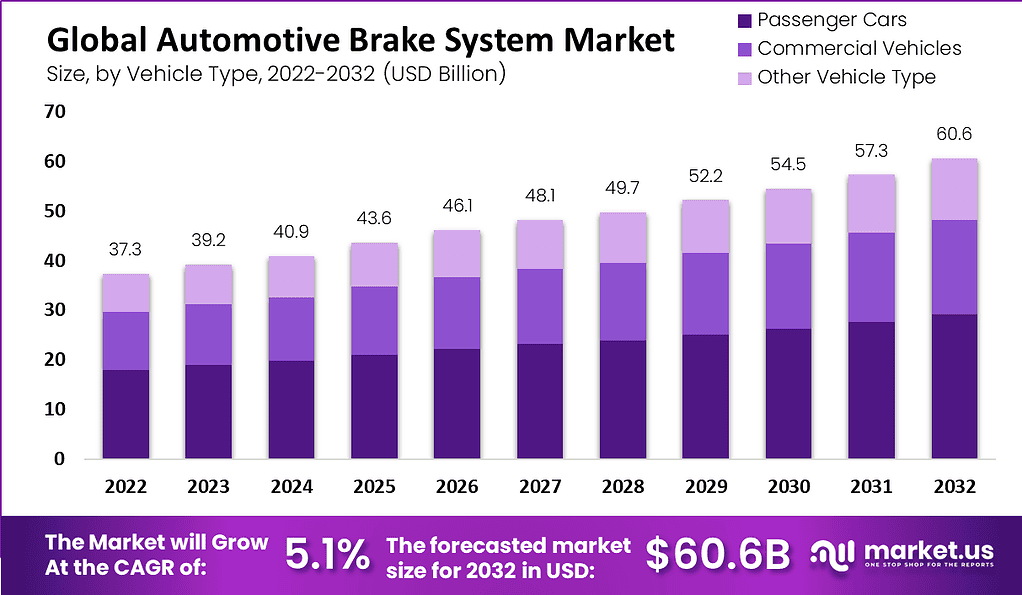

New York, April 27, 2023 (GLOBE NEWSWIRE) -- The Global Automotive Brake System Market size is expected to be worth around USD 60.6 Billion by 2032 from USD 37.3 Billion in 2022, growing at a CAGR of 5.1% during the forecast period from 2022 to 2032.

As demand for passenger and commercial vehicles expands in countries such as China and India, the market for automotive brake systems is projected to experience substantial growth. The increasing adoption of luxury cars, stringent safety regulations, and increasing use of disc brakes in commercial vehicles have all contributed to the expansion of this market. Furthermore, brake components only last so many kilometers before needing replacement - further fueling the repair market. In response to concerns about traffic accidents and an increasing death toll, participants have implemented more stringent safety protocols set by government bodies and regulatory organizations. With such strict protocols in place, car brake systems will continue to grow in demand.

To get additional highlights on major revenue-generating segments, Request an Automotive Brake System Market sample report at https://market.us/report/automotive-brake-systems-market/request-sample/

Key Takeaway:

- By Type, in 2022, the Automotive Brake System market was dominated by the Disc Brake segment due to their ability to function in adverse weather conditions without overheating or fading.

- By Vehicle, the Passenger cars segment dominated the largest market share in Vehicle type analysis and accounted for the largest revenue share in the Automotive Brake System Market in 2022.

- By Technology, the Antilock Brake System (ABS) segment dominated the largest market share in Technology analysis.

- By Sales Channel, the OEMs segment dominates the largest Market Share.

- In 2022, Asia-Pacific dominated the market with the highest revenue share of 34%.

- North America is anticipated to have the highest CAGR among all the regions.

Factors Affecting the Growth of the Automotive Brake System Market

There are several factors that can have an impact on the growth of the Automotive Brake System Market. Some of these factors include:

- Growing Demand for Automotive Safety Features: Due to an increase in road accidents worldwide, demand for safety features such as antilock brake systems (ABS), electronic stability control, traction control, electronic stabilization control, tire pressure monitors, and airbags is on the rise. People are becoming more concerned about what kind of car they drive due to these conditions - making cars even more vulnerable than before.

- Improvements in Technology for Safety Features: Automobile manufacturers are always developing and improving products to guarantee safe and comfortable driving. Players strive to create safer cars by developing technologies such as electronic stability control and antilock brake system. The development of automotive brake systems is potentially being driven by technological improvements in vehicle safety features.

- High Costs for Installation and Upkeep: Antilock brake systems have a limited market due to the expensive maintenance costs of their components. On average, maintenance and installation for ABS cost around $2000; labor is included for commercial vehicles. ABS' electronic control module costs anywhere from $1000 to $5000 but isn't widely available yet. Given these high upfront expenses, automotive brake makers are expected to slow down production in response.

- Development of advanced Braking systems for two-wheelers: The market for antilock brake systems is predicted to expand in the coming years due to technological advancements and improvements in this sector. Modern antilock brake systems such as modular and scalable models are specifically designed to withstand two-wheelers but can be modified for use on models ranging from low-power segments up through high-end sports bikes. Key market players stand to gain from more efficient two-wheeler braking systems.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://market.us/report/automotive-brake-systems-market/#inquiry

Top Trend in Automotive Brake System Market

- Growing Investments into R&D Activities by Key Players to Drive Demand in the Market

Automakers constantly create innovative products to make driving easy and safer, such as anti-lock brakes and electronic stability control systems that work together to prevent skidding and maintain control of vehicles. Market demand may expand in response to advances in car safety technologies. Players often create anti-lock braking systems, electronic stability control, stop-by-wire, and anti-collision devices to make safer and betters cars.

Market Growth

The global automotive brake system market is forecast to experience steady growth over the coming years due to factors such as rising demand for passenger and commercial vehicles, increasing awareness about vehicle safety issues, and stringent government regulations related to this area. With increased concerns regarding vehicle safety among both consumers and governments worldwide, growth in this space should continue.

Regional Analysis

Asia-Pacific held the majority of automotive brake system market revenues in 2022 due to its low labor cost. Businesses located there can enjoy significant cost savings while manufacturing centers are located in countries like India or China. The industry will grow due to rising demand for automotive brake systems, rising sales of luxury and high-end vehicles, rising car ownership rates, and an increase in accidents. North America's automotive market is expanding due to rising demand for vehicles that can withstand adverse weather conditions, the presence of major automakers, and an increase in passenger cars as well as light commercial vehicles.

Have Queries? Speak to an expert or Click Here To Download/Request a Sample

Scope of the Report

| Report Attribute | Details |

| Market Value (2022) | USD 37.3 Billion |

| Market Size (2032) | USD 60.6 Billion |

| CAGR (from 2023 to 2032) | 5.1% |

| Asia Pacific Revenue Share | 34% |

| Historic Period | 2016 to 2022 |

| Base Year | 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

- Inclusion of advanced brake systems such as ABS and EBD to enhance vehicle safety

Stopping distances can be reduced using electrical braking systems such as Anti-lock Brake Systems (ABS), Electrical Brakeforce Distribution (EBD), and Brake Assist (BA). ABS helps shorten stopping distances when applying force by providing car stability and directional control. ABS offers many advantages over traditional stopping systems, including increased steadiness and shorter stopping distances. BA is often combined with ABS to maximize vehicle braking power; EBD acts as an extension of ABS by applying consistent power to each wheel. EBD benefits include better traction on roads and improved vehicle maneuverability due to EBD's function as an extension of ABS.

Market Restraints

- High Costs of Braking Technology Development and Maintenance

General maintenance can be very expensive. It includes the replacement of brake fluid, brake shoes, and brake pads. Also, the cleaning and adjustment of other braking mechanisms can be more expensive. Maintaining an ABS can be costly as there are many sensors placed on each wheel. This can add up to hundreds of dollars. In countries such as Brazil and India, where costs are high, the penetration of electronic systems in high-end vehicles is limited. These systems are also not accepted due to their high maintenance costs.

Market Opportunities

- Government rules requiring the use of sophisticated emergency braking devices

More than 40 countries have signed the United Nations Regulation requiring advanced emergency brakes (AEB) systems in cars. As per Regulation No 152-00, light passenger and commercial vehicles with AEB systems can now be installed by the EU; all new models must include this safety feature and undergo 60 MPH testing by manufacturers. AEB (advanced emergency brake) has become more prevalent due to mandatory government mandates; AEB is an efficient emergency brake that helps reduce collisions and their severity.

Grow your profit margin with Market.us - Purchase This Premium Report at https://market.us/purchase-report/?report_id=19840

Report Segmentation of the Automotive Brake System Market

Type Insight

The two main categories in the automotive brake industry are drum brakes and disk brakes. Because they can function in harsh weather conditions without overheating and fading, disc brakes have been the leader of the sector for a long time. Disc brakes' interoperability and other modern systems are also driving growth in this sector.

Drum brakes have a narrow caliper and rotor to stop wheel movement, while disc brakes have an enclosed design with circular parts to provide friction to slow down the speed. Although drum-based systems have a greater braking power than disc-based systems, manufacturers tend to prefer drums because they are more affordable.

Vehicle Insight

Commercial vehicles and passenger automobiles are the two primary markets for automotive brake systems based on vehicle type. Passenger cars dominate this market share due to increasing populations, increased disposable income, and urbanization. Manufacturers strive to design more effective braking systems to add safety features. To provide greater braking force on different terrain types, numerous companies are developing various versions of brake systems. In turn, high-performance lightweight braking systems have emerged on the market as manufacturers place great emphasis on reducing system weight.

Technology Insight

Electronic brake-force distribution, antilock brake systems (ABS), and stability control systems are all technology-driven segments of the automotive brake market. ABS dominates this space. ABS technology has seen a meteoric rise in adoption due to the aggressive push by several car industry groups for ABS deployment in strategic places. Electronic stability control technology is also seeing increased usage due to its capacity for regaining vehicle control during an emergency. In the coming decade, automotive brake system sales are projected to soar. Traction Control Systems (TCSs) are expected to lead the sector growth as they provide grip in difficult driving conditions and can be combined with anti-lock brake systems for maximum effectiveness. Traction control also prevents wheel spin by applying brake power through ABS and throttle control mechanisms.

Sales Channel Insight

Original Equipment Manufacturers (OEMs) are the primary purchasers of car brake systems. OEMs purchase brake systems from suppliers and integrate them into their cars during production, fuelling an increasing OEM market. As global auto production increases, this segment of the industry will see steady growth going forward.

Aftermarket sales are another vital source for automotive brake system sales. This category encompasses both licensed dealerships and independent repair facilities alike, offering brake systems to maintain or replace them.

Recent Development of the Automotive Brake System Market

- March 2022: A review of Brembo brake usage in Catalonia, with information on the anti-drug technology that is also offered for street-legal vehicles.

- May 2022: Instructions for using Brembo brakes in Moto GP and on public roads, as well as details on their application in the French GP.

- April 2022: Brembo MotoE systems specs and the best brake discs for the track

- April 2022: Brembo's most recent replacement options for commercial vehicles include a broad selection of brake discs and a complete range of brake pads.

For more insights on the historical and Forecast market data from 2016 to 2032 - download a sample report at https://market.us/report/automotive-brake-systems-market/request-sample/

Market Segmentation

Based on Type

- Disc Brake

- Drum Brake

Based on Vehicle Types

- Passenger Cars

- Commercial Vehicles

- Other Vehicle Types

Based on Sales Channel

- Original Equipment Manufacturers

- Aftermarket

Based on Technology

- Antilock Braking Systems

- Electronic Stability Control

- Traction Stability Control

- Electronic Brakeforce Distribution

By Geography

- North America

-

- The US

- Canada

- Mexico

- Western Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

-

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

-

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The automotive brake system market is highly competitive, with numerous global players Competing for market share. Market growth will be spurred by increasing demand for safety features and the shift to electric and hybrid cars, offering opportunities to both established players and new entrants.

- Advics Co. Ltd.

- ZF Friedrichshafen AG

- Akebono Brake Industry Co.

- Hitachi Automotive System

- Brembo SpA

- Robert Bosh GmbH

- Aisin Seiki Co. Ltd.

- Haldex AB

- Web Co.

- Nissin Kogyo Co. Ltd.

- BWI Group

- Mando Corporation

- Continental AG

- Batz Group

- TE Connectivity

- Cardollite Corporation

- Kor-Pak Corporation

- Pro-Tech Friction Group

- Trimat Limited

- Other Market Players

Browse More Related Reports:

- Advanced Driver Assistance Systems Market size is expected to be worth around USD 118 billion by 2032 from USD 32.9 billion in 2023, growing at a CAGR of 14% during the forecast period from 2022 to 2032.

- Automotive Brake Line Market has valued at USD 26.72 billion in 2023 and the market share is estimated at 3.97%, and it is expected to be USD 26.72 billion in 2033, from 2023 to 2033.

- Bus Infotainment System Market is estimated to be valued at USD 0.23 billion in 2022, with a CAGR of 9.6% during the forecast period. It is expected to reach USD 0.58 billion.

- Automotive Axle Market size is expected to be worth around USD 81,655.32 million by 2032 from USD 63,170 million in 2022, growing at a CAGR of 2.60% during the forecast period from 2022 to 2032.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: