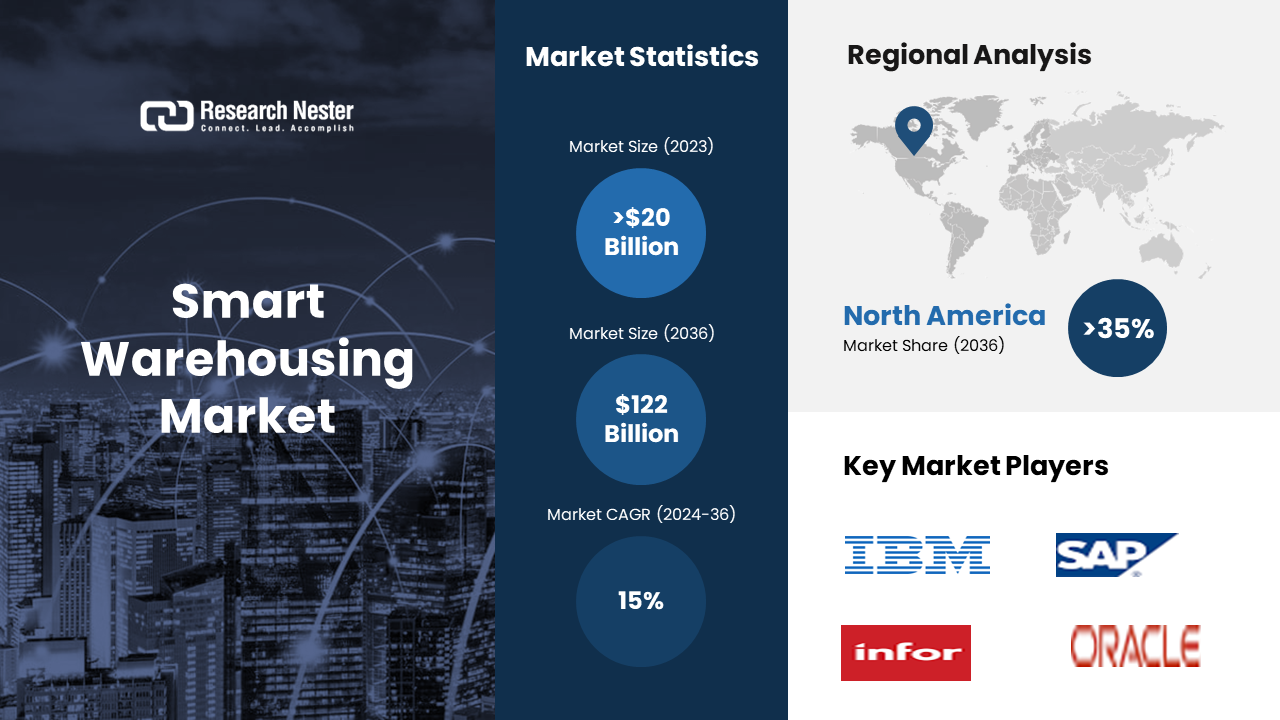

New York, Jan. 17, 2024 (GLOBE NEWSWIRE) -- The global smart warehousing market size is slated to expand at ~15% CAGR between 2024 and 2036. The market is poised to garner a revenue of USD 122 billion by the end of 2036, up from a revenue of ~USD 20 billion in the year 2023.The growth of the market is due to growing incidences of email phishing and ransomware, as well as the need for coherence between security policies and facility audit trails. The number of global ransomware attacks was estimated at 236.1 million during the first half of 2022. In 2021 there was a global outbreak of 623.3 million ransomware attacks. In 2022, the number of ransomwares was around 20 % of all cyber-crimes.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5313

In addition, the smart warehousing industry is taking off as e-commerce's popularity increases and digitalization progresses. To improve and accelerate the supply chain's network, a wide range of suppliers from all over the world are using cutting-edge technologies such as barcode scanning software, automatic driving aids or radio frequency identification technology to reduce errors. In order to develop the market, it is vital that these technologies are used for storage. Smart warehousing extends beyond the warehouse itself, encompassing last-mile delivery solutions that leverage technology to optimize the final stages of the supply chain. Smart warehousing refers to the integration of various technologies to optimize and automate warehouse operations, improving efficiency, accuracy, and overall supply chain management.

Increasing demand for mobile devices across the Globe to Boost Market Growth

As a result of the widespread use of mobile devices such as smartphones and tablets, warehouse workers and logistics partners now have access to many tools and materials. In 2023, there will be 6.8 billion users of smartphones in the world. The scanning of inventory with barcode applications, viewing the precise location of cargo on a map, gathering detailed shipping information and reporting in less than an hour is some of the features that would be advantageous for warehouse managers to manage effectively their entire warehousing process which drives the smart warehousing market growth. The Warehouse 4.0 program is aimed to produce more consistent, interlinked experiences in order to shorten the time that is spent training new employees, warehouses are moving to a voice plus touchscreen-based process for selecting and restocking inventory. Moreover, the integration of low-cost sensors such as computer vision AI robots and high-level computers can be integrated to create a solid warehouse automation system, Internet of Things (IoT), Big Data & Data Scientists, Wearables, Augmented Reality, Low-Cost Sensors, Computer Vision Artificial Intelligence or High-Level Computers. In today's age, 50 percent of the workforce can be controlled. Growth in the market is also driven by an increasing threat to cybersecurity and complexity as well as increased ability to detect and react to security incidents that are occurring at regular intervals.

Smart Warehousing Market: Regional Overview

The market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Expanding technology infrastructure to Drive the Market Growth in North America Region

The smart warehousing market in North America region is estimated to garner the largest revenue by the end of 2036. North America is known for its advanced technology infrastructure and innovative industries, making it a hub for adopting smart warehousing. The region’s strong technology ecosystem and continuous innovation make it a key player in driving the development and adoption of these solutions globally. The smart warehousing market for robotics in North America was strongly growing: the number of manufacturing installations increased by 12% between 2012 and 2022 to 41,624. Number one adopter is the automotive industry: companies based in the US, Canada, and Mexico installed 20,391 industrial robots, up 30% compared to 2021. The surge in e-commerce activities, especially accelerated by the COVID-19 pandemic, has been a primary driver for the adoption of smart warehousing solutions. As consumers increasingly turn to online shopping, businesses are compelled to optimize their warehouse operations for faster order fulfillment and seamless inventory management. Smart warehousing technologies, including automation and real-time data analytics, enable retailers to meet the demands of the dynamic e-commerce landscape efficiently. Advancements in automation and robotics play a pivotal role in enhancing warehouse efficiency. Automated guided vehicles (AGVs), robotic arms, and autonomous mobile robots (AMRs) are streamlining tasks such as picking, packing, and sorting.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5313

E-commerce Boom and Rising Consumer Demand to Propel the Growth in the Asia Pacific Region

The Asia Pacific smart warehousing market is estimated to garner the highest CAGR by the end of 2036. The Asia Pacific region is experiencing an unprecedented surge in e-commerce activities, fueled by a growing middle class and increasing internet penetration. As consumers shift towards online shopping, the demand for efficient and technology-driven warehousing solutions has intensified. Smart warehousing technologies enable businesses to meet the demands of a rapidly evolving e-commerce landscape by optimizing order fulfillment processes and enhancing overall supply chain agility. The e-commerce sales in Asia Pacific is projected to reach USD 2.7 trillion in 2022, with China being a significant contributor. Governments across the Asia Pacific are actively promoting the adoption of Industry 4.0 technologies, including those related to smart warehousing. Incentives, subsidies, and policies supporting the integration of automation, robotics, and IoT technologies are driving widespread adoption. These initiatives aim to enhance manufacturing and logistics capabilities, improve competitiveness, and position the region as a global leader in smart supply chain solutions.

Smart Warehousing, Segmentation by Offering

- Hardware

- Software

- Services

Amongst these segments, the hardware segment in smart warehousing market is anticipated to hold the largest share over the forecast period. The growing popularity of smartphones in many vertical areas, which can be quickly deployed inventory control systems & automated picking tools to simplify the management of inventories and lower total labor costs, has contributed to this growth. In response to the growing consumer demand of Internet of Things, sensor and AI technologies that will improve warehousing operations, vendors are beginning to develop smart warehouse equipment. More than 29 billion Internet of Things (IoT) devices are expected to be installed worldwide in 2030, nearly doubling the number from 15.2 billion in 2020. China is expected to have more than 8 billion consumer devices by 2030, which will be the world's largest market for the Internet of Things. The rollout of 5G networks is a significant driver for hardware growth, particularly in the telecommunications sector. 5G infrastructure requires new and advanced hardware components, including base stations, antennas, and network equipment. The increased data speeds and low latency offered by 5G technology necessitate hardware upgrades to support the demands of a more connected and data-intensive world.

Smart Warehousing, Segmentation by Deployment

- On-Premises

- Cloud

Amongst these segments, the cloud segment in smart warehousing market is anticipated to hold a significant share over the forecast period. Enterprises across industries are embracing digital transformation to enhance operational efficiency, agility, and customer experiences. Cloud computing is a cornerstone of digital transformation, enabling organizations to migrate applications and data to the cloud for scalability and accessibility. As businesses invest heavily in digital initiatives, the demand for cloud services continues to surge. According to IDC, global spending on digital transformation is expected to reach USD 2.3 trillion in 2023. The widespread adoption of remote work and virtual collaboration tools has accelerated the demand for cloud services. Cloud-based applications for video conferencing, project management, and collaboration enable seamless communication and workflow management for distributed teams. As organizations prioritize remote-friendly solutions, the cloud segment experiences sustained growth.

Smart Warehousing, Segmentation by Organization Size

- Small & Medium Enterprises

- Large Enterprises

Smart Warehousing, Segmentation by Technology

- AI & Analytics

- Robotics & Automation

Smart Warehousing, Segmentation by Application

- Transport Management

- Order Management

- Inventory Management

- Predictive Analytics

Smart Warehousing, Segmentation by Industry

- Transportation & Logistics

- Retail & E-Commerce

- Food & Beverages

Few of the well-known indsutry leaders in the smart warehousing market that are profiled by Research Nester are Oracle Corporation, SAP SE, Infor, Inc., Softeon, Korber AG, Manhattan Associates, Inc., PTC, Inc., Tecsys, Inc., Epicor Software corporation, and other key market players.

Recent Development in the Smart Warehousing Market

- Oracle unveiled its Oracle Fusion Cloud Supply Chain & Manufacturing (SCM). It joins shippers' supply networks with a unified suite of cloud business applications. The updates are for subsets in Oracle Fusion Cloud Global SCM-Oracle Transportation Management (OTM) & Oracle Trade Management (GTM)- & are motivated into helping shippers raise efficiency and value all over their global supply chains, and also reduce cost & risk, better experience of the customer, & also become more adaptable to business interruptions.

- Manhattan Associates released its new Order Management Digital Self-Service capabilities. It would offer new features like order cancellations, and enhanced order tracking & returns.

Read our insightful Blogs and Data-driven Case Studies:

- 5G in Information & Communication Technology

Know about the various applications of the 5G technology for consumers. The various kinds of 5G networks are low-band 5G, C-band 5G, mid-band 5G, and millimeter wave 5G. There will be numerous benefits of 5G.

- The impact of an IT Company on Competitive Analysis and Benchmarking

This case study explains the challenges IT company faced in case of competitiveness and benchmarking and how and who offered them with effective solution to overcome these challenges making them expand their business.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.