Dublin, Nov. 07, 2023 (GLOBE NEWSWIRE) -- The "United States Medical Imaging Device Market Size, Share & Trends Analysis, 2024-2030 | MedSuite | Includes: X-Ray Imaging, Breast Imaging, and 5 more" report has been added to ResearchAndMarkets.com's offering.

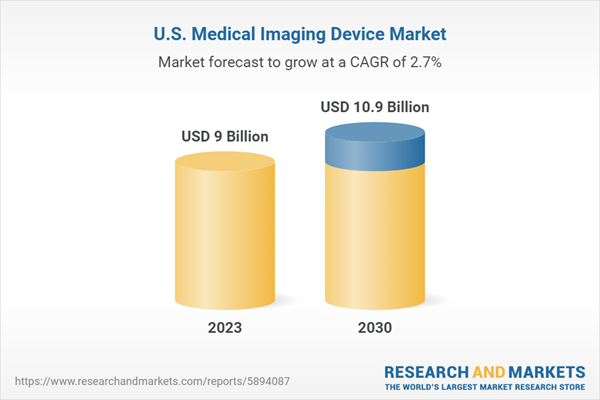

In 2023, the U.S. medical imaging market achieved a valuation of $9 billion, with a projected growth rate of 2.7% at a Compound Annual Growth Rate (CAGR), the market is anticipated to reach $10.9 billion during the forecast period.

This comprehensive report suite on the U.S. Medical Imaging Market encompasses a diverse spectrum of over 60 companies in the United States. It encompasses X-ray imaging, breast imaging, magnetic resonance imaging (MRI), ultrasound equipment, computed tomography (CT) imaging, nuclear medicine imaging, and contrast agents and injectors.

U.S. Medical Imaging Market Insights

The rise in chronic diseases and growing awareness of their impact are playing significant roles in driving the growth of the imaging market in the US. As chronic diseases become more prevalent, there is an increasing need for accurate and timely diagnosis, disease monitoring and treatment evaluation.

This report is the result of an extensive analysis of over 60 medical imaging companies, employing a rigorous methodology to assess diagnostic procedure numbers, market sizes, unit sales, company market shares, and generate precise forecasts.

In 2023, there were over 607 million medical imaging procedures performed in the United States. The number of medical imaging procedures has been growing steadily across all segments including X-ray procedures, breast imaging procedures, magnetic resonance imaging procedures, ultrasound procedures, computed tomography procedures, and nuclear medicine procedures.

Imaging, as a diagnostic tool, remains a cornerstone relied upon by medical professionals and healthcare institutions. The progress in imaging technology is poised to be a driving force behind the continued escalation in the number of surgical procedures performed.

U.S. Medical Imaging Market Share Insights

In 2023, GE Healthcare emerged as the frontrunner in the U.S. imaging market, holding a unique position as the sole contender in every imaging segment. GE dominated the X-ray, ultrasound, and nuclear medicine sectors.

Securing the second spot in the overall imaging market for 2023, Siemens Healthineers excelled in the magnetic resonance imaging (MRI) and computed tomography (CT) markets. The company also actively participated in the X-ray, breast imaging, ultrasound, and nuclear medicine markets.

Philips Healthcare, positioned as the third major player in the comprehensive imaging market in 2023, competed across various domains, including X-ray, breast imaging, MRI, ultrasound, and CT markets.

Key highlights from the report include:

- Robust Market Expansion: In 2023, the US medical imaging market reached a valuation of $9 billion. This valuation is expected to continue its upward trajectory, with a solid Compound Annual Growth Rate (CAGR), ultimately reaching almost $11 billion by the end of the forecast period.

- Technological Advancements: Ongoing advancements in imaging technologies, such as higher resolution, faster scan times and the integration of AI and machine learning, drive the adoption of new and improved imaging modalities.

- Demographic Factors: As people age, the prevalence of chronic diseases and age-related conditions such as cardiovascular diseases, cancer, osteoporosis and neurological disorders increases.

- Competitive Landscape: The report provides an in-depth analysis of the competitive landscape, profiling key players and their strategic initiatives. Currently, GE Healthcare, Siemens Heathineers, and Philips Healthcare lead the US medical imaging market.

Market Segmentation Summary:

- X-Ray Imaging Market - includes analog, computed radiography (CR), digital radiography (DR), fluoroscopy and cardiovascular X-ray systems.

- Breast Imaging Market - includes mammography, molecular breast imaging (MBI), breast ultrasound and breast magnetic resonance imaging (MRI) coil markets.

- Magnetic Resonance Imaging Market - includes low-, mid- and high-field MRI systems as well as closed-bore and wide-bore MRIs of any field strength.

- Ultrasound Imaging Market - segmented into: equipment for cardiology, radiology, obstetrics and gynecology (OB/GYN), urology, surgery, vascular, ophthalmic and point of care (POC).

- Computed Tomography Imaging Market - includes 16/20, 32/40, 64 and ultra-premium slice scanners.

- Nuclear Medicine Imaging Market - includes positron emission tomography/computed tomography (PET/CT), single photon emission computed tomography (SPECT) and single photon emission computed tomography/computed tomography (SPECT/CT).

- Contrast Agent and Injector Imaging Market - includes X-ray and computed tomography (CT) agents, magnetic resonance imaging (MRI) agents and ultrasound agents as well as contrast injectors.

Research Scope Summary:

- Report Attribute

- Regions: United States

- Base Year: 2023

- Forecast: 2024-2030

- Historical Data: 2020-2022

- Quantitative Coverage: Market Size, Market Shares, Market Forecasts, Market Growth Rates, Units Sold, and Average Selling Prices

- Qualitative Coverage: COVID19 Impact, Market Growth Trends, Market Limiters, Competitive Analysis & SWOT for Top Competitors, Mergers & Acquisitions, Company Profiles, Product Portfolios, FDA Recalls, Disruptive Technologies, Disease Overviews

- Data Sources: Primary Interviews with Industry Leaders, Government Physician Data, Regulatory Data, Hospital Private Data, Import & Export Data, Internal Research Database

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 387 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $9 Billion |

| Forecasted Market Value (USD) by 2030 | $10.9 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | United States |

Key Topics Covered:

1. Executive Summary

2. Impact of COVID-19 on the U.S. Medical Imaging Market

2.1 Introduction

2.2 Analysis by Market Segment

2.2.1 Worst Case Scenario

2.2.2 Base Case Scenario

2.2.3 Best Case Scenario

3. Product Assessment

3.1 Introduction

3.2 Product Portfolios

3.2.1 X-Ray Imaging Market

3.2.2 Breast Imaging Market

3.2.3 Magnetic Resonance Imaging Market

3.2.3.1 Closed-Bore Vs. Wide-Bore Systems

3.2.4 Ultrasound Imaging Market

3.2.5 Computed Tomography Imaging Market

3.2.6 Nuclear Medicine Imaging Market

3.2.7 Contrast Agent and Injector Market

3.3 Regulatory Issues and Recalls

3.3.1 X-Ray Imaging Market Fda Recalls

3.3.2 Breast Imaging Market Fda Recalls

3.3.3 Magnetic Resonance Imaging Market Fda Recalls

3.3.4 Ultrasound Imaging Market Fda Recalls

3.3.5 Computed Tomography Imaging Market Fda Recalls

3.3.6 Nuclear Medicine Imaging Market Fda Recalls

3.3.7 Contrast Agent and Injector Market Fda Recalls

3.4 Clinical Trials

3.4.1 X-Ray Imaging Market Clinical Trials

3.4.2 Breast Imaging Market Clinical Trials

3.4.3 Magnetic Resonance Imaging Market Clinical Trials

3.4.4 Ultrasound Imaging Market Clinical Trials

3.4.5 Computed Tomography Imaging Market Clinical Trials

3.4.6 Nuclear Medicine Imaging Market Clinical Trials

3.4.7 Contrast Agent and Injector Market Clinical Trials

4. U.S. Medical Imaging Market Overview

4.1 Introduction

4.2 Market Overview & Trend Analysis

4.3 Drivers and Limiters

4.4 Competitive Market Share Analysis

4.5 Mergers and Acquisitions

4.6 Company Profiles

4.6.1 Bayer

4.6.2 Canon Medical

4.6.3 Fujifilm

4.6.4 GE Healthcare

4.6.5 Hologic

4.6.6 Philips Healthcare

4.6.7 Siemens Healthineers

4.7 SWOT Analysis

4.7.1 Bayer

4.7.2 Canon Medical

4.7.3 Fujifilm

4.7.4 GE Healthcare

4.7.5 Hologic

4.7.6 Philips Healthcare

4.7.7 Siemens Healthineers

5. Procedure Numbers

5.1 Introduction

5.2 Procedures

5.2.1 X-Ray Procedures

5.2.2 Breast Imaging Procedures

5.2.3 Magnetic Resonance Imaging Procedures

5.2.4 Ultrasound Procedures

5.2.5 Computed Tomography Procedures

5.2.6 Nuclear Medicine Procedures

6. X-Ray Imaging Market

6.1 Introduction

6.2 Market Overview

6.3 Market Analysis and Forecast

6.3.1 Total X-Ray Market

6.3.2 Analog X-Ray Market

6.3.3 Computed Radiography X-Ray Market

6.3.4 Digital Radiography X-Ray Market

6.3.5 Fluoroscopy X-Ray Market

6.3.6 Cardiovascular X-Ray Market

6.4 Drivers and Limiters

6.5 Competitive Market Share Analysis

7. Breast Imaging Market

7.1 Introduction

7.2 Market Overview

7.3 Market Analysis and Forecast

7.3.1 Total Mammography Market

7.3.2 Total Molecular Breast Imaging Market

7.3.3 Total Breast Ultrasound Market

7.3.4 Mri Coil Market

7.4 Drivers and Limiters

7.5 Competitive Market Share Analysis

8. Magnetic Resonance Imaging Market

8.1 Introduction

8.2 Market Overview

8.3 Market Analysis and Forecast

8.3.1 Total Closed-Bore Mri Market

8.3.2 Total Wide-Bore Mri Market

8.4 Drivers and Limiters

8.5 Competitive Market Share Analysis

9. Ultrasound Imaging Market

9.1 Introduction

9.2 Market Overview

9.3 Market Analysis and Forecast

9.3.1 Total Ultrasound Imaging Market

9.3.2 Cardiology Ultrasound Market

9.3.3 Radiology Ultrasound Market

9.3.4 Obstetrics and Gynecology Ultrasound Market

9.3.5 Urology Ultrasound Market

9.3.6 Surgery Ultrasound Market

9.3.7 Vascular Ultrasound Market

9.3.8 Ophthalmic Ultrasound Market

9.3.9 Point-Of-Care Ultrasound Market

9.4 Drivers and Limiters

9.5 Competitive Market Share Analysis

10. Computed Tomography Imaging Market

10.1 Introduction

10.2 Market Overview

10.3 Market Analysis and Forecast

10.3.1 Total Computed Tomography Imaging Market

10.3.2 16/20 Slice Market

10.3.3 32/40 Slice Market

10.3.4 64 Slice Market

10.3.5 Ultra-Premium Slice Market

10.4 Drivers and Limiters

10.5 Competitive Market Share Analysis

11. Nuclear Medicine Imaging Market

11.1 Introduction

11.2 Market Overview

11.3 Market Analysis and Forecast

11.3.1 Pet/Ct Nuclear Medicine Imaging Market

11.3.2 Spect Nuclear Medicine Imaging Market

11.3.3 Spect/Ct Nuclear Medicine Imaging Market

11.4 Drivers and Limiters

11.5 Competitive Market Share Analysis

12. Contrast Agent and Injector Imaging Market

12.1 Introduction

12.2 Market Overview

12.3 Market Analysis and Forecast

12.3.1 Total Contrast Agent Market

12.3.2 Contrast Injector Market

12.4 Drivers and Limiters

12.5 Competitive Market Share Analysis

A selection of companies mentioned in this report includes

- Abbott

- ACIST Medical System

- AGFA Healthcare

- Alpinion

- Amrad Medical

- Arcoma-IMIX

- Assured Imaging Mobile Mammography

- B Braun

- Bayer

- BD

- Boston Scientific

- Bracco

- BrainLab

- Butterfly Network

- Canon Medical

- Carestream

- CMR-Naviscan

- Cuattro

- DGH-KOI

- Ellex/Lumibird Imaging

- Esaote

- eZono

- Fischer-Giotto

- Fujifilm

- GE Healthcare

- Guerbet

- Hologic

- iCRco

- Imaging Dynamics Company

- Keeler

- Konica Minolta

- Lakeshore Technologies Inc.

- Lantheus Medical Imaging

- Machnet B.V.

- MILabs

- Mindray

- Neusoft Medical Systems

- Olympus

- Omega Medical Imaging

- Philips Healthcare

- Planmed OY

- Quantel Medical

- Rayence

- Rivanna

- Samsung

- Shimadzu

- Siemens Healthineers

- Smart Breast

- SonoCine

- Sonogage

- Sonomed Escalon

- Spectrum Dynamics

- Stryker

- Swissray

- Synaptive Medical

- Teleflex

- Terason

- The Prometheus Group

- Tomey

- TXR

- UMG/Del Medical

- United Medical Imaging Healthcare

For more information about this report visit https://www.researchandmarkets.com/r/k9mv69

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment