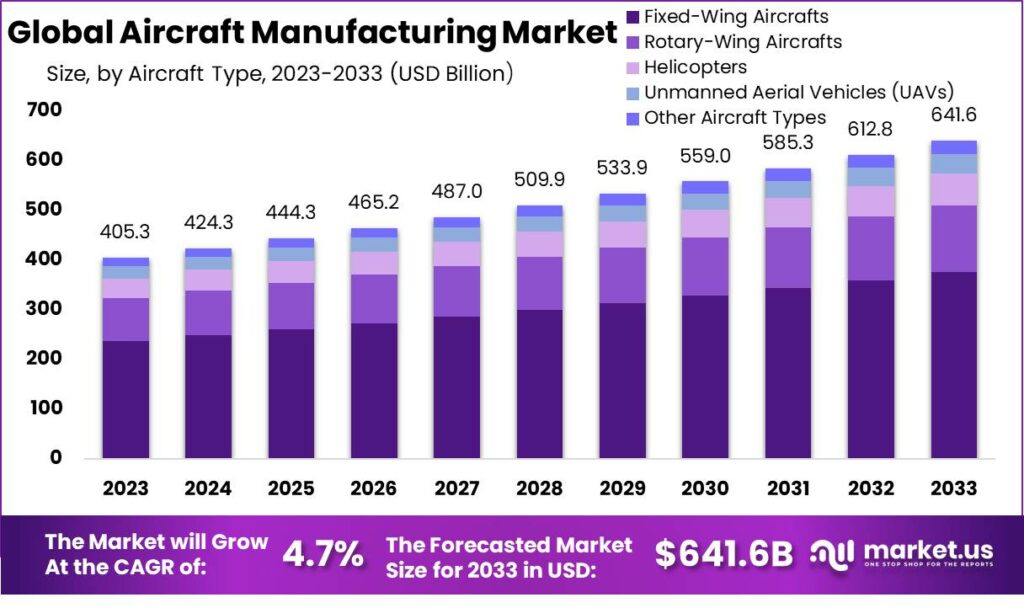

New York, Jan. 23, 2024 (GLOBE NEWSWIRE) -- According to Market.us, The Global Aircraft Manufacturing Market size is expected to be worth around USD 641.6 Billion by 2033, from USD 405.3 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Aircraft manufacturing involves the design, development, production, and assembly of aircraft, including airplanes, helicopters, and unmanned aerial vehicles (UAVs). It encompasses a wide range of activities, including engineering, materials sourcing, manufacturing processes, quality control, and certification. The aircraft manufacturing market refers to the industry and market dynamics surrounding the production and sale of aircraft.

The aircraft manufacturing market is largely dominated by a few major players, such as Airbus and Boeing. These companies have a significant market share and compete in various segments, including commercial, military, and business aviation. They invest heavily in research and development, manufacturing capabilities, and innovation to maintain their competitive edge.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/aircraft-manufacturing-market/request-sample/

Key Statistics

- The Aircraft Manufacturing Market is projected to reach USD 641.6 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

- Fixed-Wing Aircrafts: Fixed-wing aircrafts dominate the market with a share exceeding 58.7%, known for their stability, efficiency, and versatility across sectors.

- Commercial Aviation: Dominating with a 45.2% market share, driven by the growing global population and demand for air travel.

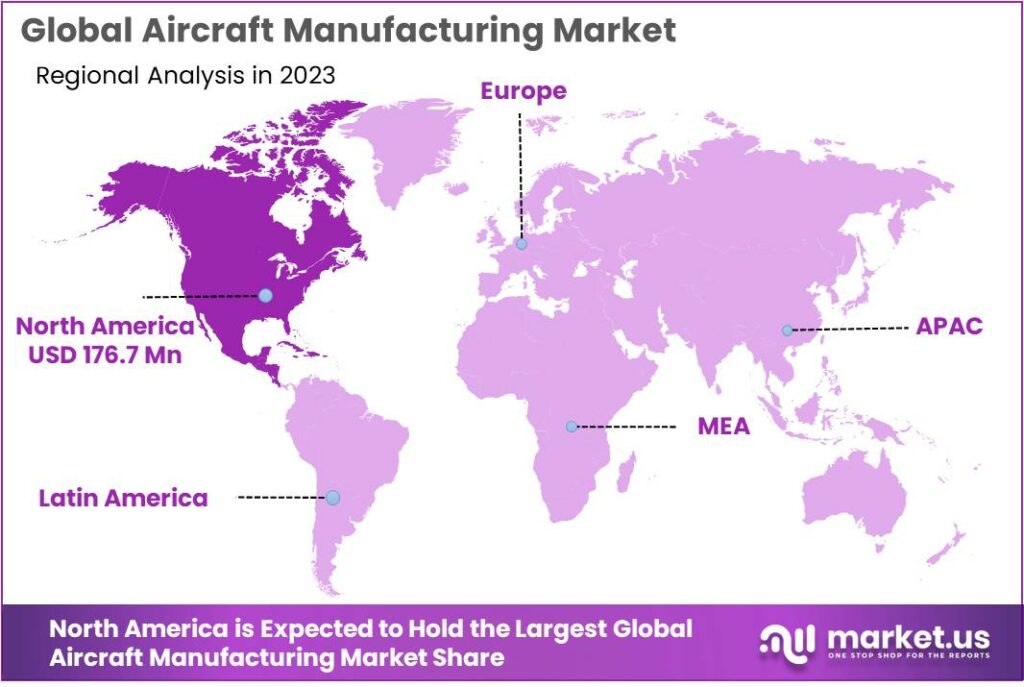

- The Aircraft Manufacturing Market exhibits distinctive regional dynamics, with North America commanding a formidable position, boasting a substantial 43.6% revenue share.

Factors Affecting the Growth of the Aircraft Manufacturing Market

- Economic Growth and Air Travel Demand: Economic growth, particularly in emerging markets, drives the demand for air travel. As income levels rise and middle-class populations expand, more people are able to afford air travel for business and leisure purposes. The increasing demand for air travel leads to higher orders for new aircraft, stimulating the growth of the aircraft manufacturing market.

- Fleet Modernization and Replacement: Airlines worldwide seek to modernize their fleets by replacing older, less fuel-efficient aircraft with newer, more technologically advanced models. Newer aircraft offer improved fuel efficiency, reduced emissions, enhanced passenger comfort, and lower maintenance costs. The need for fleet modernization creates opportunities for aircraft manufacturers to secure orders for new aircraft.

- Technological Advancements and Innovation: Continuous technological advancements drive the growth of the aircraft manufacturing market. Manufacturers invest heavily in research and development to introduce new technologies and improve aircraft performance, safety, and efficiency. Advancements in materials, propulsion systems, avionics, and manufacturing processes contribute to the development of more advanced and sophisticated aircraft, attracting demand from airlines and other operators.

- Environmental Regulations: Increasing concerns about carbon emissions and their impact on climate change have led to stricter environmental regulations. Aircraft manufacturers are under pressure to develop more eco-friendly and fuel-efficient aircraft to comply with these regulations.

- Air Travel Trends: Trends in air travel, such as the growth of low-cost carriers and the emergence of new travel markets, influence demand for different types of aircraft. Manufacturers must adapt to these changing preferences.

- Geopolitical Factors: Geopolitical stability or instability can affect the global aircraft manufacturing market. Trade disputes, tariffs, and diplomatic tensions can disrupt supply chains and impact market dynamics.

Market Dynamics

Driver: Technological Advancements

A key driver for the Global Aircraft Manufacturing Market is ongoing technological advancements. Innovations in aircraft design, materials, and propulsion systems are leading to the development of more fuel-efficient, environmentally friendly, and advanced aircraft. This not only addresses environmental concerns but also attracts airlines seeking to reduce operational costs and meet stricter emission standards.

Restraint: Regulatory Compliance and Environmental Concerns

A significant restraint in the aircraft manufacturing industry is the stringent regulatory environment and increasing environmental concerns. Compliance with safety and emissions regulations adds complexity and cost to aircraft development. Meeting these standards while maintaining profitability can be challenging for manufacturers.

Opportunity: Emerging Markets and Increased Air Travel

An opportunity lies in the growing demand for air travel in emerging markets, particularly in Asia and the Middle East. Rising incomes, urbanization, and a burgeoning middle class are driving increased air travel. Manufacturers have the chance to tap into these expanding markets by providing aircraft tailored to regional needs and preferences.

Challenge: Supply Chain Disruptions

A major challenge faced by the Global Aircraft Manufacturing Market is the potential for supply chain disruptions. Events like geopolitical tensions, natural disasters, or global pandemics can disrupt the flow of critical components and materials, affecting production schedules and leading to delays and increased costs.

Buy Now this Premium Report to Grow your Business: https://market.us/purchase-report/?report_id=25503

Report Segmentation of Global Aircraft Manufacturing Market

Aircraft Type Analysis

In 2023, the Fixed-Wing Aircrafts segment firmly maintained its dominant market position, capturing an impressive 58.7% share of the aircraft manufacturing market. This commanding presence can be attributed to several key factors. Firstly, fixed-wing aircrafts have historically been the backbone of the aviation industry, serving a wide range of applications including commercial air travel, military operations, cargo transportation, and more. Their versatility and reliability have earned them a strong reputation in the aerospace sector.

Moreover, the growing demand for long-range and high-capacity aircraft for commercial purposes has significantly bolstered the prominence of fixed-wing aircrafts. With an increasing global population and the expansion of air travel, airlines have sought to enhance their fleets with large, fuel-efficient aircraft capable of accommodating more passengers. This has led to substantial investments in the manufacturing of fixed-wing aircrafts.

Furthermore, technological advancements in materials, aerodynamics, and propulsion systems have enabled the development of more fuel-efficient and environmentally friendly fixed-wing aircrafts. In an era where sustainability is a paramount concern, the appeal of these aircrafts lies not only in their operational efficiency but also in their reduced carbon footprint.

Additionally, the enduring demand for military fixed-wing aircrafts for reconnaissance, transport, and combat roles has contributed significantly to their dominance in the market. Governments worldwide continue to invest in modernizing their air forces, driving the need for advanced fixed-wing platforms.

End-User Insights

In 2023, the Commercial Aviation segment held a dominant market position, capturing more than a 45.2% share in the global aircraft manufacturing market.

This segment's strong performance can be attributed to several factors that have contributed to its dominance. Firstly, the rise in global air travel demand and the increasing number of passengers opting for commercial flights have driven the growth of the commercial aviation sector. As disposable incomes rise and travel becomes more accessible to a larger population, the demand for air transportation grows steadily. This trend has led to a significant increase in orders for new commercial aircraft, thereby bolstering the market position of the Commercial Aviation segment.

Secondly, the need for fleet modernization and replacement has been a significant driver for the Commercial Aviation segment. Airlines worldwide have been focusing on upgrading their fleets with newer, more fuel-efficient aircraft models. The introduction of advanced technologies and materials has resulted in improved fuel efficiency, reduced operational costs, and enhanced passenger comfort. Airlines are keen on acquiring these modern aircraft to enhance their operational efficiency, reduce maintenance costs, and offer better services to passengers.

Furthermore, the competitive landscape of the commercial aviation sector has contributed to its dominance in the aircraft manufacturing market. Major players in the industry, such as Airbus and Boeing, have a strong market presence and a wide range of aircraft offerings. These companies have established long-standing relationships with airlines, allowing them to secure significant orders and maintain a competitive edge. Additionally, their continuous investment in research and development enables them to introduce innovative and technologically advanced aircraft, further strengthening their position in the market.

Want to Access the Statistical Data and Graphs, Request PDF Sample @ https://market.us/report/aircraft-manufacturing-market/request-sample/

Competitive Landscape

The competitive landscape of the market has also been examined in this report. Some of the major players include:

- The Boeing Company

- Airbus SE

- The Lockheed Martin Corp.

- Embraer S.A.

- Bombardier Inc.

- Textron Aviation Inc.

- BAE Systems plc

- Dassault Aviation SA

- AeroVironment, Inc.

- Northrop Grumman Corp.

- Mitsubishi Aircraft Corp.

- Other Key Players

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | US$ 405.3 Billion |

| Forecast Revenue 2033 | US$ 641.6 billion |

| CAGR (2024 to 2033) | 4.7% |

| North America Revenue Share | 43.6% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2024 to 2033 |

Regional Analysis

In 2023, North America held a dominant market position in the global aircraft manufacturing market, capturing more than a 43.6% share. This regional dominance can be attributed to several key factors that have contributed to its strong market position.

Firstly, North America is home to some of the world's largest aircraft manufacturers, including Boeing in the United States and Bombardier in Canada. These companies have a long-standing history of producing commercial, military, and business aircraft, providing a strong foundation for the region's dominance in the market. Their extensive manufacturing capabilities, technological expertise, and strong industry partnerships have allowed them to cater to the demand for aircraft not only within North America but also globally.

Secondly, North America has a highly developed aviation infrastructure and a significant presence of major airlines. The region's well-established airline industry contributes to the demand for new aircraft, including fleet modernization and expansion initiatives. The need to meet growing passenger demands, replace aging aircraft, and enhance operational efficiency drives the demand for new aircraft in the region.

By Geography

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Browse More Related Reports

- Game-Based Learning Market is expected to reach USD 77.4 bn between 2023 and 2032; register the highest CAGR of 21.6%.

- API Management Market will reach USD 49.9 Billion in 2032, from USD 4.5 Billion in 2022; at a CAGR of 28% during forecast period.

- Electric Vehicle (EV) Charging Infrastructure Market is Set to Attain USD 224.8 Billion by 2032, Expands Steadily at a CAGR of 27.5%.

- Farm Management Software Market was USD 2.60 bn in 2022. It is estimated to reach USD 8.94 bn in 2032, CAGR of 13.5% from 2023-32.

- AI Training Dataset Market was valued at USD 1.9 Billion in 2022. This market is estimated to register the highest CAGR of 20.5%.

- Neuromorphic Computing Market reached USD 4.2 Bn in 2022 and is projected to reach US$ 29.2 Bn by 2032, growing at a CAGR of 22%

- Speech and voice recognition market size is expected to be worth around USD 83 bn by 2032 from USD 14 bn in 2022, grow at a CAGR of 20%

- Telecom Cloud Market is estimated to reach USD 127.6 billion by 2032, growing at a impressive CAGR of 18.9%.

- Dental Practice Management Software Market size is projected to surpass at USD 6.88 Billion by 2032; growing at a CAGR of 11.89%.

- Payment gateway market is expected to reach USD 161 billion in 2032. This market is estimated to register the highest CAGR of 20.5%.

- Digital content creation market size is expected to be worth around US$ 181.4 Bn by 2032 from US$ 24.5 Bn in 2023, at a CAGR of 25.7%.

- IT Professional Services Market was worth USD 776,210 million in 2021 and expected to experience a CAGR of 9.8% between 2023-2032.

- Data Center Server Market was valued at UЅD $61,502.4 Мn in 2020, and is projected to register а САGR of 13.1% over the next 10 years.

- Video Management Software Market is projected to be US$ 4,143 Mn in 2018 to reach US$ 10,931 Mn by 2028 at a CAGR of 10.2 %.

- Surveillance Market Is Projected To Be Us$ 32,800.0 Mn In 2018 To Reach Us$ 95,328.5 Mn By 2028 At A Cagr Of 10.7%

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: