Plans

Plan Finances/ROI Analysis

- Financial Planning

- Budgeting for New Initiatives

- Capital Allocation and Investment Strategy

- ROI Analysis

- Measuring Return on Investment

- Key Metrics and Performance Indicators

- Cost-Benefit Analysis

- Evaluating Financial Viability

- Risk Assessment and Mitigation

- Funding and Investment Strategies

- Sources of Funding

- Investment Options and Opportunities

Supply Chain Intelligence/Streamline Operations

- Supply Chain Overview

- Key Components and Processes

- Current Supply Chain Challenges

- Intelligence Gathering

- Tools and Techniques for Supply Chain Analysis

- Leveraging Data for Decision Making

- Streamlining Operations

- Identifying Inefficiencies and Bottlenecks

- Strategies for Operational Improvements

- Supplier and Vendor Management

- Building Strong Supplier Relationships

- Strategies for Effective Vendor Management

Cross-Border Intelligence

- International Market Analysis

- Opportunities and Challenges in Global Markets

- Key Trends and Developments

- Regulatory and Compliance Considerations

- Navigating International Regulations

- Compliance Strategies

- Cultural and Market Differences

- Understanding Local Market Dynamics

- Adapting Strategies for Different Regions

- Global Supply Chain Management

- Managing Cross-Border Supply Chains

- Strategies for International Logistics

Business Model Innovation

- Current Business Models

- Overview of Existing Models in the Industry

- Strengths and Weaknesses

- Innovation Strategies

- Approaches to Business Model Innovation

- Examples of Successful Business Model Changes

- Implementation and Scaling

- Planning for Innovation

- Scaling and Adapting New Models

Blue Ocean vs. Red Ocean Strategies

- Blue Ocean Strategies

- Concept and Principles

- Examples of Blue Ocean Innovations

- Benefits and Implementation

- Red Ocean Strategies

- Concept and Principles

- Competitive Tactics in Existing Markets

- Risks and Challenges

- Comparative Analysis

- Blue Ocean vs. Red Ocean Approach

- Choosing the Right Strategy for Different Situations

- Strategic Recommendations

- Recommendations for Applying Both Strategies

- Balancing Innovation with Competition

Competitive Landscape

- Top Companies Overview

- Tenneco

- ZF Friedrichshafen AG

- Delphi Automotive PLC

- Mando Corporation

- Nexteer Automotive Group Limited

- NSK Ltd

- CTR Corporation

- Sankei Industry Co., Ltd.

- ACDelco

- Mevotech LP

- Febi Bilstein

- Dorman Products, Inc.

- Dana Inc

- Motorcraft

- HARDRACE

- MEYLE AG

- THK

- Rane Group

- Skyjacker

- Whiteline Performance

- Market Share Analysis

- Strategic Initiatives and Developments

- Product Innovations and Launches

- Partnerships and Acquisitions

Market Forecast and Trends

- Growth Projections

- Future Trends and Innovations

- Opportunities for Growth

Conclusion

- Summary of Key Findings

- Strategic Recommendations

Appendices

- Data Sources and Methodology

- Glossary of Terms

- List of Abbreviations

- Contact Information

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1321

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive