ROUND ROCK, TX, March 25, 2015 (GLOBE NEWSWIRE) -- TG, in consultation with the National Association of Student Financial Aid Administrators (NASFAA), has released the second of five reports on the efficacy of federal student loan counseling. Informed or Overwhelmed? A Legislative History of Student Loan Counseling with a Literature Review on the Efficacy of Loan Counseling details how ever-evolving policy changes and the complexity of the federal student loan programs may hamper students' abilities to fully understand and retain information about their loans.

"The proliferation of mandated topics seems to stem from federal policymakers' concern about the lack of college affordability and the economic uncertainty student borrowers face after college," explained Kasey Klepfer, the report's author. "Though well intended, growth in the number of topics that students cover in counseling causes many to grow apathetic during their learning experience."

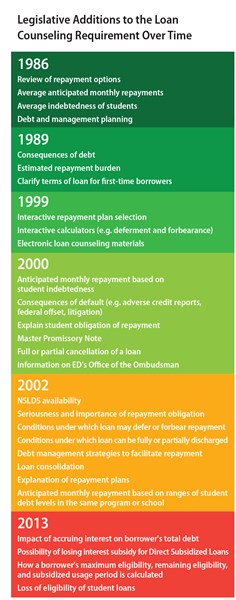

In the report, Klepfer illustrates how counseling methods and topics have changed over time from when it became mandatory in 1986 for student borrowers to receive loan entrance and exit counseling until today when students use the federally-approved online counseling modules. As of 2013, 28 different topics are covered in the online counseling modules from the four introduced in 1986.

"As our users pointed out during testing, web materials and online counseling can be efficient, but without a mechanism for personalized information or in-person support, the current methods for counseling are not sufficient to educate them about the financial decisions they're making or have made during college," explained Klepfer.

Through student observations and surveys, the researchers conclude that different approaches to student loan counseling need to be developed and subjected to randomized testing, with knowledge retention and outcomes tracked over time.

TG's research team released the first report on the efficacy of loan counseling, "From Passive to Proactive: Understanding and Improving the Borrower Experience with Online Student Loan Exit Counseling," in February. A report related to student loan entrance counseling will be released in April, and best practices later in 2015. Information and links for all TG research publications can be found at www.TG.org.

"TG's work provides much needed historical context that sheds light on how the loan counseling system we have today came to be, and how it can be improved. We look forward to continuing to collaborate with TG on this important and timely issue" said NASFAA President & CEO Justin Draeger.

TG is a nonprofit corporation that promotes educational success to help millions of students and families realize their college and career dreams. TG provides critical support to schools, students, and borrowers at every stage of the federal student aid process — from providing information on how to pay for a higher education including financial aid options, to facilitating successful loan repayment after graduation.

A photo accompanying this release is available at: http://www.globenewswire.com/newsroom/prs/?pkgid=31659