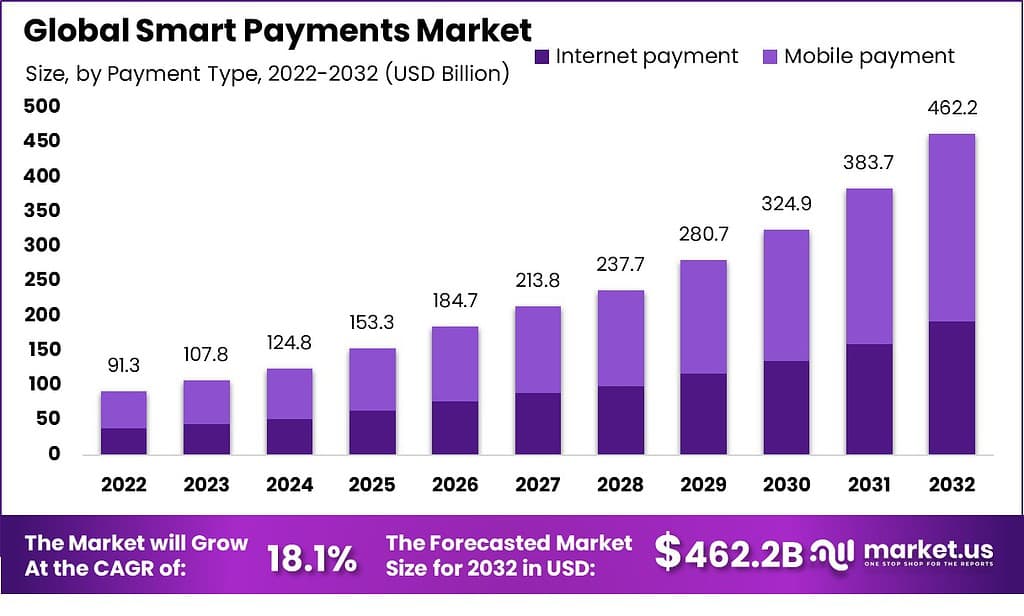

New York, Dec. 06, 2023 (GLOBE NEWSWIRE) -- According to Market.us, The Global Smart Payments Market size is poised to cross USD 124.8 Billion in 2024 and is likely to attain a valuation of USD 462.2 million by 2032. The Smart Payments industry share is projected to develop at a CAGR of 18.1% from 2023 to 2032.

Smart payments involve a diverse set of secure, data-powered digital payment techniques, all with the aim of enhancing the efficiency, safety, and ease of financial transactions. They hold a vital position in the ever-changing world of contemporary finance, delivering advantages to individuals, companies, and entire economies. The traditional payment options, including cash or card-based transactions aren't without limitations in terms of security and ease of use. Smart Payments seek to eliminate these limitations by providing new methods payment methods that are quicker and more easily accessible. They are also specifically designed to meet the needs of today's consumers.

One of the most important aspects in Smart Payments is usage smartphones, like smartphones or wearables as payment tools. Mobile payment apps allow users to keep their information regarding payments in a secure manner and conduct transactions simply by scanning, tapping, or with biometric authentication. This means that you no longer need to carry a physical wallet or cards, providing an easier and more convenient payment experience.

Want to Access the Statistical Data and Graphs, Request PDF Sample @ https://market.us/report/smart-payments-market/request-sample/

"The rapid adoption of digital technology, the growing preference for cashless transactions, and the increasing emphasis on secure and convenient payment methods are among the key drivers propelling the heightened interest in smart payments. Additionally, the integration of advanced technologies such as Near Field Communication (NFC), contactless payments, and mobile wallets has further accelerated the demand for innovative and efficient payment solutions." Says Mr. Yogesh Shinde (Team Lead at Market.us)

Key Takeaway:

- By payment type, the mobile payment segment leads the market with the highest revenue share of 58.5%.

- By end-use industry, the retail sector dominates the segment with a revenue share of 33.0% in the account.

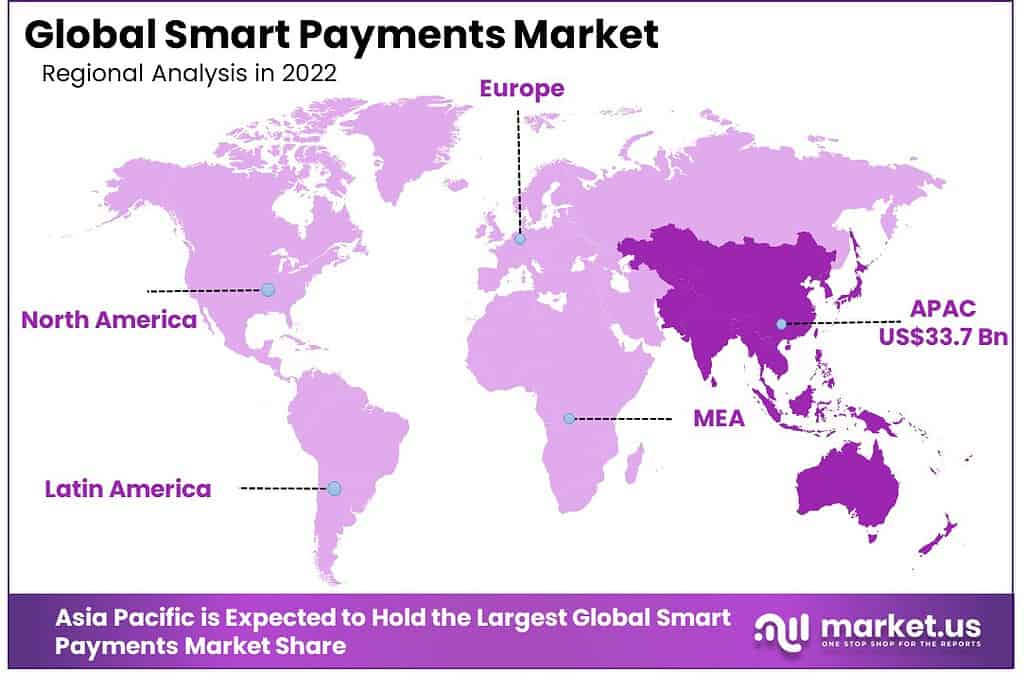

- Asia Pacific leads with a revenue share of 37.0% in 2022.

- North American market is anticipated to grow at a high CAGR during the forecast period.

High demand for smart payments is primarily driven by convenience, security, technological progress, shifting consumer habits, and changing business approaches. As these elements continue to change, the adoption of smart payment techniques is expected to expand, fundamentally altering the way financial transactions are carried out worldwide. It is expected to fuel the market growth during the projection period.

Factors affecting the growth of the Smart Payments Market

Several factors can affect the growth of the Smart Payments market. Some of these factors include:

- Increasing smartphone usage: The extensive adoption of smartphones has laid the essential groundwork and made things more convenient for the expansion of smart payment methods. With the accessibility of smartphones, the incorporation of advanced technology, and shifts in what consumers prefer, smartphones have emerged as a key catalyst for the growing appeal of smart payment solutions. Consequently, the expected increase in smartphone usage is likely to fuel market growth in the foreseeable future.

- Rise in e-commerce: The surge in online shopping and the digital commerce sector has significantly heightened the demand for smart payment solutions. The rapid growth of e-commerce has reshaped consumer behavior and expectations, leading to a greater reliance on secure and modern payment choices. Hence, rising e-commerce is expected to contribute to the market growth during the projection period.

Top Trends in Global Smart Payments Market

Rising decentralized finance platforms:

The rise of decentralized finance platforms presents a challenge to conventional financial systems by providing decentralized lending, borrowing, and trading opportunities, frequently built on blockchain networks. It is expected to drive market expansion over the projection period.

Market Growth

The desire for smart payment solutions is driven by convenience, security, technological progress, shifting consumer habits, and evolving business strategies. As these elements continue to develop, the adoption of smart payment techniques is expected to expand, fundamentally altering how financial transactions are carried out globally. It is likely to contribute to the market growth during the estimated time period.

Regional Analysis

Asia Pacific region leads the market by accounting for a significant revenue share of 37.0%. The Asia-Pacific area, notably nations like China and India, has witnessed swift economic expansion, accompanied by a surge in technology adoption. The demand for Smart Payments in Asia-Pacific reached USD 33.7 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. This growth can be attributed to changing lifestyles, the latest advancements in online retail, and the growing prevalence of smartphones. Additionally, government efforts to promote cashless transactions in Asia-Pacific countries have further amplified the expansion of the regional market.

Build a Future-proof Business! Buy our Premium Insights at Affordable Prices Now: https://market.us/purchase-report/?report_id=105795

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include American Express Company, Apple Inc., Google LLC, MasterCard, One Communication Limited, PayPal Holdings Inc., Samsung, Visa Inc., Amazon.com, Inc., Square. Inc., and other key players.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 107.8 Billion |

| Forecast Revenue 2032 | US$ 462.2 Billion |

| CAGR (2023 to 2032) | 918.1% |

| Asia Pacific Revenue Share | 37% |

| Base Year | 2022 |

| Historic Period | 2016 to 2022 |

| Forecast Year | 2023 to 2032 |

Market Drivers

Rising smartphone usage and key government initiatives are driving the demand for smart payments

Smartphones serve as a platform for mobile wallet applications like Apple Pay, Google Pay, and Samsung Pay. These apps enable users to securely store their payment card information and make contactless payments using smartphones. The convenience of simply tapping a phone to make a payment has popularized this method. Thus, rising smartphone usage is likely to fuel the demand for smart payments during the forecast period. Also, supportive government initiatives have fuelled the demand for smart payments.

Market Restraints

Security concerns associated with smart payments

Several fraudulent methods, including account hijacking, identity theft, and phishing, present dangers to smart payment systems. The consequences of these illicit activities can result in significant financial losses for both individuals and businesses. These security risks have the potential to impede the market's expansion in the projected period.

Market Opportunities

Increasing technological advancements

As new technologies like the Internet of Things (IoT) and blockchain continue to advance, smart payments are poised to become smarter, more streamlined, and safer. For example, IoT-enabled devices are already facilitating automatic payments in various contexts, such as connected cars and smart homes. Meanwhile, blockchain's decentralized and transparent nature has the potential to revolutionize our understanding of payments, enhancing their efficiency even further. Hence, such beneficial technological advancements are likely to propel market growth during the projection period.

Stay informed about market trends and growth opportunities: https://market.us/report/smart-payments-market/request-sample/

Report Segmentation of the Smart Payments Market

By Payment Type Insight

Mobile payment leads the payment type segment by accounting for a major revenue share in the market during the forecast period. An increased availability of high-speed internet connectivity allows numerous businesses to establish mobile-oriented payment options for their customers. Another contributing factor is that in today's context, nearly everyone possesses a smartphone, which not only makes it convenient to use smart payment systems but also helps maintain privacy.

By End-use Industry Insight

The retail sector dominates the end-use industry segment by accounting for the largest revenue share in the market. This growth be attributed to the growth of the mobile industry, which is facilitating digital payments. This surge has boosted digital transactions, leading people to rely on smart payment methods for their everyday product purchases and bill settlements. This is a major factor which is likely to fuel segment growth during the projection period.

Market Segmentation

By Payment Type

- Internet payment

- Mobile payment

By End-Use Industry

- Retail

- Transportation

- Hospital

- Media and Entertainment

- Other End-Use Industry

By Geography

- North America

-

- The US

- Canada

- Mexico

- Europe

-

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Western Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

-

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

-

- South Africa

- Saudi Arabia

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The global Smart Payments market is moderately competitive and major market players have a prominent presence. The market is growing at a high rate due to growing smartphone usage. Also, mergers and acquisitions, new strategic agreements, and key product innovations by key market players are expected to contribute to the market growth during the upcoming time period.

- American Express Company

- Apple Inc.

- Google LLC

- Mastercard

- One Communication Limited

- PayPal Holdings Inc

- Samsung

- Visa Inc.

- com, Inc

- Inc

- Other Key Players

Recent Development of the Smart Payments Market

- June 2022: Verizon Business explored the possibility of teaming up with First National Bank of Omaha (FNBO) and Mastercard to introduce a credit card designed specifically for small business owners. This special credit card, known as the Verizon Business Mastercard, is accessible to businesses that have an online account and maintain less than 100 connections. When using the card, users will have the opportunity to earn reward points for every transaction they make.

- December 2021: Xiaomi had made an official announcement about the release of the Mi Smart Band 6, a cutting-edge product created in partnership with MasterCard. This innovative device provides the essential feature of making contactless payments at terminals that are compatible with MasterCard transactions.

Explore Extensive Ongoing Coverage in Information and Communications Technology Market Research Reports Domain:

- Digital Signage market is expected to reach USD 52.7 billion in 2032. Between 2023 and 2032, register the highest CAGR of 7.7%.

- Payment gateway market is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5%.

- Payment Processing Solutions Market size is expected to be worth around USD 198 Billion by 2032, growing at a CAGR of 12.00%.

- Virtual Content Creation Market sales are anticipated to surge to USD 47.3 billion by 2032. Demand is poised to soar at 25.7% CAGR.

- Collision Avoidance Sensor Market size is expected to be worth around USD 15.1 Billion by 2032, growing at a CAGR of 11.90%.

- Image Sensors Market is expected to grow at a CAGR of roughly 8.1%. It will reach USD 55.8 Bn in 2032, from USD 28.2 Bn in 2023.

- Multi-factor Authentication Market is expected to be valued at USD 49.7 in 2032, from USD 14.4 Bn in 2023 with a CAGR of 15.2%.

- Security Safes Market is poised to soar to an estimated total valuation of around USD 12,546.9 Million by 2033; projected CAGR of 17.2%

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: