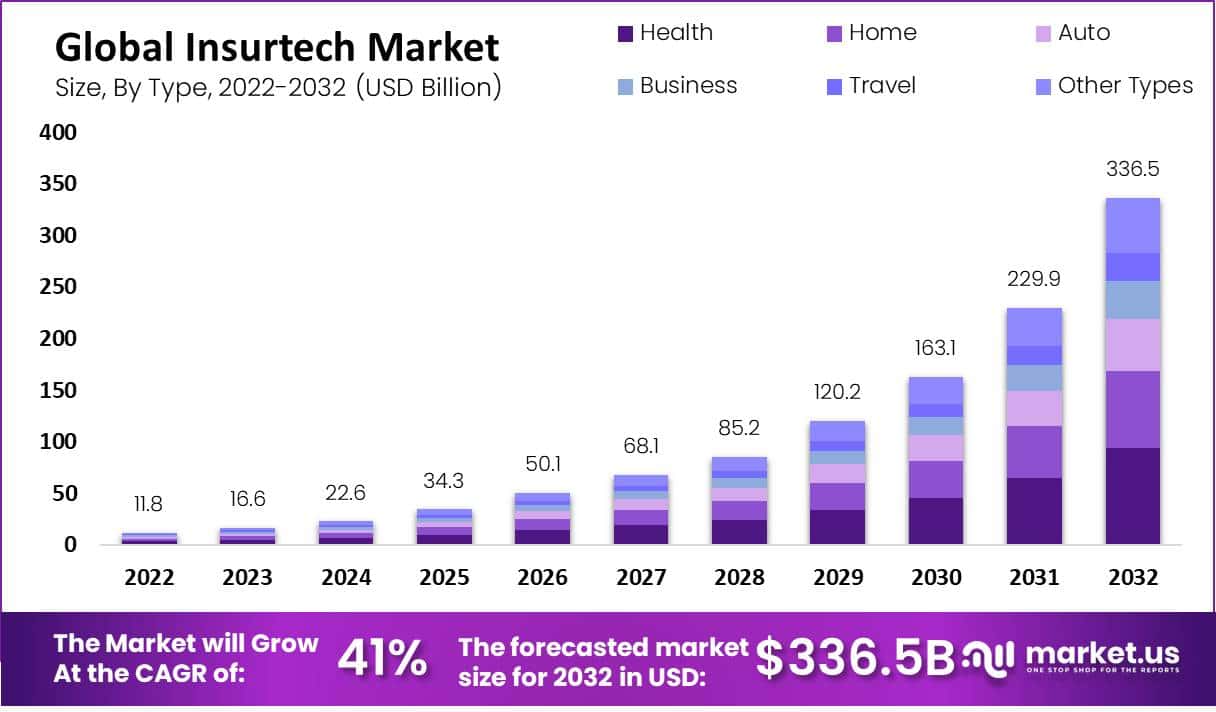

New York, Feb. 08, 2024 (GLOBE NEWSWIRE) -- The Insurtech market is experiencing significant growth, with a projected value of USD 336.5 billion by 2032, showcasing a remarkable Compound Annual Growth Rate (CAGR) of 41.0% from 2023 to 2032.

The Insurtech market, characterized by the integration of innovative technologies into the insurance sector, has experienced substantial growth in recent years. This growth can be attributed to several factors, including the increasing demand for digital solutions, the rise of data analytics and artificial intelligence, and shifting consumer preferences towards seamless, user-friendly insurance experiences. Insurtech companies are leveraging technology to streamline processes such as underwriting, claims management, and customer service, ultimately enhancing operational efficiency and reducing costs for insurers.

Furthermore, the Insurtech market is witnessing significant investment activity, with venture capital firms and traditional insurers alike pouring funds into startups and technologies that promise to revolutionize the industry. These investments are driving further innovation and fueling the development of novel products and services tailored to meet evolving consumer needs.

Drive Your Growth Strategy! Purchase the Report to Uncover Key Insights: https://market.us/purchase-report/?report_id=101093

Important Revelation:

- The Insurtech market is anticipated to witness exponential growth, with a projected value of USD 336.5 billion by 2032, showcasing a remarkable Compound Annual Growth Rate (CAGR) of 41.0% from 2023 to 2032.

- The surge in demand for personalized insurance solutions and the increasing awareness about insurance are driving the growth of the Insurtech market. Innovations in technology are enabling Insurtech companies to cater to specific client interests and offer tailored product offerings, fostering market expansion.

- Type Dominance: The health segment leads the Insurtech industry, fueled by the growing demand for digital platforms connecting brokers, providers, and health insurance carriers.

- Deployment Trends: Cloud-based solutions are gaining prominence due to their cost-effectiveness and scalability, driving market competition and innovation.

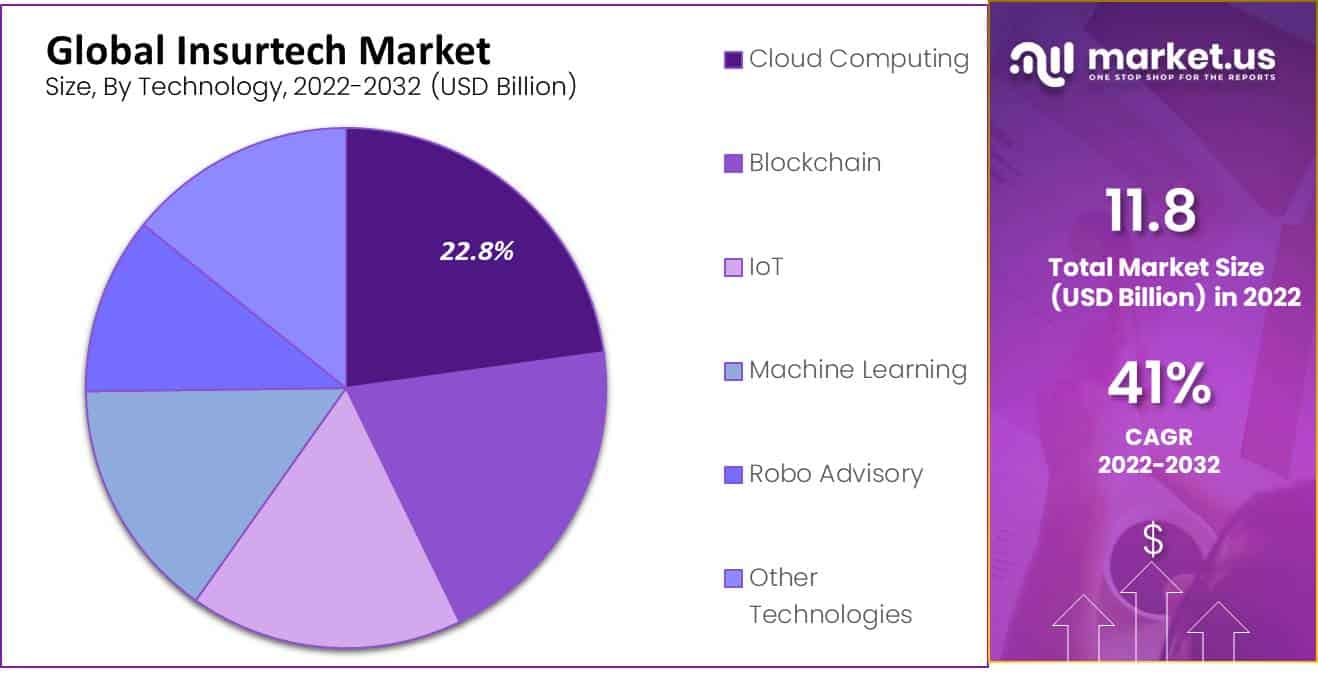

- Technology Advancements: Cloud computing holds a significant market share, offering flexibility, deployment simplicity, and resourcefulness, revolutionizing the insurance industry.

- Services Landscape: Managed services account for a substantial share, providing insurers with expertise and technology to facilitate transformation and improve business models.

- End-User Insights: The BFSI segment remains the primary user of Insurtech solutions, leveraging technology to enhance business efficiency and data management.

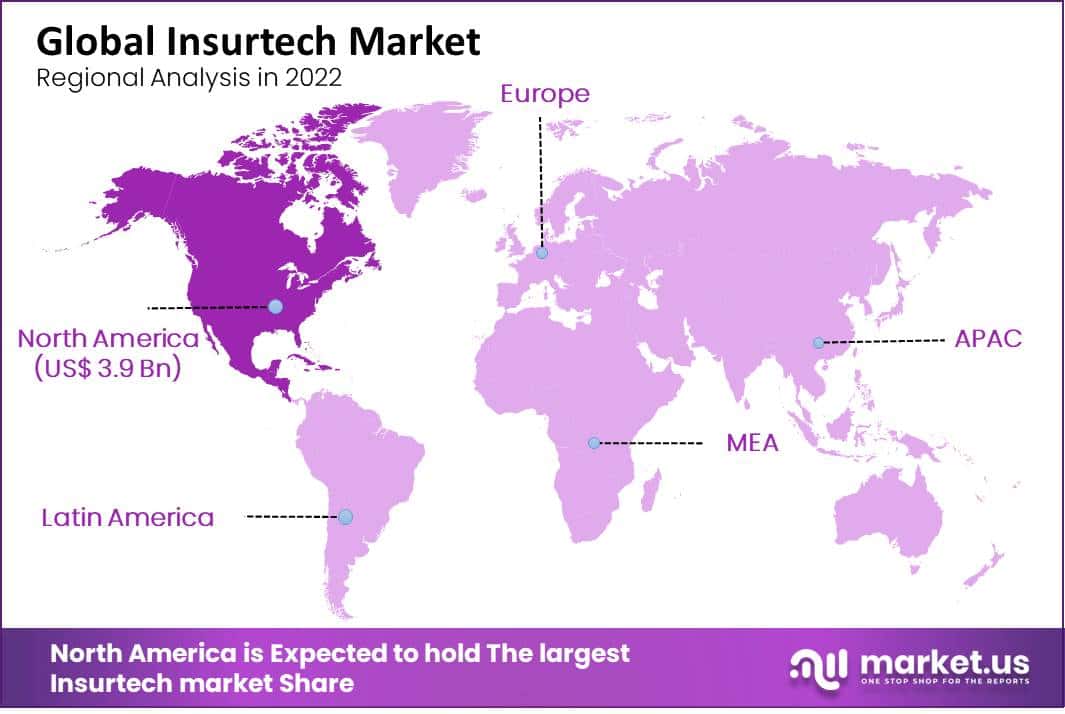

- North America leads the global Insurtech market, driven by increasing product purchases and the presence of numerous startups.

Request Sample Report and Drive Impactful Decisions: https://market.us/report/insurtech-market/request-sample/

Key Influencers in the Insurtech Market Growth

Several key influencers are driving the growth of the insurtech market, shaping its trajectory and fueling innovation within the industry. These influencers encompass a range of factors, including technological advancements, regulatory changes, shifting consumer preferences, and evolving market dynamics. Below are some of the key influencers contributing to the growth of the insurtech market:

- Technological Advancements: Rapid advancements in technology, including artificial intelligence (AI), machine learning, Internet of Things (IoT), blockchain, and data analytics, are revolutionizing the insurance industry. Insurtech companies are leveraging these technologies to streamline processes, enhance underwriting accuracy, improve claims management, personalize insurance products, and enhance overall customer experience.

- Changing Consumer Expectations: Consumers are increasingly demanding seamless, personalized, and digitally-driven insurance experiences. Insurtech startups are capitalizing on this trend by offering innovative solutions that cater to the evolving needs and preferences of modern consumers. From on-demand insurance to usage-based pricing models, insurtech firms are reshaping the way insurance products are designed, distributed, and consumed.

- Regulatory Environment: Regulatory changes and initiatives are also playing a significant role in shaping the insurtech landscape. Regulatory bodies are increasingly embracing innovation and technology-driven solutions to enhance transparency, improve regulatory compliance, and foster competition within the insurance sector. Regulatory sandboxes and pilot programs are providing insurtech startups with opportunities to test new products and services in a controlled environment, driving innovation and market adoption.

- Insurer Partnerships and Collaboration: Traditional insurance companies are recognizing the value of partnering with insurtech startups to drive innovation, improve operational efficiency, and enhance their competitive positioning. Strategic partnerships, joint ventures, and investments in insurtech firms enable insurers to leverage cutting-edge technologies, access new markets, and diversify their product offerings, while providing insurtech startups with access to capital, distribution channels, and industry expertise.

Build a Future-proof Business! Buy our Premium Insights at Affordable Prices Now: https://market.us/purchase-report/?report_id=101093

Regional Analysis:

North America emerges as the leading market for insurtech, commanding a substantial share of the global revenue at 33.6%. This dominance can be attributed to several factors that characterize the region's insurtech landscape. Firstly, North America boasts a mature and technologically advanced insurance market, providing a fertile ground for the adoption of innovative insurtech solutions. The presence of established insurance companies, leading tech hubs, and a supportive regulatory environment further catalyze the growth of the insurtech sector in the region.

Moreover, North America's vast consumer base, characterized by tech-savvy consumers with evolving insurance needs, presents ample opportunities for insurtech startups to thrive and expand their market presence. The region's culture of entrepreneurship and innovation fosters the emergence of disruptive insurtech solutions that cater to diverse segments of the insurance market, from property and casualty to life and health insurance.

Report Segmentation

Type Analysis

In the Insurtech market, the health segment emerges as the predominant force. This dominance can be attributed to the increasing adoption of technology-driven solutions aimed at enhancing the efficiency and accessibility of healthcare insurance services. Factors such as the rising cost of healthcare, the growing demand for personalized insurance plans, and the integration of AI and machine learning for risk assessment have significantly contributed to the health segment's leading position in the Insurtech landscape.

Deployment Analysis

Deployment of Insurtech solutions shows a marked preference for cloud-based platforms over on-premise alternatives. The appeal of cloud-based solutions lies in their cost-effectiveness, scalability, and ease of implementation. These characteristics enable insurance companies to leverage advanced technologies without the need for substantial upfront investments in infrastructure, thereby facilitating more agile and responsive service offerings.

By Technology Analysis

Cloud computing has established a commanding presence in the Insurtech market, securing a revenue share that exceeded 22.8% by 2022. The technology's dominance is underpinned by its ability to provide scalable, flexible, and efficient data storage and processing capabilities. This enables Insurtech companies to deliver innovative services that require high computational power and storage capacity, such as real-time data analysis, predictive modeling, and personalized customer interactions.

By Services Analysis

Within the services spectrum of the Insurtech market, managed services have carved out a significant niche, accounting for more than 36% of total revenue. This segment's prominence is driven by the growing complexity of IT infrastructure and the increasing need for specialized knowledge in managing Insurtech platforms. Managed services offer insurers the expertise and tools necessary to optimize their technological capabilities, enhance operational efficiencies, and mitigate risks associated with cyber security and data privacy.

By End-User Analysis

The Banking, Financial Services, and Insurance (BFSI) sector stands out as the dominant end-user in the Insurtech market, capturing a substantial portion of the global revenue share. This dominance is reflective of the critical role that technological innovation plays in transforming traditional banking and insurance services. The BFSI sector's investment in Insurtech solutions is aimed at improving customer experience, streamlining operations, and developing new business models that can adapt to the changing financial landscape.

Sample Report Request: Unlock Valuable Insights for Your Business: https://market.us/report/insurtech-market/request-sample/

Top Market Leaders

- Damco Group

- DXC Technology Company

- KFin Technologies

- Majesco

- Oscar Insurance

- OutSystems

- Quantemplate

- Shift Technology

- Trov Insurance Solutions LLC

- Wipro Limited

- Zhongan Insurance

Recent Developments

1. KFin Technologies:

- April 2023: Announced a partnership with "PolicyStreet" to offer online insurance distribution platform solutions.

- August 2023: Launched "KFin AI Assist," an AI-powered chatbot for insurance policy servicing and customer support.

- December 2023: Acquired "Mindtree," gaining expertise in developing cloud-based insurance technology solutions.

2. Majesco:

- May 2023: Released "Majesco CloudPhore," a cloud-native core insurance platform offering scalability and agility for the evolving insurance landscape.

- September 2023: Partnered with "Amazon Web Services" to accelerate cloud adoption for its insurance platform solutions.

- November 2023: Launched "Majesco ClaimConnect," a cloud-based claims processing platform featuring AI-powered automation and analytics.

Scope of the Report

| Report Attributes | Details |

| Market Value (2023) | USD 16.6 Billion |

| Forecast Revenue 2032 | USD 336.5 billion |

| CAGR (2023 to 2032) | 41.0% |

| North America Revenue Share | 33.6% |

| Base Year | 2023 |

| Historic Period | 2018 to 2022 |

| Forecast Year | 2023 to 2032 |

Key Market Segments

By Type

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Other Types

By Deployment

- On-Premise

- Cloud-Based

By Technology

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Other Technologies

By Services

- Consulting

- Support & Maintenance

- Managed Services

By End-User

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Other End-Users

By Geography

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Explore Extensive Ongoing Coverage on Technology and Media Reports Domain:

- In 2023, Underwater Drone Market was valued at USD 4.4 Billion, this market is estimated to register the highest CAGR of 12.4% and is expected to reach USD 12.2 Billion during the forecast period of 2023 to 2032.

- Self-service Kiosk Market is anticipated to be USD 48.3 billion by 2033. It is estimated to record a steady CAGR of 7.3% in the Forecast period 2023 to 2033. It is likely to total USD 23.9 billion in 2023.

- Hyperspectral Imaging Market is estimated to garner a market size of USD 51.2 Billion by 2032; rising at a CAGR of 13.5% from 2023 to 2032.

- Federated Learning Market is anticipated to be USD 311.4 Mn by 2032. It is estimated to record a steady CAGR of 10.2% in the forecast period.

- Microphone market accounted at USD 3.8 bn and is expected to reach USD 5.04 bn in 2032 at a CAGR of 3.5% between 2023 and 2032.

- 360 Degree Camera Market size is expected to be worth around USD 8 Billion by 2032 from USD 1.3 Billion in 2023, growing at a CAGR of 22.50% during the forecast period from 2023 to 2032.

- Digital Pen Market size is expected to be worth around USD 1,860.0 Million by 2032, growing at a CAGR of 11.80%.

- Online Video Platform Market is anticipated to expand from USD 10.3 Billion in 2023 to USD 57.2 Billion by 2033, grow at a CAGR of 18.7%.

- Emission Monitoring System (EMS) Market is anticipated to be USD 9.7 billion by 2033 and It is estimated to record a steady CAGR of 9.5%.

- Laboratory Information Management System Market size is USD 4.7 Bn by 2033 from USD 1.8 Bn, growing at a CAGR of 10.1%.

- Docking station market is expected to witness substantial growth, reaching USD 3.1 billion by 2033, with a projected CAGR of 5.5%.

- Aviation MRO Market is projected to surpass around USD 131.6 billion by 2033, growing at a CAGR of 5.3% during the forecast period.

About Us

Market.US (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. Market.US provides customization to suit any specific or unique requirement and tailor-makes reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us On LinkedIn Facebook Twitter

Our Blog: