TRUCKEE, Calif., March 5, 2013 (GLOBE NEWSWIRE) -- Clear Capital (www.clearcapital.com), the premium provider of data and solutions for real estate asset valuation and collateral risk assessment, today released its Home Data Index™ (HDI) Market Report with data through February 2013. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

Photos accompanying this release are available at:

http://www.globenewswire.com/newsroom/prs/?pkgid=17441

http://www.globenewswire.com/newsroom/prs/?pkgid=17442

http://www.globenewswire.com/newsroom/prs/?pkgid=17443

Report highlights include:

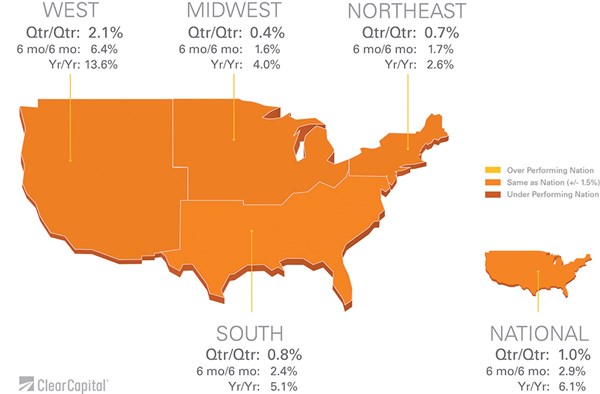

- February's home prices are up 6.1% over the year.

- Quarterly price trends at the national and regional levels show moderate improvement over the typically slow winter season.

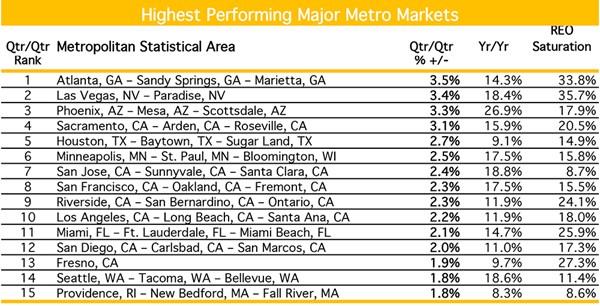

- 11 (of 15) of the lowest performing major metro markets saw quarterly price trends in February give way to minor losses.

- Contact Alanna Harter for your February 2013 file of the Top 30 MSA price trends.

"While February's yearly growth of 6.1% is encouraging, let's remember this rate of growth is measured against the market's bottom, which we reported in our March 2012 Market Report," said Dr. Alex Villacorta, director of research and analytics at Clear Capital." Consumer confidence continues to be vital to a broader housing recovery and national quarterly home prices expanding 1.0% in the midst of winter is confirmation the recovery has legs. While 1.0% is weaker in comparison to more recent rates of quarterly growth, the positive trend continues to support homebuyer confidence and is on par with the new normal.

Recent updates on the regulatory front could also build momentum in the housing revival. The Qualified Mortgage (QM) rule gives lenders more definition on extending credit to homebuyers, who continue to be encouraged by positive economic signs. The real question now is how many of those sidelined borrowers will qualify for a loan under the new rules. All told, February's home data shows the housing recovery on track."

Click here to view the full HDI report, including price trends for the 15 highest and lowest performing markets and a comprehensive national and regional analysis. Contact Alanna Harter for your February 2013 file of the Top 30 MSA price trends.

About Clear Capital

Clear Capital (www.clearcapital.com) is the premium provider of data and solutions for real estate asset valuation and collateral risk assessment for large financial services companies. Our products include appraisals, broker price opinions, property condition inspections, value reconciliations, automated valuation models, quality assurance services, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff, and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date, and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms, and other financial organizations. Clear Capital's home price data can be accessed on the Bloomberg Professional service by typing CLCA <GO>.

The Clear Capital logo is available at http://www.globenewswire.com/newsroom/prs/?pkgid=16857

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.