Dublin, Jan. 31, 2024 (GLOBE NEWSWIRE) -- The "Plant-Based Protein Market by Source (Soy, Wheat, Pea, Canola Rice & Potato, Beans & Seeds, Fermented Protein), Type (Concentrates, Isolates, Textured), Form (Dry, Liquid), Nature (Conventional, Organic), Application and Region - Global Forecast to 2028" report has been added to ResearchAndMarkets.com's offering.

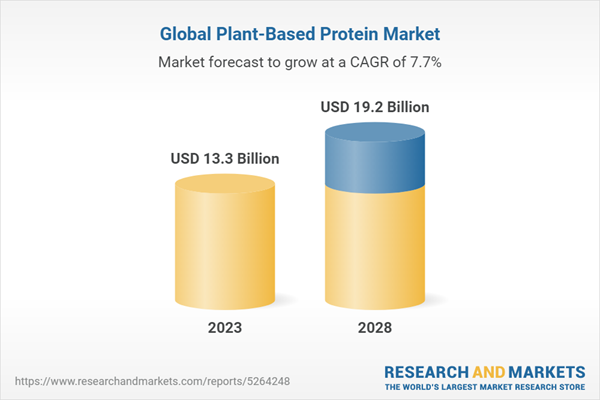

The global market for plant-based protein is estimated to be valued at USD 13.3 billion in 2023 and is projected to reach USD 19.2 billion by 2028, at a CAGR of 7.7% during the forecast period. This report categorizes the plant-based protein market by source, type, form, nature, application and region.

The increasing awareness about health and changing consumer preferences have spurred the demand for plant-based protein products. To boost sales in this market, it is essential to implement effective marketing strategies such as diversification and segmentation. The primary goal is to create a stronger demand among health-conscious individuals, vegetarians, flexitarians, and vegans by positioning the product strategically within the right sales channels.

Utilizing a well-thought-out promotional mix can open growth opportunities within the plant-based protein market. Producers of products like pea protein or soy protein have seen remarkable success by correctly positioning their brands within the plant-based protein category. The rise in health consciousness and evolving lifestyles have driven significant growth in this market. Furthermore, the ongoing efforts by plant-based protein manufacturers to offer innovative flavors, extend product shelf life, and improve nutritional profiles have set the stage for substantial market expansion in the years to come.

Nonetheless, it is worth noting that the high cost of production and potential challenges related to raw material availability can act as constraints in the plant-based protein market. Despite these hurdles, the growing demand for healthier and sustainable protein sources suggests a promising future for the industry.

The concentrates sub-segment in the type of segment is estimated to reach at a USD 8.5 billion during the forecast period

Plant-based protein concentrates play a pivotal role in the growth of the plant-based protein market, as they are derived from various sources like soybeans, peas, and wheat, and undergo processing to enhance their protein content, typically ranging from 40% to 90%. These concentrates are known for their notable qualities, including excellent water-holding and emulsification properties, as well as their ability to control expansion in extruded snacks. The food industry is expected to maintain a high production of plant protein concentrates due to increased protein consumption and the growing use of plant-derived proteins in food products, particularly in developing nations.

The demand for plant-based protein concentrates has surged in recent years due to their versatility in various food categories such as baked goods, snacks, cereals, soups, pasta, sauces, and plant-based dairy and meat alternatives. Companies are also introducing innovative products derived from alternative sources like chickpeas and oats to capitalize on expanding business opportunities. The prevalence of dietary preferences like vegetarianism, veganism, and flexitarianism has further driven the demand for plant-based proteins. This rising demand has spurred innovation in the food industry, resulting in a wide range of plant-based protein products, including burgers and meat substitutes, many of which rely on plant-based protein concentrates to deliver quality and taste. For instance, in February 2019, InnovoPro, an Israeli company, launched CP-Pro 70, claiming to be the first to offer a chickpea concentrate product range, aiming to tap into the growing market for plant-based protein in sports nutrition supplements.

The organic sub-segment of nature segment is projected to grow at the highest CAGR of 8.1% during the forecast period

The demand for organic plant-based proteins has been steadily increasing, particularly following the COVID-19 pandemic. Consumers are gravitating towards clean label and organic ingredients, considering them safer and more nutritious compared to conventional proteins. Organic options offer greater transparency regarding their source. Many plant-based food consumers are conscious of product labeling and have a strong environmental focus, making organic plant-based proteins particularly appealing to this demographic. While the organic plant-based protein market is still in its early stages, it has experienced substantial growth recently. Numerous manufacturers have expanded their product offerings to include organic plant-based proteins to meet this growing demand.

For example, in October 2022, Roquette Frise (France) introduced a new line of organic pea ingredients, including organic pea starch and organic pea protein. These ingredients are sourced from a network of organic pea growers in Canada and produced at their facility in Portage la Prairie, Manitoba. Nature Zen (Canada) also seized the opportunity by launching organic, high-quality plant-based protein in the US market in August 2021, capitalizing on the surge in demand for organic food and ingredients. Orgain (US), a company specializing in organic nutritional products, entered the market with its organic plant-based protein powder in chocolate peanut butter cups at Costco in January 2020.

This product launch aimed to meet the increasing demand from health-conscious millennials for products with simpler and fewer ingredients. The trend toward clean-label products and the desire for greater food source transparency are expected to provide significant growth opportunities for the organic plant-based protein market in the coming years. The strategies adopted by these companies, expanding their product lines to include organic plant-based proteins, align with the growing consumer demand for such products.

Europe to grow at the CAGR of 7.3% during the forecast period, in plant-based protein market to reach a value of USD 6.3 billion by 2028

The European market offers substantial business prospects for plant-based protein ingredient manufacturers. The growing trend of embracing veganism in the region is contributing to increased demand for plant-based protein.

The European plant-based protein market can be categorized into food and feed applications. The rise of new manufacturers of final products and the acceptance of plant-based protein as a viable alternative have resulted in a higher number of product launches. Additionally, the surge in veganism, driven by concerns about sustainability and health, is having a significant impact, not only in the consumer sector but also in the industrial sector, prompting adjustments to product portfolios and processing methods.

The growing shift toward veganism and away from animal-based meat has created significant business opportunities for companies in the plant-based protein industry. According to the Organization for Economic Co-operation and Development-Food and Agriculture Organization (OECD-FAO) Agricultural Outlook 2021-2030, per capita consumption of pork, beef, and lamb is expected to decrease considerably by 2030 in Europe and other developed nations. The European market benefits from the presence of several prominent players in the industry, such as Glanbia plc (Ireland), Roquette Freres (France), and Kerry Group PLC (Ireland).

These manufacturers are actively seeking ways to strengthen their market position, including launching new products, expanding production capabilities, and forming partnerships or making acquisitions with other industry players to enhance their geographical presence and establish a firm foothold in the European plant-based protein industry. For instance, in June 2020, Kerry Group PLC (Ireland) announced the expansion of their plant protein range sourced from peas, rice, and sunflowers in response to rising customer demand in Europe and the increasing popularity of plant-based products like nutritional bars, yogurts, juices, and smoothies.

Market Dynamics

- Drivers

- Growth in Consumer Preference for Vegan Diet

- Growing Interest in Health-Centric Food and Beverages

- Awareness Regarding Meat Alternatives' Role in Environmental Sustainability

- Innovation and Developments Related to Plant-based Protein to Augment Vegan Trend

- Prevalence of Lactose Intolerance

- Restraints

- Allergies Associated with Plant-based Protein Sources, such as Soy and Wheat

- Possibility of Nutritional Deficiencies Among Vegans

- Opportunities

- Emergence of Aquatic Plants as New Sources of Protein

- Effective Marketing Strategies and Correct Positioning of Plant-based Proteins

- Changes in Consumer Lifestyles

- Challenges

- Concerns Over Quality of Food and Beverages due to Adulteration of GM Ingredients

- Economic Constraints Related to Processing Capacity of Pea Protein

- Concerns Regarding Taste and Texture of Plant-based Protein

Case Study Analysis

- Blue Diamond Growers Partnered with Group Lala to Establish Network in Mexico

- Kerry Group PLC Revolutionized Plant-based Products in Asia-Pacific Market

- ADM Offered New Plant-based Proteins to Meet Growing Consumer Demand

- Glanbia Launched Its Grain Portfolio to Address Consumers' Rising Health Concerns

Key Attributes

| Report Attribute | Details |

| No. of Pages | 380 |

| Forecast Period | 2023-2028 |

| Estimated Market Value (USD) in 2023 | $13.3 Billion |

| Forecasted Market Value (USD) by 2028 | $19.2 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

Companies Profiled

- ADM

- Agt Food and Ingredients

- Amco Proteins

- Aminola

- Australian Plant Proteins Pty. Ltd.

- Axiom Foods, Inc.

- Beneo GmbH

- Burcon Nutrascience Corporation

- Cargill, Incorporated

- Cosucra

- DSM

- Emsland Group

- Etchem

- European Protein A/S

- Glanbia PLC

- Ingredion

- International Flavors & Fragrances Inc.

- Kerry Group PLC

- Mycotechnology, Inc.

- Nutraferma, Inc.

- Proeon

- Puris

- Roquette Freres

- Shandong Jianyuan Group

- Sotexpro

- Tate & Lyle

- The Green Labs LLC.

- Wilmar International Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/3dgl30

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment