Dublin, Jan. 15, 2024 (GLOBE NEWSWIRE) -- The "Large Satellite Propulsion and AOCS Subsystem Market - A Global and Regional Analysis: Focus on Application, End User, Subsystem, and Region - Analysis and Forecast, 2023-2033" report has been added to ResearchAndMarkets.com's offering.

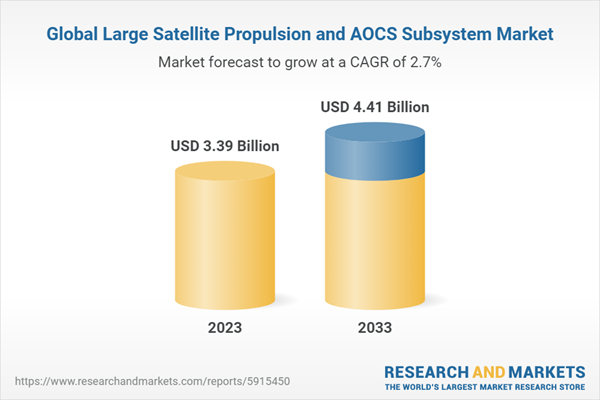

The global large satellite propulsion and AOCS subsystem market is estimated to reach $4.41 billion by 2033. The study also highlights that the market is set to witness a CAGR of 2.66% during the forecast period 2023-2033.

The market is witnessing significant growth driven by an increasing demand for advanced satellite capabilities in communication, Earth observation, navigation, and defense applications. The propulsion systems enable satellites to reach their designated orbits, perform station-keeping maneuvers, and conduct orbital adjustments throughout their operational lifespan. Simultaneously, the AOCS ensures accurate orientation, stabilization, and pointing of the satellite's instruments.

In November 2023, Maxar Space Systems announced that it had successfully handed over the operations of the large communication satellite JUPITER 3 to EchoStar. The satellite has 14 solar panels, allowing it to serve a wide range of high-bandwidth communications missions, including deep space missions such as NASA's PPE program, which is part of Gateway.

Industrial Impact

The industrial impact of advancements in large satellite propulsion and attitude and orbit control systems (AOCS) is profound, marking a significant evolution in space technology. These developments have extended the operational life of satellites due to the enhanced capabilities of propulsion systems that facilitate precise orbit placement and maintenance. This aspect is particularly crucial in sectors such as telecommunications and broadcasting, where consistent, long-term service is essential.

Furthermore, AOCS advancements have dramatically improved the precision and stability of satellites, ensuring accurate positioning and orientation. This precision is vital for critical applications such as earth observation, scientific research, and global navigation systems. The combination of advanced propulsion and AOCS technologies not only enhances the performance and reliability of satellites but also opens up new possibilities in space exploration and utilization, driving innovation across various industries.

Market Segmentation:

Segmentation 1: by Subsystem

- Propulsion

- Chemical Thruster

- Electric Thruster

- Cold Gas Thruster

- Hybrid Thruster

- Attitude and Orbit Control Subsystem (AOCS)

- Actuator

- Sensor

- Sun Sensor

- Processor

- Magnetometer

- Reaction Wheel

Segmentation 2: by Region

- North America - U.S. and Canada

- Europe - U.K., Germany, France, Rest-of-Europe

- Asia-Pacific - Japan, India, China, and Rest-of-Asia-Pacific

- Rest-of-the-World - Middle East and Africa, and Latin America

North America region is expected to experience significant growth in the large satellite propulsion and AOCS subsystem market owing to key investments and global companies' active presence in the market and due to rising investment activities in the research and development of novel space technologies. The large satellite propulsion and AOCS subsystem market is currently experiencing significant demand in the U.S. and Canada, driven by notable developments in various end user applications and services. The region captured a significant market share of 43.0% in terms of value in 2022 and witnessed a growth rate of 6.26% over the forecast period.

Regional countries such as the U.S. and Canada are allocating significant funds to support space programs such as satellite launches for plant observation, exploration, communication, and defense applications. For instance, in March 2023, the U.S. Space Force announced its plan to invest a $30 billion budget for FY2024, where more than 60% of the total space budget would be allocated to support the research, development, testing, and evaluation of new technologies.

Recent Developments in the Global Large Satellite Propulsion and AOCS Subsystem Market

- In August 2023, the AFRL awarded a two-year contract to Benchmark Space Systems valued at $2.8 million to develop and qualify thrusters utilizing the Advanced Spacecraft Energetic Non-Toxic (ASCENT) propellant to facilitate maneuvering and in-orbit mobility.

- In July 2023, the engineering team from Aerojet Rocketdyne collaborated with NASA and began the qualification testing on the 12-kilowatt Advanced electric propulsion system (AEPS) thruster. Three AEPS thrusters would be used on the power and propulsion element (PPE) for the station, keeping the lunar Gateway in the planned 15-year mission duration.

- In June 2023, Safran and Terran Orbital announced a partnership to manufacture electric propulsion systems using Safran's PPSX00 plasma thruster. The PPSX00 is a Hall effect plasma thruster designed by Safran for the low Earth orbit satellite sector and is increasingly favored for satellite positioning, orbital transfer, and station keeping.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers: Favorable Government Initiatives to Develop Secure Satellite Communication Infrastructure for Defense Sector

The increasing demand for secure satellite communication infrastructure for the defense sector is a key driver of growth for the large satellite propulsion and AOCS subsystem market. Governments around the world are investing heavily in developing secure satellite communication networks to support their national security needs. These networks rely on large satellites that require high-performance propulsion and attitude control systems (AOCS) to maintain their orbits and provide reliable communication links.

Market Challenges: Stringent Regulations to Control Space Pollution

As space exploration, AOCS satellite and satellite technology continue to advance, the issue of space pollution has become increasingly concerning. Space pollution refers to the accumulation of human-made debris in Earth's orbit, which poses a significant threat to the safe operation of satellites and spacecraft. To address this issue, there is a growing need for stringent regulations to control space pollution. Currently, there are several international guidelines and treaties that address space pollution, including:

- Outer Space Treaty: This treaty prohibits the placement of nuclear weapons in orbit and calls for the avoidance of harmful interference with other states' peaceful exploration and use of outer space.

- UN Space Debris Mitigation Guidelines: These guidelines provide recommendations for minimizing the creation of space debris during launch and satellite operations.

- Kessler Effect: This concept highlights the potential for a chain reaction of collisions in orbit, leading to an exponential increase in debris and making it nearly impossible to operate satellites safely.

Market Opportunities: Innovation in Fuel Technologies

Advancements in satellite propulsion fuel technologies are driven by the need for more efficient, reliable, and environment-friendly propulsion systems. Traditional chemical propellants, such as hydrazine, are highly toxic and hazardous to handle, posing significant safety and environmental concerns. Advanced propulsion technologies, such as electric propulsion (EP) and hybrid propulsion (HP), offer promising alternatives to traditional chemical propellants, providing higher performance, longer lifespan, and reduced environmental impact.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

The global large satellite propulsion and AOCS subsystem market comprises key players who have established themselves thoroughly and have the proper understanding of the market, accompanied by start-ups who are looking forward to establishing themselves in this highly competitive market. In 2022, the large satellite propulsion and AOCS subsystem market was dominated by established players, accounting for 90% of the market share, whereas start-ups managed to capture 10% of the market. With the growing need for advanced defense capabilities and technological innovation, start-ups in the large satellite propulsion and AOCS subsystem market are expected to expand their presence and market share as they bring fresh perspectives and cutting-edge solutions to meet the demands of modern warfare.

Companies Mentioned

- AIRBUS

- Busek Co. Inc.

- Israel Aerospace Industries

- L3Harris Technologies, Inc.

- Moog Inc.

- Northrop Grumman

- OHB SE.

- QinetiQ

- Safran

- Sierra Nevada Corporation

- Maxar Technologies

- Thales Alenia Space

- Sitael S.p.A.

- Jena-Optronik GmbH

- Zenno Astronautics

For more information about this report visit https://www.researchandmarkets.com/r/pf4kx

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment