WASHINGTON, DC--(Marketwired - Jun 2, 2014) - Successful homeownership begins with knowing 'your numbers' according to Marietta Rodriguez, vice president of homeownership programs and lending at NeighborWorks America. Just as with managing health requires keeping an eye on key physical indicators, the path to successful homeownership begins with knowing the four most important financial numbers that lead to sustainable homeownership.

"Homeownership is what the vast majority of Americans want to achieve and as National Homeownership Month starts we're urging consumers to gain the knowledge to succeed in this very tough housing environment," said Rodriguez.

The four key homeownership numbers are:

1. How much mortgage could you comfortably afford

2. What are current mortgage rates

3. What is your credit score

4. How much do you have for a down payment and closing costs

How much home could you comfortably afford is an important first number because it's the one number that probably won't change during the home buying process. How much home a homebuyer could afford is based on their income at the time of purchase.

"The rule of thumb for housing expense is that it should be no more than 30 percent of gross income," said Rodriguez. "So if your annual income is $60,000, then a homeowner's total annual housing costs shouldn't be more than $18,000 per year or about $1,500 per month. Going above that payment amount could lead to budget troubles down the road."

Basically, keeping an eye on the monthly payment limit means that a buyer could purchase more home if the mortgage rate falls or if the price of the home falls, and less home if either one increases.

That leads to the next number: the level of mortgage rates. Higher mortgage rates mean higher mortgage payment amounts, whether the price of the home a person wants to purchase goes up or not.

"Mortgage rates are still lower than they were for most of the past 20 years, creating an opportunity for more affordable mortgage payments," Rodriguez added. "According to forecasts by economists and statements by the Federal Reserve Board, it's not likely that 30-year fixed-rate mortgage rates will go much higher in the next 12 months."

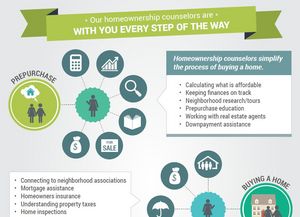

NeighborWorks believes that homebuyers should work with a housing counselor to identify several mortgage lenders and then lock in the best mortgage rate for as long as possible at the lowest cost, allowing time to search for the right home.

Although the foreclosure crisis has dropped off the front pages, home foreclosure is still affecting hundreds of thousands of families. Research for NeighborWorks America found that working with a NeighborWorks housing counselor could help reduce the chance of mortgage default and foreclosure.

Knowing the credit score number affects the mortgage rate. Lenders are slowly moving their credit score targets to levels where more homebuyers could access a low-rate mortgage. However, if the homebuyer's credit score is below the threshold, the mortgage will cost more, if a mortgage is available at all.

"That's why NeighborWorks organizations around the country are here to help consumers, not just homebuyers, understand what helps and hurts a credit score," said Rodriguez "If a person can't come in to see a NeighborWorks organization, we recommend caution when thinking about paying for credit repair services. There are no quick fixes to credit issues."

Another number that doesn't usually change overnight is a buyer's savings or money available for down payment. A survey by NeighborWorks America, a national nonprofit housing and community development corporation based in Washington, DC found that saving for a down payment is second only to saving for retirement. Even so, saving the thousands of dollars usually needed for a minimal down payment takes time.

"To help homebuyers close the time gap, we encourage them to seek out down payment assistance programs that may be available from us or other sources, as well as to retain a Realtor who will negotiate for closing costs assistance from the seller if possible," explained Rodriguez. "Closing costs are not the down payment, but having help here means less money from savings has to be used for the overall financing."

About NeighborWorks America

NeighborWorks America creates opportunities for people to improve their lives and strengthen their communities by providing access to homeownership and to safe and affordable rental housing. In the last five years, NeighborWorks organizations have generated more than $19.5 billion in reinvestment in these communities. NeighborWorks America is the nation's leading trainer of community development and affordable housing professionals.

Contact Information:

Contact:

Douglas Robinson

202-760-4062

drobinson@nw.org