TRUCKEE, Calif., Nov. 4, 2013 (GLOBE NEWSWIRE) -- Clear Capital®, the premium provider of data and solutions for real estate asset valuation and collateral risk assessment, today released its Home Data Index™ (HDI) Market Report with October 2013 data. Using a broad array of public and proprietary data sources, the HDI Market Report publishes the most granular home data and analysis earlier than nearly any other index provider in the industry.

October 2013 highlights include:

- National home price trends showed signs of moderation in October.

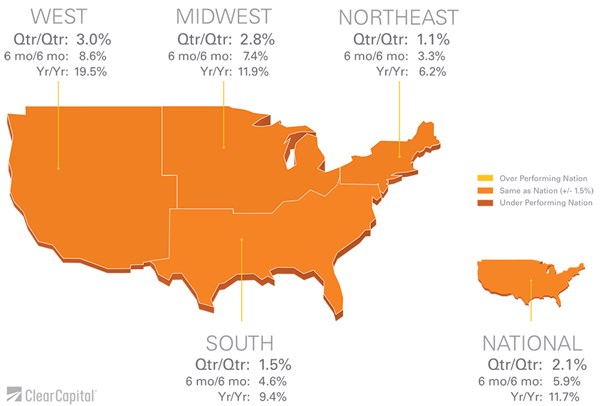

- Nationally, prices expanded 11.7% over the last year. The West maintained the regional lead with 19.5% yearly growth.

- Rolling quarterly rates of growth indicate moderation is underway. National quarterly rates of growth have fallen from 3.8% to 2.1%.

- Nationally, low price tier homes (with values in the 25th percentile of all homes sold) have seen strong moderation from the last rolling quarter. Current rolling quarterly gains of 2.5% are less than half of the prior rolling quarter. Considering this sector led the recovery, the current cooling is further indication that moderation is unfolding.

- Metro markets continue to exhibit variation in their growth drivers, yet share some similarities in overall trends:

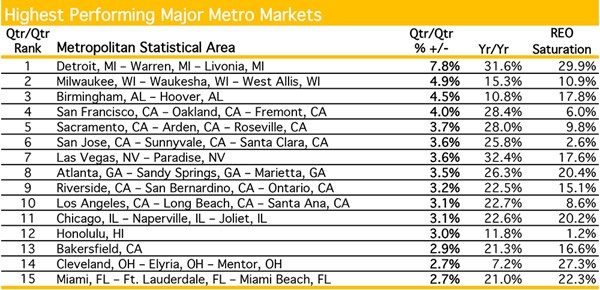

- Of the 15 highest performing major metro markets, 11 have seen yearly gains top 20.0%.

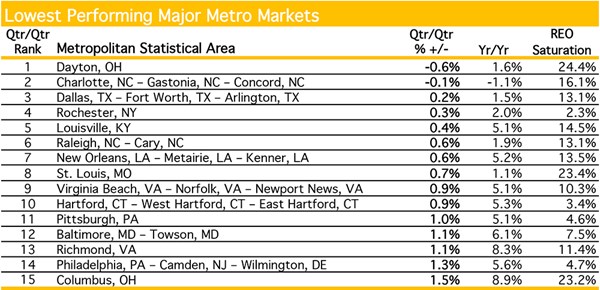

- Lowest performing major metro markets remained relatively stable. Only one metro saw price declines over the last year at -1.1%, a relatively minor decline.

- Out of the top 50 major metro markets, the Detroit MSA turned out the strongest quarterly growth at 7.8% and second highest yearly gains of 31.6%. This can be attributed, in part, to its improved REO saturation rate, down 34.7 percentage points from the high of 64.6% in 2009.

- Detroit's median price is $120,000, just over half the national median price of $210,000. Relatively small price gains will more heavily influence percentage gains in Detroit than in higher priced markets.

- Detroit also ranks number one in REO Saturation at 29.9%.

- In a market with severely depressed prices, bubble-like behavior is unlikely. A sustained recovery will depend on the strength of the local economy. Unemployment sits at more than 9.0% in Detroit, and median incomes are nearly half of national median incomes.

- Contact Alanna Harter for your October 2013 file of the Top 30 MSAs, or access our data on the Bloomberg Professional service by typing CLCA <GO>.

"While prices across the country saw another boost in October, gains are starting to taper over the last quarter, in what could be the tail end of the summer buying season," said Dr. Alex Villacorta, vice president of research and analytics at Clear Capital. "We continue to see trends in the low tier price sector support a likely moderation ahead. And as we've maintained, moderation defines a healthy recovery. While some markets currently have eye-popping growth rates reminiscent of the housing run-up, these trends are mainly short term corrections as markets fall back in line with their long run levels.

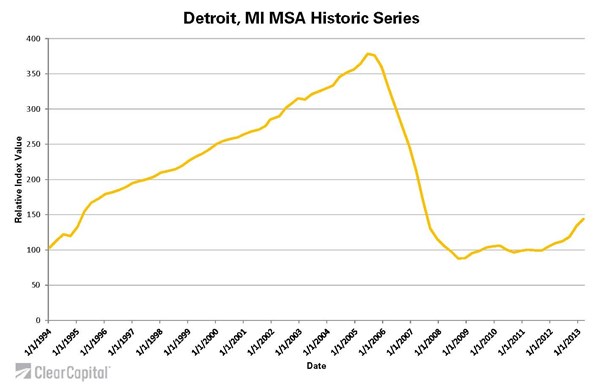

"While the speed at which some markets are returning to pre-bubble norms is noteworthy, recovery is relative. Detroit is a great example. While it has seen more than 30% growth over the year, the market would need to see another 262% growth to hit peak prices. Our graph shows how Detroit prices have fallen in line with its historical trends (pre-2006). Following 2006, prices fell nearly 77%, so what we're seeing is a response to a severe price correction."

For the complete file of the Top 30 MSA price trends for October 2013, please contact Alanna Harter.

About Clear Capital®

Clear Capital (www.ClearCapital.com) is the premium provider of data and solutions for the mortgage finance industry. The Company's products include appraisals, broker price opinions, property condition inspections, value reconciliations, automated valuation models, quality assurance services, and home data indices. Clear Capital's combination of progressive technology, high caliber in-house staff, and a well-trained network of more than 40,000 field experts sets a new standard for accurate, up-to-date, and well documented valuation data and assessments. The Company's customers include the largest U.S. banks, investment firms, and other financial organizations. Clear Capital's home price data can be accessed on the Bloomberg Professional service by typing CLCA <GO>.

The information contained in this report is based on sources that are deemed to be reliable; however no representation or warranty is made as to the accuracy, completeness, or fitness for any particular purpose of any information contained herein. This report is not intended as investment advice, and should not be viewed as any guarantee of value, condition, or other attribute.

Photos accompanying this release are available at

http://www.globenewswire.com/newsroom/prs/?pkgid=21962

http://www.globenewswire.com/newsroom/prs/?pkgid=21963