TRUCKEE, CA--(Marketwire - Jan 9, 2012) - Clear Capital (www.clearcapital.com), released its monthly Home Data Index™ (HDI) Market Report, with news of a year-over-year national price change in 2011 of -2.1%, and forecast of a slight 0.2% gain in 2012.

Report highlights include:

- 2011's decrease of -2.1% year-over-year was bolstered by a stabilizing of prices in the latter half of the year and decreasing REO saturation.

- In 2012, U.S. home prices are forecasted to show continued stabilization with a slight gain of 0.2% across all markets, remaining near levels not seen since back in 2001.

- Importance of micro-market analysis is reiterated as the 2012 forecast is for a flat U.S. market, but only 40% of individual markets (20 of 50) are projected to be stable.

"Overall, 2011 was a relatively quiet year for U.S. home prices compared to the last five years," said Dr. Alex Villacorta, Director of Research and Analytics at Clear Capital. "With national prices down a little more than two percent for the year and sitting at their lowest point since 2001, our projections show that the current balance the market has found will continue through 2012.

"However, individual markets reacting to their local economic drivers exhibit a wide range of performance levels," added Dr. Villacorta. "Although the national numbers suggest markets are flat, when looking at individual metro markets it turns out only 24% of them showed signs of stabilization in 2011, while the others are still moving more dramatically higher or lower. What's most interesting is that the lower segments of appreciating markets are driving much of the current price growth. In places like Florida, which have historically been hard hit, we are now seeing considerable activity in lower-end properties as demand continues to heat up."

2011: Quarter-over-Quarter Numbers Reflect Seasonality

U.S. prices declined -0.4% in December on a quarter-over-quarter basis, showing the markets giving back some of the gains of the summer buying season. This is the first cooling off after six monthly reports showing minimal quarterly gains. In fact, the most recent six months of the year (June - December) saw national home prices flat at -0.1%.

While these national quarterly numbers for December fell slightly, half of the major markets covered saw quarterly gains. Dayton, OH checked in at the top of highest quarterly performers with a gain of 5.0%. On the downside, Atlanta, GA showed consistent weakness as December's lowest performing major market with a loss of -8.4% quarter-over-quarter.

In addition to the relatively flat home price performance, national REO saturation rates at the end of 2011 reached a new yearly low at 24.8%. REO saturation was volatile early in 2011, and showed consistent declines and stability toward the latter half of the year.

2011: U.S. Numbers Stable Over the Year

The -2.1% price decline in 2011 marked the smallest year-end change in either direction since the market gained 1.7% in 2006. The majority of the downturn was early in the year through May, with upticks hitting during the summer buying season, and then remaining stable through the fall and early winter.

Regional trends revealed a bit more price variability. The Northeast's meager 0.1% yearly gain led the nation, comparing favorably to the -1.3%, -3.0% and -4.4% price declines turned in by the South, Midwest and West, respectively.

While the changes in prices across the U.S. were mild for 2011, there were notable extremes at the positive and negative sides of the market. Four metros posted price declines greater than 10%, with Atlanta leading the way down with a -18.3% price change, followed by Seattle, WA at -15.1%. Birmingham, AL and Detroit, MI also rode the markets down with -11.1% and -10.8% price drops, respectively. Each of the markets with double digit declines saw an increase in the percentage of sales that were REOs through the year.

On the positive side, Dayton enjoyed 11.5% annual price growth in 2011. The next two strongest performers came from Florida, with Orlando and Miami basking in 6.7% and 5.6% price gains, respectively. Just as increasing REO saturation affected our worst performers, decreasing REO saturation for these three markets in 2011 (Dayton down 12.3%, Orlando down 21.0% and Miami down 9.9%) appeared to buoy their home prices for the year. Chart 1 below shows all metro markets ranked by their yearly numbers, and includes quarterly performance and REO saturation measured at the end of the year.

Chart 1: 2011 Observed

| Major U.S. Metro Markets (2011 Observed) | ||||

| 2011 Yr/Yr Rank |

Metropolitan Statistical Area | 2011 Observed Yr/Yr |

2011 Observed Qtr/Qtr |

REO Saturation |

| 1 | Dayton, OH | 11.5% | 5.0% | 29.2% |

| 2 | Orlando, FL | 6.7% | 3.2% | 24.9% |

| 3 | Miami, FL - Fort Lauderdale, FL - Miami Beach, FL | 5.6% | 1.7% | 31.3% |

| 4 | Rochester, NY | 4.7% | 2.1% | 3.5% |

| 5 | Milwaukee, WI - Waukesha, WI - West Allis, WI | 4.5% | -0.3% | 19.9% |

| 6 | Washington, DC - Arlington, VA - Alexandria, VA | 3.5% | 4.7% | 11.8% |

| 7 | Denver, CO - Aurora, CO | 3.3% | 3.0% | 22.5% |

| 8 | Dallas, TX - Fort Worth, TX - Arlington, TX | 2.7% | 0.7% | 28.5% |

| 9 | Providence, RI - NewBedford, MA - Fall River, MA | 2.6% | -3.4% | 14.5% |

| 10 | Pittsburgh, PA | 2.5% | 0.0% | 6.1% |

| 11 | Jacksonville, FL | 1.7% | 0.1% | 27.9% |

| 12 | Phoenix, AZ - Mesa, AZ - Scottsdale, AZ | 1.5% | 2.7% | 32.9% |

| 13 | New York, NY - No. New Jersey, NJ - Long Island, NY | 1.2% | 0.6% | 7.0% |

| 14 | Boston, MA - Cambridge, MA - Quincy, MA | 0.1% | 0.2% | 8.7% |

| 15 | Tampa, FL - St. Petersburg, FL - Clearwater, FL | -0.6% | 2.1% | 23.7% |

| 16 | Houston, TX - Baytown, TX - Sugar Land, TX | -0.8% | 1.8% | 27.6% |

| 17 | Honolulu, HI | -0.8% | 1.6% | 7.4% |

| 18 | Cleveland, OH - Elyria, OH - Mentor, OH | -1.1% | 0.9% | 31.1% |

| 19 | Oklahoma City, OK | -1.2% | -1.6% | 12.3% |

| 20 | Charlotte, NC - Gastonia,NC - Concord, NC | -2.2% | -0.3% | 13.3% |

| 22 | Bakersfield, CA | -2.6% | 0.5% | 42.7% |

| 23 | Chicago, IL - Naperville, IL - Joliet, IL | -2.6% | 0.6% | 29.9% |

| 24 | New Orleans, LA - Metairie, LA - Kenner, LA | -2.9% | -1.9% | 20.6% |

| 25 | Riverside, CA - San Bernardino, CA - Ontario, CA | -3.4% | -1.7% | 42.2% |

| 26 | Columbus, OH | -3.5% | 0.3% | 33.9% |

| 27 | Portland, OR - Vancouver, OR - Beaverton, OR | -3.5% | 0.8% | 15.5% |

| 28 | Hartford, CT - West Hartford, CT - East Hartford, CT | -3.6% | 0.4% | 5.4% |

| 29 | Raleigh, NC - Cary, NC | -3.7% | -0.9% | 5.6% |

| 30 | Los Angeles, CA - Long Beach, CA - Santa Ana, CA | -3.7% | -2.3% | 28.9% |

| 31 | Cincinnati, OH - Middletown, OH | -4.1% | -0.4% | 22.3% |

| 32 | Virginia Beach, VA - Norfolk, VA - Newport News, VA | -4.4% | 1.2% | 20.0% |

| 33 | Memphis, TN | -4.7% | -6.4% | 37.4% |

| 34 | San Diego, CA - Carlsbad, CA - San Marcos, CA | -4.7% | -2.4% | 26.7% |

| 35 | San Francisco, CA - Oakland, CA - Fremont, CA | -4.7% | 0.1% | 24.3% |

| 36 | Nashville, TN - Davidson, TN - Murfreesboro, TN | -4.8% | -0.8% | 17.1% |

| 37 | Philadelphia, PA - Camden, NJ - Wilmington, DE | -5.0% | -2.5% | 9.9% |

| 38 | Richmond, VA | -5.9% | -0.9% | 18.3% |

| 39 | Baltimore, MD - Towson, MD | -6.2% | -1.7% | 14.2% |

| 40 | Sacramento, CA - Arden, CA - Roseville, CA | -6.9% | -0.1% | 34.0% |

| 41 | Fresno, CA | -7.3% | 0.5% | 38.6% |

| 42 | St. Louis, MO | -7.7% | -0.9% | 25.9% |

| 43 | Oxnard, CA - Thousand Oaks, CA - Ventura, CA | -7.8% | -3.7% | 28.0% |

| 44 | Minneapolis, MN - St.Paul, MN - Bloomington, WI | -8.7% | -0.5% | 42.1% |

| 45 | Las Vegas, NV - Paradise, NV | -9.2% | -2.0% | 46.5% |

| 46 | Tucson, AZ | -9.4% | -1.5% | 39.2% |

| 47 | Detroit, MI - Warren, MI - Livonia, MI | -10.8% | -4.7% | 48.4% |

| 48 | Birmingham, AL - Hoover, AL | -11.1% | 4.3% | 34.0% |

| 49 | Seattle, WA - Tacoma, WA - Bellevue, WA | -15.1% | -3.7% | 19.7% |

| 50 | Atlanta, GA - Sandy Springs, GA - Marietta, GA | -18.3% | -8.4% | 42.2% |

Looking To 2012: The End of Five Years of Declines?

- U.S. price gains forecasted at 0.2% for 2012.

- Various metros continue to be volatile, some double digit gains and losses are expected.

- Florida markets predicted to lead recovery as all four markets expect solid increases.

On the national level, 2012 is expected to play out much like the last half of 2011, with a very subtle price change. A minimal decline in the beginning of the year is expected to turn into a meager gain by year's end. At a more granular level, half of the 50 major metro markets are expected to post gains for the year, and individual metros will experience the full gamut of price movement, from double-digit growth to double-digit drops.

Double digit volatility can be seen with the two strongest markets, including Orlando with a healthy price increase of 11.7%, and Bakersfield close behind with a projected 11.1% increase. The deepest drops come from Atlanta with an expected drop of -14.4%, and Los Angeles with a predicted drop of -10.3%.

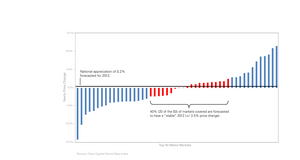

Chart 2 (below) shows the 2012 forecast with each market ranked by year-over-year performance, and includes 2011 year-over-year performance and ranking of those markets for comparison.

Following Orlando's lead, other Florida markets are expected to extend their impressive 2011 performances into 2012. Miami and Tampa are projected to be among the five highest performing metros with 8.8% and 7.4% growth, respectively, and Jacksonville is forecasted to gain 4.3%, placing it at a respectable eighth among the top metro markets. The exceptional growth in these markets can be a result of several factors, including being hit especially hard in the downturn. While fighting back, they remain significantly off their highs of 2006. Other factors in play in these markets include large increases in the values of their lower priced homes (near double-digits for all markets) when compared to higher priced segments of the market, and a high percentage of all cash transactions (51.8%) when compared to other metros. This indicates a high degree of investor activity as they look for bargains in the region, driving up demand.

Chart 2: 2012 Forecast

| 50 Major U.S. Metro Markets Price Change (2012 Forecast) | ||||

| 2012 Forecast Rank |

Metropolitan Statistical Area | 2012 Forecast Yr/Yr |

2011 Observed Yr/Yr |

2011 Observed Rank |

| 1 | Orlando, FL | 11.7% | 6.7% | 2 |

| 2 | Bakersfield, CA | 11.1% | -2.6% | 22 |

| 3 | Washington, DC - Arlington, VA - Alexandria, VA | 9.3% | 3.5% | 6 |

| 4 | Phoenix, AZ - Mesa, AZ - Scottsdale, AZ | 8.9% | 1.5% | 12 |

| 5 | Miami, FL - Fort Lauderdale, FL - Miami Beach, FL | 8.8% | 5.6% | 3 |

| 6 | Tampa, FL - St. Petersburg, FL - Clearwater, FL | 7.4% | -0.6% | 15 |

| 7 | Dallas, TX - Fort Worth, TX - Arlington, TX | 5.8% | 2.7% | 8 |

| 8 | Jacksonville, FL | 4.3% | 1.7% | 11 |

| 9 | Cleveland, OH - Elyria, OH - Mentor, OH | 4.2% | -1.1% | 18 |

| 10 | Honolulu, HI | 3.2% | -0.8% | 17 |

| 11 | Houston, TX - Baytown, TX - Sugar Land, TX | 3.0% | -0.8% | 16 |

| 12 | New York, NY - No. New Jersey, NJ - Long Island, NY | 3.0% | 1.2% | 13 |

| 13 | Memphis, TN | 2.5% | -4.7% | 33 |

| 14 | Portland, OR - Vancouver, OR - Beaverton, OR | 1.9% | -3.5% | 27 |

| 15 | Denver, CO - Aurora, CO | 1.8% | 3.3% | 7 |

| 16 | San Jose, CA - Sunnyvale, CA - Santa Clara, CA | 1.6% | -2.5% | 21 |

| 17 | New Orleans, LA - Metairie, LA - Kenner, LA | 1.6% | -2.9% | 24 |

| 18 | Fresno, CA | 1.5% | -7.3% | 41 |

| 19 | Boston, MA - Cambridge, MA - Quincy, MA | 1.4% | 0.1% | 14 |

| 20 | Dayton, OH | 1.4% | 11.5% | 1 |

| 22 | Providence, RI - NewBedford, MA - Fall River, MA | 1.0% | 2.6% | 9 |

| 23 | Pittsburgh, PA | 0.4% | 2.5% | 10 |

| 24 | San Francisco, CA - Oakland, CA - Fremont, CA | 0.1% | -4.7% | 35 |

| 25 | Milwaukee, WI - Waukesha, WI - West Allis, WI | 0.1% | 4.5% | 5 |

| 26 | Rochester, NY | -0.2% | 4.7% | 4 |

| 27 | Charlotte, NC - Gastonia,NC - Concord, NC | -1.5% | -2.2% | 20 |

| 28 | Columbus, OH | -2.0% | -3.5% | 26 |

| 29 | Cincinnati, OH - Middletown, OH | -2.2% | -4.1% | 31 |

| 30 | Virginia Beach, VA - Norfolk, VA - Newport News, VA | -2.3% | -4.4% | 32 |

| 31 | Minneapolis, MN - St.Paul, MN - Bloomington, WI | -2.4% | -8.7% | 44 |

| 32 | Hartford, CT - West Hartford, CT - East Hartford, CT | -2.4% | -3.6% | 28 |

| 33 | Raleigh, NC - Cary, NC | -3.0% | -3.7% | 29 |

| 34 | Sacramento, CA - Arden, CA - Roseville, CA | -3.3% | -6.9% | 40 |

| 35 | Tucson, AZ | -3.6% | -9.4% | 46 |

| 36 | Birmingham, AL - Hoover, AL | -3.8% | -11.1% | 48 |

| 37 | Nashville, TN - Davidson, TN - Murfreesboro, TN | -3.8% | -4.8% | 36 |

| 38 | Richmond, VA | -3.8% | -5.9% | 38 |

| 39 | San Diego, CA - Carlsbad, CA - San Marcos, CA | -3.8% | -4.7% | 34 |

| 40 | St. Louis, MO | -3.9% | -7.7% | 42 |

| 41 | Philadelphia, PA - Camden, NJ - Wilmington, DE | -4.1% | -5.0% | 37 |

| 42 | Riverside, CA - San Bernardino, CA - Ontario, CA | -4.2% | -3.4% | 25 |

| 43 | Baltimore, MD - Towson, MD | -4.9% | -6.2% | 39 |

| 44 | Chicago, IL - Naperville, IL - Joliet, IL | -5.2% | -2.6% | 23 |

| 45 | Detroit, MI - Warren, MI - Livonia, MI | -5.6% | -10.8% | 47 |

| 46 | Las Vegas, NV - Paradise, NV | -6.4% | -9.2% | 45 |

| 47 | Oxnard, CA - Thousand Oaks, CA - Ventura, CA | -6.7% | -7.8% | 43 |

| 48 | Seattle, WA - Tacoma, WA - Bellevue, WA | -7.5% | -15.1% | 49 |

| 49 | Los Angeles, CA - Long Beach, CA - Santa Ana, CA | -10.3% | -3.7% | 30 |

| 50 | Atlanta, GA - Sandy Springs, GA - Marietta, GA | -14.4% | -18.3% | 50 |

2012: The Forecast in Perspective

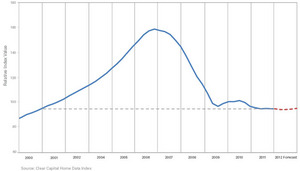

Although the range of movement for U.S. prices stabilized through 2011, prices have settled at the lowest level since early 2001 (see Chart 3). The forecast for 2012 shows home prices starting with a dip in the first quarter, improving in the spring and summer buying season, and continuing to climb to 0.2% overall growth for 2012.

For 2012: Buyer Beware

Although "stable" and "flat" have been used to describe the performance of 2011 and forecast for 2012, the performance of individual metro markets has not been flat at all. In fact, metros across the nation have experienced an interesting balance of increases and losses, that when averaged, create an impression that metro markets across the U.S. are stable.

Individual markets reacting to their local economic conditions continued to exhibit a wide range of performance levels in 2011, with only 12 of the top 50 metro markets (24%), returning year-over-year price movement that can be considered stable -- price swings of less than 2.5 percentage points. This will continue into 2012, with only 40% being considered stable.

Chart 4 indicates the forecasted movement of 50 metros within our 2012 forecast. It includes the forecasted 0.2% increase as the black horizontal line, and the metro markets that are within +/- 2.5% of zero change in red to represent price stability. The chart shows 20 of 50 markets shown to be stable, with the rest being above 2.5% increases or below -2.5% declines.

This large expected fluctuation in home prices among the individual markets speaks to the importance of regularly tracking each market's performance as numerous dynamics, including varying REO saturation and unemployment levels, are still very much in play.

Success in 2012's real estate market will be driven by picking markets carefully and fully understanding local drivers.

About the Clear Capital Home Data Index (HDI) Market Report

The Clear Capital HDI Market Report provides insights into market trends and other leading indices for the real estate market at the national and local levels. A critical difference in the value of the HDI Market Report is the capability of Clear Capital to provide more timely and granular reporting than other home price index providers.

The Clear Capital HDI Market Report:

- Offers the real estate industry (investors, lenders and servicers), government agencies and the public insight into the most recent pricing conditions, not only at the national and metropolitan level, but within local markets as well.

- Is built on the most recent information available from recorder/assessor offices, and then further enhanced by adding the company's proprietary streaming market data for the most comprehensive geographic coverage and local insights available.

- Reflects nationwide coverage of sales transactions and aggregates this comprehensive dataset at ten different geographic levels, including hundreds of metropolitan statistical areas (MSAs) and sub-ZIP code boundaries.

- Includes equally-weighted distressed bank owned sales (REOs) from around the country to give the most real world look of pricing dynamics across all sales types.

- Allows for the most current market data by providing more frequent updates with patent-pending rolling quarter technology. This ensures decisions are based on the most up-to-date information available.

Clear Capital Home Data Index™ Methodology

- Generates the timeliest indices in patent pending rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, significantly reducing the multi-month lag time experienced with other indices.

- Includes both fair market and institutional (real estate owned) transactions, giving equal weight to all market transactions and identifying price tiers at a market specific level. By giving equal weight to all transactions the HDI is truly representative of each unique market.

- Results from an address-level cascade create an index with the most granular, statistically significant market area available.

- Provides classes of weighted repeat sale and price-per-square-foot indices that use multiple sale types, including single-family homes, multi-family homes and condominiums.

About Clear Capital

Clear Capital (www.clearcapital.com) is a premium provider of data and solutions for real estate asset valuation and risk assessment for large financial services companies. Our products include appraisals, broker-price opinions, property condition inspections, value reconciliations, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms and other financial organizations.

Legend

Home Data Index (HDI) -- Powerful analytics tool that provides contextual data augmenting other, human-based valuation tools. Clear Capital's multi-model approach combines address-level accuracy with the most current proprietary home pricing data available.

Metropolitan Statistical Area (MSA) -- Geographic entities defined by the U.S. Office of Management and Budget (OMB) for use by Federal statistical agencies in collecting, tabulating, and publishing Federal statistics.

Real Estate Owned (REO) Saturation -- Calculates the percentage of REOs sold as compared to all properties sold in the last rolling quarter.

Rolling Quarters -- Clear Capital uses patent pending rolling quarter intervals to compare the most recent three months and a fourth month of proprietary data against the previous three months. We include the most current fourth month of proprietary pricing data, because it often contains the most relevant and insightful information.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Contact Information:

Media Contact:

Michelle Sabolich

Atomic PR for Clear Capital

415.593.1400