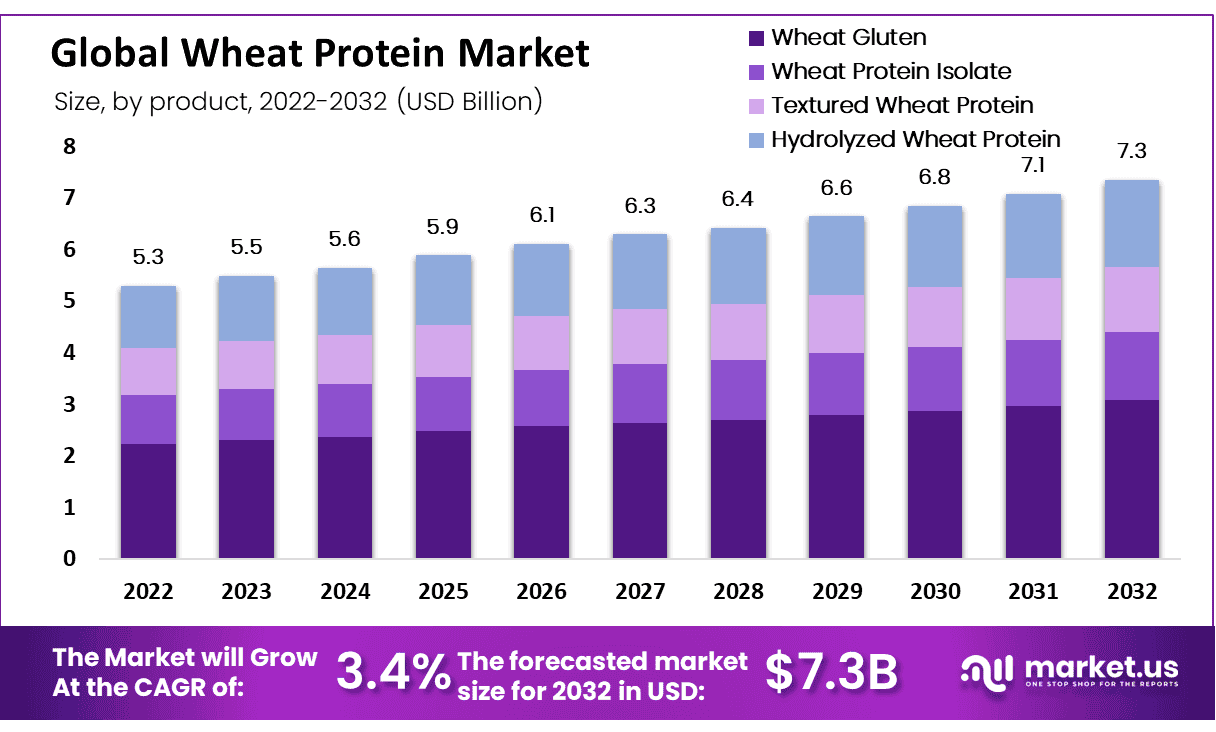

New York, April 24, 2023 (GLOBE NEWSWIRE) -- The wheat protein market size is projected to surpass around USD 7.3 billion by 2032, and it is poised to reach a registered CAGR of 3.4% from 2023 to 2032. In 2022, it was valued at USD 5.3 billion.

This rapidly developing industry encompasses the production, distribution, and sale of wheat protein-based products. Manufacturing wheat protein requires a few steps like the separation of wheat flour into its constituent components, isolation of wheat protein through different methods like filtration, centrifugation and precipitation, refining, and concentration to the desired level. The global wheat protein market is driven by several factors, including an increasing demand for plant-based protein products, the growing health and wellness trend, as well as rising interest in protein supplements for sports nutrition and weight management. Furthermore, this market is affected by numerous other trends such as the development of new and innovative wheat protein products, expansion into new regions, and adoption of sustainable and eco-friendly manufacturing practices.

To get additional highlights on major revenue-generating segments, Request a Wheat Protein market sample report at https://market.us/report/wheat-protein-market/request-sample/

Key Takeaway:

- Based on product type, in 2022, the wheat protein market was dominated by the wheat gluten segment owing to its increasing usage.

- By form type, in 2022, the solid type segment dominated the largest market share in the wheat gluten industry segment.

- By protein concentration, the 75% protein concentration fragment dominated the largest market share in protein concentration type analysis.

- Based on application, in 2022, the wheat protein market was dominated by the bakery & confectionery segment owing to its increasing usage.

- In 2022, North America dominated the market with the highest share of 36%.

- Asia Pacific is expected as the fastest-growing region in the projected period of the wheat protein market.

Factors affecting the growth of the wheat protein industry

There are a few factors that affect the growth of the wheat protein industry, including:

- Increasing demand for plant-based protein: There is a raising trend towards plant-based diets and a shift away from animal-based products, which is driving demand for wheat protein products as another source of protein.

- Growing health and wellness trend: Consumers are upcoming more health-conscious and are looking for products that offer health benefits like weight management, muscle building, and improved overall health. Wheat protein products are considered to be a healthy alternative to animal protein owing to their high protein content and low-fat content.

- Rising demand for protein supplements: The demand for protein supplements is increasing, particularly in the sports nutrition and weight management sectors. Wheat protein products are often used as a source of protein in these supplements, which is driving demand for wheat protein products.

- Technological advancements in producing processes: The development of the latest technologies and manufacturing processes has led to the production of high-quality wheat protein products that are more cost-effective and efficient to produce, which is driving growth in the industry.

To understand how our Wheat Protein Market report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/wheat-protein-market/#inquiry

Market Growth

The wheat protein market has seen tremendous growth over the last several years and is forecasted to keep expanding at a steady rate over the upcoming years. This growth is fuelled by factors such as increasing demand for plant-based proteins, an escalating health & wellness trend, and rising interest in protein supplements for sports nutrition and weight management purposes. Overall, analysts anticipate continued expansion of this segment owing to shifting consumer preferences and advancements in wheat protein product development.

Regional Analysis

In terms of revenue, North America will have the largest market share for wheat protein in the world in 2022. The region's well-established food and beverage department contributes to the market expansion for wheat protein. With increasing consumer information on the health improvement of plant-based proteins & gluten-free goods, the United States & Canada are the region's two largest marketplaces. With a CAGR of 3.4%, Asia Pacific is predicted to develop at the quickest rate in the world market for wheat protein. Owing to rising consumer interest in health and well-being as well as the need for plant-based proteins, Asia-Pacific has the fastest-growing market for wheat protein.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 5.3 Billion |

| Market Size (2032) | USD 7.3 Billion |

| CAGR (from 2023 to 2032) | 3.4% |

| North America Revenue Share | 36% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

The versatile and sustainable source of protein, wheat protein, is becoming increasingly popular with consumers looking for healthier and more eco-friendly foods. Wheat protein is the focus of a lot of research and development. This includes the development of new products as well as the improvement of existing products. Wheat protein can be used in many food and beverage products including baked goods, meat substitutes as well nutritional supplements. Wheat protein's versatility is driving its acceptance in the food industry, and helping to grow the market.

Market Restraints

Wheat protein synthesis may be expensive, leading to increased costs for customers. This could deter some consumers - particularly those in price-sensitive economies - from using products containing wheat protein. Owing to its potential to cause allergies, wheat protein may only be utilized in certain goods or markets, potentially restricting its requirement and hindering market expansion. There are various plant-based protein sources such as soy, pea as well rice proteins even though there is a growing demand for plant-based proteins.

Market Opportunities

The need for high-quality protein sources that may help athletes gain and maintain muscle mass is expanding as the sports nutrition sector expands quickly. Wheat protein is a valuable source of essential amino acids and protein, making it a popular choice in the market for sports nutrition. Several foods, including bread and pasta, can be made using wheat protein instead of wheat flour to avoid introducing gluten into the product. The market for wheat protein has a sizable opportunity due to the rising demand for gluten-free goods. The creation of modern wheat protein products like textured wheat protein as well as drinks containing wheat protein has a lot of promise. The market for goods containing wheat protein may grow as a result of these most recent products.

Grow your profit margin with Market.us - Purchase This Premium Wheat Protein Market Report at https://market.us/purchase-report/?report_id=100441

Report Segmentation of the Wheat Protein Market

Product Type Insight

With a predicted CAGR of 3.4%, the wheat gluten segment is the most profitable in the overall wheat protein market. In 2022, wheat protein products will account for 42% of all income. The form of wheat protein that is most frequently employed is wheat gluten. It is a highly elastic protein that is frequently used in bread, pasta, and other baked foods as a binder and dough improver. A wheat protein that has been digested into smaller peptides is known as hydrolyzed wheat protein. It is frequently used as a protein source and flavor enhancer in a variety of culinary products, including soups, sauces as well spices.

Form Insight

In terms of wheat protein market revenue in 2022, the solid segment accounted for the largest revenue share. Due to the fact that solid wheat protein is readily available as powders or granules, it is frequently utilized in a broad range of culinary products, including baked goods, meat substitutes, and snacks. Solid wheat protein is very concentrated and is simple to add to various formulas. Available as syrups or solutions, liquid wheat protein is frequently employed in a variety of food and beverage items as a binder, emulsifier, or taste enhancer.

Protein Concentration Insight

The segment with a 75% protein concentration is the most lucrative one in the market for wheat protein. Bakery products typically use wheat protein products with a 75% protein concentration as a dough improver and strengthened. Moreover, they are utilized in morning cereals, snacks, and meat substitutes. Often utilized in vegetarian burgers, sausages, and nuggets are wheat protein products with approximately 80% protein content.

Form Insight

With a predicted revenue share of 41%, the bakery & confectionery industry is predicted to be the most profitable in the worldwide wheat protein market. As a binder and dough improver, wheat protein is used in bakery and confectionery items such as bread, cakes, cookies, and pastries. It is used as a stabilizer, thickener, and emulsifier in dairy products including cheese, yogurt, and ice cream. Based on its useful qualities and cost-effectiveness, wheat protein is used in a variety of applications.

Recent Developments of the Wheat Protein Market

- December 2021: ADM published the expansion of its plant-based protein production facility in Missouri, USA, to meet the growing demand for plant-based proteins, including wheat protein products.

- January 2022: Cargill published the introduction of its new line of wheat protein products, which are specifically designed for meat alternative applications.

For more insights on the historical and Forecast Wheat Protein Market data from 2016 to 2032 - download a sample report at https://market.us/report/wheat-protein-market/request-sample/

Market Segmentation

Based on Product Type

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

Based on the Form

- Solid

- Liquid

Based on Protein Concentration

- 75% Protein Concentration

- 80% Protein Concentration

- 95% Protein Concentration

Based on the Application

- Dairy

- Bakery & Confectionery

- Nutritional Supplements

- Animal Feed

- Meat Analogy

- Processed Meat

- Other Applications

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The market for wheat protein is extremely competitive and fragmented, with only a few major players present. To increase their market share and satisfy the rising demand for products containing wheat protein, these businesses are concentrating on innovation, product development, and strategic alliances.

Key Market Players:

Listed below are some of the most prominent wheat protein industry players.

- Archer Daniels Midland Company

- Agridient Inc

- MGP Ingredients

- AB Amilina

- Cargill Inc

- Manildra Group

- Crespel & Deiters GmbH and Co. KG

- Kroener Staerke

- Crop Energies AG

- Roquette Freres

- Other Key Players

Browse More Related Reports:

- Plant Based Diet Market size is expected to be worth around USD 31.1 billion by 2032 from USD 14.4 billion in 2023, growing at a CAGR of 8.2% during the forecast period 2023 to 2032.

- Propionic Acid Market was valued at USD 1.57 billion and is expected to grow to USD 3.12 billion in 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 7.3%.

- Protein Supplement Market size is expected to be worth around USD 45.3 billion by 2032 from USD 20.1 billion in 2022, growing at a CAGR of 8.70% during the forecast period from 2023 to 2032.

- Commercial Seed Market is expected to be worth around USD 150.9 billion by 2031 from USD 73.6 billion in 2021, growing at a CAGR of 7.99% during the forecast period 2021 to 2031.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: