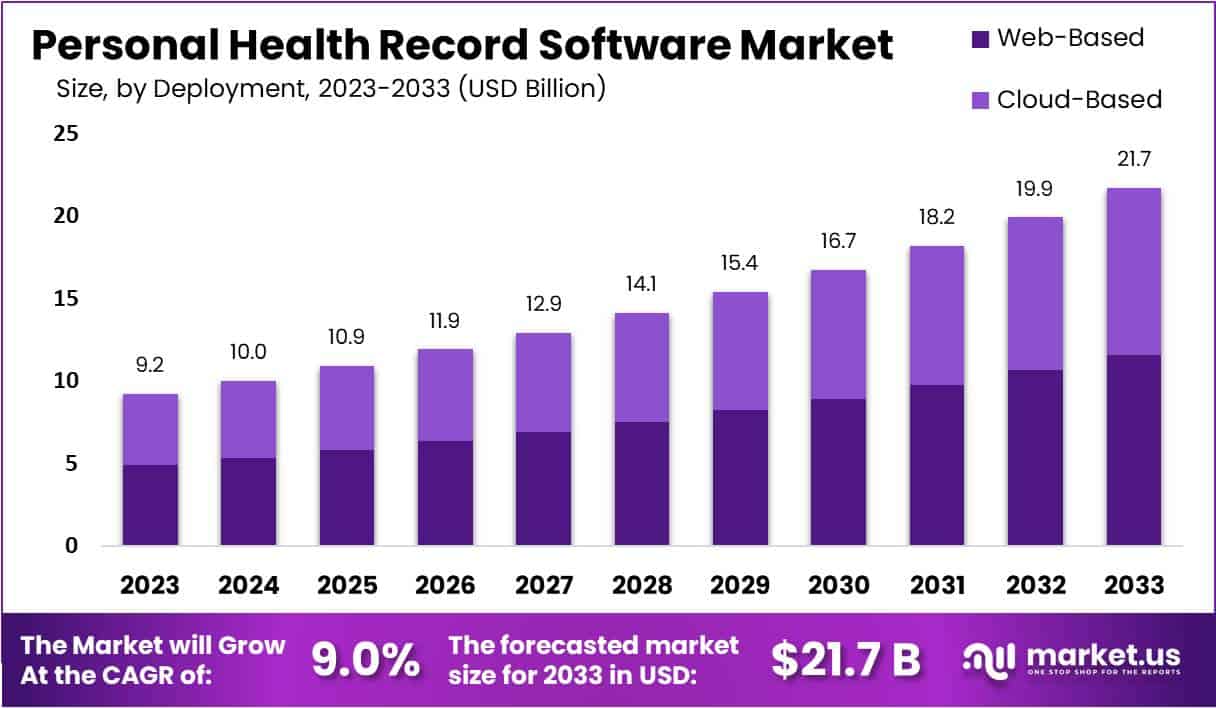

New York, Jan. 08, 2024 (GLOBE NEWSWIRE) -- According to market.us, the Personal Health Record Software Market is expected to achieve a valuation of approximately USD 21.7 Billion by 2033, surpassing the 2023 figure of USD 9.2 Billion. This growth is forecasted to occur at a Compound Annual Growth Rate (CAGR) of 9% from 2024 to 2033.

Personal Health Record (PHR) software stands as a crucial digital asset, empowering individuals to efficiently organize and electronically store their health information. It encompasses features tailored for comprehensive health management, allowing users to input and update medical history, meticulous medication tracking, and seamless documentation of allergies/immunization records. The software's appointment and health tracker aids in coordinating medical events and monitoring essential metrics. With secure access, only authorized individuals can retrieve personal health information, promoting confidentiality.

The PHR software market has witnessed significant growth due to heightened awareness of health information management, digital healthcare transformation, and government initiatives supporting PHR use to enhance patient outcomes and reduce costs. The market's dynamism is driven by vendors striving to offer user-friendly, secure, and interoperable solutions amid healthcare industry digitization.

Get PDF Sample for Technological Breakthroughs@ https://market.us/report/personal-health-record-softwaremarket/request-sample/

Key Takeaway:

- Thriving Market Growth: The Personal Health Record Software market is poised to soar to USD 21.7 Billion by 2033, showcasing a robust 9% Compound Annual Growth Rate (CAGR) from 2024-2033.

- Cloud-Based Dominance: In 2023, Cloud-Based solutions claimed a significant 53.4% market share. Users prefer the accessibility and real-time updates offered by cloud-based platforms, contributing to their dominance in the deployment segment.

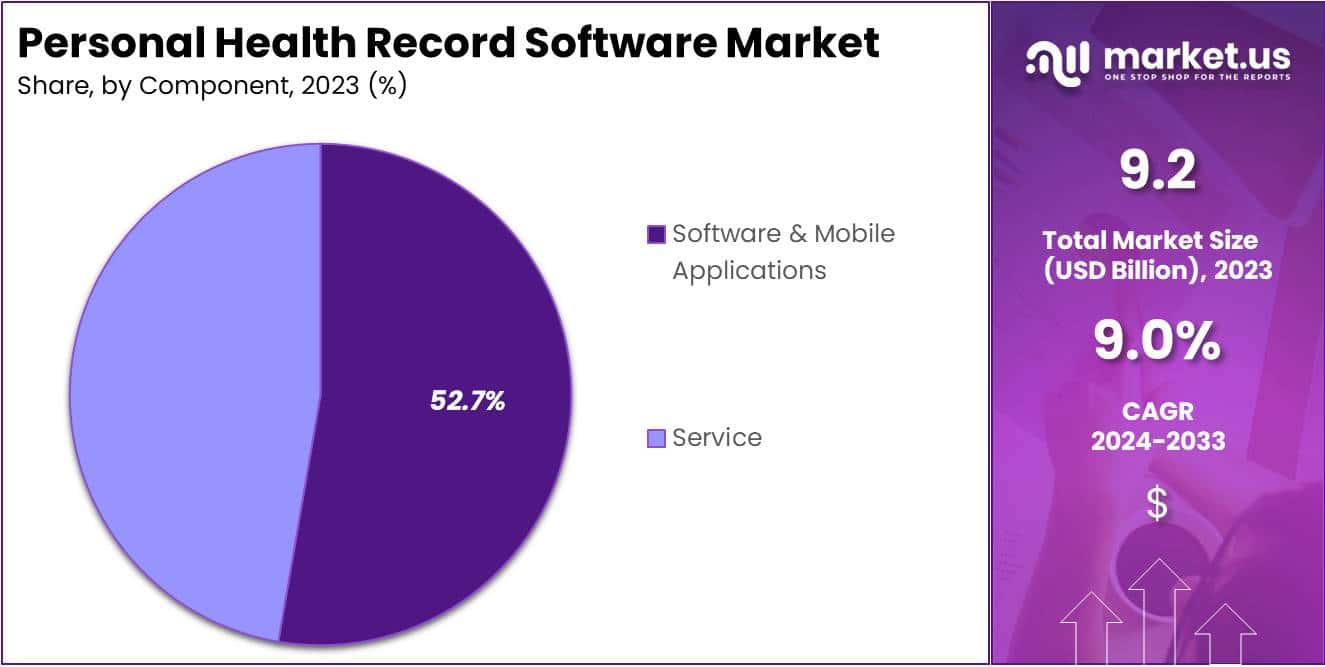

- User-Centric Software: Software & Mobile Applications took the lead in 2023, commanding a 52.7% market share. This highlights the emphasis on user-centric design, ensuring efficient management of health data through intuitive applications.

- Standalone Autonomy: Standalone PHR Software asserted its presence with a 40.1% market share in 2023. This architecture provides users with autonomy in managing their health records independently, contributing to its popularity.

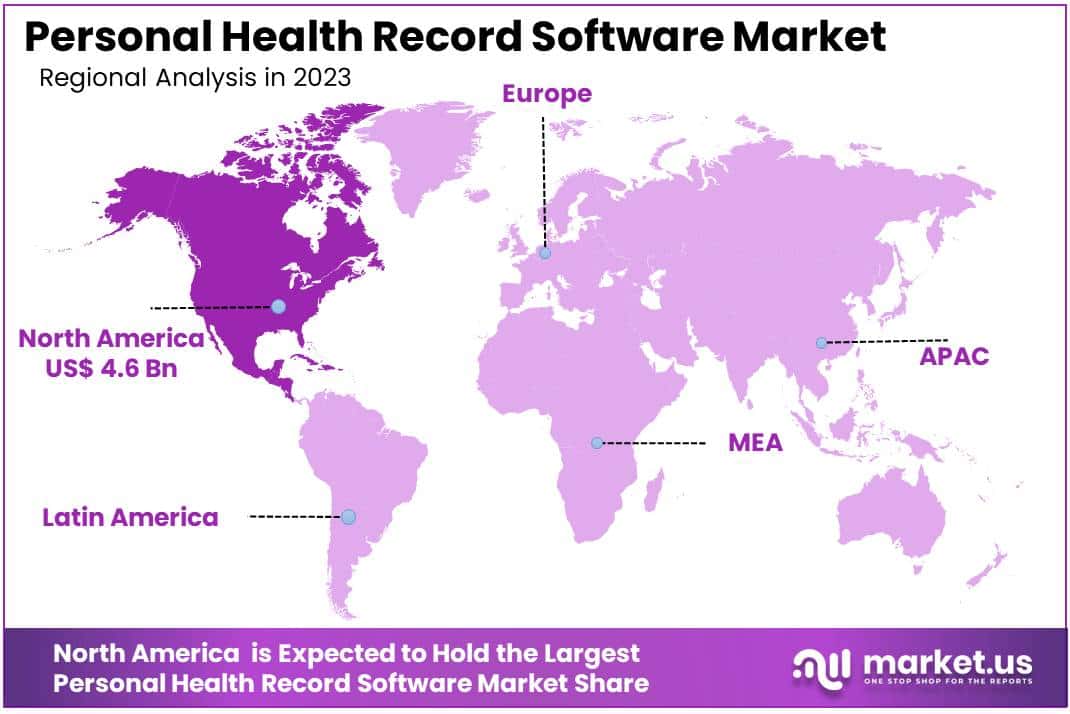

- Regional Leadership: North America took the lead in 2023, commanding a substantial 50.2% market share valued at USD 4.6 Billion. This dominance is attributed to advanced infrastructure, widespread technology adoption, and supportive government policies in the region.

- Exploring Opportunities: Emerging market adoption, integration of Artificial Intelligence (AI) and Machine Learning (ML), collaborations with insurance companies, and expansion into telehealth services present promising growth opportunities for Personal Health Record Software providers.

Factors affecting the growth of the Personal Health Record Software industry

Various factors influence the growth of Personal Health Record Software market are;

- Growing Awareness and Patient Interest: More people are realizing how important it is to keep track of their health records. People want to actively manage their health, and this is driving the demand for software that helps them do that.

- Mobile Health App Trends: With everyone using smartphones, there's a rising trend in using mobile apps for health. PHR software that works well on phones and is easy to use aligns with the increasing habit of checking health information on the move.

- Data Security and Privacy Worries: Since health information is so private, people are really concerned about how it's handled. Software that puts a strong focus on keeping data safe and follows privacy rules is more likely to be trusted and used.

- Advancements in Tech Helping PHR: Technology is always improving, and that's true for PHR software too. Things like AI and machine learning are making these systems more powerful. Features like predicting health trends and giving useful insights can make these systems even more helpful for users.

Regional Analysis

In 2023, the global Personal Health Record (PHR) Software Market displayed a marked regional variation, notably with North America emerging as the predominant player, securing over 50.2% market share and a value of USD 4.6 Billion. The region's advanced healthcare infrastructure and high technology adoption fueled the widespread implementation of personal health record solutions.

Supportive government initiatives promoting digitization further heightened the demand for PHR software in North America. Key market players and continuous advancements in healthcare IT solutions positioned the region as a leader in developing cutting-edge PHR software to meet evolving needs of both healthcare providers and patients. Increased consumer awareness about the benefits of digital health records, such as enhanced access to medical information and improved patient engagement, significantly contributed to North America's dominance.

Looking ahead, Asia-Pacific anticipates explosive growth driven by rising healthcare expenditures and a push for modernizing healthcare infrastructure, while Europe is poised for steady market share gains, leveraging its established healthcare system and focusing on patient-centric care. As global healthcare evolves, regional disparities in market trends will play a pivotal role in shaping its trajectory.

To explore the transformative potential of our report for your business strategy, request a brochure at https://market.us/report/personal-health-record-softwaremarket/#inquiry

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 9.2 Billion |

| Forecast Revenue 2032 | USD 21.7 Billion |

| CAGR (2024 to 2033) | 9% |

| North America Revenue Share | 50.2% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Market Drivers

The growth of the PHR software market is propelled by the increasing digitization of healthcare, as global systems shift to digital records, making personal health record (PHR) software crucial for efficient record maintenance and access. This transition not only enhances efficiency but also reduces paperwork, as evidenced by a notable rise in digital record adoption, as highlighted in a recent HIMSS study. The demand for PHR software is further fueled by a rising emphasis on patient-centric healthcare services, empowering individuals to manage their health data for improved outcomes, aligning with the American Medical Association's endorsement of its significance.

Additionally, the integration of wearable technology, such as fitness trackers and smartwatches, contributes to the surge in PHR software usage, given their increasing prevalence and data generation capabilities. Projections from the International Data Corporation (IDC) anticipate rapid growth in wearable device usage, indirectly boosting the PHR software sales market. Furthermore, government initiatives, exemplified by measures like the Health Information Technology for Economic and Clinical Health Act (HITECH), provide crucial support by offering financial incentives for adopting electronic health records, thereby encouraging the widespread use of PHR software.

Market Restraints

Privacy and security challenges loom large in the PHR software market, presenting formidable barriers. The sensitivity of health data necessitates stringent security measures, with rising incidents of breaches in healthcare, as reported by HIPAA Journal, intensifying concerns. The high implementation and maintenance costs pose a significant hurdle for healthcare providers, especially smaller practices, as revealed in a study by the American Hospital Association.

Financial constraints impede the adoption of digital technologies in these settings. Additionally, a notable hindrance emerges in the form of end-users lacking technical know-how, limiting the effective utilization of PHR software capabilities. A survey by the Pew Research Center highlights varying levels of digital literacy among the general population, impacting the uptake of digital health tools. Furthermore, resistance to change within healthcare practices, documented in the Journal of Medical Internet Research, proves to be a common obstacle in embracing technology solutions.

Market Opportunities

PHR software providers are tapping into the immense growth potential of emerging markets, capitalizing on the improved healthcare infrastructure in countries like India and China. The rapid digitization efforts in these regions create vast customer bases for Personal Health Record (PHR) vendors. Additionally, the integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies into PHR software is identified as a significant growth opportunity. These advanced technologies enable the analysis of large datasets, offering personalized healthcare and predictive analytics insights, as highlighted in a McKinsey & Company report.

Collaborations between PHR software vendors and insurance companies further contribute to market expansion, allowing insurers to leverage patient data for risk analysis and personalized policies. The expanding telehealth services also drive demand for effective health record management systems, positioning PHR software as a crucial component in facilitating seamless access to health records for both patients and healthcare providers, according to insights from The Telehealth Market Report.

Get Immediate Delivery | Secure Your Copy of This High-Quality Research Report https://market.us/purchase-report/?report_id=83604

Report Segmentation of the Personal Health Record Software Market

Deployment Insight

In 2023, the Cloud-Based segment dominated the Personal Health Record (PHR) Software Market, holding a substantial 53.4% market share. This widespread preference can be attributed to the user-friendly nature and accessibility of cloud-based solutions, allowing individuals to conveniently access their health records anytime, anywhere. Meanwhile, Web-Based solutions, with a slightly lower market share, gained traction due to their intuitive interfaces and the ability to access health records through standard web browsers.

The rise of Cloud-Based deployment reflects the growing consumer demand for seamless integration across devices and platforms, providing real-time updates for accurate health information. To stay competitive, PHR software providers must tailor solutions to individual user needs, enhancing both Cloud-Based and Web-Based segments with user-friendly features for optimal satisfaction in this evolving market.

Component Insight

In 2023, the Personal Health Record Software Market saw a noteworthy trend, with the Software & Mobile Applications segment taking the lead with a robust 52.7% market share. This dominance stems from the growing reliance on user-friendly digital solutions that prioritize accessibility and convenience in managing personal health information. The surge in adoption is linked to the user-centric design of Software & Mobile Applications, allowing individuals to efficiently organize and access health records on the go.

The Service segment also played a crucial role, with services like implementation, training, and support receiving praise for enhancing the efficiency of software solutions. The harmonious coexistence of Software & Mobile Applications and Services provides users with a comprehensive and user-friendly approach to personal health management. As the market matures, stakeholders anticipate a nuanced interplay among these segments, emphasizing the need for solutions seamlessly fitting into individuals' lives.

Architecture Insight

In 2023, the Personal Health Record (PHR) Software Market witnessed the Standalone segment taking a dominant position with a robust 40.1% share. Standalone PHR Software's self-sufficiency resonated well, enabling users to independently manage their health records. The Provider-Tethered segment closely followed, emphasizing seamless integration with healthcare providers for enhanced coordination. Simultaneously, the Payer-Tethered segment gained traction, focusing on connectivity with insurance providers.

Looking forward, Standalone solutions are expected to maintain their lead, driven by the growing demand for personalized health management. However, the collaborative nature of Provider-Tethered and Payer-Tethered segments is anticipated to contribute to steady market growth, fostering a competitive landscape in the evolving PHR Software Market.

Don't miss out on business opportunities | Get sample pages at https://market.us/report/personal-health-record-softwaremarket/request-sample/

Recent Developments in the Personal Health Record Software Market

- In December 2023, CareCloud Corporation: CareCloud upgraded its PHR platform, now emphasizing interoperability, enabling patients to amalgamate data from diverse healthcare sources and devices.

- In November 2023, Athenahealth Inc.: Teamed up with CVS Health to create a joint PHR platform, merging Athena's EHR features with CVS's pharmacy data for a comprehensive patient health overview.

- In October 2023, Allscripts Healthcare Solutions Inc.: Integrated FollowMyHealth PHR with Humana's Medicare Advantage plans, simplifying member access to health information.

- In September 2023, GE Healthcare: Introduced Health Cloud for Individuals, a new PHR solution empowering individual patients to manage health records and connect with healthcare providers.

- In June 2023, Epic Systems Corporation: Introduced "OpenNotes" in Epic MyChart PHR, allowing direct patient access to physician notes, fostering transparency and engagement.

- In May 2023, eClinicalWorks LLC: Collaborated with Health Catalyst for deeper insights, integrating PHR with Health Catalyst's data analytics platform.

Market Segmentation

Deployment

- Cloud-Based

- Web-Based

Component

- Software & Mobile Applications

- Service

Architecture

- Payer-Tethered

- Provider-Tethered

- Standalone

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the realm of Personal Health Record (PHR) Software, a competitive landscape prevails with distinct strengths exhibited by key players. Epic stands out for its user-friendly interfaces and seamless integration with healthcare systems, enhancing experiences for providers and patients. Cerner Corporation brings innovation, focusing on interoperability and data analytics, providing valuable insights.

Allscripts Healthcare Solutions Inc. offers flexible and customizable PHR Software solutions, catering to diverse healthcare settings. Athenahealth Inc. delivers a cloud-based solution, emphasizing data accessibility and scalability. The market, featuring both established entities and emerging startups, thrives on healthy competition, fostering continuous innovation in PHR Software solutions.

Market Key Players

- Epic Systems Corporation

- Cerner Corporation

- Allscripts Healthcare Solutions Inc.

- Athenahealth Inc.

- McKesson Corporation

- eClinicalWorks LLC

- Greenway Health LLC

- MEDITECH

- GE Healthcare

- CareCloud Corporation

- Amazing Charts LLC

- Other Key Players

Browse More Related Reports

- Patient Registry Software Market size is expected to be worth around USD 3632 Million by 2032, growing at a CAGR of 12% during the forecast period from 2023 to 2032.

- Remote Patient Monitoring Software and services Market size is expected to be worth around USD 78.4 Billion by 2032, growing at a CAGR of 28.7% during the forecast period from 2023 to 2032.

- Patient Portal Market size is expected to be worth around USD 21.9 Billion by 2033, growing at a CAGR of 20.1% during the forecast period from 2024 to 2033.

- Medical Transcription Software Market size is expected to be worth around USD 190.2 Billion by 2032, growing at a CAGR of 9.60% during the forecast period from 2023 to 2032.

- Clinical Perinatal Software Market size is expected to be worth around USD 808.4 Mn by 2033 from USD 287.3 Mn in 2023, a CAGR of 10.9%.

- Patient Engagement Solutions Market size is expected to be worth around USD 113.4 billion by 2033, from USD 20.6 billion in 2023.

- Wearable Medical Devices Market size is expected to be worth around USD 156.0 Billion by 2032, growing at a CAGR of 16.60%.

- Oncology Market size is expected to be worth around USD 628 Billion by 2032 from USD 208 Billion in 2022, at a CAGR of 12% (2022-2032).

- Artificial Disc Replacement Market size is expected to reach USD 2032.6 Mn by 2033 from USD 660.3 Mn in 2023, at a CAGR of 11.9% (2024-2033).

- Tumor Ablation Market size is expected to be worth around USD 4,389 Million by 2032, growing at a CAGR of 13% during the forecast period from 2023 to 2032.

- Biohacking Market Size Was USD 16 Billion In 2022 And Projected To Reach a Revised Size Of USD 83 Billion By 2032.

About Us:

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn

Our Blog: